Mortgage Officer Compensation and Pay Trends Survey

advertisement

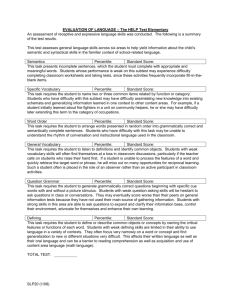

Mortgage Officer Compensation and Pay Trends Survey January 2011 Survey Results Table of Contents We conducted an online survey of Mortgage Officer compensation in Fall 2010. A total of 65 banks completed the survey reporting on a total of 329 mortgage officer incumbents. Data is effective as of November 2010. Total cash compensation is based on 2010 base salaries plus 2009 incentives or commissions earned. Survey Demographics 3‐4 Compensation Structure 5 Mortgage Officer Compensation 6‐8 Variable Pay Variable Pay – Minimum Performance Requirements 9 Variable Pay – Link to Asset Quality 10 Variable Pay Detail 11‐13 Variable Pay – Clawback Provisions 14 Variable Pay by Loan Type 15 Basis Points Paid by Loan Type 16‐19 Loan Approval Authority 20 Mortgage Officer Benefits 21 Mortgage Officer Termination Pay 22 Mortgage Manager Compensation 23‐24 Loan Workout Officer Compensation 25 Page 2 Survey Demographics Number of Banks by Asset Size (n = 65) 1 Under $100 Million 9 $100 Million ‐ $249 Million 17 $250 Million ‐ $499 Million 21 $500 Million ‐ $999 Million 13 $1 Billion ‐ $2.99 Billion 4 $3 Billion ‐ $4.99 Billion 0 TARP Redeemed 3% 5 10 15 20 TARP Status Ownership Type n = 65 n = 65 No TARP 29% Public 58% TARP 68% Page 3 Private 42% 25 Survey Demographics Pay Classification of Lenders n = 65 Non‐exempt 17% Exempt, but considering reclassifying 28% Exempt and Non‐exempt 17% Exempt 38% Retention of Residential Loan Portfolio • Respondents reported selling an average of 83% of their portfolio in the secondary market. • Of 63 respondents, only 8 reported selling less than 50% of their loans. Page 4 Compensation Structure Compensation Structure for Mortgage Officers By Asset Size n = 65 All Banks n = 65 60% 50% 14% 40% 43% 43% 30% 20% 10% Base salary only Base salary plus incentive/ commission Commission only 0% <$500M n = 27 Page 5 $500M‐$1B n = 21 >$1B n = 17 Mortgage Officer Compensation Compensation – Banks Paying Base Salary Only (n = 9) Entry All Orgs Average 25th Percentile 50th Percentile 75th Percentile n (number of banks) n (total incumbents in position) Assets <$500M Average 25th Percentile 50th Percentile 75th Percentile n (number of banks) n (total incumbents in position) Assets $500M‐$1B Average 25th Percentile 50th Percentile 75th Percentile n (number of banks) n (total incumbents in position) * Base Salary Mid Level Senior $ 33,387 $28,000 $28,000 $33,500 5 10 $43,139 $35,400 $38,300 $46,176 6 11 $57,235 $48,000 $52,040 $72,449 8 23 $29,833 $28,000 $28,000 $30,750 3 5 $36,400 $34,750 $35,800 $37,450 4 6 $48,533 $46,000 $50,000 $51,800 3 10 $38,718 $33,076 $38,718 $44,359 2 5 $56,617 $52,426 $56,617 $60,809 2 5 $62,455 $50,480 $72,000 $73,797 4 13 None of the banks with assets greater than $1B reported paying base salary only to Mortgage Officers. ** Some banks did not disclose the total number of incumbents in each position. If not disclosed, we assumed one incumbent. Page 6 Mortgage Officer Compensation Compensation – Banks Paying Base Salary Plus Incentive / Commissions (n = 28) Base Salary All Orgs Average 25th Percentile 50th Percentile 75th Percentile n (number of banks) n (total incumbents in position) Assets <$500M Average 25th Percentile 50th Percentile 75th Percentile n (number of banks) n (total incumbents in position) Assets $500M‐$1B Average 25th Percentile 50th Percentile 75th Percentile n (number of banks) n (total incumbents in position) Assets >$1B Average 25th Percentile 50th Percentile 75th Percentile n (number of banks) n (total incumbents in position) Cash Comp Entry Mid Level Senior Entry Mid Level