Louis Chan, CFA 陈少威

公司报告:新秀丽 (01910 HK)

+852 2509 5310

louis.chan@gtjas.com.hk

24 March 2015

Solid Fundamental Pricing in, Downgrade to “Accumulate”

稳固的基本面正在价格上反映,下调至“收集”

GTJA Research 国泰君安研究

Company Report: Samsonite (01910 HK)

Accumulate

Rating:

Downgraded

FY14 revenue increased by 15.4% YoY to US$2.35 bn, in line with our

estimate and market consensus. However, net profit increased by 5.8%

YoY to US$186 mn which was 8.9% and 10.9% lower than our estimate and

market consensus due to higher than expected acquisition costs. North

America continued to be the fastest growing market with a YoY increase of

22.5% in sales, driven by acquisitions.

Gross margin decreased by 0.5 ppt YoY to 52.9% for FY14, in line. The

drop in gross margin was mainly due to a higher sales contribution from North

America, where a lower gross margin was yield due to the adoption of a

wholesale model. The drop in gross margin was also partly explained by the

acquisition of Speck brand.

Downgrade to “Accumulate” but raise TP to HK$28.85. International

tourist arrivals showed uninterrupted growth and persistent growth is

expected. Though the Company has a high visibility for its medium term

top-line growth and profitability, we downgrade the Company’s rating due to a

rich valuation. We raise our TP to HK$28.85, representing 24.6x and 21.1x

FY15 and FY16 PER respectively, to factor in increased industry valuation.

评级:

收集 (下调)

6-18m TP 目标价:

HK$28.85

Revised from 原目标价:

HK$27.68

Share price 股价:

HK$26.700

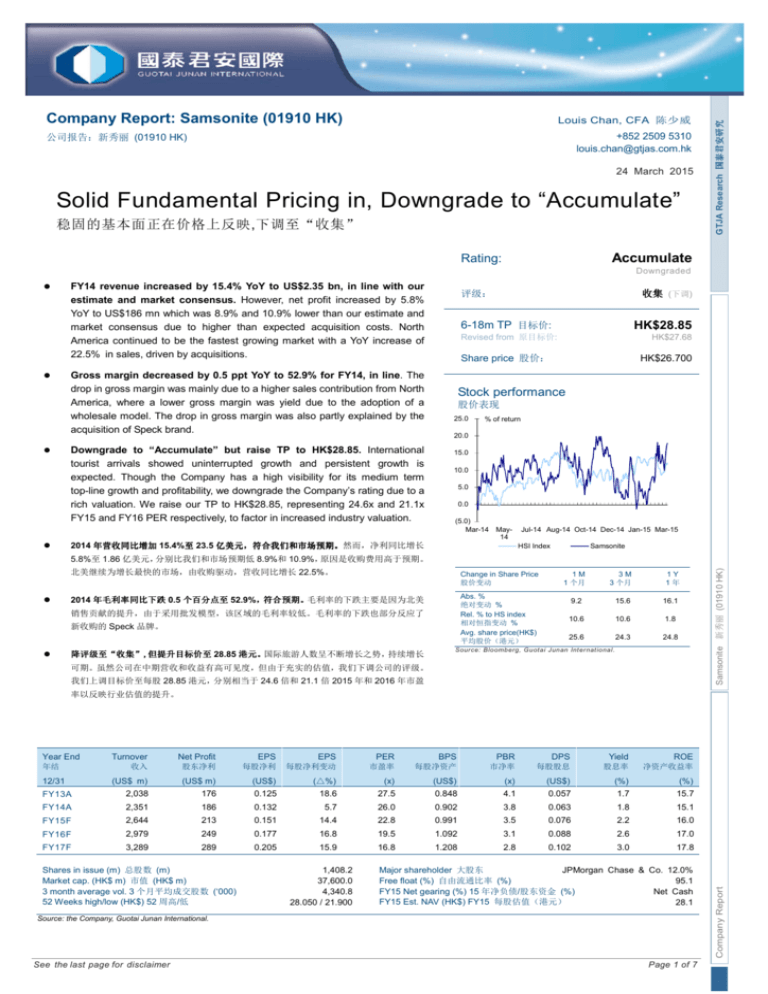

Stock performance

股价表现

25.0

% of return

20.0

15.0

10.0

5.0

0.0

(5.0)

