SOLUTIONS TO END-OF

Chapter 5

SOLUTIONS TO END-OF-CHAPTER PROBLEMS

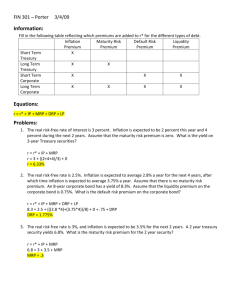

5-1 k* = 3%; I

1

= 2%; I

2

= 4%; I

3

= 4%; MRP = 0; k

T-2

= ?; k

T-3

= ? k = k* + IP + DRP + LP + MRP.

Since these are Treasury securities, DRP = LP = 0. k

T-3

= k* + IP

3

.

IP

3

= (2% + 4% + 4%)/3 = 3.33%. k

T-3

= 3% + 3.33% = 6.33%.

5-2 k

T-10

= 6%; k

C-10

= 8%; LP = 0.5%; DRP = ? k = k* + IP + DRP + LP + MRP. k

T-10

= 6% = k* + IP + MRP; DRP = LP = 0. k

T-2

= k* + IP

2

.

IP

2

= (2% + 4%)/2 = 3%. k

T-2

= 3% + 3% = 6%. k

C-10

= 8% = k* + IP + DRP + 0.5% + MRP.

Because both bonds are 10-year bonds the inflation premium and maturity risk premium on both bonds are equal. The only difference between them is the liquidity and default risk premiums. k

C-10

= 8% = k* + IP + MRP + 0.5% + DRP. But we know from above that k* +

IP + MRP = 6%; therefore, k

C-10

= 8% = 6% + 0.5% + DRP

1.5% = DRP.

5-3 k

T-1, 1

= 5%; k

T-1, 2

= 6%; k

T-2

= ? k

T-2

=

5% + 6%

= 5.5%.

2

5-4 k* = 3%; IP = 3%; k

T-2

= 6.2%; MRP

2

= ? k

T-2

= k* + IP + MRP = 6.2% k

T-2

= 3% + 3% + MRP = 6.2%

Harcourt, Inc. items and derived items copyright © 2000 by Harcourt, Inc.

Answers and Solutions: 5 - 1

MRP = 0.2%.

Answers and Solutions: 5 - 2 Harcourt, Inc. items and derived items copyright © 2000 by Harcourt, Inc.

5-5 Let x equal the yield on 1-year securities 1 year from now:

(5.6% + x)/2 = 6%

5.6% + x = 12%

x = 6.4%.

5-6 Let x equal the yield on 2-year securities 4 years from now:

7.5% = [(4)(7%) + 2x]/6

0.45 = 0.28 + 2x

x = 0.085 or 8.5%.

5-7 k = k* + IP + MRP + DRP + LP. k* = 0.03.

IP = [0.03 + 0.04 + (5)(0.035)]/7 = 0.035.

MRP = 0.0005(6) = 0.003.

DRP = 0.

LP = 0. k = 0.03 + 0.035 + 0.003 = 0.068 = 6.8%.

5-8 a. k

1

= 3%, and k

2

=

3% + k

1 in Year 2

2

= 4.5%,

Solving for k

1

in Year 2, we obtain k

1

in Year 2 = (4.5% × 2) - 3% = 6%. b. For riskless bonds under the expectations theory, the interest rate for a bond of any maturity is k n

= k* + average inflation over n years. If k* = 1%, we can solve for IP n

:

Year 1: k

1

= 1% + I

1

= 3%;

I

1

= expected inflation = 3% - 1% = 2%.

Year 2: k

1

= 1% + I

2

= 6%;

I

2

= expected inflation = 6% - 1% = 5%.

Note also that the average inflation rate is (2% + 5%)/2 = 3.5%, which, when added to k* = 1%, produces the yield on a 2-year bond, 4.5 percent. Therefore, all of our results are consistent.

Alternative solution: Solve for the inflation rates in Year 1 and Year

2 first: k

RF

= k* + IP

Harcourt, Inc. items and derived items copyright © 2000 by Harcourt, Inc.

Answers and Solutions: 5 - 3

Year 1: 3% = 1% + IP

1

; IP

1

= 2%, thus I

1

= 2%.

Year 2: 4.5% = 1% + IP

2

; IP

2

= 3.5%.

IP

2

= (I

1

+ I

2

)/2

3.5% = (2% + I

2

)/2

I

2

= 5%.

Then solve for the yield on the one-year bond in the second year:

5-9 k* = 2%; MRP = 0%. k

1

= 5%; k

2

= 7%.

Year 2: k

1

= 1% + 5% = 6%. k

2

= k

1

+ k

1 in

2

Year 2

,

7% =

5% + k

1 in Year 2

2

,

9% = k

1

in Year 2. k

1

in Year 2 = k* + I

2

,

9% = 2% + I

2

7% = I

2

.

5-10 First, note that we will use the equation k t

= 3% + IP t

+ MRP t

. We have the data needed to find the IPs:

IP

5

=

8% + 5% + 4% + 4% + 4%

5

=

25%

5

= 5%.

The average interest rate during the 2-year period differs from the 1-year interest rate expected for Year 2 because of the inflation rate reflected in the two interest rates. The inflation rate reflected in the interest rate on any security is the average rate of inflation expected over the security’s life.

IP

2

=

8% + 5%

2

= 6.5%.

Now we can substitute into the equation: k

2

= 3% + 6.5% + MRP

2

= 10%. k

5

= 3% + 5% + MRP

5

= 10%.