Senior $30,319 $24,002 $30,000 $36,003 19 36 $34,243 $30,000 $34,000 $38,000 17 41 $43,087 $35,975 $41,000 $55,000 24 73 $42,547 $34,350 $42,766 $46,250 16 28 $58,198 $46,329 $54,750 $69,875 14 34 $91,546 $63,750 $85,000 $118,750 20 67 $31,917 $30,000 $30,000 $35,625 6 9 $39,179 $31,875 $37,750 $46,679 6 11 $48,086 $36,000 $55,000 $57,400 9 16 $45,131 $42,800 $45,000 $52,000 5 8 $49,058 $40,763 $50,500 $53,375 6 11 $76,443 $56,200 $64,200 $85,300 7 13 $29,008 $23,832 $30,000 $34,000 7 7 $30,509 $23,746 $29,002 $35,500 6 11 $41,700 $29,830 $40,000 $55,925 7 19 $42,833 $36,750 $42,500 $44,500 6 6 $69,375 $60,875 $67,250 $75,750 4 9 $98,717 $82,500 $98,000 $112,750 6 18 $30,251 $25,000 $30,750 $35,375 6 20 $32,801 $30,000 $32,000 $36,005 5 19 $38,676 $35,979 $39,000 $42,750 8 38 $39,618 $32,400 $40,960 $42,732 5 14 $60,731 $43,829 $55,386 $72,289 4 14 $100,502 $65,369 $100,000 $141,065 7 36 * Some banks did not disclose the total number of incumbents in each position. If not disclosed, we assumed one incumbent. Page 7 Mortgage Officer Compensation Compensation – Banks Paying Commission Only (n = 28) Cash Comp All Orgs Average 25th Percentile 50th Percentile 75th Percentile n (number of banks) n (total incumbents in position) Assets <$500M Average 25th Percentile 50th Percentile 75th Percentile n (number of banks) n (total incumbents in position) Assets $500M‐$1B Average 25th Percentile 50th Percentile 75th Percentile n (number of banks) n (total incumbents in position) Assets >$1B Average 25th Percentile 50th Percentile 75th Percentile n (number of banks) n (total incumbents in position) Entry Mid Level Senior $45,650 $32,500 $47,500 $57,500 10 25 $82,583 $49,500 $68,095 $83,061 12 42 $145,721 $82,500 $100,648 $150,448 14 62 $45,000 $37,500 $45,000 $52,500 2 2 $54,333 $41,500 $48,000 $64,000 3 4 $103,000 $60,000 $100,000 $160,000 5 6 $53,038 $45,000 $50,000 $60,000 5 19 $66,449 $50,000 $70,000 $75,000 5 24 $114,400 $90,000 $100,000 $107,000 5 36 $33,770 $25,655 $40,000 $45,000 3 4 $123,939 $64,643 $92,879 $152,175 4 14 $238,272 $95,971 $111,544 $253,845 4 20 * Some banks did not disclose the total number of incumbents. If not disclosed, we assumed one incumbent. Page 8 Variable Pay – Minimum Performance Requirements A majority, or 86% of respondents, reported paying commissions and/or incentives. Some banks require minimum performance requirements before incentives or commissions are earned. Banks requiring minimum volume requirements before paying incentives n = 56 Banks requiring a minimum yield on loans before paying incentives n = 53 Require 23% Require 32% Do Not Require 77% Do Not Require 68% • For those reporting a minimum yield, the average loan yield ranged from 0.5% to 1.8%. • Eleven banks reported a monthly loan minimum with a range from $50,000‐ $500M; median = $500,000/month. • Other reported methods include: Commission calculation must exceed quarterly salary received, or must exceed base salary. Page 9 Variable Pay – Link to Asset Quality • Eleven percent of respondents* reported modifying or reducing incentive or commission payments based on asset quality measures and three percent plan to implement this type of feature in the near future. • Five percent of banks* hold back a portion of incentives until the end of the year to assess asset quality and another five percent plan to implement this type of deferral feature in the near future. • The chart below depicts common asset quality measures used by banks that reported using or planning to use these going forward. Asset Quality Measures n = 9 60% 50% 56% 44% 44% 40% 30% 22% 20% 10% 0% Non‐performing assets Past dues Classified loans Other • 22% of banks used more than one asset