Mar-14 May14

2014 年营收同比增加 15.4%至

至 23.5 亿美元,

亿美元,符合我们和市场预期。

符合我们和市场预期。然而,净利同比增长

Jul-14 Aug-14 Oct-14 Dec-14 Jan-15 Mar-15

HSI Index

Samsonite

北美继续为增长最快的市场,由收购驱动,营收同比增长 22.5%。

Change in Share Price

股价变动

Abs. %

绝对变动 %

Rel. % to HS index

相对恒指变动 %

Avg. share price(HK$)

平均股价(港元)

2014 年毛利率同比下跌 0.5 个百分点至 52.9%,

,符合预期。

符合预期。毛利率的下跌主要是因为北美

销售贡献的提升,由于采用批发模型,该区域的毛利率较低。毛利率的下跌也部分反应了

新收购的 Speck 品牌。

降评级至“

降评级至“收集”

收集”,但提升目标价至 28.85 港元。

港元。国际旅游人数呈不断增长之势,持续增长

1M

1 个月

3M

3 个月

1Y

1年

9.2

15.6

16.1

10.6

10.6

1.8

25.6

24.3

24.8

Source: Bloomberg, Guotai Junan Int ernat ional.

可期。虽然公司在中期营收和收益有高可见度,但由于充实的估值,我们下调公司的评级。

我们上调目标价至每股 28.85 港元,分别相当于 24.6 倍和 21.1 倍 2015 年和 2016 年市盈

Samsonite 新秀丽 (01910 HK)

