2015 Email Vendor Features &

Functions Guide

Small-Market / Mid-Market Edition

© RED PILL EMAIL

All Rights Reserved. Unauthorized distribution strictly prohibited. Information provided by participants and is subject to change

with product advancements. CONTACT Red Pill Email – 310-488-6769 – Advertisements in this document link to advertisers.

Email Vendor Features & Functions Guide

Small-Market / Mid-Market Edition

Email Vendor Features & Functions Guide

Table of Contents

1

EXECUTIVE SUMMARY ......................................................................................................... 3

PARTICIPANT SELECTION ..................................................................................................... 3

DEFINING MARKETS & USERS ................................................................................................ 4

USING THIS GUIDE ............................................................................................................. 7

FEATURES & FUNCTIONS ...................................................................................................... 8

BUSINESS OFFERINGS ....................................................................................................... 8

REGIONS SERVED ........................................................................................................ 8

SUPPORTED CHANNELS ................................................................................................ 8

BUSINESS & PRICING MODELS ......................................................................................... 9

PRICING OPTIONS BY PARTICIPANT .................................................................................. 11

PROFESSIONAL SERVICES .............................................................................................. 13

TARGETED VERTICALS AND GEOGRAPHIC MARKETS............................................................. 20

PRODUCT OFFERINGS ..................................................................................................... 21

PLATFORM .............................................................................................................. 21

SERVICE LEVEL AGREEMENTS (SLAS), DATA BACK-UP, & REDUNDANCY .................................... 23

SECURITY FEATURES ................................................................................................... 23

SECURITY SCORES ...................................................................................................... 24

SUPPORTED BROWSERS ............................................................................................... 24

SUPPORTED API PROTOCOLS ........................................................................................ 25

DATA & SEGMENTATION ................................................................................................. 26

DATA CONTROL: ...................................................................................................... 26

QUERIES & SEGMENTATION: ......................................................................................... 29

FORM PROCESSING:.................................................................................................... 32

EXPORTING DATA VIA THE USER INTERFACE: ..................................................................... 34

DATA & SEGMENTATION SCORING: ................................................................................. 37

DATA & SEGMENTATION SCORE BREAKDOWNS .................................................................. 39

DELIVERABILITY & LIST HYGIENE: ...................................................................................... 41

DELIVERABILITY & LIST HYGIENE SCORING: ....................................................................... 42

DELIVERABILITY & LIST HYGIENE SCORE NUMERIC VALUES .................................................... 44

CAMPAIGN BUILDING & WORKFLOW .................................................................................. 45

ACCOUNT MANAGEMENT ............................................................................................ 45

ASSET SUPPORT:........................................................................................................ 48

DEPLOYMENT MANAGEMENT ........................................................................................ 51

PRE-CONFIGURED PROGRAMS ....................................................................................... 53

RSS AND SMS SUPPORT ............................................................................................... 56

USER SUPPORT ......................................................................................................... 60

CAMPAIGN BUILDING & WORKFLOW SCORING................................................................... 63

Email Vendor Features & Functions Guide

CAMPAIGN BUILDING & WORKFLOW SCORE NUMERIC VALUES ............................................... 65

TESTING & REPORTING ................................................................................................... 66

TESTING: ................................................................................................................ 66

REPORTING: ............................................................................................................ 69

TESTING & REPORTING SCORE NUMERIC VALUES ................................................................ 76

THIRD-PARTY INTEGRATION ............................................................................................ 77

DELIVERABILITY ........................................................................................................ 77

ANALYTICS .............................................................................................................. 78

CRM ..................................................................................................................... 79

EMAIL VALIDATION SERVICES INTEGRATION ...................................................................... 80

CONTENT MANAGEMENT SYSTEMS ................................................................................. 81

OTHER INTEGRATION ................................................................................................. 81

S.A.M.E. STANDARDS ................................................................................................. 82

TRAINING & SUPPORT..................................................................................................... 82

TRAINING ................................................................................................................ 82

DOCUMENTATION ..................................................................................................... 84

SUPPORT & ACCOUNT MANAGEMENT ............................................................................. 84

VENDOR SCORES ACROSS ALL CATEGORIES.............................................................................. 86

PREPARING FOR VENDOR SELECTION ..................................................................................... 89

DISCOVERY .............................................................................................................. 89

FUNCTIONAL............................................................................................................ 89

NON-FUNCTIONAL .................................................................................................... 89

PREPARING AN RFP ....................................................................................................... 90

SCORING THE PROSPECTS ................................................................................................ 90

S.A.M.E. ....................................................................................................................... 92

THE S.A.M.E. PROJECT METRICS & CALCULATIONS ............................................................ 92

APPENDIX....................................................................................................................... 95

ADDITIONAL CHARTS & GRAPHS........................................................................................ 95

SUPPORTED API FUNCTIONS ......................................................................................... 95

ASSET SUPPORT:........................................................................................................ 98

REPORT LEVELS ...................................................................................................... 100

REPORTS............................................................................................................... 100

SAMPLE DISCOVERY QUESTIONS ...................................................................................... 103

SAMPLE RFP .............................................................................................................. 104

SAMPLE SCORE CARD ................................................................................................... 106

USER REVIEWS ............................................................................................................... 107

REVIEWS................................................................................................................... 107

ELITE EMAIL ........................................................................................................... 107

GLOSSARY OF TERMS ....................................................................................................... 110

ABOUT RED PILL EMAIL .................................................................................................... 113

2

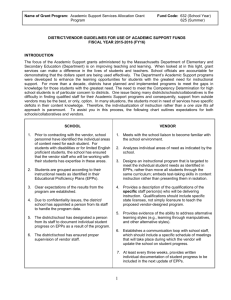

Executive Summary

Welcome to the sixth annual edition of the Email Vendor Features & Functions Guide from Red Pill Email;

the only guide compiled and written by an email marketing veteran who has made a living sending email

and integrating email deployment tools, not just talking about it.

Vendors do not pay to participate on our Guides. Vendor offerings include hosted, on premise, and

hybrid solutions and services. Participants were asked a series of Yes/No questions about their product

features and functions, and about the skill level required to utilize those features and functions.

Information is provided by the participants and is accepted as submitted. Responses to our questionnaire

are converted to binary values and then weighted by the responses in each category and subcategory to

provide an objective view of each participant’s features and functional capabilities. Other factors such as

hourly throughput may also impact a participants effective and/or overall score and/or product placement

within this Guide.

This edition of the Guide highlights the abilities of Small-Market email marketing platforms and MidMarket platforms that go beyond the features and functions of the Small Market but don’t quite reach the

needs of advanced Mid-Market or Enterprise users. High Mid-Market and Enterprise users with more

sophisticated needs should refer to our Mid-Market Enterprise Guide edition

For 2015 Red Pill Email surveyed 38 International providers with over 600 questions across 8 top-level

categories regarding their technical product offerings and service options important to prospective users.

Buyers should not focus on price alone and should let business requirements and contact strategy drive

the selection process. In an increasingly crowded market, buyers need to find providers that offer both

scalable technology and pricing.

Participant Selection

The participants were selected from the previous Email Vendor Features & Functions Guide, the author’s

hands-on experience, from vendor evaluations conducted by the author on behalf of end-user clients,

from International market presence, and from active Industry participation.

