June 2012

advertisement

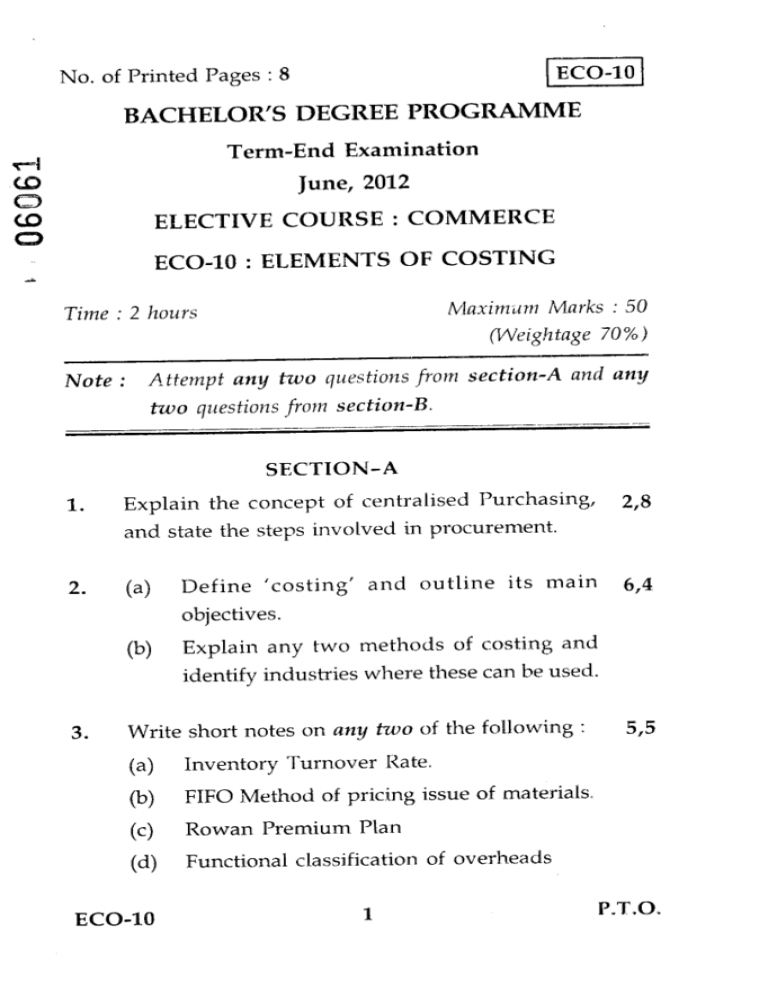

ECO-10

No. of Printed Pages : 8

BACHELOR'S DEGREE PROGRAMME

Term-End Examination

June, 2012

CD

CO

ELECTIVE COURSE : COMMERCE

ECO-10 : ELEMENTS OF COSTING

Maximum Marks : 50

(VVeightage 70%)

Time : 2 hours

Note : Attempt any two questions from section-A and any

two questions from section-B.

SECTION-A

1.

Explain the concept of centralised Purchasing, 2,8

and state the steps involved in procurement.

2.

(a) Define 'costing' and outline its main 6,4

objectives.

(b) Explain any two methods of costing and

identify industries where these can be used.

3.

Write short notes on any two of the following :

(a)

Inventory Turnover Rate.

(b)

FIFO Method of pricing issue of materials.

(c)

Rowan Premium Plan

(d)

Functional classification of overheads

ECO-10

1

5,5

P.T.O.

SECTION-B

4.

The product of a manufacturing concern passes

through two processes A and B and then to

finished stock Account. It is ascertained that in

each process normally 5% of the total weight of

input is lost and 10% is scrap which realises

Rs. 160 and Rs. 400 per ton from proces A and

process B respectively.