quality modifier. • The “other” category in the above table includes: financial distress, need to buy back secondary mortgage loans, loan closing /early payment exceptions, and other policy exceptions. * Based on 62 responses to this question. Page 10 Variable Pay Detail Additional Pay for Overages? Reduce Payments for Underages? n = 45 n = 47 Yes 22% Yes 27% No 73% No 78% Twenty‐two percent of respondents reported paying for overages or above PAR pricing. Twenty‐seven percent reported reducing payouts for underages or sub PAR pricing. • For those that pay for overages, the majority split the profit with the mortgage officer. The range is from 20% ‐ 60%, with the most prevalent being 50%. • Two banks mentioned paying 5 basis points for overages. • For those that reduce payments for underages, all of the banks mentioned reducing pay/commission by some amount. • The majority of mortgage officers are responsible for either 50% or 100% of the underage. Note: The Mortgage Compensation Guidelines released by the Federal Reserve and the Dodd‐ Frank Act prohibit paying incentives for overages. Page 11 Variable Pay Detail Incentive for Deposit Generation Incentive Paid for Referrals n = 56 n = 56 Yes 16% . No 62% No 84% Yes 38% 38% of banks pay incentives for referrals. Of those, most paid between $25‐$500 per referral, with most prevalent being $50. Most required the referral lead to a closed loan. 16% of banks pay incentives for deposit generation. Of those, some pay as part of their bonus calculation, others paid between $10‐$50 per new account. Page 12 Variable Pay Detail Incentives Payout Schedule Incentive Plans Capped? n = 60* n = 56 Quarterly 8% Annually 13% Yes 9% Biweekly 18% Monthly 61% No 91% The majority of banks with a commission or incentive structure report having uncapped plans. This is fairly common for the mortgage officer position. The majority of banks pay commissions on a monthly basis. We anticipate more banks will lengthen the pay schedules or add a deferral or holdback feature to help mitigate risk. * Three banks noted paying commissions monthly and incentives quarterly or annually. Page 13 Variable Pay – Clawback Provisions Twenty‐five percent of respondents* currently have clawback provisions for their mortgage officers and another five percent are implementing clawbacks in the near future. Forty percent of banks with clawback provisions reported their recovery periods are under one year, while one‐third reported having indefinite recovery periods. Clawback Recovery Period n = 15 27% 33% 40% Indefinite One to three years * Based on 63 responses to this question. Page 14 Less than a year Variable Pay by Loan Type How are Incentives/Commissions Paid on Different Loan Types? Based on loan portfolio/profitabilty Residential 1‐4 Family Residential Multi Family Basis points based on loan production/volume Percent of Fees Jumbo Refinances Construction FHA/VA Second Mortgages 0% 10% 20% 30% 40% 50% 60% 70% Residential 1‐4 Family Residential Multi Family Jumbo Refinances Construction FHA/VA Second Mortgages n = 53 n = 38 n = 51 n = 53 n = 39 n = 48 n = 27 Loan Profitability Methodology ‐ For those that paid a percentage of loan profit the range of profit shared is between 45% and 60%. ‐ Other methodology includes: 20% of income (fees and yield spread), brokered loan profit multiplied by incentive percentage of 2.5%‐10%. Loan Basis Points Methodology ‐ 52% of banks (n = 54) use a tiered approach where basis points vary by loan volume. See next page for additional information. Loan Percent of Fees Methodology ‐ For those that paid a percent of fees, the percentages ranged from 6% ‐ 75%. The median percent of fees paid is 50%. ‐ Various