Email Vendor Features & Functions Guide

All participants in this Guide support their own email deployment tools. While several vendors leverage

OEM products and services such as commercial MTAs, no white-labeled services of other turn-key

products are included. Vendor revenue was not taken into consideration, nor was the size or revenue of

vendor clients.

3

Equally important to what functions a vendor offers is how those functions work and what it takes to

configure the product to meet the desired result. It is up to the user to demonstrate each product under

consideration and understand the level of effort required to configure those functions important to the

organization.

A total of 67 vendors were invited to participate in the Guide. Apsis, AWeber, Bronto, Campaign Monitor,

Copernica, eBay Enterprise, e-Village, Lyris, MadMimi, MailChimp, Marketo, MyEmma, Newsweaver,

Optivo, Puresend, Sailthru, SendGrid, Sentori, SmartFocus, Streamsend, TC Media, Teradata (Aprimo),

VerticalResponse, Webpower, Yesmail, and Zrinity did not meet the questionnaire deadline or selected

not to participate.

Advertisements in this document link to advertisers

Defining Markets & Users

The fundamentals for implementing email marketing deployment tools are the same regardless of the size

of the organization. The primary difference between the vendor’s abilities to support Small, Mid, or

Enterprise clients is scale and sophistication.

Participants of the 2015 Guide were asked if their marketing efforts were targeted exclusively by business

size. To be included in this Edition of the Guide participants must focus their own marketing efforts on

Small and Mid-Market clients while supporting those features, functions, and through-put requirements of

those market clients.

Small-Market (Minimal Sophistication; Low Volume):

Signs of Small-Market email tools generally include free trial offers with no contracted month-to-month

service, pre-made message templates, and shared IP addresses, although more and more Small-Market

vendors offer optional dedicated IP addresses at an additional cost.

Several vendors offer basic to intermediate integration capabilities, and many support advanced features

such as RSS, video, and built-in social sharing. User Interfaces and segmentation capabilities range from

basic to intermediate as do reporting features.

Small-Market tools benefit beginner through intermediate users; those with email volumes of thousands to

tens of thousands of messages per month; and/or those requiring only basic messaging and reporting

needs.

Small-Market vendors for 2015 include All Web Email, Cooler Email, Elite Email, GreenRope, SparkPost,,

and Venntive.

Mid-market vendors provide a higher degree of integration and customization than most small-market

solutions, and like enterprise applications, generally provide import and export wizards, application

program interfaces (APIs) and third-party integration tools for streamlined system implementation. As

with enterprise tools, mid-market tools provide the ability to more readily customize the application for

particular business requirements and objectives.

Mid-Market class tools benefit beginner to advanced users with email volumes of tens of thousands to

several millions of messages per month; those with enhanced data and messaging automation needs;

and/or those requiring a moderate level of integration and customization.

Mid-Market vendors for 2015 include Act-On, BlueHornet, Brick Street, Communicator Corp, ContactLab,

Cordial, Delivra, dotMailer, EmailDirect, ExpertSender, Gold Lasoo, Goolara, Harland Clarke Digital,

Inbox Marketer Connect, Listrak, Mailup, Maropost, PostUp, Tripolis, and WhatCounts. NOTE: Only

Mid-Market vendors that also cater to the Small-Market are included in this edition of the

Guide. Mid-Market vendors reaching into the Enterprise market may be found in our MidMarket/Enterprise edition at Red Pill Email.

Email Vendor Features & Functions Guide

Mid-Market (Moderate Sophistication; Moderate Volume):

Mid-Market deployment tools are competitive with Small-Market tools on one end of the spectrum and

Enterprise tools at the other. While some Mid-Market vendors offer free trials of their products, most

require term contracts; unique IP addresses per customer are standard fare. The widely varying

capabilities of mid-market applications can make comparing solutions difficult. The costs, the stability of

the vendor, and flexibility of services are all key considerations in selecting mid-market deployment tools.

4

Email Vendor Features & Functions Guide

Enterprise (Highly Sophisticated; High Volume):

A key consideration of an enterprise-class email deployment tool is its ability to send tens of millions of

messages per month per client. Other considerations include bi-directional data integration capabilities

with the client’s data base(s), with the most advanced tools featuring open relational data table structures;

integration to third-party applications; multi-channel support; integrated Promotional and Transactional

platforms; dedicated IP addresses; and conditional data-driven messaging based on the user’s business

rules.

5

Advanced campaign and operational reporting at a granular level in real or near real time is a standard

feature of an enterprise-class ESP. Sophisticated User Interfaces provide non-technical user access to

the advanced functions of the tool, while more technical users may operate the tool via command line or

API. Better SLAs, superior uptime, and an improved user experience allow internal IT staff to focus on

core competencies and strategic tasks.

Commercial MTAs and appliances are generally considered an enterprise tool due to in-house

operational and maintenance requirements; however larger mid-market users may want to investigate

these options, also.

Enterprise-class tools benefit intermediate to advanced users with email volumes of several million to tens

of millions of messages per month; those with highly sophisticated conditional rules-driven messaging

needs; and/or those requiring a high degree of integration and customization.

Enterprise vendors for 2015 include Acxiom Digital Impact, Adestra, Epsilon, Experian Marketing

Services, GreenArrow, IBM Silverpop Engage, Measuremail, Message Systems, Oracle Responsys,

Salesforce Marketing Cloud, Striata, StrongView, and Zeta Interactive.

Full Service:

Participants of the 2015 Guide were asked the percentage of full-service and self-service clients. For the

purpose of this Guide those vendors stating 55% or higher will be considered Full-Service vendors. FullService vendors are a subset of Small, Mid-Market and Enterprise vendors included in this Guide and are

shown separately as a convenience for those considering a full-service or partial full/self-service option.

Full-Service vendors may cater to Small, Mid or Enterprise markets. Clients are involved in the decision

making and approval processes however the vendor handles and is responsible for all aspects of the

client’s email marketing programs including design, coding, execution, and subsequent reporting.

Full-Service vendors for 2015 include Acxiom Digital Impact, All Web Email, Brick Street, Epsilon,

Experian Marketing Services, Inbox Marketer Connect, Striata, Tripolis, and Zeta Interactive. NOTE: Only

All Web Email focuses on Small-Market organizations.

Skill Lev els:

Beginner:

Beginners have between no and basic HTML skills and usually use WYSIWYG editors built into their

email deployment tool to add content to pre-defined templates. The Beginner’s understanding of data

and/or data management may be limited making segmentation more challenging. They are beginning to

learn the use of filter and query wizards available in the deployment tool but may not understand and may

be just learning the nesting of operators within a filter or query. Beginners hear and read about

"integration", "automation", message triggering, and APIs, but haven't developed or are developing the

knowledge or technical expertise to specify or implement them.

Identifying features and functions as Beginner suggests the user has little to no email marketing skills and

may be unfamiliar with the email lexicon.

Intermediate:

The Intermediate user has developed experience in basic segmenting and testing and is proficient with

built-in data filters and wizards. Intermediate users are proficient in HTML and understand opens, clicks,

and other metrics. They can execute time-based message triggering and messages containing dynamic

content based on data elements within their distribution list. Intermediate users understand the impact

that integration and automation has on the organization and are beginning to develop the knowledge and

skills to specify and/or implement them.

