Annual Report 2013–14 - Great Plains College

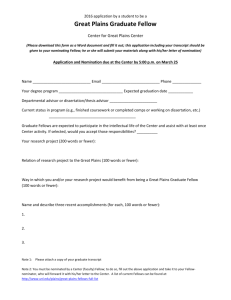

advertisement