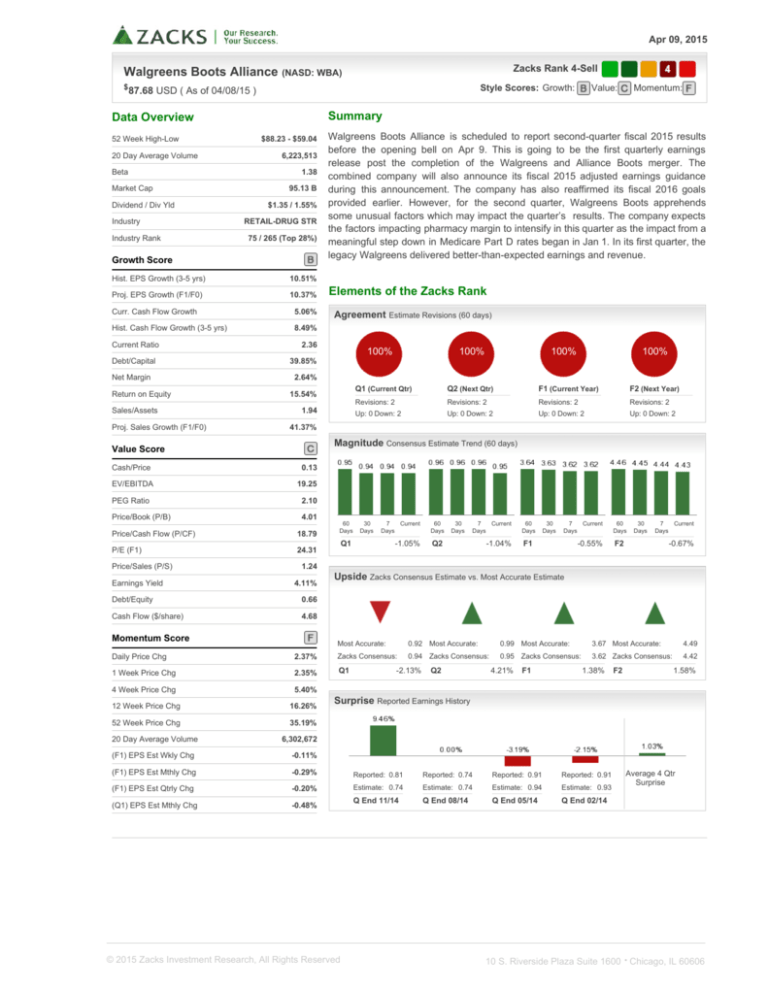

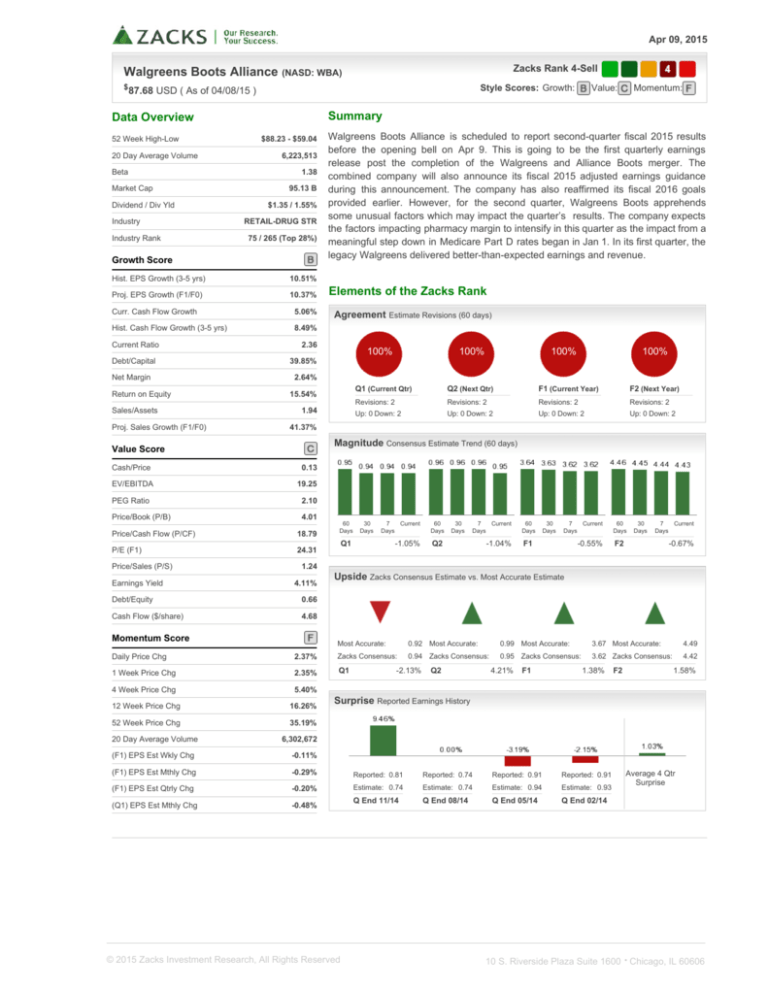

Apr 09, 2015

Zacks Rank 4-Sell

Walgreens Boots Alliance (NASD: WBA)

$87.68

Style Scores: Growth:

USD ( As of 04/08/15 )

20 Day Average Volume

Beta

Market Cap

Dividend / Div Yld

Industry

Industry Rank

$88.23 - $59.04

6,223,513

1.38

95.13 B

$1.35 / 1.55%

RETAIL-DRUG STR

75 / 265 (Top 28%)

Growth Score

Hist. EPS Growth (3-5 yrs)

10.51%

Proj. EPS Growth (F1/F0)

10.37%

Curr. Cash Flow Growth

5.06%

Hist. Cash Flow Growth (3-5 yrs)

8.49%

Current Ratio

Debt/Capital

Net Margin

Return on Equity

Sales/Assets

Proj. Sales Growth (F1/F0)

EV/EBITDA

PEG Ratio

Price/Book (P/B)

Agreement

Estimate Revisions (60 days)

100%

100%

100%

100%

2.64%

15.54%

1.94

Q1 (Current Qtr)

Q2 (Next Qtr)

F1 (Current Year)

F2 (Next Year)

Revisions: 2

Revisions: 2

Revisions: 2

Revisions: 2

Up: 0 Down: 2

Up: 0 Down: 2

Up: 0 Down: 2

Up: 0 Down: 2

41.37%

Magnitude Consensus Estimate Trend (60 days)

0.13

19.25

2.10

4.01

18.79

P/E (F1)

24.31

Earnings Yield

Elements of the Zacks Rank

2.36

Price/Cash Flow (P/CF)

Price/Sales (P/S)

Walgreens Boots Alliance is scheduled to report second-quarter fiscal 2015 results