Identifying features and functions as Intermediate suggest the user has moderate email marketing skills

and is gaining technical and implementation experience.

Intermediate users are learning and/or practicing:

» Filter/Query Wizards

» Nesting Operators in Filters

» Basic SQL Skills

» Lifecycle Program Implementation

» Segmented Distribution

» A/B Testing

Email Vendor Features & Functions Guide

Beginners are learning and/or practicing basic:

» HTML/ CSS Coding

» CAN-SPAM Regulations

» Simple Broadcast deployment

» Uploading data and/or content

» Metrics Reporting

6

Advanced:

Advanced users understand the technology and what it takes to integrate with their back-end and/or

peripheral systems to automate data transfer and complex messaging programs. They understand

business rules, functional and non-functional specifications, can translate them into technical

specifications, and are technically capable of implementing or assisting in the implementation of those

specifications. Advanced users understand data and data base management and are comfortable

creating nested queries within filters and/or creating raw SQL queries.

Advanced users are comfortable with and/or proficient in:

» Specifying and/or Developing API-based Automation

» Specifying and/or Developing Stored Procedures

» Complex Program Development and Implementation

» Multi-Channel Data and Metrics Integration

Professional Services Only:

Configuration and implementation is available only through the organization’s Professional Services

Operations. Example; User can specify data table configuration, but cannot hands-on develop via UI or

API; or, user can specify a filed name of a data table, but cannot add that field via UI or API.

Using This Guide

This document provides general overview information about the product and service offerings of the

participants, and the ranking of participants across all categories and by category.

Data is presented in aggregate showing offerings of Small and Mid-Market level platforms at the

beginning of each section, and by each market separately following aggregate data. When using this

Guide in the selection of an appropriate vendor, Small or Mid-Market level users should focus on vendor

capabilities within their market categories and not aggregated data.

Email Vendor Features & Functions Guide

We realize that most users of email deployment products will rarely use more than 30% of the features

and functions available from any vendor; however not all organizations will use the same 30%. Know

what features you need to support your business objectives before shopping for email deployment

vendors.

7

Users of this Guide will find the best results if they first define and list the messaging specifications unique

to their own organization, then see how each vendor rates in each category that addresses those

specifications. Users can compile their own unique vendor rating or score by weighting each category of

importance to their unique specifications and organization’s needs and by discounting those features and

functions that are not required by or important to the organization.

As stated throughout this Guide, we look only at what the vendor can do; how they do it will be unique to

each participant. The skill level required to implement some features and functions should be discussed

with those vendors of interest or under consideration, and should be a part of any product demonstration.

An advanced feature or function may be implemented by users with basic skills, or may require more

intermediate or advanced skills. It is up to the buyer to make that decision for their organization.

Features & Functions

Business Offerings

Regions Served

More and more Email Service Providers (ESPs) are extending their market presence around the globe.

While the majority of participants in this Guide edition are based in North America, those that are not are

supporting a physical presence on the Continent. Challenges of providing service to global markets often

include:

•

•

•

•

Dilution of Brand-Name Power - Being popular in your home country doesn't mean you'll be as

popular when introduced in other countries.

Cultural Nuance - Expanding into other counties requires more than accurate translation of the

message from one language to another.

Communication Style - Besides language differences the customs and pace of business

negotiations can be different.

Time and Distance - Time zone differences can make it difficult to coordinate projects where

collaboration is required.

Regions Served

NOAM

APAC

EMEA

LATAM

n= 14

10%

20%

LATAM

57.14%

30%

40%

EMEA

71.43%

50%

60%

APAC

71.43%

70%

80%

90%

100%

NOAM

100.00%

Supported Channels

ESPs are just about Email Marketing anymore. In addition to expanse into Social Marketing with the

ability to share to and from social networks, as well as collecting and leveraging that data, ESPs have

long integrated with and supported SMS platforms. Of those participants supporting SMS about half do

so through a 3rd party platform. About 50% of Small/Mid-Market participants also provide Print services

and integration, while just over 30% have integrated Display to their platforms. Approximately half of all

participants’ clients are multi-channel users, with the other half being email-only.

Email Vendor Features & Functions Guide

0%

8

Supported Channels

Email

SMS

Print

Display

0%

10%

20%

30%

40%

Display

35.71%

n =14

50%

60%

Print

50.00%

70%

80%

SMS

71.43%

90%

100%

Email

100.00%

Business & Pricing Models

Organizations without technical resources to support an on premise solution will look to SaaS vendors.

Advanced users with available technical resources may consider Licensed Software or Appliance

vendors. Fast-growing larger senders may consider vendors capable of supporting more than one

business model.

Business Offerings

SaaS

White-Label

Licensed Software

Appliance

9

n = 14

10%

20%

Appliance

0.00%

30%

40%

50%

Licensed Software

28.57%

60%

70%

80%

White-Label

71.43%

All Web Email

Cooler Email

White Label

Appliance

Licensed

Software

90%

SaaS

100.00%

Small-Market Business Models

SaaS

Email Vendor Features & Functions Guide

0%

100%

Elite Email

GreenRope

SparkPost

Venntive

White Label

Appliance

Licensed

Software

SaaS

Mid-Market Business Models

Act-On

ContactLab

Delivra

dotMailer

EmailDirect

Goolara

Harland Clarke Digital

Email Vendor Features & Functions Guide

MailUp

10

Pricing options by participant

The most common pricing is by Tiered Rates. Tiered Rates are most often based on the volume of

messages sent, usually at a CPM, or cost per milli (thousand), but may also be based on the number of

records hosted on the platform. With Tiered Rates, as message or record volume increases to meet

contractual benchmarks rates are reduced, however not always automatically. 85.71% of participants

included here offer tiered rates by volume sent, and 42.86% offer tiered rates by data stored.

Pricing Options

Tiered Rates

CPM-Based

Free Trial

Flat Rate

Term Contract

0%

n = 14

10%

Term Contract

57.14%

20%

30%

Flat Rate

64.29%

40%

50%

Free Trial

78.57%

60%

70%

CPM-Based

78.57%

80%

90%

100%

Tiered Rates

100.00%

CPM rates vary wildly amongst participants with low-volume rates anywhere between $40.00 and $2.50

and high-volume rates anywhere between $1.25 and $0.25. The average low-volume CPM across both

Mid-Market and Enterprise-level participants is $9.46, with the average high-volume CPM at $0.44.

Email Vendor Features & Functions Guide

Contracted rates define a minimum message or data/record volume over the term and often build in a

tiered pricing structure. Not meeting or maintaining minimum contract volume requirements will result in a

higher Effective CPM (ECPM) than the contracted rate when based on the volume of messages sent or

amount of data/records stored.

11

Flat-Rate offers a single fixed fee regardless of the volume of messages sent and is usually based on the

number of records hosted on the platform. Flat Rates may be Tiered based on the number of records

hosted on the platform. This generally includes both active and inactive – including unsubscribed –

records.

Small-Market Pricing

The most common pricing structure among Small-Market vendors is Tiered Rates (100.00%) with 83.33%

basing tiers on CPM and 66.67% offering tiered pricing based on Stored Data. 50% of Small Market

vendors providing tiered pricing offer an option or combination of CPM and/or Stored Data.