qualifiers: total income after taxes, fees earned in excess of lender's quarterly salary, percentage varied based on loan volume and/or experience, refinances received 10% less than new loans. Page 15 Basis Points Paid by Loan Type Residential 1‐4 Family Loans Residential Multi‐Family Loans 45% 70% 40% 60% 35% 50% 30% 40% 25% 30% 20% 15% 20% 10% 10% 5% 0% 0% <30 BPS 30‐39 BPS 40‐49 BPS Retail/Retained Portfolio n = 21 50‐59 BPS 60‐69 BPS 70‐79 BPS Retail/Secondary Market n = 27 >100 BPS Wholesale n = 7 * None of the banks paid basis points between 80‐99 bps <30 BPS 30‐39 BPS 40‐49 BPS 50‐59 BPS 60‐69 BPS 70‐79 BPS Retail/Retained Portfolio Retail/Secondary Market Wholesale n = 10 n = 3 n = 13 * None of the banks paid basis points greater than 80 bps Page 16 Basis Points Paid by Loan Type Jumbo Loans Refinance Loans 45% 40% 40% 35% 35% 30% 30% 25% 25% 20% 20% 15% 15% 10% 10% 5% 5% 0% 0% <30 BPS 30‐39 BPS 40‐49 BPS Retail/Retained Portfolio n = 20 50‐59 BPS 60‐69 BPS 70‐79 BPS Retail/Secondary Market n = 27 >100 BPS Wholesale n = 5 * None of the banks paid basis points between 80‐99 bps <30 BPS 30‐39 BPS 40‐49 BPS Retail/Retained Portfolio n = 21 50‐59 BPS 60‐69 BPS 70‐79 BPS Retail/Secondary Market n = 28 >100 BPS Wholesale n = 6 * None of the banks paid basis points between 80‐99 bps Page 17 Basis Points Paid by Loan Type Construction Loans FHA/VA Loans 40% 40% 35% 35% 30% 30% 25% 25% 20% 20% 15% 15% 10% 10% 5% 5% 0% 0% <30 BPS 30‐39 BPS 40‐49 BPS Retail/Retained Portfolio n = 19 50‐59 BPS 60‐69 BPS 70‐79 BPS Retail/Secondary Market n = 20 >100 BPS <30 BPS 30‐39 BPS Wholesale n = 5 * None of the banks paid basis points between 80‐99 bps 40‐49 BPS Retail/Retained Portfolio n = 14 50‐59 BPS 60‐69 BPS 70‐79 BPS 80‐89 BPS Retail/Secondary Market n = 27 Wholesale n = 6 * None of the banks paid basis points between 90‐99 bps Page 18 >100 BPS Basis Points Paid by Loan Type Second Mortgage Loans 50% 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% <30 BPS 30‐39 BPS Retail/Retained Portfolio n = 10 40‐49 BPS 50‐59 BPS Retail/Secondary Market n = 12 * None of the banks paid basis points between 60‐99 bps Page 19 >100 BPS Wholesale n = 4 Loan Approval Authority Loan Approval Authority? n = 54 Yes 15% No 85% • Fifteen percent (15%) of banks reported their mortgage lenders have loan approval authority ranging from $75,000 ‐ $400,000. • Some banks indicated having different limits based on secured loans vs. unsecured loans. • Five banks indicated having an underwriting department or senior lender who has various levels of loan approval authority. • Four banks indicated using a secondary market for underwriting decisions. Page 20 Mortgage Officer Benefits Benefits Offered to Mortgage Loan Officers n = 65 100% 80% 60% 40% 20% 0% Methodology • Most banks offered several types of benefit to their mortgage lenders. • The “other” category in the above table includes ten banks that indicated loan officers have cell phones and four banks that provide some sort of transportation benefit to their mortgage loan officers. • Wellness benefits, tuition reimbursement, laptops, and business entertainment or expense accounts were also noted by individual banks. Page 21 Equity Benefits • None of the banks reported paying a portion of cash incentives or commissions in equity. • Only five percent of banks provide equity to their mortgage officers as an additional incentive. Mortgage Officer Termination Pay Incentive/Commission Payout Schedule at Termination* n = 55 Pay according to next payout schedule Pay out after 30 days 16% 40% 20% Pay out after 60 days Pay out after 90 days 20% Incentive is forfeited 0% Other 4% Most banks (40%) reported they will pay according