Answers and Solutions: 5 - 4 Harcourt, Inc. items and derived items copyright © 2000 by Harcourt, Inc.

Now we can solve for the MRPs, and find the difference:

Difference = (2% - 0.5%) = 1.5%.

5-11 Basic relevant equations: k t

= k* + IP t

+ DRP t

+ MRP t

+ LP t

.

But here IP is the only premium, so k t

= k* + IP t

.

IP t

= Avg. inflation = (I

1

+ I

2

+ ...)/N.

MRP

5

= 10% - 8% = 2%. MRP

2

= 10% - 9.5% = 0.5%.

We know that I

1

= IP

1

= 3% and k* = 2%. Therefore, k

1

= 2% + 3% = 5%. k

3

= k

1

+ 2% = 5% + 2% = 7%. But, k

3

= k* + IP

3

= 2% + IP

3

= 7%, so

IP

3

= 7% - 2% = 5%.

We also know that I t

= Constant after t = 1.

We can set up this table:

k* I Avg. I = IP t

k = k* + IP t

1 2 3 3%/1 = 3% 5%

2 2 I (3% + I)/2 = IP

2

3 2 I (3% + I + I)/3 = IP

3

k

3

= 7%, so IP

3

= 7%-2% = 5%.

Avg. I = IP

3

= (3% + 2I)/3 = 5%

2I = 12%

I = 6%.

5-12 a. Real

Years to Risk-Free

Maturity Rate (k*) IP** MRP k

T

= k* + IP + MRP

1 2% 7.00% 0.2% 9.20%

2 2 6.00 0.4 8.40

3 2 5.00 0.6 7.60

4 2 4.50 0.8 7.30

5 2 4.20 1.0 7.20

10 2 3.60 1.0 6.60

20 2 3.30 1.0 6.30

Harcourt, Inc. items and derived items copyright © 2000 by Harcourt, Inc.

Answers and Solutions: 5 - 5

**The computation of the inflation premium is as follows:

Expected Average

Year Inflation Expected Inflation

1 7% 7.00%

2 5 6.00

3 3 5.00

4 3 4.50

5 3 4.20

10 3 3.60

20 3 3.30

For example, the calculation for 3 years is as follows:

7% + 5% + 3%

= 5.00%.

3

Thus, the yield curve would be as follows:

8.5

8.0

7.5

7.0

6.5

Interest Rate

(%)

11.0

10.5

10.0

9.5

9.0

LILCO

Exxon

T-bonds

0 2 4 6 8 10 12 14 16 18 20

Years to Maturity b. The interest rate on the Exxon bonds has the same components as the

Treasury securities, except that the Exxon bonds have default risk, so a default risk premium must be included. Therefore, k

Exxon

= k* + IP + MRP + DRP.

For a strong company such as Exxon, the default risk premium is virtually zero for short-term bonds. However, as time to maturity increases, the probability of default, although still small, is sufficient to warrant a default premium. Thus, the yield risk curve for the

Exxon bonds will rise above the yield curve for the Treasury

Answers and Solutions: 5 - 6 Harcourt, Inc. items and derived items copyright © 2000 by Harcourt, Inc.

securities. In the graph, the default risk premium was assumed to be

1.0 percentage point on the 20-year Exxon bonds. The return should equal 6.3% + 1% = 7.3%. c. LILCO bonds would have significantly more default risk than either

Treasury securities or Exxon bonds, and the risk of default would increase over time due to possible financial deterioration. In this example, the default risk premium was assumed to be 1.0 percentage point on the 1-year LILCO bonds and 2.0 percentage points on the

20-year bonds. The 20-year return should equal 6.3% + 2% = 8.3%.

5-13 Term Rate

6 months 5.1%

1 year 5.5

2 years 5.6

Interest Rate

10

(%)

8

3 years 5.7

4 years 5.8

5 years 6.0

10 years 6.1

6

4

20 years 6.5

30 years 6.3

2

0

0 5 10 15 20 25

Years to Maturity

30

5-14 a. The average rate of inflation for the 5-year period is calculated as:

Average inflation = (0.13 + 0.09 + 0.07 + 0.06 + 0.06)/5 = 8.20%. rate b. k = k* + IP

Avg.

= 2% + 8.2% = 10.20%. c. Here is the general situation:

Arithmetic

1-Year Average Maturity Estimated

Expected Expected Risk Interest

Year Inflation Inflation k* Premium Rates

1 13% 13.0% 2% 0.1% 15.1%

2 9 11.0 2 0.2 13.2

3 7 9.7 2 0.3 12.0

5 6 8.2 2 0.5 10.7

. . . . . .

. . . . . .

. . . . . .

10 6 7.1 2 1.0 10.1

20 6 6.6 2 2.0 10.6

Harcourt, Inc. items and derived items copyright © 2000 by Harcourt, Inc.

Answers and Solutions: 5 - 7

Interest Rate

(%)

15.0

12.5

10.0

7.5

5.0

2.5

0 2 4 6 8 10 12 14 16 18 20

Years to Maturity d. The “normal” yield curve is upward sloping because, in “normal” times, inflation is not expected to trend either up or down, so IP is the same for debt of all maturities, but the MRP increases with years, so the yield curve slopes up. During a recession, the yield curve typically slopes up especially steeply, because inflation and consequently shortterm interest rates are currently low, yet people expect inflation and interest rates to rise as the economy comes out of the recession. e. If inflation rates are expected to be constant, then the expectations theory holds that the yield curve should be horizontal. However, in this event it is likely that maturity risk premiums would be applied to long-term bonds because of the greater risks of holding long-term rather than short-term bonds:

Percent

(%)

Actual yield curve

A

Maturity risk premium

Pure expectations yield curve

Years to Maturity

If maturity risk premiums were added to the yield curve in Part e above, then the yield curve would be more nearly normal; that is, the long-term end of the curve would be raised. (The yield curve shown in this answer is upward sloping; the yield curve shown in Part c is downward sloping.)