before the opening bell on Apr 9. This is going to be the first quarterly earnings

release post the completion of the Walgreens and Alliance Boots merger. The

combined company will also announce its fiscal 2015 adjusted earnings guidance

during this announcement. The company has also reaffirmed its fiscal 2016 goals

provided earlier. However, for the second quarter, Walgreens Boots apprehends

some unusual factors which may impact the quarter’s results. The company expects

the factors impacting pharmacy margin to intensify in this quarter as the impact from a

meaningful step down in Medicare Part D rates began in Jan 1. In its first quarter, the

legacy Walgreens delivered better-than-expected earnings and revenue.

39.85%

Value Score

Cash/Price

Momentum:

Summary

Data Overview

52 Week High-Low

Value:

60

Days

30

Days

7

Current

Days

60

Days

-1.05%

Q2

Q1

30

Days

7

Current

Days

-1.04%

60

Days

30

Days

7

Current

Days

F1

-0.55%

60

Days

30

Days

7

Current

Days

F2

-0.67%

1.24

4.11%

Debt/Equity

0.66

Cash Flow ($/share)

4.68

Momentum Score

Upside Zacks Consensus Estimate vs. Most Accurate Estimate

Most Accurate:

0.92 Most Accurate:

0.99 Most Accurate:

3.67 Most Accurate:

Daily Price Chg

2.37%

Zacks Consensus:

0.94 Zacks Consensus:

0.95 Zacks Consensus:

3.62 Zacks Consensus:

1 Week Price Chg

2.35%

Q1

4 Week Price Chg

12 Week Price Chg

52 Week Price Chg

20 Day Average Volume

-2.13%

Q2

4.21%

F1

1.38%

F2

4.49

4.42

1.58%

5.40%

16.26%

Surprise Reported Earnings History

35.19%

6,302,672

(F1) EPS Est Wkly Chg

-0.11%

(F1) EPS Est Mthly Chg

-0.29%

Reported: 0.81

Reported: 0.74

Reported: 0.91

Reported: 0.91

(F1) EPS Est Qtrly Chg

-0.20%

Estimate: 0.74

Estimate: 0.74

Estimate: 0.94

Estimate: 0.93

(Q1) EPS Est Mthly Chg

-0.48%

Q End 11/14

Q End 08/14

Q End 05/14

Q End 02/14

© 2015 Zacks Investment Research, All Rights Reserved

Average 4 Qtr

Surprise

10 S. Riverside Plaza Suite 1600 · Chicago, IL 60606

The data on the front page and all the charts in the report represent market data as of 04/08/15, while the reports text is as of

04/09/2015

Overview

Founded in Dec 2014, Walgreens Boots Alliance (WBA) is the

world’s first pharmacy-led, health and wellbeing enterprise. The

company has been formed through the combination of

Walgreens Co. (WAG) and Alliance Boots that brought together

two leading companies with iconic brands, complementary

geographic footprints, shared values, and trusted health care

services through pharmaceutical wholesaling and community

pharmacy care.

The company includes the largest global pharmaceutical

wholesaler and distribution network with over 340 distribution

centers in 19 countries. In addition, Walgreens Boots Alliance is

the world's largest purchaser of prescription drugs and several

other health and wellbeing products. Its portfolio of retail and

business brands includes Walgreens, Duane Reade, Boots and

Alliance Healthcare, as well as global health and beauty product

brands, such as No7 and Botanics that are gaining popularity.

On Dec 31, 2014, Walgreens and Alliance Boots completed Step

2 of their strategic partnership to form Walgreens Boots Alliance,

following the approval by the former’s shareholders on Dec 29.

The new global enterprise combines Walgreens, the largest

drugstore chain in the USA; Boots, a leading European retail

pharmacy and Alliance Healthcare, a major international

wholesaler and distributor.

Walgreens is now a fully-owned subsidiary of the new company, which will be headquartered in Deerfield, IL. Stefano Pessina will

become the acting CEO of Walgreens Boots Alliance, following the retirement of Walgreen’s current CEO Greg Wasson.

Originally, Walgreens and Alliance Boots had entered into a long-term strategic partnership in Jun 2012, with the former acquiring a

45% equity ownership in the latter for about $6.7 billion in cash and stock.

Zacks Equity Research: WBA

www.zacks.com

Page 2 of 8

Reasons To Sell:

Several Headwinds Weigh on Stock: Walgreen is currently challenged by headwinds that

include recent changes in the environment of the company's pharmacy business, ongoing

generic drug inflation, reimbursement pressure and a shift in pharmacy mix toward 90-day

prescription refills at retail locations and Medicare Part D. The generic wave in the

pharmaceutical industry remains a threat to revenues. We are also worried about the fate of the

Alliance Boots deal which remains cloudy ever since the acquisition procedure was initiated.

Although the company has promised successful integration and synergy down the line, nearterm outlook is bleak.

Pressure on Margins Continues: Introduction of generic versions of drugs generally benefits

gross profit margin compared to patent protected brand name drugs. However, in the last few

years, slowdown in generic introduction has been affecting the company’s margins. Besides,

over the past few years, increased reimbursement pressure and generic drug cost inflation

have been hampering Walgreens’ margin, on a significant level. Per management, the fewer

generic drug introductions compared to the prior-year period and the ongoing generic drug

inflation has hindered the quarter’s pharmacy margin. The company expects these negative

factors will continue to adversely impact pharmacy margin in the next quarter as well. However,

management is working tirelessly to increase efficiency and provide high quality and cost

effective pharmacy services, in order to reduce overall pharmacy cost.