5.8%至 1.86 亿美元,分别比我们和市场预期低 8.9%和 10.9%,原因是收购费用高于预期。

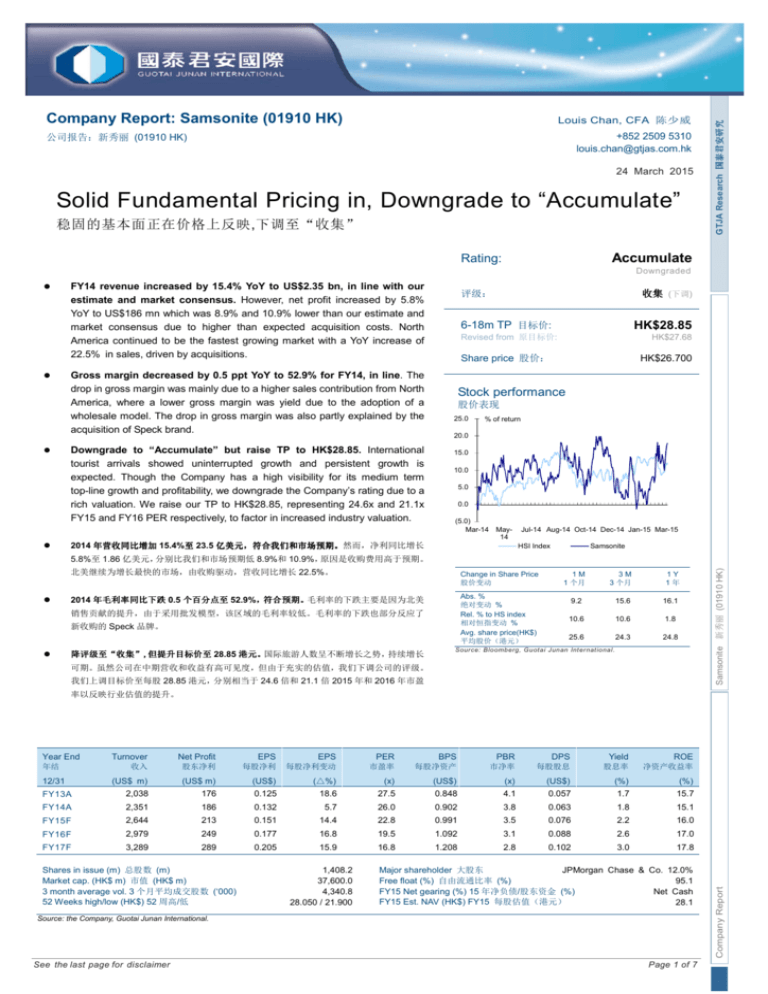

Year End

Turnover

Net Profit

EPS

EPS

PER

BPS

PBR

DPS

Yield

ROE

收入

股东净利

每股净利

每股净利变动

市盈率

每股净资产

市净率

每股股息

股息率

净资产收益率

(US$ m)

(US$ m)

(US$)

(△%)

(x)

(US$)

(x)

(US$)

(%)

(%)

2,038

176

0.125

18.6

27.5

0.848

4.1

0.057

1.7

15.7

FY14A

2,351

186

0.132

5.7

26.0

0.902

3.8

0.063

1.8

15.1

FY15F

2,644

213

0.151

14.4

22.8

0.991

3.5

0.076

2.2

16.0

FY16F

2,979

249

0.177

16.8

19.5

1.092

3.1

0.088

2.6

17.0

FY17F

3,289

289

0.205

15.9

16.8

1.208

2.8

0.102

3.0

17.8

年结

12/31

FY13A

Shares in issue (m) 总股数 (m)

Market cap. (HK$ m) 市值 (HK$ m)

3 month average vol. 3 个月平均成交股数 (‘000)

52 Weeks high/low (HK$) 52 周高/低

1,408.2

37,600.0

4,340.8

28.050 / 21.900

Major shareholder 大股东

JPMorgan Chase & Co. 12.0%

Free float (%) 自由流通比率 (%)

95.1

FY15 Net gearing (%) 15 年净负债/股东资金 (%)

Net Cash

FY15 Est. NAV (HK$) FY15 每股估值(港元)

28.1

Source: the Company, Guotai Junan International.

See the last page for disclaimer

Page 1 of 7

Company Report

率以反映行业估值的提升。

FY14 top-line met estimates. Samsonite (the “Company”)’s FY14 revenue increased by 15.4% YoY to US$2.35 bn, which

was in line with our estimate and market consensus. However, net profit increased by 5.8% YoY to US$186 mn which was

and Gregory brands were acquired in 2014 and have contributed to the sales growth. North America, though being a mature

market, continued to be the fastest growing market with a YoY increase of 22.5% in sales, driven by acquisitions. Excluding

acquisitions, sales increased by 7.3% on a constant currency basis. Asia continued to be the second fastest growing market

with a YoY increase of 16.1% in sales, driven by American Tourister, Samsonite Orgional and Samsonite Red. The region

24 March 2015

8.9% and 10.9% lower than our estimate and market consensus due to higher than expected acquisition costs. Lipault, Speck

continued to be the region contributing the largest sales, 38.0% of total sales. Sales in Europe increased by 8.3% YoY driven

by accelerated American Tourister brand penetration in the region. Latin America was the slowest growing market with a YoY

increase of 5.7% in sales due to continued import restrictions imposed by Argentina government and currency headwinds.

Excluding Argentina, sales growth in Latin America was 20.0% on a constant currency basis. We reiterate optimism on the

Company’s strategy of leveraging its global supply chain and global brand management experience to accelerate the

geographical penetration of newly acquired and developed brands.

Gross margin decreased by 0.5 ppt YoY to 52.9% for FY14. Gross margin was in line with our expectation and slightly

higher than the market expectation. The drop in gross margin was mainly due to a higher sales contribution from North

America, where a lower gross margin was yield due to the adoption of a wholesale model. The acquired Speck Products was

also attributable to the drop in gross margin. Crude oil price slumped in 4Q14 and continued to be weak in 1Q15. However, as

about 80% of the product manufacturing was outsourced and a multiple-layer structure of its supply chain, the drop in raw

material price cannot match the crude oil decline and it would take several months to materialize the savings. Gross margin for

FY15 is expected to be flat comparing to FY14. The plan of gradually shifting to more direct-to-consumer channels is a positive

to the gross margin in the medium term.