Answers and Solutions: 5 - 8 Harcourt, Inc. items and derived items copyright © 2000 by Harcourt, Inc.

SPREADSHEET PROBLEM

5-15 The detailed solution for the spreadsheet problem is available both on the instructor’s resource CD-ROM and on the instructor’s side of the Harcourt

College Publishers’ web site, http://www.harcourtcollege.com/finance/ brigham.

CYBERPROBLEM

5-16 The detailed solution for the cyberproblem is available on the instructor’s side of the Harcourt College Publishers’ web site, http://www. harcourtcollege.com/finance/brigham.

Harcourt , Inc. items and derived items copyright © 2000 by Harcourt, Inc.

Computer/Internet Applications: 5 - 9

INTEGRATED CASE

Smyth Barry & Company

Financial Markets, Institutions, and Taxes

5-17 ASSUME THAT YOU RECENTLY GRADUATED WITH A DEGREE IN FINANCE AND HAVE

JUST REPORTED TO WORK AS AN INVESTMENT ADVISOR AT THE BROKERAGE FIRM OF

SMYTH BARRY & CO. YOUR FIRST ASSIGNMENT IS TO EXPLAIN THE NATURE OF

THE U. S. FINANCIAL MARKETS TO MICHELLE VARGA, A PROFESSIONAL TENNIS

PLAYER WHO HAS JUST COME TO THE UNITED STATES FROM MEXICO. VARGA IS A

HIGHLY RANKED TENNIS PLAYER WHO EXPECTS TO INVEST SUBSTANTIAL AMOUNTS

OF MONEY THROUGH SMYTH BARRY. SHE IS ALSO VERY BRIGHT, AND, THEREFORE,

SHE WOULD LIKE TO UNDERSTAND IN GENERAL TERMS WHAT WILL HAPPEN TO HER

MONEY. YOUR BOSS HAS DEVELOPED THE FOLLOWING SET OF QUESTIONS THAT YOU

MUST ASK AND ANSWER TO EXPLAIN THE U. S. FINANCIAL SYSTEM TO VARGA.

A. WHAT IS A MARKET? HOW ARE PHYSICAL ASSET MARKETS DIFFERENTIATED FROM

FINANCIAL MARKETS?

ANSWER: [SHOW S5-1 AND S5-2 HERE.] A MARKET IS ONE IN WHICH ASSETS ARE BOUGHT

AND SOLD. THERE ARE MANY DIFFERENT TYPES OF FINANCIAL MARKETS, EACH

ONE DEALING WITH A DIFFERENT TYPE OF FINANCIAL ASSET, SERVING A

DIFFERENT SET OF CUSTOMERS, OR OPERATING IN A DIFFERENT PART OF THE

COUNTRY. FINANCIAL MARKETS DIFFER FROM PHYSICAL ASSET MARKETS IN THAT

REAL, OR TANGIBLE, ASSETS SUCH AS MACHINERY, REAL ESTATE, AND

AGRICULTURAL PRODUCTS ARE TRADED IN THE PHYSICAL ASSET MARKETS, BUT

FINANCIAL SECURITIES REPRESENTING CLAIMS ON ASSETS ARE TRADED IN THE

FINANCIAL MARKETS.

B. DIFFERENTIATE BETWEEN MONEY MARKETS AND CAPITAL MARKETS.

ANSWER: MONEY MARKETS ARE THE MARKETS IN WHICH DEBT SECURITIES WITH MATURITIES

OF LESS THAN ONE YEAR ARE TRADED. NEW YORK, LONDON, AND TOKYO ARE

MAJOR MONEY MARKET CENTERS. LONGER-TERM SECURITIES, INCLUDING STOCKS

AND BONDS, ARE TRADED IN THE CAPITAL MARKETS. THE NEW YORK STOCK

Integrated Case: 5 - 10 Harcourt, Inc. items and derived items copyright © 2000 by Harcourt, Inc.

EXCHANGE IS AN EXAMPLE OF A CAPITAL MARKET, WHILE THE NEW YORK

COMMERCIAL PAPER AND TREASURY BILL MARKETS ARE MONEY MARKETS.

C. DIFFERENTIATE BETWEEN A PRIMARY MARKET AND A SECONDARY MARKET. IF

APPLE COMPUTER DECIDED TO ISSUE ADDITIONAL COMMON STOCK, AND VARGA

PURCHASED 100 SHARES OF THIS STOCK FROM MERRILL LYNCH, THE UNDERWRITER,

WOULD THIS TRANSACTION BE A PRIMARY MARKET TRANSACTION OR A SECONDARY

MARKET TRANSACTION? WOULD IT MAKE A DIFFERENCE IF VARGA PURCHASED

PREVIOUSLY OUTSTANDING APPLE STOCK IN THE DEALER MARKET?