Ongoing generic

drug inflation,

reimbursement

pressure and

competitive market

offer tough

challenges for

Walgreens. Also, the

present weak

macroeconomic

environment

prevailing in the U.S.

might hamper the

company’s margin.

Competitive Landscape: Walgreens faces headwinds from increased competition and tough industry conditions. Even though the

company continues to grab market share from other traditional drug store retailers, major mass merchants such as Target and WalMart are expanding their pharmacy businesses and enjoy a fair market share. We note that the retail wing of CVS Caremark

witnessed a record market share gain following the termination of the Walgreens-Express Scripts contract. While the company’s

sluggish performance is showing signs of improving with the return of customers, CVS management commentary of retaining a

majority of the client wins raises our concern. There are also risks from other channels, such as supermarkets and mail order

operations. In addition, industry conditions remain challenging, as insurers reduce reimbursement rates and increase prescription

co-payments.

Additional Challenges: Under the present weak macroeconomic environment, unemployment remains high at 6.1%, and food and

gas prices are on the rise. Increasing costs coupled with unemployment makes the customers more value driven. Consequently,

spending on discretionary items gets affected. We are of the opinion that this situation will impact same store sales growth. Our

proposition is supported by the continued decline in customer traffic in comparable stores.

Risks

Alliance Boots Acquisition, a Major Positive: With the completion of Step 2 of Alliance Boots acquisition, Walgreens has

successfully become a fully-owned subsidiary of the new company called Walgreens Boots Alliance, the first global pharmacy-led

health and wellbeing enterprise. This constitutes a major part of Walgreen’s strategic journey that the company began six years

back, to position orderings for new generation of growth and value creation. Since the strategic partnership started off in 2012,

Walgreens and Alliance Boots have achieved several significant goals including senior leadership exchanges, successful synergy

generation, a joint own-brand sourcing program in Asia and the sharing of best practices and innovative technologies. In addition,

the companies launched No7 and other Boots product brands in Walgreens stores across the U.S. The completion of this

strategic transaction marks another breakthrough for both the companies. The acquisition will greatly expand Walgreen's

international presence. Combining Walgreen, the largest drugstore chain in the U.S.; Boots, the market leader in European retail

pharmacy; and Alliance Healthcare, the leading international wholesaler and distributor, the new entity spans over 25 countries

with more than 12,800 stores, and over 370,000 employees. The merger will also bring together a unique portfolio of retail,

wholesale, service and product brands, alongside the world’s largest pharmaceutical wholesaler and distribution network. Having

attained this global stature, Walgreens will be able to generate significant and sustainable benefits for local markets as well as for

all stakeholders.

Strategic Goal for Next Three Years: While announcing the second step of the Alliance Boots acquisition, Walgreens had also

outlined a new three-year ‘Next Chapter plan’ through fiscal 2017 that will set strategic goals for the combined company and

maximize its scope and scale over time. The plan will reflect significant value-creating opportunities for the combined enterprise to

drive long-term shareholder value. Under this plan, the combined company will establish goals for fiscal 2016 including revenues

between $126 billion and $130 billion and adjusted earnings per share of $4.25 to $4.60. As Walgreens strides on the synergy

track, the company expects to exceed the combined synergy goal of $1 billion by the end of 2016. The plan also focuses on

improving core performance in the near-term.

So far, Walgreens’ partnership with Alliance Boots has been yielding positive results, with combined synergies reaching $491

million in fiscal 2014. Moreover, Alliance Boots contributed $0.06 per share to Walgreens’ fourth-quarter fiscal 2014 adjusted net

earnings. The company expects this joint synergy program to deliver approximately $650 million in fiscal 2015. The company

estimates accretion from Alliance Boots in the first quarter of fiscal 2015 in the range of $0.10 to $0.11 per share (on an adjusted

basis, including a $0.02 benefit related to the Alliance Boots’ acquisition of its partner’s interest in a joint venture). We are

looking forward to all these new ventures at Walgreens and expect them to complement the company’s growth going forward.