CPM pricing is available from 83.33% of Small-Market vendors and is actually more common than with

Mid-Market vendors (75.00%). 100% of Small-Market vendors offer a free product trial, while only

16.67% require a contracted term.

Low-volume rates from all Small-Market vendors can run CPMs as high as $15.00 and as low as $2.50.

High-volume CPM rates can run as high as $1.50 and as low as $1.00. The average low-volume CPM

rate for Small-Market vendors is $9.38. The average Small-Market high-volume CPM rate is $1.19.

Free Trial

Term

Contract

Tiered Rates

CPM-Based

Flat Rate

Small-Market Pricing Models

All Web Email

Cooler Email

Elite Email

GreenRope

SparkPost

Venntive

Mid-Market Pricing

The most common pricing structure among Mid-Market vendors is Tiered Rates (100.00%) with 87.50%

basing tiers on CPM and 25.00% offering tiered pricing based on Stored Data. 16.67% of Mid-Market

vendors providing tiered pricing offer an option or combination of CPM and/or Stored Data.

CPM pricing is available from 75.00% of Mid-Market vendors;62.5% offer a free product trial, and 87.50%

require a contracted term.

Act-On

ContactLab

Free Trial

Term

Contract

Tiered Rates

CPM-Based

Flat Rate

Mid-Market Pricing Models

Email Vendor Features & Functions Guide

Low-volume rates from all Mid-Market vendors can run CPMs as high as $40.00 and as low as $10.00.

High-volume CPM rates can run as high as $0.50 and as low as $0.20. The average low-volume CPM

rate for Mid-Market vendors is $23.75. The average Small-Market high-volume CPM rate is $0.34.

12

Delivra

dotMailer

EmailDirect

Goolara

Harland Clarke

Digital

MailUp

Professional Services

Organizations with limited marketing resources might consider vendors providing full-services or à la carte

full/self-serve. Vendor in-house professional services might include Strategic, Technical, Production, or

Creative services and are billed by the hour or by quote.

Not every type of Professional Service will be of equal importance to all users. Consider and prioritize

those Professional Services required by or important to your organization when selecting a vendor.

Professional Services

In-house Strategy

In-house Technical

In-house Production

In-house Creative

Email Vendor Features & Functions Guide

0%

13

Have Services

No Services

10%

20%

In-house Creative

78.57%

21.43%

30%

40%

In-house Production

92.86%

7.14%

50%

60%

70%

In-house Technical

85.71%

14.29%

80%

90%

100%

In-house Strategy

85.71%

14.29%

Professional Services like in-house creative may mean less to an organization staffing those roles than

one that does not. An organization staffing strategic and creative roles may not staff technical or

production roles and require those services from a vendor. Likewise, an organization may be well staffed

technically, but require strategic and creative services.

Strategic Services

85.71% of Small- and Mid-Market participants surveyed offer Strategic Services. 85.71% offer Tactical

Recommendations and Reporting Metrics Analysis. 78.57% provide Actionable Analysis, and 71.43% of

participants surveyed offer Competitive Analysis.

Competitive Analysis may be difficult for vendors that do not have a high enough sampling of client

verticals to provide data that is valuable enough to one client while not divulging confidential or sensitive

information on another. Likewise, “Financial Services” may include banks, credit card companies, prepaid credit and gift cards, credit reporting agencies, mortgage brokers, and lenders of all stripes making

available data too broadly categorized to provide actionable intelligence.

Strategy Services

Tactical Recommendations

Reporting Metrics Analysis

Actionable Analysis

Competitive Analysis

0%

Have Services

No Services

10%

20%

30%

40%

Competitive Analysis

Actionable Analysis

71.43%

28.57%

78.57%

21.43%

50%

60%

70%

Reporting Metrics

Analysis

85.71%

14.29%

80%

90%

100%

Tactical

Recommendations

85.71%

14.29%

n = 14

Tec hnical Services

85.71% of Small- and Mid-Market participants surveyed offer Technical Services. 85.71% offer Systems

Integration and Tactical Implementation. 78.57% offer Specialized Training and Systems Architecture

and Design.

Specialized Training

Tactical Implementation

Systems Architecture/Design

Systems Integration

0%

10%

Systems Integration

Have Services

No Services

85.71%

14.29%

20%

30%

40%

Systems

Architecture/Design

78.57%

21.43%

50%

60%

70%

80%

90%

100%

Tactical Implementation

Specialized Training

85.71%

14.29%

78.57%

21.43%

Email Vendor Features & Functions Guide

Technical Services

14

Vendors have a vested interest in integrating a client’s internal system with the vendor platform.

Generally speaking, the deeper the integration the more sophistication can be gained by the platform; and

the more difficult – and expensive – it is to switch to another vendor. Most Mid-Market vendors also

integrate with third-party products (listed later in this Guide) to provide greater business intelligence while

extending the functionality of the vendor platform. Third-party systems integration is not as widely offered

with Small-Market vendors as it is with Mid-Market vendors. The two most common third-party

integrations supported by Small-Market vendors are Google Analytics and Salesforce.

Produc tion Services

92.86% of Small- and Mid-Market participants surveyed offer Production Services. 92.86% offer

Automated Message and/or Campaign Development, Message and/or Campaign Reporting, and

Message and/or Campaign Assembly, while 78.57% offer Message and/or Campaign Deployment.

Production Services

Message/Campaign Reporting

Automated Message/Campaign Development

Message/Campaign Deployment

Message/Campaign Assembly

0%

Email Vendor Features & Functions Guide

Have Services

No Services

15

10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Message/Campaign

Assembly

Message/Campaign

Deployment

92.86%

7.14%

78.57%

21.43%

Automated

Message/Campaign

Development

92.86%

7.14%

Message/Campaign

Reporting

92.86%

7.14%

Creative Services

78.57% of participants surveyed offer Creative Services. 78.57% offer Graphic and Design Services

and/or Copywriting and/or Editing Services.

Creative Services

Graphic/Design Services

Copywriting/Editing Services

0%

10%

20%

30%

40%

50%

Copywriting/Editing Services

78.57%

21.43%

Have Services

No Services

60%

70%

80%

90%

100%

Graphic/Design Services

78.57%

21.43%

Service Types

92.86% of Small- and Mid-Market participant’s surveyed offer a Self-Service option, 78.57% offer a FullService option, and 92.86% offer a la carte services, or a mix-and-match offering of Self- and Full-Service

options. Only one Small-Market participant, All Web Email, is classified as a Full-Service platform based

on their percentage of Full-Service clients.

à la carte

Self-Service

Full-Service

0%

n = 14

10%

20%

Full-Service

78.57%

30%

40%

50%

Self-Service

92.86%

60%

70%

80%

90%

à la carte

92.86%

100%

Email Vendor Features & Functions Guide

Service Types

16

By Quote

By Hour

à la carte

SelfService

FullService

Service Types by Participant

Act-On

All Web Email

ContactLab

Cooler Email

Delivra

dotMailer

Elite Email

EmailDirect

Goolara

GreenRope

Harland Clarke Digital

MailUp

SparkPost

Venntive

Professional Services Pricing

Email Vendor Features & Functions Guide

92.86% of participants surveyed price projects and professional services by Quote, 78.57% by the Hour.