ANSWER: A PRIMARY MARKET IS ONE IN WHICH COMPANIES RAISE CAPITAL BY SELLING

NEWLY ISSUED SECURITIES, WHEREAS PREVIOUSLY OUTSTANDING SECURITIES ARE

TRADED AMONG INVESTORS IN THE SECONDARY MARKETS. IF VARGA PURCHASED

NEWLY ISSUED APPLE STOCK, THIS WOULD CONSTITUTE A PRIMARY MARKET

TRANSACTION, WITH MERRILL LYNCH ACTING AS AN INVESTMENT BANKER IN THE

TRANSACTION. IF VARGA PURCHASED “USED” STOCK, THEN THE TRANSACTION

WOULD BE IN THE SECONDARY MARKET.

D. DESCRIBE THE THREE PRIMARY WAYS IN WHICH CAPITAL IS TRANSFERRED BETWEEN

SAVERS AND BORROWERS.

ANSWER: [SHOW S5-3 AND S5-4 HERE.] TRANSFERS OF CAPITAL CAN BE MADE (1) BY

DIRECT TRANSFER OF MONEY AND SECURITIES, (2) THROUGH AN INVESTMENT

BANKING HOUSE, OR (3) THROUGH A FINANCIAL INTERMEDIARY. IN A DIRECT

TRANSFER, A BUSINESS SELLS ITS STOCKS OR BONDS DIRECTLY TO INVESTORS

(SAVERS), WITHOUT GOING THROUGH ANY TYPE OF INSTITUTION. THE BUSINESS

BORROWER RECEIVES DOLLARS FROM THE SAVERS, AND THE SAVERS RECEIVE

SECURITIES (BONDS OR STOCK) IN RETURN.

IF THE TRANSFER IS MADE THROUGH AN INVESTMENT BANKING HOUSE, THE

INVESTMENT BANK SERVES AS A MIDDLEMAN. THE BUSINESS SELLS ITS

SECURITIES TO THE INVESTMENT BANK, WHICH IN TURN SELLS THEM TO THE

SAVERS. ALTHOUGH THE SECURITIES ARE SOLD TWICE, THE TWO SALES

CONSTITUTE ONE COMPLETE TRANSACTION IN THE PRIMARY MARKET.

IF THE TRANSFER IS MADE THROUGH A FINANCIAL INTERMEDIARY, SAVERS

INVEST FUNDS WITH THE INTERMEDIARY, WHICH THEN ISSUES ITS OWN

SECURITIES IN EXCHANGE. BANKS ARE ONE TYPE OF INTERMEDIARY, RECEIVING

DOLLARS FROM MANY SMALL SAVERS AND THEN LENDING THESE DOLLARS TO

Harcourt, Inc. items and derived items copyright © 2000 by Harcourt, Inc. Integrated Case: 5 - 11

BORROWERS TO PURCHASE HOMES, AUTOMOBILES, VACATIONS, AND SO ON, AND

ALSO TO BUSINESSES AND GOVERNMENT UNITS. THE SAVERS RECEIVE A

CERTIFICATE OF DEPOSIT OR SOME OTHER INSTRUMENT IN EXCHANGE FOR THE

FUNDS DEPOSITED WITH THE BANK. MUTUAL FUNDS, INSURANCE COMPANIES, AND

PENSION FUNDS ARE OTHER TYPES OF INTERMEDIARIES.

E. WHAT ARE THE TWO LEADING STOCK MARKETS? DESCRIBE THE TWO BASIC TYPES

OF STOCK MARKETS.

ANSWER: [SHOW S5-5 HERE.] THE TWO LEADING STOCK MARKETS TODAY ARE THE NEW YORK

STOCK EXCHANGE AND THE NASDAQ STOCK MARKET. THERE ARE JUST TWO BASIC

TYPES OF STOCK MARKETS: (1) PHYSICAL LOCATION EXCHANGES, WHICH INCLUDE

THE NEW YORK STOCK EXCHANGE (NYSE), THE AMERICAN STOCK EXCHANGE (AMEX),

AND SEVERAL REGIONAL STOCK EXCHANGES, AND (2) ELECTRONIC DEALER-BASED

MARKETS THAT INCLUDE THE NASDAQ STOCK MARKET, THE LESS FORMAL OVER-THE-

COUNTER MARKET, AND THE RECENTLY DEVELOPED ELECTRONIC COMMUNICATIONS

NETWORKS (ECNs).

THE PHYSICAL LOCATION EXCHANGES ARE FORMAL ORGANIZATIONS HAVING

TANGIBLE, PHYSICAL LOCATIONS AND TRADING IN DESIGNATED SECURITIES.

THERE ARE EXCHANGES FOR STOCKS, BONDS, COMMODITIES, FUTURES, AND

OPTIONS. THE PHYSICAL LOCATION EXCHANGES ARE CONDUCTED AS AUCTION

MARKETS WITH SECURITIES GOING TO THE HIGHEST BIDDER. BUYERS AND

SELLERS PLACE ORDERS WITH THEIR BROKERS WHO THEN EXECUTE THOSE ORDERS

BY MATCHING BUYERS AND SELLERS, ALTHOUGH SPECIALISTS ASSIST IN

PROVIDING CONTINUITY TO THE MARKETS.