FY13

2,038

(949)

1,088

(670)

(133)

(4)

281

270

(73)

176

0.125

FY14

2,351

(1,107)

1,244

(771)

(151)

(22)

299

282

(77)

186

0.132

YoY

15.4%

16.6%

14.3%

15.1%

13.6%

436.3%

6.4%

4.5%

5.6%

5.8%

5.7%

% of our estimation

100.4%

100.5%

100.2%

101.0%

100.8%

373.0%

93.0%

89.9%

90.8%

91.1%

91.1%

Gross margin

Operating margin

Net margin

53.4%

13.8%

8.6%

52.9%

12.7%

7.9%

-0.5

-1.1

-0.7

-0.1

-1.0

-0.8

% of the consensus

100.5%

100.9%

92.5%

89.1%

89.1%

87.6%

Samsonite 新秀丽 (01910 HK)

Table-1: 2014 Results Analysis

US$ mn

Turnover

Cost of sales

Gross profit

Selling and distribution expenses

Administrative expenses

Other expenses

Profit from operations

Profit before taxation

Income tax

Profit attributable to equity shareholders

Basic EPS (US$)

(ppts)

0.2

-1.1

-1.0

Company Report

Source: the Company, Bloomberg, Guotai Junan International.

See the last page for disclaimer

Page 2 of 7

Figure-1: Samsonite’s Revenue Growth

35.00%

3,000

30.00%

2,500

25.00%

2,000

20.00%

1,500

15.00%

1,000

10.00%

500

24 March 2015

US$ mn

3,500

5.00%

0

0.00%

2011A

2012A

2013A

Revenue (LHS)

2014A

2015F

2016F

2017F

Revenue growth YoY (RHS)

Source: the Company, Guotai Junan International.

Table-2: Sales Contribution by Product Categories

Net sales by product category

2014

2013

2012

2011

2010

1,654,402

1,515,852

1,357,054

1,186,683

885,944

70%

74%

77%

76%

73%

252,069

205,871

109,743

81,849

112,213

11%

10%

6%

5%

9%

256,228

193,474

189,561

189,582

110,321

Travel

% of sales

Casual

% of sales

Business

% of sales

Accessories

11%

9%

11%

12%

9%

147,222

85,745

79,662

70,786

50,186

% of sales

Other

6%

4%

4%

5%

4%

40,786

36,870

35,706

36,247

56,643

% of sales

Net sales

2%

2%

2%

2%

5%

2,350,707

2,037,812

1,771,726

1,565,147

1,215,307

Source: the Company.

Figure-2: Net Sales by Region, 2014

Figure-3: Net Sales by Region, 2013

5.6%

6.1%

Asia

Asia

23.7%

38.0%

North America

North America

Europe

Europe

Latin America

Latin America

Corporate

Corporate

32.4%

30.5%

Source: the Company.

Company Report

Source: the Company.

37.7%

25.3%

Samsonite 新秀丽 (01910 HK)

(US$'000):

See the last page for disclaimer

Page 3 of 7

55%

16.0%

55%

14.0%

54%

12.0%

24 March 2015

Figure-4: Samsonite’s Profitability

10.0%

54%

8.0%

53%

6.0%

53%

4.0%

52%

2.0%

52%

0.0%

2011A 2012A 2013A 2014A 2015F 2016F 2017F

Gross margin (LHS)

Operating margin (RHS)

Net margin (RHS)

Source: the Company, Guotai Junan International.

Well managed SG&A spending. Advertising spend as percentage of sales decrease slightly from 6.3% for FY13 to 6.2% for

FY14. Overall SG&A as percentage of sales dropped slightly from 39.4% for FY13 to 39.2% for FY14.