15

The following data is availabe for the month of

March, 2010 relating to both processes:

A

B

Materials (in tons)

1,000

70

250

400

Rs. 56,000

20,000

Rs. 16,000

10,500

830

780

repare process accounts showing cost per ton of

each process. There was no stock of work -inprogress in any process.

Cost of materials per ton

Wages

Mfg. Expenses

Output in tons

5.

Rs.

(a) The financial accounts of a company 10, 5

showed a net loss of Rs. 1,14,640 for the year

2009-10. The cost accounts of the cumpany

showed a net loss of Rs. 74,200. On

scrutinising the figures of both sets of books,

the following facts were revealed :

(i)

Director fees not charged in cost

accounts Rs. 2,600.

(ii) Provision for bad debts made in

financial accounts Rs. 2,280.

(iii) Bank interest credited in financial

accounts Rs. 120.

ECO-10

2

6.

(iv) Obsolescence loss charged in financial

accounts Rs. 33,200.

(v) Overheads shown in the financial

accounts were Rs. 23,280 whereas

overheads shown in cost accounts

were estimated at Rs. 24,000; and

(vi) Depreciation recoverd in cost

accounts Rs. 16,000 whereas

depreciation in financial accounts

appeared at Rs. 19,200.

Prepare a statement reaconciling the amount of

loss shown in financial accounts and cost

accounts.

(b) How do you deal with interest on capital in

cost accounts ? Explain with necessary

arguments.

(a) Compute Machine hour rate (MIIR) from 10, 5

the following data :

Rs.

10,00,000

Cost of machine

1,00,000

Installation charges

50,000

Estimated scrap value

(after 15 years of working life)

Rent for the sho. •er Month

Lighting for the shop (per Month)

Insurance of the machine (per annum)

Repairs of the machine (per Month)

Power consumption 10 units per hour

Power Rate for 100 units

Estimated working hours per annum

were 2000 hours

Su ervisor's salar )er month

ECO-10

3

2,000

3,000

9,600

10,000

200

6,000

P.T.O.

The machine accupies 1/4th of the shop area. The 8, 7

supervisor is expected to devote 1/5th of his time

for supervising the work of the machine.

(b) The following receipts and issues were made

of an item of stores :

July 1

Received 2000 units at

Rs. 30,000

Aug 1

Received 2000 units Rs. 24,000

Aug 31

Issued 2,400 units

Sept 1

Received 2,000 units at

Rs. 36,000

Sept 30

Issued 2,400 units

Prepare stores Ledger Account on the basis

of LIFO method.

ECO-10

4

177-6W qiRtWrzNill

Tiqtff 1+k') VT

11,

2012

1-6.7Wri.

+1,C1 ctrei

1A.311. — 10 : 01111c1

TiTrzr

311-i4.hr14-1 afw : 5o

:

( To- w 70% )

-1

:

1.

c41[

W?1 c

1:-61 fEthT *TA. cni 13

2.

(a)

0141d

(b)

c1141d -ra-9FuT

oqRsell

c1

2,8

w-q-

-{IT 'A1W1tf-47,

941 -$RTIFELq*z1

4

4I chIr&

6,4

6-1 3-6Th' t -1144 f-Ofu7 fq9-4 -OWE W:PilTT

t?

fwzrr

.q2.il

ki1 ci

3.

f311 dull-0141 WUR

Iq

(a)

k-dch 31M

(b)

Tri-TITA

f941:1-9. ' 71-eU

(c)

t1E -9-

5,5

311-71:19

f9-41-7-1

rn

tqa-r

(d)

1oi41 chi cmq c-Hcb

ECO-10

5

P.T.O.

tgus-ig

4.

ym rar-miun

c( I 3-rTq

-54-7414 A 12T1 B

15

t 3-11T F-1,( dt4 31'ftdTT TLTE-U1-3f-d-rTu cb(

*1 Tr c

tIIHI.1111 3TPTIITT

5% chg t

t at 10%

A cl.Ci

tc\LI (c-11 t I TirWzIT

chl fqWzt 1 i 160 T. -it'd

chi W149 chi fdW5f 1:ffr 400 T. 51 rd

2010 t

TB

T 9R-1

Itt

TtqfT f919

fFfufft:

A

TfTITt (d-1. -4)

B

1,000

70

T1P4t tri;Ifd z7 1,fft

T.