THE ELECTRONIC DEALER-BASED MARKET IS MADE UP OF HUNDREDS OF BROKERS

AND DEALERS AROUND THE COUNTRY WHO ARE CONNECTED ELECTRONICALLY BY

TELEPHONES AND COMPUTERS. THE DEALER-BASED MARKET FACILITATES TRADING

OF SECURITIES THAT ARE NOT LISTED ON A PHYSICAL LOCATION EXCHANGE. A

DEALER MARKET IS DEFINED TO INCLUDE ALL FACILITIES THAT ARE NEEDED TO

CONDUCT SECURITY TRANSACTIONS NOT MADE ON THE PHYSICAL LOCATION

EXCHANGES. THESE FACILITIES INCLUDE (1) THE RELATIVELY FEW DEALERS WHO

HOLD INVENTORIES OF THESE SECURITIES AND WHO ARE SAID TO MAKE A MARKET

IN THESE SECURITIES; (2) THE THOUSANDS OF BROKERS WHO ACT AS AGENTS IN

BRINGING THE DEALERS TOGETHER WITH INVESTORS; AND (3) THE COMPUTERS,

TERMINALS, AND ELECTRONIC NETWORKS THAT PROVIDE A COMMUNICATION LINK

BETWEEN DEALERS AND BROKERS. DEALERS CONTINUOUSLY POST A PRICE AT

Integrated Case: 5 - 12 Harcourt, Inc. items and derived items copyright © 2000 by Harcourt, Inc.

WHICH THEY ARE WILLING TO BUY THE STOCK (THE BID PRICE) AND A PRICE AT

WHICH THEY ARE WILLING TO SELL THE STOCK (THE ASK PRICE). THE ASK

PRICE IS ALWAYS HIGHER THAN THE BID PRICE, AND THE DIFFERENCE (OR “BID-

ASK SPREAD”) REPRESENTS THE DEALER’S MARKUP, OR PROFIT.

F. WHAT DO WE CALL THE PRICE THAT A BORROWER MUST PAY FOR DEBT CAPITAL?

WHAT IS THE PRICE OF EQUITY CAPITAL? WHAT ARE THE FOUR MOST

FUNDAMENTAL FACTORS THAT AFFECT THE COST OF MONEY, OR THE GENERAL LEVEL

OF INTEREST RATES, IN THE ECONOMY?

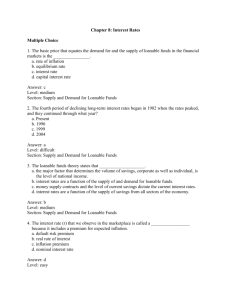

ANSWER: [SHOW S5-6 AND S5-7 HERE.] THE INTEREST RATE IS THE PRICE PAID FOR

BORROWED CAPITAL, WHILE THE RETURN ON EQUITY CAPITAL COMES IN THE FORM

OF DIVIDENDS PLUS CAPITAL GAINS. THE RETURN THAT INVESTORS REQUIRE ON

CAPITAL DEPENDS ON (1) PRODUCTION OPPORTUNITIES, (2) TIME PREFERENCES

FOR CONSUMPTION, (3) RISK, AND (4) INFLATION.

PRODUCTION OPPORTUNITIES REFER TO THE RETURNS THAT ARE AVAILABLE

FROM INVESTMENT IN PRODUCTIVE ASSETS: THE MORE PRODUCTIVE A PRODUCER

FIRM BELIEVES ITS ASSETS WILL BE, THE MORE IT WILL BE WILLING TO PAY

FOR THE CAPITAL NECESSARY TO ACQUIRE THOSE ASSETS.

TIME PREFERENCE FOR CONSUMPTION REFERS TO CONSUMERS’ PREFERENCES FOR

CURRENT CONSUMPTION VERSUS SAVINGS FOR FUTURE CONSUMPTION: CONSUMERS

WITH LOW PREFERENCES FOR CURRENT CONSUMPTION WILL BE WILLING TO LEND AT

A LOWER RATE THAN CONSUMERS WITH A HIGH PREFERENCE FOR CURRENT

CONSUMPTION.

INFLATION REFERS TO THE TENDENCY OF PRICES TO RISE, AND THE HIGHER

THE EXPECTED RATE OF INFLATION, THE LARGER THE REQUIRED RATE OF RETURN.

RISK, IN A MONEY AND CAPITAL MARKET CONTEXT, REFERS TO THE CHANCE

THAT A LOAN WILL NOT BE REPAID AS PROMISED--THE HIGHER THE PERCEIVED

DEFAULT RISK, THE HIGHER THE REQUIRED RATE OF RETURN.

RISK IS ALSO LINKED TO THE MATURITY AND LIQUIDITY OF A SECURITY. THE

LONGER THE MATURITY AND THE LESS LIQUID (MARKETABLE) THE SECURITY, THE

HIGHER THE REQUIRED RATE OF RETURN, OTHER THINGS CONSTANT.

THE PRECEDING DISCUSSION RELATED TO THE GENERAL LEVEL OF MONEY

COSTS, BUT THE LEVEL OF INTEREST RATES WILL ALSO BE INFLUENCED BY SUCH

THINGS AS FED POLICY, FISCAL AND FOREIGN TRADE DEFICITS, AND THE LEVEL

OF ECONOMIC ACTIVITY. ALSO, INDIVIDUAL SECURITIES WILL HAVE HIGHER

Harcourt, Inc. items and derived items copyright © 2000 by Harcourt, Inc. Integrated Case: 5 - 13

YIELDS THAN THE RISK-FREE RATE BECAUSE OF THE ADDITION OF VARIOUS

PREMIUMS AS DISCUSSED BELOW.

G. WHAT IS THE REAL RISK-FREE RATE OF INTEREST (k*) AND THE NOMINAL RISK-

FREE RATE (k

RF

)? HOW ARE THESE TWO RATES MEASURED?