Zacks Equity Research: WBA

www.zacks.com

Page 3 of 8

Cost Reduction and Capital Allocation Initiatives: The three-year plan of the combined company also includes a multi-faceted

cost-reduction initiative across the enterprise. This plan includes corporate, field and store-level cost reductions. The company

has already started making significant progress in this matter and expects to begin realizing incremental benefits in fiscal 2015.

Walgreens has also approved a new capital allocation policy for the combined enterprise which is designed to ensure a balanced

and disciplined approach to capital. The company expects this to drive business growth and generate strong returns, while

returning cash to shareholders through dividends and share repurchases over the long term.

Strong Balance Sheet: Walgreens’ cash and cash equivalent at the end of the first quarter of fiscal 2015 was almost $12.86

billion, significantly higher than $969 million as of Nov 30, 2013. Long-term debt was pegged at $13.76 billion in the reported

quarter, compared with $4.5 billion as of Nov 30, 2013. Cash flow trends remain strong as overall networking capital decreased

13.8% on a year-over-year basis, which helped drive solid cash flow performance for the quarter. Operating cash flow for the first

quarter was approximately $1.03 billion compared with $133 million for the same period last year. Notably, year-ago cash flow

was adversely impacted by the timing of payments related to the AmerisourceBergen transaction. Free cash flow for the quarter

was $696 million versus free cash outflow of $231 million a year ago.

The healthy cash balance should support the company’s plans for suitable acquisitions, to drive its revenues going forward. Also,

bolstered by a strong cash position, the company strives to benefit its shareholders through dividend payments and share

repurchases. Walgreens’ strong balance sheet has enabled it to consistently hike dividends. The hike reflects a compound

annual growth rate (CAGR) of 23% over 5 years. It is encouraging to note that the company has been paying dividends for more

than 80 years now and the latest 7.1% hike Walgreens made in Oct 2014 marked the thirty-ninth consecutive quarter of dividend

increase for the company. This hike was in line with its long-term dividend payout ratio of 30% to 35%. In the last fiscal, the

company has returned more than $1 billion to its shareholders via dividends. Going forward, the company plans to review its

capital deployment strategy. Moreover, in addition to the $500 million in shares Walgreens bought back in the fourth quarter of

fiscal 2014, it has bought another $500 million in the reported quarter. These efforts underline the company’s focus toward a

healthy investment grade rating.

Last Earnings Report

Walgreen reported adjusted net earnings of $0.81 per share in the first quarter of fiscal

2015, up 12.5% from the year-ago adjusted number. The adjusted figure also beat the

Zacks Consensus Estimate of $0.74 by 9.5%.

Quarter Ending 11/2014

Report Date

Sales Surprise

A year-over-year high-single-digit increase in the revenues primarily resulted in this bottomline improvement.

In Aug 2012, Walgreens had entered into a strategic partnership with a global international

pharmacy-led health and beauty group Alliance Boots GmbH, in which it acquired a 45%

stake for $6.7 billion. This alliance fits Walgreens' strategy to advance community pharmacy

and bring additional specialty pharmacy products and services closer to patients.

EPS Surprise

NA

NA

9.46%

Quarterly EPS

0.81

Annual EPS (TTM)

3.37

So far, Walgreens' partnership with Alliance Boots has been yielding positive results, with combined synergies reaching $140 million in

the reported quarter. Moreover, Alliance Boots contributed 11 cents per share to Walgreens' first-quarter fiscal 2015 adjusted net

earnings.

The company expects this joint synergy program to deliver approximately $650 million in fiscal 2015.

On a reported basis (including certain one-time items), net earnings came in at $809 million or 85 cents per share, an improvement of

16.4% or 18.1% respectively from the year-ago net earnings of $695 million or 72 cents per share.

Quarter in Detail

During the reported quarter, Walgreens' total sales reached $19.6 billion in the first quarter, registering sales growth of 6.7% year over

year and a comfortable beat over the Zacks Consensus Estimate of $19.4 billion. This sales result came in line with the preliminary

November sales figures posted by Walgreens in the first week of December.