to their next payout schedule and twenty percent of banks have commission or incentive forfeited in case of employee’s termination. * Does not include termination for cause or fraud. ** None of the banks reported pay out after 90 days. Page 22 Mortgage Manager Compensation Mortgage Manager Compensation (n = 52) All Orgs Average 25th Percentile 50th Percentile 75th Percentile n (number of banks) Assets: <$250M Average 25th Percentile 50th Percentile 75th Percentile n (number of banks) Assets: $250M‐$499M Average 25th Percentile 50th Percentile 75th Percentile n (number of banks) Assets: $500M‐$1B Average 25th Percentile 50th Percentile 75th Percentile n (number of banks) Assets: >$1B Average 25th Percentile 50th Percentile 75th Percentile n (number of banks) Base Salary Cash Compensation 92,295 66,875 80,500 110,000 52 111,986 72,000 100,000 125,033 49 65,629 53,700 60,000 72,500 7 76,233 63,800 74,000 95,000 6 74,288 65,000 72,000 80,000 13 92,883 63,000 74,500 94,938 12 103,705 78,750 85,297 122,500 16 124,893 78,172 105,000 138,750 16 107,182 79,867 101,755 117,500 16 128,868 102,900 116,567 132,517 15 Page 23 Mortgage Manager Compensation Manager Incentives Criteria (n = 53) 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% Overall department volume Individual portfolio Corporate goals Departmental profit Basis point override Other Methodology Incentive Plans • Many banks chose more than one category. Seven banks did not have incentives for mortgage managers; therefore, are not included in the table above. • The “Other” category includes five banks that base incentive on overall bank and/or departmental goals; two banks that indicate it is a discretionary bonus and three banks that use quality measurements (i.e. compliance, risk management, service quality). • Of fifty‐three respondents, 60% reported not having a cap on manager incentive plans at all. • A third (33%) of banks reported having a cap on the manager incentive plans as a whole, and six percent (6%) reported having a portion of the manager incentive plan capped. Page 24 Loan Workout Officer Compensation Loan Workout Officer Compensation (n = 20) Base Cash Salary Compensation All Orgs Average 25th Percentile 50th Percentile 75th Percentile n (number of banks) n (total incumbents in position) Assets: <$500M Average 25th Percentile 50th Percentile 75th Percentile n (number of banks) n (total incumbents in position) Assets: $500M‐$1B Average 25th Percentile 50th Percentile 75th Percentile n (number of banks) n (total incumbents in position) Assets: >$1B Average 25th Percentile 50th Percentile 75th Percentile n (number of banks) n (total incumbents in position) Loan Workouts 73,168 49,775 70,815 92,500 20 42 73,318 50,000 70,815 94,375 20 42 • Only 12% of banks’ loan officers are responsible for loan workouts. In 6% of banks, loan officers are responsible for some of the loan workouts. Fifty‐two banks responded. 63,000 45,000 50,000 65,000 5 7 65,000 45,000 50,000 65,000 5 7 • 44% of banks have separate loan workout officers. The table to the left represents the compensation of these separate loan workout officers. Four banks reported having separate loan workout officers; however, did not report their salary. Therefore, these four are not included in the table to the left. 77,020 49,100 90,000 100,000 5 5 79,220 54,100 90,000 100,000 5 5 • 25% of banks with separate loan workout officers pay incentives for loans worked out. Incentives used for loan workout officers include: performance against individual and/or corporate goals, board discretion, incented per workout, and as a percent of re‐capture. 76,327 58,303 76,709 84,125 10 30 77,527 58,303 76,709 90,625 10 30 Page 25