78.57% of participants surveyed price projects and professional services by both Quote and by the Hour.

17

Service Pricing

Quote

Both

Hour

0%

n = 14

10%

20%

Hour

78.57%

30%

40%

50%

Both

78.57%

60%

70%

80%

90%

Quote

92.86%

100%

Professional Services Staffing

The average number of In-House Production staff is 4.93, up from 3.11 in 2014, and with an average of

7.00 years of experience, up from 4.74 years in 2014. In-House Technical staff averages 6.57, up from

3.42 in 2014, averaging 6.93 years of experience compared to 5.68 years in 2014. The average number

of In-House Strategy staff is 3.93 up from 2.63 in 2014, with the average years of experience of strategy

staff at 8.07 up from 5.16 in 2014. In-House Creative staff is at an average of 3.64 compared to 2.05 in

2014 and with an average of 6.64 years of experience up from 5 years in 2014.

Professional Services Staff

In-house Strategy

In-house Technical

In-house Production

In-house Creative

0.00

Average Years

Average Number

1.00

2.00

In-house Creative

6.64

3.64

3.00

4.00

5.00

In-house Production

7.00

4.93

6.00

7.00

In-house Technical

6.93

6.57

8.00

9.00

In-house Strategy

8.07

3.93

n = 14

Cooler Email

Elite Email

GreenRope

SparkPost

Venntive

Technical

Strategy

Email Vendor Features & Functions Guide

All Web Email

Production

Creative

Small-Market In-House Services

18

Strategy

Technical

Production

Creative

Mid-Market In-House Services

Act-On

ContactLab

Delivra

dotMailer

EmailDirect

Goolara

Harland Clarke Digital

MailUp

19

3.61

4.72

5.00

GreenRope

SparkPost

Venntive

4.72

0.00

4.72

Act-On

ContactLab

Delivra

dotMailer

3.33

5.00

5.00

5.00

Pro-Services

Score

Mid-Market Professional Services Score

Pro-Services

Score

Email Vendor Features & Functions Guide

All Web Email

Cooler Email

Elite Email

Pro-Services

Score

Pro-Services

Score

Small-Market Professional Services Sc ore

EmailDirect

Goolara

Harland Clarke Digital

MailUp

5.00

3.89

5.00

3.61

Targeted Verticals and Geographic Markets

Several vendors focus on and/or excel in specific vertical markets. Having specialized experience in a

specific market often influences the features and functions of the email platform. Professional Services

staff experienced in specific vertical markets often brings experience that can accelerate their client’s

marketing efforts, but there is often a fine line between repetitive efforts across a targeted vertical and

treating all clients within a vertical the same.

Targeted Verticals

Targeted Verticals

Business to Business

Consumer/Retail

Non-Profit

Media/Publishing

Other

Banking/Financial

Education

Health/Insurance

Entertainment

Travel

Automotive

Real Estate

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

n = 14

Targeted Geographic Markets

International

16%

n = 14

Domestic

84%

Email Vendor Features & Functions Guide

Targeted Markets

20

Produc t Offerings

Platform

The average user won’t be concerned with a vendor’s platform. Advanced and technical users will have

opinions on commercial and proprietary MTAs (Message Transfer Agents) that may influence their

purchasing decisions. Those that do are encouraged to ask their sales representative for details.

MTA Type

Proprietary

14%

Commmercial

86%

n = 12

Email Vendor Features & Functions Guide

A commercial MTA is a software agent supported by an independent vendor. A proprietary MTA is a

software agent supported by the vendor. Only one participant in the Small- / Mid-Market edition of the

2015 Guide is a developer of MTAs, and it is the parent company that is the MTA developer. For the

purposes of this Guide MTA developers are considered as commercial. While proprietary MTAs are

represented, 86% of participants are developed on commercial MTAs compared to 74% in 2014 and up

from 70% in 2013.

21

A full 50.00% of Small and Mid-Market participants using a commercial MTA use Port25’s PowerMTA,

down from 64.29% of participants using PowerMTA in 2014 and down from 66.67% in 2013. A full third

(33.33%) of Small and Mid-Market participants use Message Systems’ Momentum MTA, up from 7.14%

in 2014 and from 13.33% in 2013. 16.74% of Small and Mid-Market participants use the Green Arrow

MTA, down from 21.43% in 2014.

Two important things to note:

1. The number of Small and Mid-Market participants of this edition of the Guide in 2015 is 14

compared to 19 participants in 2014. This is due to some vendors missing the deadline for

inclusion and to some moving to the Mid-Market/Enterprise edition of the Guide.

2. Less than 3 weeks before this Guide was publically released Message Systems announced the

purchase of Port25 and PowerMTA giving Message Systems 85-90% market share of

commercial MTAs used across all levels of ESPs.

MTA Brand

PMTA

Message Systems

GreenArrow

n = 12

10%

GreenArrow

16.67%

20%

30%

40%

50%

Message Systems

33.33%

60%

70%

80%

90%

100%

PMTA

50.00%

Email Vendor Features & Functions Guide

0%

22

Service Level Agreements (SLAs), Data Back- up, & Redundancy

85.71% of Small- and Mid-Market participants will contract SLAs. 100% back-up their own and client data

daily or more frequently. 92.86% support redundant platforms.

Sec urity Features

ESPs protect not only their own data, but also the data of hundreds of clients. Security breaches at ESPs

and their users within the past few years have heightened the need for improved security of vendor and

user data alike. PCI Compliance is on the rise amongst leading ESPs, as is Multi-Level Authentication

and “Safe Harbor” data hosting. Geo-Based Access Restrictions are gaining in popularity while basic

record encryption remains flat. Popular encryption methods include MD5#, PGP/GPG, and TripleDES.

Security Features

Data Security Policy

IP-Based Access Restrictions

Multi-Level Auth

Geo-Based Access Restrictions

PCI-Compliant

Safe Harbor Hosting

0%

Email Vendor Features & Functions Guide

n = 14

23

Safe Harbor

Hosting

64.29%

10%

PCI-Compliant

71.43%

20%

30%

40%

50%

60%

70%

80%

Geo-Based Access

IP-Based Access

Multi-Level Auth

Restrictions

Restrictions

71.43%

78.57%

100.00%

90%

100%

Data Security

Policy

100.00%

In 2015 as in 2014 100% of Small- and Mid-Market participants have a Data Security Policy in place. In

2015 100% of participants support IP-Based Access Restrictions compared to 84.21% in 2014. MultiLevel Authentication has increase to 78.57% in 2015 up from 52.63% in 2014. Geo-Based Access

Restrictions have risen to 71.43% as has PCI Compliance in 2015 compared to only 36.84% and 57.89%

respectively in 2014. Safe Harbor Hosting has also seen an increase in adoption from 42.11% in 2014 to

71.43% in 2015.

Sec urity Scores

All Web Email

Cooler Email

Elite Email

Security

Score

Security

Score

Small-Market Vendor Sec urity Score

GreenRope

SparkPost

Venntive

2.50

5.00

4.17

5.00

5.00

5.00

Act-On

ContactLab

Delivra

dotMailer

Security

Score

Security

Score

Mid-Market Vendor Security Sc ore

EmailDirect

Goolara

Harland Clarke Digital

MailUp

5.00

3.33

4.17

4.17

4.17

3.33

3.33

2.50

Supported Browsers

Of all participants responding to the question of multiple browser support, not one participant provides

only single browser support.