Effective tax rate up 0.3 ppt YoY to 27.3%. The increase in effective tax rate was mainly due to increased withholding taxes

on dividend and royalty income. The management was confident to achieve a lower effective tax rate of around 26.0% for

FY15.

Stable dividend payment. A total of US$88.0 mn dividend payment was proposed, a YoY increase of 10.0%. The dividend

payout ratio was 47.2% for FY14, comparing to 45.4% for FY13. The Company’s dividend policy was to maintain an

approximately 50.0% of dividend payout ratio in the medium term.

Table-3: Key Assumptions and Adjustments

Total revenue

Asia

OLD

CHANGE

2015F

2016F

2017F

2015F

2016F

2015F

2016F

2,644

2,979

3,289

2,666

3,002

-0.9%

-0.8%

0.6%

1,010

1,145

1,275

1,011

1,139

-0.1%

North America

886

1,010

1,142

868

981

2.1%

3.0%

Europe

601

658

699

628

698

-4.3%

-5.7%

Latin America

138

157

166

152

177

-8.7%

-11.1%

8

8

7

8

8

1.1%

1.1%

1,399

1,582

1,760

1,421

1,603

-1.6%

-1.3%

Operating profit

326

378

434

350

399

-7.0%

-5.3%

Net profit

213

249

289

224

256

-4.8%

-2.9%

0.151

0.177

0.205

0.159

0.182

-4.8%

Others

Gross profit

Basic EPS (US$)

Samsonite 新秀丽 (01910 HK)

NEW

US$ mn

-2.9%

(ppts)

Gross profit margin

52.9%

53.1%

53.5%

53.3%

53.4%

(0.4)

(0.3)

Operating profit margin

12.3%

12.7%

13.2%

13.1%

13.3%

(0.8)

(0.6)

% SG&A of total turnover

40.0%

40.0%

40.0%

40.0%

40.0%

0.0

0.0

Effective tax rate

26.0%

26.0%

26.0%

27.0%

27.0%

(1.0)

(1.0)

Net profit margin

8.1%

8.4%

8.8%

8.4%

8.5%

(0.3)

(0.2)

Source: Guotai Junan International.

Downgrade to “Accumulate” but raise TP to HK$28.85. International tourist arrivals showed uninterrupted growth and

we downgrade the Company’s “Buy” rating to “Accumulate” due to recent outperformance against the market and a rich

valuation. We raise our TP from HK$27.68 to HK$28.85, representing 24.6x and 21.1x FY15 and FY16 PER respectively, to

factor in increased industry valuation.

See the last page for disclaimer

Page 4 of 7

Company Report

persistent growth is expected. Though the Company has a high visibility for its medium term top-line growth and profitability,

Company

Stock

Code Currency

Luggage

SAMSONITE

1910 HK

TUMI

TUMI US

Simple Average

Weighted Average

Luxury Brands

1913 HK

PRADA*

LVMH

MC FP

CHRISTIAN

CDI FP

DIOR

KERING

KER FP

MICHAEL

KORS US

KORS*

BURBERRY

BRBY LN

COH US

COACH*

HUGO BOSS

BOSS GY

SALVATORE

SFER IM

FERRAGAMO

TOD'S

TOD IM

Simple Average

Weighted Average

Sportswear

NKE US

NIKE*

ADIDAS

ADS GR

UNDER

UA US

ARMOUR

Simple Average

Weighted Average

Overall

Simple Average

Weighted Average

Market

Cap

Last

price HK$ mn

PE(x)

PB(x)

D/Y(%)

EV/

EBITDA(x)

Gross

Margin(%)

Operating

Margin(%)