ANSWER: [SHOW S5-8 AND S5-9 HERE.] KEEP THESE EQUATIONS IN MIND AS WE DISCUSS

INTEREST RATES. WE WILL DEFINE THE TERMS AS WE GO ALONG: k = k* + IP + DRP + LP + MRP. k

RF

= k* + IP.

THE REAL RISK-FREE RATE, k*, IS THE RATE THAT WOULD EXIST ON DEFAULT-

FREE SECURITIES IN THE ABSENCE OF INFLATION.

THE NOMINAL RISK-FREE RATE, k

RF

, IS EQUAL TO THE REAL RISK-FREE RATE

PLUS AN INFLATION PREMIUM, WHICH IS EQUAL TO THE AVERAGE RATE OF

INFLATION EXPECTED OVER THE LIFE OF THE SECURITY.

THERE IS NO TRULY RISKLESS SECURITY, BUT THE CLOSEST THING IS A

SHORT-TERM U. S. TREASURY BILL (T-BILL), WHICH IS FREE OF MOST RISKS.

THE REAL RISK-FREE RATE, k*, IS ESTIMATED BY SUBTRACTING THE EXPECTED

RATE OF INFLATION FROM THE RATE ON SHORT-TERM TREASURY SECURITIES. IT

IS GENERALLY ASSUMED THAT k* IS IN THE RANGE OF 1 TO 4 PERCENTAGE

POINTS. THE T-BOND RATE IS USED AS A PROXY FOR THE LONG-TERM RISK-FREE

RATE. HOWEVER, WE KNOW THAT ALL LONG-TERM BONDS CONTAIN INTEREST RATE

RISK, SO THE T-BOND RATE IS NOT REALLY RISKLESS. IT IS, HOWEVER, FREE

OF DEFAULT RISK.

H. DEFINE THE TERMS INFLATION PREMIUM (IP), DEFAULT RISK PREMIUM (DRP),

LIQUIDITY PREMIUM (LP), AND MATURITY RISK PREMIUM (MRP). WHICH OF

THESE PREMIUMS IS INCLUDED WHEN DETERMINING THE INTEREST RATE ON

(1) SHORT-TERM U. S. TREASURY SECURITIES, (2) LONG-TERM U. S. TREASURY

SECURITIES, (3) SHORT-TERM CORPORATE SECURITIES, AND (4) LONG-TERM

CORPORATE SECURITIES? EXPLAIN HOW THE PREMIUMS WOULD VARY OVER TIME

AND AMONG THE DIFFERENT SECURITIES LISTED ABOVE.

Integrated Case: 5 - 14 Harcourt, Inc. items and derived items copyright © 2000 by Harcourt, Inc.

ANSWER: [SHOW S5-10 HERE.] THE INFLATION PREMIUM (IP) IS A PREMIUM ADDED TO

THE REAL RISK-FREE RATE OF INTEREST TO COMPENSATE FOR EXPECTED

INFLATION.

THE DEFAULT RISK PREMIUM (DRP) IS A PREMIUM BASED ON THE PROBABILITY

THAT THE ISSUER WILL DEFAULT ON THE LOAN, AND IT IS MEASURED BY THE

DIFFERENCE BETWEEN THE INTEREST RATE ON A U. S. TREASURY BOND AND A

CORPORATE BOND OF EQUAL MATURITY AND MARKETABILITY.

A LIQUID ASSET IS ONE THAT CAN BE SOLD AT A PREDICTABLE PRICE ON

SHORT NOTICE; A LIQUIDITY PREMIUM IS ADDED TO THE RATE OF INTEREST ON

SECURITIES THAT ARE NOT LIQUID.

THE MATURITY RISK PREMIUM (MRP) IS A PREMIUM THAT REFLECTS INTEREST

RATE RISK; LONGER-TERM SECURITIES HAVE MORE INTEREST RATE RISK (THE

RISK OF CAPITAL LOSS DUE TO RISING INTEREST RATES) THAN DO SHORTER-TERM

SECURITIES, AND THE MRP IS ADDED TO REFLECT THIS RISK.

1. SHORT-TERM TREASURY SECURITIES INCLUDE ONLY AN INFLATION PREMIUM.

2. LONG-TERM TREASURY SECURITIES CONTAIN AN INFLATION PREMIUM PLUS A

MATURITY RISK PREMIUM. NOTE THAT THE INFLATION PREMIUM ADDED TO

LONG-TERM SECURITIES WILL DIFFER FROM THAT FOR SHORT-TERM SECURITIES

UNLESS THE RATE OF INFLATION IS EXPECTED TO REMAIN CONSTANT.

3. THE RATE ON SHORT-TERM CORPORATE SECURITIES IS EQUAL TO THE REAL

RISK-FREE RATE PLUS PREMIUMS FOR INFLATION, DEFAULT RISK, AND

LIQUIDITY. THE SIZE OF THE DEFAULT AND LIQUIDITY PREMIUMS WILL VARY

DEPENDING ON THE FINANCIAL STRENGTH OF THE ISSUING CORPORATION AND

ITS DEGREE OF LIQUIDITY, WITH LARGER CORPORATIONS GENERALLY HAVING

GREATER LIQUIDITY BECAUSE OF MORE ACTIVE TRADING.

4. THE RATE FOR LONG-TERM CORPORATE SECURITIES ALSO INCLUDES A PREMIUM

FOR MATURITY RISK. THUS, LONG-TERM CORPORATE SECURITIES GENERALLY

CARRY THE HIGHEST YIELDS OF THESE FOUR TYPES OF SECURITIES.