In the reported quarter, Walgreens delivered solid performance across both its pharmacy and retail products businesses, which resulted

in the top-line improvement.

Front-end comparable store (those open for at least a year) sales and basket size grew 1.5% and 4.2%, respectively, in the quarter.

Overall, comparable store sales improved 5.7%. On the other hand, customer traffic in comparable stores was down 2.7%.

Pharmacy sales (accounting for 66.8% of total sales in the quarter) climbed 9% over the prior-year quarter, while pharmacy sales in

comparable stores increased 8.1%. Moreover, Walgreens filled a record 222 million prescriptions (up 4.3% year over year) during the

reported quarter.

Prescriptions filled at comparable stores rose 4.1%. As of Nov 30, Walgreens retail prescription market share on a 30-day adjusted

basis reached 19%, as reported by IMS Health.

Notably, Walgreens has completed its financing to seal the Alliance Boots transaction. The company expects to close the second step

of the transaction on Dec 31, 2014, following the special meeting of shareholders to be held on Dec 29 in New York City.

Zacks Equity Research: WBA

www.zacks.com

Page 4 of 8

Margins

Adjusted gross profit increased 2.6% year over year to $5.35 billion. However, as expected, adjusted gross margin contracted 100 basis

points (bps) to 27.3% as pharmacy gross profit was negatively impacted by lower third-party reimbursement and generic drug price

inflation, partially offset by an increase in the brand-to-generic drug conversions.

However, as expected, both pharmacy and front-end margins gained from purchasing synergies from the company's joint venture with

Alliance Boots.

Adjusted selling, general and administrative (SG&A) expenses scaled up 1.7% to $4.3 billion. Adjusted operating margin remained flat

at 5.2%.

Recent News

Walgreens Boots Alliance is scheduled to report second-quarter fiscal 2015 results before the opening bell on Apr 9 2015. As a

combined company, Walgreens Boots intends to continue reporting comparable sales results on a quarterly basis. However, it has

stopped issuing monthly sales results as it used to do for the legacy company.

On Mar 17, 2015, Walgreens announced the list of states with the highest rates of influenza according to its season-ending Flu Index,

which examined aggregate prescription data from Nov 2014 through Feb 2015. Oklahoma, Mississippi and Tennessee were the states

where in people were affected by influenza at most.

On Feb 20, 2015, Walgreens announced that the company will celebrate the official opening of a new two-story, flagship store at 1488

Kapiolani Blvd., Honolulu, in the popular Ala Moana shopping district on Feb. 21, 2015. The location features an extensive collection of

innovative offerings, products and services unexpected from a drugstore, marking this as Walgreens’ 15th flagship store, and its 12th

store on Oahu and 18th in Hawaii.

Zacks Equity Research: WBA

www.zacks.com

Page 5 of 8

Industry Analysis Zacks Industry Rank: 75 / 265 (Top 28%)

Top Peers

AHOLD N V ADR (AHONY)

ARCOS DORADOS-A (ARCO)

BIOSCRIP INC (BIOS)

CVS HEALTH CORP (CVS)

DIPLOMAT PHARMA (DPLO)

GNC HOLDINGS (GNC)

HERBALIFE LTD (HLF)

CHINA NEPSTAR (NPD)

RITE AID CORP (RAD)

Industry Comparison Retail-drug Str | Position in Industry: 3 of 8

Market Cap

# of Analysts

Dividend Yield

WBA

95.93 B

M Industry

917.87 M

Industry Peers

S&P 500

18.89 B

BIOS

321.22 M

CVS

117.42 B

DPLO

1.87 B

18

6

14

5

18

6

1.53%

0.00%

1.76%

0.00%

1.35%

0.00%

-

-

Growth Score

Hist. EPS Growth (3-5 yrs)

10.51%

11.17%

10.88%

-45.69%

13.99%

NA

Proj. EPS Growth (F1/F0)

10.37%

15.46%

7.06%

88.46%

21.95%

2.45%

Curr. Cash Flow Growth

5.06%

7.22%

7.16%

-511.83%

1.45%

138.91%

Hist. Cash Flow Growth (3-5 yrs)

