ACCA Paper P1 Free Course notes

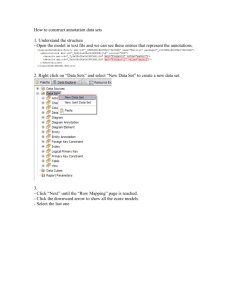

advertisement