I. WHAT IS THE TERM STRUCTURE OF INTEREST RATES? WHAT IS A YIELD CURVE?

ANSWER: [SHOW S5-11 HERE.] THE TERM STRUCTURE OF INTEREST RATES IS THE

RELATIONSHIP BETWEEN INTEREST RATES, OR YIELDS, AND MATURITIES OF

Harcourt, Inc. items and derived items copyright © 2000 by Harcourt, Inc. Integrated Case: 5 - 15

SECURITIES. WHEN THIS RELATIONSHIP IS GRAPHED, THE RESULTING CURVE IS

CALLED A YIELD CURVE.

(SKETCH OUT A YIELD CURVE ON THE BOARD.)

J. SUPPOSE MOST INVESTORS EXPECT THE INFLATION RATE TO BE 5 PERCENT NEXT

YEAR, 6 PERCENT THE FOLLOWING YEAR, AND 8 PERCENT THEREAFTER. THE REAL

RISK-FREE RATE IS 3 PERCENT. THE MATURITY RISK PREMIUM IS ZERO FOR

BONDS THAT MATURE IN 1 YEAR OR LESS, 0.1 PERCENT FOR 2-YEAR BONDS, AND

THEN THE MRP INCREASES BY 0.1 PERCENT PER YEAR THEREAFTER FOR 20 YEARS,

AFTER WHICH IT IS STABLE. WHAT IS THE INTEREST RATE ON 1-YEAR,

10-YEAR, AND 20-YEAR TREASURY BONDS? DRAW A YIELD CURVE WITH THESE

DATA. WHAT FACTORS CAN EXPLAIN WHY THIS CONSTRUCTED YIELD CURVE IS

UPWARD SLOPING?

ANSWER: [SHOW S5-12 THROUGH S5-18 HERE.] S5-12 SHOWS A RECENT (AUGUST 1999)

TREASURY YIELD CURVE.

STEP 1: FIND THE AVERAGE EXPECTED INFLATION RATE OVER YEARS 1 TO 20:

YR 1: IP = 5.0%.

YR 10: IP = (5 + 6 + 8 + 8 + 8 + ... + 8)/10 = 7.5%.

YR 20: IP = (5 + 6 + 8 + 8 + ... + 8)/20 = 7.75%.

STEP 2: FIND THE MATURITY PREMIUM IN EACH YEAR:

YR 1: MRP = 0.0%.

YR 10: MRP = 0.1

×

9 = 0.9%.

YR 20: MRP = 0.1

×

19 = 1.9%.

STEP 3: SUM THE IPs AND MRPs, AND ADD k* = 3%:

YR 1: k

RF

= 3% + 5.0% + 0.0% = 8.0%.

YR 10: k

RF

= 3% + 7.5% + 0.9% = 11.4%.

YR 20: k

RF

= 3% + 7.75% + 1.9% = 12.65%.

THE SHAPE OF THE YIELD CURVE DEPENDS PRIMARILY ON TWO FACTORS:

(1) EXPECTATIONS ABOUT FUTURE INFLATION AND (2) THE RELATIVE RISKINESS

OF SECURITIES WITH DIFFERENT MATURITIES.

Integrated Case: 5 - 16 Harcourt, Inc. items and derived items copyright © 2000 by Harcourt, Inc.

Interest rate (%)

13

12

11

10

9

8

0 1 5 10 15 20

Years to maturity

THE CONSTRUCTED YIELD CURVE IS UPWARD SLOPING. THIS IS DUE TO

INCREASING EXPECTED INFLATION AND AN INCREASING MATURITY RISK PREMIUM.

K. AT ANY GIVEN TIME, HOW WOULD THE YIELD CURVE FACING AN AAA-RATED

COMPANY COMPARE WITH THE YIELD CURVE FOR U. S. TREASURY SECURITIES? AT

ANY GIVEN TIME, HOW WOULD THE YIELD CURVE FACING A BB-RATED COMPANY

COMPARE WITH THE YIELD CURVE FOR U. S. TREASURY SECURITIES?

DRAW A

GRAPH TO ILLUSTRATE YOUR ANSWER.

ANSWER: [SHOW S5-19 THROUGH S5-21 HERE.] (CURVES FOR AAA-RATED AND BB-RATED

SECURITIES HAVE BEEN ADDED TO DEMONSTRATE THAT RISKIER SECURITIES

REQUIRE HIGHER RETURNS.) THE YIELD CURVE NORMALLY SLOPES UPWARD,

INDICATING THAT SHORT-TERM INTEREST RATES ARE LOWER THAN LONG-TERM

INTEREST RATES. YIELD CURVES CAN BE DRAWN FOR GOVERNMENT SECURITIES OR

FOR THE SECURITIES OF ANY CORPORATION, BUT CORPORATE YIELD CURVES WILL

ALWAYS LIE ABOVE GOVERNMENT YIELD CURVES, AND THE RISKIER THE

CORPORATION, THE HIGHER ITS YIELD CURVE. THE SPREAD BETWEEN A

CORPORATE YIELD CURVE AND THE TREASURY CURVE WIDENS AS THE CORPORATE

BOND RATING DECREASES.

Harcourt, Inc. items and derived items copyright © 2000 by Harcourt, Inc. Integrated Case: 5 - 17

Yield Curves

Interest

Rate (%)

15

10

5

5.4%

5.7%

15

6.0%

BB-Rated

AAA-Rated

Treasury yield curve

Years to

20 maturity

0

0 1 5 10

L. WHAT IS THE PURE EXPECTATIONS THEORY? WHAT DOES THE PURE EXPECTATIONS

THEORY IMPLY ABOUT THE TERM STRUCTURE OF INTEREST RATES?