Supported Browsers

Firefox

Internet Explorer

Safari

Other

0%

n = 14

Other

21.43%

10%

20%

30%

Safari

78.57%

40%

50%

Internet Explorer

100.00%

60%

70%

Firefox

100.00%

80%

90%

Chrome

100.00%

100%

Email Vendor Features & Functions Guide

Chrome

24

Although browser support is interesting information, it should not be a primary or even secondary

consideration when selecting an ESP. The most common “Other” supported browser is Opera.

Supported API Protocols

APIs play an important role in bi-directional data integration and real-time messaging. Technical users

and resources will appreciate knowing what API protocols are available for the transfer of documents and

data to or from the vendor. See Appendix for percentages of Supported API Functions.

WCF

REST

JSON

GET/POST

XML

SOAP

Small-Market Supported API Protocols

All Web Email

Cooler Email

Elite Email

GreenRope

SparkPost

Venntive

Act-On

Email Vendor Features & Functions Guide

ContactLab

25

Delivra

dotMailer

EmailDirect

Goolara

Harland Clarke

Digital

MailUp

WCF

REST

JSON

GET/POST

XML

SOAP

Mid-Market Supported API Protocols

Data & Segmentation

Data is at the heart of any email marketing program. The greater the options are to transfer, structure,

query, and segment data the more intricate and complex messaging can become. Participants were

surveyed in four subcategories of data and segmentation.

Data Control:

Organizations with complex data matching as a core function of their business will at some point want to

flatten multiple sources to a series of single relational tables that may be joined together and queried for

reference and/or supplemental data to support a variety of messaging programs; or may just want a wellstructured flat file hosted on the vendor.

The greater control over your data at the vendor the more flexibility you will have with complex queries,

Primary and Foreign Keys, and joining and querying multiple and/or relational tables. The ability to

bypass filter wizards and directly query data may decrease processing time while yielding more refined

data sets for advanced messaging.

Each vendor will have their own unique way of implementing the features and functions of their product.

Some will require advanced programming skills and/or technological resources implement, while others

may be easily accessed and/or configured by non-technical resources via the UI.

Full-Service vendors implement features and functions on your behalf. While the features and functions

supported by Full-Service vendors will be important, ease of use should not be a concern.

Data Control

User-definable fields

Any Field/Log/ List

User Control Over Tables

Access to Logs

User-defined FK

0%

n = 14

10%

20%

User-defined FK

Access to Logs

50.00%

50.00%

30%

40%

User Control

Over Tables

71.43%

50%

60%

Multiple Indices

78.57%

70%

80%

Any Field/Log/

List

85.71%

90%

100%

User-definable

fields

100.00%

Email Vendor Features & Functions Guide

Multiple Indices

26

Small-Market Data Control Score

Data Control

Venntive

All Web Email

Cooler Email

GreenRope

SparkPost

Elite Email

Average

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

60%

70%

80%

90%

100%

Small-Market Data Control Ease of Us e

Data Control

All Web Email

Cooler Email

Email Vendor Features & Functions Guide

Elite Email

27

GreenRope

SparkPost

Venntive

Average

0%

10%

20%

Beginner

30%

40%

Intermediate

50%

Advanced

Pro Services

Mid-Market Data Control Score

Data Control

Act-On

Goolara

ContactLab

MailUp

EmailDirect

Delivra

dotMailer

Harland Clarke Digital

Average

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

60%

70%

80%

90%

100%

Mid-Market Data Control Ease of Us e

Data Control

Act-On

ContactLab

dotMailer

EmailDirect

Goolara

Harland Clarke Digital

MailUp

Average

0%

10%

20%

Beginner

30%

40%

Intermediate

50%

Advanced

Pro Services

Email Vendor Features & Functions Guide

Delivra

28

Queries & Segm entation:

Several participants provide advanced data querying and segmentation wizards making it easier on

marketers with limited technical skills or resources to segment data required for advanced messaging

programs.

Each vendor will have their own unique way of implementing the features and functions of their product.

Some will require advanced programming skills and/or technological resources implement, while others

may be easily accessed and/or configured by non-technical resources via the UI.

Queries & Segmentation

Behavior-based

Compound Seg Rules

Seg by Client

Seg by Device

Seg by Mobile Use

Seg by Social Sharing

Seg by Platform/OS

Drag & Drop Seg

Seg by Channel

0%

Seg by

Channel

Email Vendor Features & Functions Guide

n = 14

29

57.14%

10%

20%

Seg by

Drag &

Platform/

Drop Seg

OS

57.14%

71.43%

30%

40%

50%

60%

Seg by

Seg by

Seg by

Social

Mobile Use Device

Sharing

85.71%

85.71%

85.71%

70%

80%

Seg by

Client

Compound BehaviorSeg Rules

based

85.71%

90%

100.00%

100%

100.00%

Small-Market Queries & Segmentation Score

Queries & Segmentation

Cooler Email

GreenRope

SparkPost

Venntive

Elite Email

All Web Email

Average

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

90%

100%

Small-Market Queries & Segmentation Ease of Use

Queries & Segmentation Ease of Use

All Web Email

Cooler Email

GreenRope

SparkPost

Venntive

Average

0%

10%

20%

Beginner

30%

40%

Intermediate

50%

Advanced

60%

70%

Pro Services

80%

Email Vendor Features & Functions Guide

Elite Email

30

Mid-Market Queries & Segmenta tion Score

Queries & Segmentation

dotMailer

EmailDirect

MailUp

Act-On

Delivra

ContactLab

Goolara

Harland Clarke Digital

Average

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

90%

100%

Mid-Market Queries & Segmenta tion Ease of Use

Queries & Segmentation Ease of Use

Act-On

ContactLab

Delivra

Email Vendor Features & Functions Guide

dotMailer

31

EmailDirect

Goolara

Harland Clarke Digital

MailUp

Average

0%

10%

20%

Beginner

30%

40%

Intermediate

50%

Advanced

60%

70%

Pro Services

80%

Form Processing:

The ability to process forms at the vendor opens a variety of data collection and user-triggered messaging

possibilities. The more flexible vendors are to write data to a table, with the option of triggering a

message as a result, the greater the application options are to the user.

Each vendor will have their own unique way of implementing the features and functions of their product.

Some will require advanced programming skills and/or technological resources implement, while others

may be easily accessed and/or configured by non-technical resources via the UI.