250

400

-41-- t

T. 56,000

20,000

T. 16,000

10,500

830

780

cl -14 ul c'

dc,

itql (e.--if 14)

Mfr

Wr

-rEA7 72-11 c c 3c

71Id

I -4-Tft

"51-r-*--qf

t fd-ffIzf

-tt

cf Zff

1.11- 314 f9flfd

4-110 16 • 2-TT I

5.

(a)

?4 1,14,640 T. chi f9-arTTR

rcRt1(.11

(i)

3T TT citi 2009-10 10, 5

qi

ir-t 74,200 T. t 2.11' I

t

F-14-1FOR.Id-ffV51c 4dI -q-c91 :

rf I I d . 7ffr

-fik7r-. 76-1-u

2,600 T. chl

RR{ le kTg-ITIT illf I

fq7-tz

i

'1A1

3-1-T4R 2,280 T. ET Ttfq1-4

-kf 1 -51-PgF f

ff'14 120 T. tk

'R I

ECO-10

6

frO

0611,51 "k

fd-4#1 . fT 14 33,200 T. *1 WN 1f9

'141'1

(obsolescence loss)-kTgPt

4ifOJITT,

Iif 23,280.

f4741--4

(iv)

(v)

-

ff-qT 24,000 T.

2.ft1

r;1141d T1 416,000T. chl 1-tc--4H-1 ,c141111

(vi)

.1J1 1'4

,T10114, f-d-ffT4

TTN1

19,200 T. ftlit -TTEft I

14 IT@TEft

fc171'14 (7:1 41. 7WT r-114M

kcwsT

1HN '6ct

(b)

6.

(a)

T1 *K71 I

i

••31171,

1" ,-T1. 1,1M-17 f0517-rf

Ti

cflfl1

f

ft

TPT9Tf: 10,

5

T.

-4117f17

10,00,000

c.-11417!

4-ki[-i cr1411-f v f711 TI7 ogq

*r -.34 ,1 ,A 9 R

(.15 -q-4 2,-. *Ril'itr-3 ;i417.)

1,00,000

*r 11,4iqr (714J T117T)

2,000

50,000

3,000

LV,I- I 0,-14 ( 'Arcf 1471)

9,600

117117 --I - Ii:n (-51-i-a ati)

TWFR III 1T47.-Ta. 'TT --7174 ( A '71 q11)

10,000

,ie.1

--7,

-.S7*

41,1- 7*-1 7iqr‘4111 10TAIffT

200

TITW. 11-1 100 741Ii 1-,1 -Fj

3-1-Trf9---d 11411147, --11 (t Ti )

2000

T.4.ciis,,Til. *1 k-69 (13-f Tim)

. .

-1171-9.

ECO-10

4 -

.

///4 Plii TI{ TUT

e-zi.t

7

6,000

.,

.a9-fi

P.T.O.

tt-Roll\it 349-4 t-9

5 11-Fr Tqlp-r1-9- 717f-

&1--411-{

(b)

v

TZ- T 'TiT41-41 chl "Sirrlizif (receipts) 10. f9-4179"

Trfwzri (issues) F-1 ,--t IC r(5 CI :

1

2,000 pct t

30,000 T. 117 3fTli

311R:u 1

2,000

24,000 T. 'TT

31717:?f 31

2,400

ft- 1

2,000

oilw-11 f9Tif-gra chl 1111

fW44-{ 30 2,400

LIFO 'Tea. 317n7

ECO-10

8

36,000 T. "ER -grti

f9lifiTff chi T I

tqg

I