ANSWER: [SHOW S5-22 AND S5-23 HERE.] THE PURE EXPECTATIONS THEORY ASSUMES THAT

INVESTORS ESTABLISH BOND PRICES AND INTEREST RATES STRICTLY ON THE

BASIS OF EXPECTATIONS FOR INTEREST RATES. THIS MEANS THAT THEY ARE

INDIFFERENT WITH RESPECT TO MATURITY IN THE SENSE THAT THEY DO NOT VIEW

LONG-TERM BONDS AS BEING RISKIER THAN SHORT-TERM BONDS. IF THIS WERE

TRUE, THEN THE MATURITY RISK PREMIUM WOULD BE ZERO, AND LONG-TERM

INTEREST RATES WOULD SIMPLY BE A WEIGHTED AVERAGE OF CURRENT AND

EXPECTED FUTURE SHORT-TERM INTEREST RATES. IF THE PURE EXPECTATIONS

THEORY IS CORRECT, YOU CAN USE THE YIELD CURVE TO “BACK OUT” EXPECTED

FUTURE INTEREST RATES.

M. SUPPOSE THAT YOU OBSERVE THE FOLLOWING TERM STRUCTURE FOR TREASURY

SECURITIES:

MATURITY

1 YEAR

2 YEARS

3 YEARS

4 YEARS

5 YEARS

YIELD

6.0%

6.2

6.4

6.5

6.5

ASSUME THAT THE PURE EXPECTATIONS THEORY OF THE TERM STRUCTURE IS

CORRECT. (THIS IMPLIES THAT YOU CAN USE THE YIELD CURVE GIVEN ABOVE TO

Integrated Case: 5 - 18 Harcourt, Inc. items and derived items copyright © 2000 by Harcourt, Inc.

“BACK OUT” THE MARKET’S EXPECTATIONS ABOUT FUTURE INTEREST RATES.)

WHAT DOES THE MARKET EXPECT WILL BE THE INTEREST RATE ON 1-YEAR

SECURITIES, ONE YEAR FROM NOW? WHAT DOES THE MARKET EXPECT WILL BE THE

INTEREST RATE ON 3-YEAR SECURITIES, TWO YEARS FROM NOW?

ANSWER: [SHOW S5-24 THROUGH S5-27 HERE.] CALCULATION FOR k ON 1-YEAR

SECURITIES, ONE YEAR FROM NOW:

6.2% =

6 .

0 %

2

+

X

12.4% = 6.0% + X

6.4% = X.

1-YEAR SECURITIES, ONE YEAR FROM NOW WILL YIELD 6.4%.

CALCULATION FOR k ON 3-YEAR SECURITIES, TWO YEARS FROM NOW:

6.5% =

6 .

2 %)

+

3 X

5

32.5% = 12.4% + 3X

20.1% = 3X

6.7% = X.

3-YEAR SECURITIES, TWO YEARS FROM NOW WILL YIELD 6.7%.

N. FINALLY, VARGA IS ALSO INTERESTED IN INVESTING IN COUNTRIES OTHER THAN

THE UNITED STATES. DESCRIBE THE VARIOUS TYPES OF RISKS THAT ARISE WHEN

INVESTING OVERSEAS.

ANSWER: [SHOW S5-28 AND S5-29 HERE.] FIRST, VARGA SHOULD CONSIDER COUNTRY

RISK, WHICH REFERS TO THE RISK THAT ARISES FROM INVESTING OR DOING

BUSINESS IN A PARTICULAR COUNTRY. THIS RISK DEPENDS ON THE COUNTRY’S

ECONOMIC, POLITICAL, AND SOCIAL ENVIRONMENT. COUNTRY RISK ALSO

INCLUDES THE RISK THAT PROPERTY WILL BE EXPROPRIATED WITHOUT ADEQUATE

COMPENSATION, AS WELL AS NEW HOST COUNTRY STIPULATIONS ABOUT LOCAL

PRODUCTION, SOURCING OR HIRING PRACTICES, AND DAMAGE OR DESTRUCTION OF

FACILITIES DUE TO INTERNAL STRIFE.

SECOND, VARGA SHOULD CONSIDER EXCHANGE RATE RISK. VARGA NEEDS TO

KEEP IN MIND WHEN INVESTING OVERSEAS THAT MORE OFTEN THAN NOT THE

SECURITY WILL BE DENOMINATED IN A CURRENCY OTHER THAN THE DOLLAR, WHICH

Harcourt, Inc. items and derived items copyright © 2000 by Harcourt, Inc. Integrated Case: 5 - 19

MEANS THAT THE VALUE OF THE INVESTMENT WILL DEPEND ON WHAT HAPPENS TO

EXCHANGE RATES. TWO FACTORS CAN LEAD TO EXCHANGE RATE FLUCTUATIONS.

CHANGES IN RELATIVE INFLATION WILL LEAD TO CHANGES IN EXCHANGE RATES.

ALSO, AN INCREASE IN COUNTRY RISK WILL ALSO CAUSE THE COUNTRY’S

CURRENCY TO FALL. CONSEQUENTLY, INFLATION RISK, COUNTRY RISK, AND

EXCHANGE RATE RISK ARE ALL INTERRELATED.

Integrated Case: 5 - 20 Harcourt, Inc. items and derived items copyright © 2000 by Harcourt, Inc.