14F

14F

14F

14F

14F

13A

14F

15F

16F

13A

14F

37,600

12,401

27.5

29.5

28.5

28.0

26.1

27.7

26.9

26.5

21.1

24.3

22.7

21.9

17.8

20.9

19.4

18.6

4.1

4.3

4.2

4.1

3.8

3.7

3.8

3.8

3.4

3.2

3.3

3.4

3.1

2.8

2.9

3.0

15.1

14.6

14.9

15.0

2.1

0.0

1.1

1.6

11.8

13.9

12.9

12.3

52.9

58.0

55.5

54.2

12.7

17.7

15.2

14.0

HKD

EUR

51.40 131,524

165.55 705,536

31.1

24.1

33.1

14.7

29.5

21.1

26.0

19.2

5.6

3.1

5.4

3.9

4.8

3.2

4.4

3.0

16.7

23.2

1.5

2.4

11.9

9.3

73.8

64.7

26.2

19.6

EUR

173.25 262,529

21.7

21.7

16.9

15.6

2.8

2.6

2.3

2.3

12.4

2.1

6.9

65.8

19.5

EUR

191.00 202,458

18.8

45.5

17.7

15.8

2.3

2.3

2.1

1.9

5.0

2.5

13.4

62.7

15.5

USD

66.13 102,965

15.9

15.4

13.8

12.3

6.2

5.9

4.4

3.4

41.0

0.0

16.5

60.9

30.5

HKD

USD

26.70

23.56

15F 16F

ROE(%)

GBp 1,843.00

USD

41.58

EUR

116.05

94,529

88,951

68,585

31.6

165.5

24.3

25.0

22.0

24.0

24.2

20.7

20.5

21.7

17.5

18.7

8.0

4.6

11.2

7.0

4.5

9.5

5.9

4.2

8.5

5.2

3.6

7.5

29.6

32.4

42.8

2.3

3.9

3.6

9.6

6.7

12.3

71.2

68.6

66.1

20.1

23.3

17.5

EUR

29.34

41,480

32.9

31.6

27.4

23.8

13.5

10.6

8.6

7.1

37.7

2.1

17.8

63.7

18.4

EUR

86.80

22,304

19.9

38.6

31.0

27.4

26.0

22.7

23.7

21.6

20.6

21.4

19.2

18.5

3.3

6.1

4.3

3.3

5.5

4.3

3.1

4.7

3.7

2.9

4.1

3.3

12.1

25.3

21.8

2.8

2.3

2.3

10.9

11.5

10.3

76.0

67.4

65.9

15.3

20.6

20.3

USD

EUR

101.98 683,312

68.53 120,361

29.1

18.2

28.7

29.2

25.7

20.4

22.2

17.5

7.2

2.6

7.1

2.5

6.5

2.4

5.7

2.2

24.5

8.8

1.2

2.0

15.0

9.3

44.8

47.6

13.2

6.1

USD

81.43 136,076

52.9

83.1

74.2

56.8

8.2

12.9

13.1 10.8

17.3

0.0

33.4

49.0

11.5

33.4

31.2

47.0

36.7

40.1

32.0

32.2

26.6

6.0

6.7

7.5

7.3

7.3

6.9

6.3

6.0

16.9

21.5

1.1

1.1

19.2

17.0

47.1

45.8

10.3

12.1

26.5

24.0

28.9

23.0

24.9

21.8

21.0

18.9

5.1

4.8

5.1

4.7

4.4

4.1

3.9

3.7

20.1

20.0

1.5

1.8

14.9

13.2

56.3

58.8

15.7

17.1

24 March 2015

Table-4: Peer Comparison

Company Report

Samsonite 新秀丽 (01910 HK)

Source: Bloomberg, Guotai Junan International. All forecasts are based on Bloomberg consensus.

* Note: The financial year end dates of these companies are not 31st December. For easier comparison with peers, “13A” means “FY14A” and “14F” means FY15F

and so on.