Form Processing

Trigger by Recipient Action

Trigger Pre-Def Message

Supports Form Processing

Trigger Message by Form

88%

90%

92%

94%

96%

Trigger Message by Form Supports Form Processing Trigger Pre-Def Message

n = 14

92.86%

92.86%

100.00%

98%

100%

Trigger by Recipient

Action

100.00%

Small-Market Form Processing Score

Form Processing

Cooler Email

GreenRope

SparkPost

Venntive

All Web Email

Average

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

Email Vendor Features & Functions Guide

Elite Email

32

Small-Market Form Processing Ease of Use

Form Processing

All Web Email

Cooler Email

Elite Email

GreenRope

SparkPost

Venntive

Average

0%

10%

20%

30%

Beginner

40%

50%

Intermediate

60%

Advanced

70%

80%

90%

100%

Pro Services

Mid-Market Form Processing Score

Form Processing

Act-On

ContactLab

Email Vendor Features & Functions Guide

Delivra

33

dotMailer

EmailDirect

Harland Clarke Digital

MailUp

Goolara

Average

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

Mid-Market Form Processing Ease of Use

Form Processing

Act-On

ContactLab

Delivra

dotMailer

EmailDirect

Goolara

Harland Clarke Digital

MailUp

Average

0%

10%

20%

Beginner

30%

40%

Intermediate

50%

60%

Advanced

70%

80%

90%

100%

Pro Services

Exporting Data via the User Interface:

Most vendors will you allow the export of lists or data tables through the User Interface. Not all provide

the option to export account logs, content, or message rules.

Lists

Content

Logs

Rules

0%

n = 14

10%

Rules

57.14%

20%

30%

40%

Logs

85.71%

50%

60%

70%

Content

85.71%

80%

90%

Lists

100.00%

100%

Email Vendor Features & Functions Guide

UI Export

34

Small-Market UI Export Score

UI Export

Cooler Email

Elite Email

GreenRope

Venntive

All Web Email

SparkPost

Average

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

60%

70%

80%

90%

100%

Small-Market Data Export Ease of Us e

UI Export

All Web Email

Cooler Email

Email Vendor Features & Functions Guide

Elite Email

35

GreenRope

SparkPost

Venntive

Average

0%

10%

20%

Beginner

30%

40%

Intermediate

50%

Advanced

Pro Services

Mid-Market UI E xport Sc ore

UI Export

Act-On

MailUp

ContactLab

Delivra

dotMailer

EmailDirect

Goolara

Harland Clarke Digital

Average

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

60%

70%

80%

90%

100%

Mid-Market UI E xport Ease of Use

UI Export

Act-On

ContactLab

Delivra

EmailDirect

Goolara

Harland Clarke Digital

MailUp

Average

0%

10%

20%

Beginner

30%

40%

Intermediate

50%

Advanced

Pro Services

Email Vendor Features & Functions Guide

dotMailer

36

Data & Segmentation Scoring:

Data & Segmentation scores are based on scores of each of the four subcategories; Data Control,

Queries & Segmentation, Form Processing, and UI Export.

Small-Market Data & Segm entation Score

Data & Segmentation

Cooler Email

GreenRope

Email Vendor Features & Functions Guide

Venntive

37

SparkPost

Elite Email

All Web Email

Average

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

Small-Market Data & Segm entation Ease of Use

Data & Segmentation

Act-On

ContactLab

Delivra

dotMailer

EmailDirect

Goolara

Harland Clarke Digital

MailUp

Average

0%

10%

20%

Beginner

30%

40%

Intermediate

50%

Advanced

60%

70%

80%

90%

100%

4.00

4.50

5.00

Pro Services

Mid-Market Data & Segmentation Score

Data & Segmentation

Act-On

MailUp

EmailDirect

ContactLab

Goolara

Delivra

Harland Clarke Digital

Average

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

Email Vendor Features & Functions Guide

dotMailer

38

Mid-Market Data & Segmentation Ease of Us e

Data & Segmentation

Act-On

ContactLab

Delivra

dotMailer

EmailDirect

Goolara

Harland Clarke Digital

MailUp

Average

0%

10%

20%

Beginner

30%

40%

Intermediate

50%

60%

Advanced

70%

80%

90%

100%

Pro Services

Data & Segmentation Score Breakdowns

The following charts provide a side-by-side comparison of the scores of each of the four subcategories

and the total Data & Segmentation Score for each participant. Participants are ranked first by the total

score, then by each subcategory in order below. Users of this Guide may choose to consider the total

score for each participant or may weigh prospective vendors by subcategory.

39

Data Control

Queries &

Segmentation

Form

Processing

UI Export

Venntive

Cooler Email

GreenRope

SparkPost

Elite Email

All Web Email

Data &

Segmentation

Score

Email Vendor Features & Functions Guide

Small-Market Data & Segm entation Score Breakdown

4.78

4.78

4.78

4.35

3.48

3.04

5.00

4.17

4.17

3.33

1.67

4.17

4.44

5.00

5.00

5.00

3.33

1.67

5.00

5.00

5.00

5.00

5.00

3.75

5.00

5.00

5.00

3.75

5.00

3.75

Queries &

Segmentation

Form

Processing

UI Export

4.57

4.57

4.35

4.13

3.91

3.91

3.70

2.83

5.00

4.17

3.33

2.50

5.00

4.17

2.50

1.67

3.89

4.44

5.00

5.00

3.33

3.33

3.89

3.33

5.00

5.00

5.00

5.00

3.75

5.00

5.00

5.00

5.00

5.00

3.75

3.75

3.75

3.75

3.75

1.25

Email Vendor Features & Functions Guide

Data Control

Act-On

MailUp

EmailDirect

dotMailer

Goolara

ContactLab

Delivra

Harland Clarke Digital

Data &

Segmentation

Score

Mid-Market Data & Segmentation Score Breakdown

40

Deliverability & List Hygiene:

Delivery, or Delivered, is the emails sent less the number of emails rejected by the receiving server that

has bounced back.

Deliverability is the ability to deliver to the recipient Inbox and not the spam or junk folder. Deliverability

and List Hygiene tools help the user to maintain good list health which is essential to maintaining high

deliverability.

Not every line item will be of equal importance to all users, however the following key items will be:

Throttling/Metering per ISP

Integrated Feedback Loops

Authentication

Good ISP relations

White-listing services

Each vendor will have their own unique way of implementing the features and functions of their product.

Some will require advanced programming skills and/or technological resources implement, while others

may be easily accessed and/or configured by non-technical resources via the UI.

Deliverability & Hygiene

FBLs

ISP Relations

Unsub / Pref

Custom Bounce

Deliv Scoring

Diff Opt-out

Separate IPs

White-listing

Email Vendor Features & Functions Guide

Throttle by ISP

41

Freq Caps

Selectable IPs

In-bound Message

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

InISP

Selectabl Freq Throttle White- Separate Diff

Deliv Custom Unsub /

bound

Relation FBLs

e IPs

Caps by ISP listing

IPs Opt-out Scoring Bounce Pref

Message

s

n = 14 50.00% 71.43% 71.43% 78.57% 85.71% 92.86% 92.86% 92.86% 92.86% 100.00%100.00%100.00%

Deliverability & List Hygiene Sc oring:

Deliverability & List Hygiene scores are based on participant responses to the questions in the eleven

Deliverability & Hygiene categories.