See the last page for disclaimer

Page 5 of 7

Financial Statements and Ratios

FY15F

FY16F

FY17F

Turnover

2,038

2,351

2,644

2,979

3,289

Cost of sales

(949)

(1,107)

(1,245)

(1,397)

(1,530)

Gross profit

1,088

1,244

1,399

1,582

1,760

As at Dec 31 (US$ mn)

FY13A

FY14A

FY15F

FY16F

FY17F

PP&E

155

Goodwill

214

178

211

243

276

270

270

270

270

Other intangible assets

663

767

757

747

737

67

81

77

74

68

1,100

1,296

1,315

1,334

1,351

Inventory

298

332

380

427

525

Others

Distribution costs

(541)

(626)

(693)

(780)

(862)

Marketing expenses

(129)

(145)

(196)

(220)

(243)

Administrative & general

expenses

(137)

(174)

(185)

(203)

(221)

281

299

326

378

434

Trade and other receivables

246

291

322

363

404

Prepaid expenses and other

assets

Cash balance

65

72

72

72

72

225

140

233

312

438

Total current assets

835

835

1,007

1,173

1,440

Trade and bill payables

387

415

512

575

707

Operating profit

Total non-current assets

Net finance cost

(11)

(17)

(8)

(7)

(4)

Profit before tax

270

282

317

371

430

Income tax

(73)

(77)

(83)

(96)

(112)

Minority interest

(21)

(19)

(22)

(26)

(30)

Bank loans

14

65

46

32

22

Net profit

176

186

213

249

289

Current tax liabilities

46

61

61

61

61

Employee benefits

54

62

56

50

45

502

604

674

718

835

Non-controlling interest put

options

53

58

58

58

58

Employee benefits

EPS (US$)

0.125

0.132

0.151

0.177

0.205

YoY

18.6%

5.7%

14.4%

16.8%

15.9%

DPS (US$)

0.057

0.063

0.076

0.088

0.102

Total current liabilities

33

50

45

40

36

Deferred tax liabilities &

other liabilities

116

112

117

121

127

Total non-current liabilities

203

220

215

215

216

Minority interest

Shareholders' equities

38

1,193

38

1,270

38

1,395

38

1,537

38

1,701

BPS (US$)

0.848

0.902

0.991

1.092

1.208

Cash Flow Statement

Year end Dec (US$ mn)

Financial Ratio

FY13A

FY14A

FY15F

FY16F

FY17F

Profit for the year

197

205

235

274

318

Depreciation and

amortization

45

52

59

67

75

Others

61

85

71

86

103

Working capital change

(48)

(36)

17

(24)

(8)

Tax & interest paid

(62)

(76)

(91)

(103)

(116)

Operating cash flow

193

230

292

300

373

Purchase of PP&E

FY13A

FY14A

FY15F

FY16F

FY17F

Revenue growth (%)

15.0

15.4

12.5

12.7

10.4

Operating profit growth (%)

16.4

6.4

8.8

16.0

14.9

Net profit growth (%)

18.6

5.8

14.4

16.8

15.9

Gross margin (%)

53.4

52.9

52.9

53.1

53.5

Operating margin (%)

13.8

12.7

12.3

12.7

13.2

Net profit margin (%)

8.6

7.9

8.1

8.4

8.8

(57)

(70)

(82)

(89)

(99)

Other investing activities

0

(197)

0

0

0

ROE (%)

15.7

15.1

16.0

17.0

17.8

Other proceeds

3

(1)

0

0

0

ROA (%)

9.4

9.2

9.6

10.3

10.9

Investing cash flow

(54)

(267)

(82)

(89)

(99)

Inventory turnover days

110.7

104.0

104.4

105.4

113.6

Dividend paid

(38)

(80)

(88)

(107)

(124)

Account receivable days

42.0

41.7

42.3

42.0

42.5

Other financing activities

(27)

38

(29)

(25)

(23)

Account payable days

144.1

132.3

135.9

141.9

152.9

Financing cash flow

(65)

(42)

(117)

(132)

(147)

Cash conversion cycle

8.5

13.3

10.8

5.5

3.2

Cash at beginning of year

151

225

140

233

312

Current ratio (x)

1.7

1.4

1.5

1.6

1.7

74

(79)

92

79

127

Payout ratio (%)

45.4

47.2

50.0

50.0

50.0

Net gearing (%)

Net

cash

Net

cash

Net

cash

Net

cash

Net

cash

Change in cash and cash

equivalent

Cash balance at year end

225

140

233

312

438

Source: the Company, Guotai Junan International.