Small-Market Deliverability & List Hygiene Score

Cooler Email

GreenRope

SparkPost

Venntive

Elite Email

All Web Email

Average

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

Email Vendor Features & Functions Guide

Deliverability & Hygiene

42

Small-Market Deliverability & List Hygiene Ease of Us e

Deliverability & Hygiene

All Web Email

Cooler Email

Elite Email

GreenRope

SparkPost

Venntive

Average

0%

10%

20%

30%

Beginner

40%

50%

Intermediate

Advanced

60%

70%

80%

90%

100%

Pro Services

Mid-Market Deliverability & List Hygiene Score

Deliverability & Hygiene

EmailDirect

Harland Clarke Digital

Email Vendor Features & Functions Guide

MailUp

43

Delivra

Goolara

dotMailer

Act-On

ContactLab

Average

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

Mid-Market Deliverability & List Hygiene Ease of Use

Deliverability & Hygiene

Act-On

ContactLab

Delivra

dotMailer

EmailDirect

Goolara

Harland Clarke Digital

MailUp

Average

0%

10%

20%

Beginner

30%

40%

Intermediate

50%

Advanced

60%

70%

80%

90%

100%

Pro Services

Deliverability & List Hygiene Sc ore Numeric Values

The following charts provide the numeric scoring values for each participant. Deliverability & List Hygiene

features & functions are table stakes items for full-service vendors

5.00

5.00

4.58

Venntive

Elite Email

All Web Email

4.58

4.17

3.75

EmailDirect

5.00

Deliverability

& List Hygiene

Score

Deliverability

& List Hygiene

Score

Mid-Market Deliverability & List Hygiene Score Numeric Values

Goolara

4.17

Email Vendor Features & Functions Guide

Cooler Email

GreenRope

SparkPost

Deliverability

& List Hygiene

Score

Deliverability

& List Hygiene

Score

Small-Market Deliverability & List Hygiene Score Num eric Values

44

Harland Clarke Digital

MailUp

Delivra

4.58

4.58

4.17

dotMailer

Act-On

ContactLab

3.75

3.33

3.33

Campaign Building & Workflow

Having an ordered sequence of campaign building and management tasks makes deployment tools

easier to learn and more productive in developing and managing campaigns.

Flexibility, ease of use, and implementation of built-in features such as personalization & dynamic

content; segmentation & filtering functions; campaign deployment & reporting options; and content &

asset management will also add to operational productivity which means less time building and

supporting and more time marketing.

Email Vendor Features & Functions Guide

Each vendor will have their own unique way of implementing the features and functions of their product.

Some will require advanced programming skills and/or technological resources to implement, while others

may be easily accessed and/or configured by non-technical resources via the UI.

45

Account Management

Organizations often support multiple domains for different identities, business units, or subsidiaries.

Rather than having a unique user and/or billing account for each identity, business unit, or subsidiary,

organizations may take support of multiple domains into consideration.

It is not uncommon for an organization to wish to exclude domains, such as those of their competitors or

services such as SpamCop or Spamhaus. For those organizations domain exclusion might be a tipping

factor in their decision between two otherwise equally matched vendors.

Organizations that send Transactional messages on a different IP or IP set than their Promotional

messages frequently look for vendors that support both through the same Login, same interface and/or

platform. They find having to login to two unique accounts or interfaces less efficient than a single point

of operation.

Participants were surveyed as to their functional capabilities surrounding account management, domain

and IP/Transactional/Promotional interface support.

Account Management

Domain Exclusion

Integrated Trans/Promo

Multiple Top-Level Domains

Child Account

Multi-Channel UI

0%

10%

20%

Multi-Channel UI

Child Account

57.14%

71.43%

n = 14

30%

40%

50%

Multiple Top-Level

Domains

92.86%

60%

70%

80%

Integrated

Trans/Promo

92.86%

90%

100%

Domain Exclusion

92.86%

Small-Market Account Management Score

Account Management

Cooler Email

Elite Email

Venntive

All Web Email

SparkPost

Average

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

Email Vendor Features & Functions Guide

GreenRope

46

Small-Market Account Management Ease of Use

Account Management

All Web Email

Cooler Email

Elite Email

GreenRope

SparkPost

Venntive

Average

0%

10%

20%

30%

Beginner

40%

50%

Intermediate

Advanced

60%

70%

80%

90%

100%

Pro Services

Mid-Market Account Management Score

Account Management

Act-On

EmailDirect

MailUp

Email Vendor Features & Functions Guide

Delivra

47

Harland Clarke Digital

dotMailer

Goolara

ContactLab

Average

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

Mid-Market Account Management Ease of Us e

Account Management

Act-On

ContactLab

Delivra

dotMailer

EmailDirect

Goolara

Harland Clarke Digital

MailUp

Average

10%

20%

Beginner

30%

40%

Intermediate

50%

Advanced

60%

70%

80%

90%

100%

Pro Services

Asset Support:

Participants were surveyed as to their functional capabilities surrounding content management, image

hosting, Personalization, dynamic content, and more. See Appendix for Asset Support breakdown by

percentage.

Email Vendor Features & Functions Guide

0%

48

Small-Market Asset Suppor t Score

Asset Support

Cooler Email

GreenRope

SparkPost

Venntive

All Web Email

Elite Email

Average

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

92%

94%

96%

98%

100%

Small-Market Asset Suppor t Ease of Use

Asset Support

All Web Email

Email Vendor Features & Functions Guide

Cooler Email

49

Elite Email

GreenRope

SparkPost

Venntive

Average

80%

82%

84%

Beginner

86%

88%

Intermediate

90%

Advanced

Pro Services

Mid-Market Asset Support Score

Asset Support

Delivra

EmailDirect

Act-On

dotMailer

Goolara

MailUp

ContactLab

Harland Clarke Digital

Average

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

60%

70%

80%

90%

100%

Mid-Market Asset Support Ease of Us e

Asset Support

Act-On

ContactLab

dotMailer

EmailDirect

Goolara

Harland Clarke Digital

MailUp

Average

0%

10%

20%

Beginner

30%

40%

Intermediate

50%

Advanced

Pro Services

Email Vendor Features & Functions Guide

Delivra

50

Deployment Management

Deployment Management helps to support and make adjustments to ongoing message programs,

manage links, the ability to stop or pause campaigns, and more.

Small-Market Deployment Management Score

Deployment Management

Venntive

Cooler Email

Elite Email

GreenRope

All Web Email

SparkPost

Average

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

80%

90%

100%

Small-Market Deployment Management Ease of Use

Deployment Management

All Web Email

Email Vendor Features & Functions Guide

Cooler Email

51

Elite Email

GreenRope

SparkPost

Venntive

Average

0%

10%

20%

Beginner

30%

40%

Intermediate

50%

Advanced

60%

70%

Pro Services

Mid-Market Deployment Management Score

Deployment Management

dotMailer

EmailDirect

Goolara

ContactLab

MailUp

Act-On

Delivra

Harland Clarke Digital

Average

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

70%

80%

90%

100%

Mid-Market Deployment Management Ease of Use

Deployment Management

Act-On

ContactLab

dotMailer

EmailDirect

Goolara

Harland Clarke Digital

MailUp

Average

0%

10%

20%

Beginner

30%

40%

Intermediate

50%

Advanced

60%

Pro Services

Email Vendor Features & Functions Guide

Delivra

52

Pre-Configured Programs

To make the marketer’s life easier, several vendors provide pre-configured versions of popular email

messaging programs like Abandoned Order, Welcome, and Win-Back programs. Just add data, your own

content and adjust the messaging rules, and you’re programs are ready to run.

Pre-Configured Campaigns