See the last page for disclaimer

Page 6 of 7

24 March 2015

Balance Sheet

FY14A

Samsonite 新秀丽 (01910 HK)

FY13A

Company Report

Income Statement

Year end Dec (US$ mn)

Company Rating Definition

The Benchmark: Hong Kong Hang Seng Index

Rating

Definition

Buy

Relative Performance >15%;

or the fundamental outlook of the company or sector is favorable.

Relative Performance is 5% to 15%;

or the fundamental outlook of the company or sector is favorable.

Accumulate

Neutral

Relative Performance is -5% to 5%;

or the fundamental outlook of the company or sector is neutral.

Reduce

Relative Performance is -5% to -15%;

or the fundamental outlook of the company or sector is unfavorable.

Sell

Relative Performance <-15%;

or the fundamental outlook of the company or sector is unfavorable.

24 March 2015

Time Horizon: 6 to 18 months

Sector Rating Definition

The Benchmark: Hong Kong Hang Seng Index

Time Horizon: 6 to 18 months

Rating

Outperform

Definition

Relative Performance >5%;

or the fundamental outlook of the sector is favorable.

Neutral

Relative Performance is -5% to 5%;

or the fundamental outlook of the sector is neutral.

Underperform

Relative Performance <-5%;

or the fundamental outlook of the sector is unfavorable.

(1)

(2)

(3)

(4)

The Analysts and their associates do not serve as an officer of the issuer mentioned in this Research Report.

The Analysts and their associates do not have any financial interests in relation to the issuer mentioned in this Research Report.

Except for Shandong Chenming Paper Holdings Limited-H shares (01812), China All Access (Holdings) Limited (00633), Guangshen

Railway Company Limited-H share (00525), Guotai Junan International Holdings Limited (01788) and Binhai Investment Company

Limited (02886), Guotai Junan and its group companies do not hold equal to or more than 1% of the market capitalization of the issuer

mentioned in this Research Report.

Guotai Junan and its group companies have not had investment banking relationships with the issuer mentioned in this Research Report

within the preceding 12 months.

DISCLAIMER

This Research Report does not constitute an invitation or offer to acquire, purchase or subscribe for securities by Guotai Junan Securities

(Hong Kong) Limited ("Guotai Junan"). Guotai Junan and its group companies may do business that relates to companies covered in

research reports, including investment banking, investment services and etc. (for example, the placing agent, lead manager, sponsor,

underwriter or invest proprietarily).

Samsonite 新秀丽 (01910 HK)

DISCLOSURE OF INTERESTS

Any opinions expressed in this report may differ or be contrary to opinions or investment strategies expressed orally or in written form by sales

persons, dealers and other professional executives of Guotai Junan group of companies. Any opinions expressed in this report may differ or

be contrary to opinions or investment decisions made by the asset management and investment banking groups of Guotai Junan.

Though best effort has been made to ensure the accuracy of the information and data contained in this Research Report, Guotai Junan does

not guarantee the accuracy and completeness of the information and data herein. This Research Report may contain some forward-looking

estimates and forecasts derived from the assumptions of the future political and economic conditions with inherently unpredictable and

mutable situation, so uncertainty may contain. Investors should understand and comprehend the investment objectives and its related risks,

and where necessary consult their own financial advisers prior to any investment decision.

This Research Report is not directed at, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located

in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would

subject Guotai Junan and its group companies to any registration or licensing requirement within such jurisdiction.

See the last page for disclaimer

Company Report

© 2015 Guotai Junan Securities (Hong Kong) Limited. All Rights Reserved.

27/F., Low Block, Grand Millennium Plaza, 181 Queen’s Road Central, Hong Kong.

Tel.: (852) 2509-9118

Fax: (852) 2509-7793

Website: www.gtja.com.hk

Page 7 of 7