8.49%

7.13%

10.04%

NA

5.07%

NA

2.36

1.21

1.37

1.16

1.37

1.35

39.85%

25.67%

37.94%

65.87%

23.55%

0.00%

2.64%

3.22%

10.07%

-14.98%

3.33%

NA

15.54%

12.22%

17.09%

-34.38%

13.81%

NA

1.94

1.72

0.60

1.14

1.90

NA

41.37%

%

2.44%

10.49%

7.72%

33.22%

-

-

Current Ratio

Debt/Capital

Net Margin

Return on Equity

Sales/Assets

Proj. Sales Growth (F1/F0)

Value Score

Cash/Price

0.13

0.04

0.06

0.00

0.02

0.01

EV/EBITDA

19.25

12.62

10.95

-11.13

12.40

91.77

PEG Ratio

2.10

1.85

1.81

NA

1.48

2.91

Price/Book (P/B)

4.01

3.75

3.20

1.48

3.12

10.02

Price/Cash Flow (P/CF)

18.79

14.61

12.64

NA

17.26

62.20

P/E (F1)

24.31

26.52

18.64

NA

20.10

65.48

1.24

1.23

2.12

0.33

0.84

NA

4.11%

3.43%

5.34%

-3.63%

4.98%

1.52%

Debt/Equity

0.66

0.27

0.59

1.93

0.31

0.00

Cash Flow ($/share)

4.68

1.73

5.30

-1.03

5.99

0.53

-

-

Daily Price Chg

2.37%

0.00%

0.63%

4.93%

0.70%

-3.01%

1 Week Price Chg

2.35%

0.00%

0.03%

9.09%

-0.39%

-4.84%

4 Week Price Chg

5.40%

0.92%

1.00%

8.84%

0.91%

15.62%

12 Week Price Chg

16.26%

4.70%

3.38%

-17.90%

6.41%

25.32%

52 Week Price Chg

35.19%

6.18%

14.17%

-31.13%

40.09%

NA

6,302,672

292,643

2,309,971

1,998,848

4,187,358

708,005

(F1) EPS Est Wkly Chg

-0.11%

0.00%

0.00%

0.00%

0.00%

0.00%

(F1) EPS Est Mthly Chg

-0.29%

0.00%

0.00%

0.00%

0.00%

0.00%

(F1) EPS Est Qtrly Chg

-0.20%

-1.31%

-1.79%

-633.33%

0.10%

23.04%

(Q1) EPS Est Mthly Chg

-0.48%

0.00%

0.00%

0.00%

0.00%

0.00%

Price/Sales (P/S)

Earnings Yield

Momentum Score

20 Day Average Volume

Zacks Equity Research: WBA

www.zacks.com

Page 6 of 8

Zacks Rank Education

The Zacks Rank is calculated from four primary inputs: Agreement, Magnitude, Upside and Surprise.

Agreement

This is the extent which brokerage analysts are revising their earnings estimates in the same

direction. The greater the percentage of estimates being revised higher, the better the score for this

component.

For example, if there were 10 estimate revisions over the last 60 days, with 8 of those revisions up,

and the other 2 down, then the agreement factor would be 80% positive. If, however, 8 were to the

downside with only 2 of them up, then the agreement factor would be 80% negative. The higher the

percentage of agreement the better.

Magnitude

This is a measure based on the size of the recent change in the current consensus estimates. The

Zacks Rank looks at the magnitude of these changes over the last 60 days.

In the chart to the right, the display shows the consensus estimate from 60-days ago, 30-days ago,

7-days ago, and the most current estimate The difference between the current estimate and the

estimate from 60-days ago is displayed as a percentage. A larger positive percentage increase will

score better on this component.

Upside

This is the difference between the most accurate estimate, as calculated by Zacks, and the

consensus estimate. For example, a stock with a consensus estimate of $1.00, and a most

accurate estimate of $1.05 will have an upside factor of 5%.

This is not an indication of how much a stock will go up or down. Instead, it's a measure of the

difference between these two estimates. This is particularly useful near earnings season as a

positive upside percentage can be used to help predict a future surprise.

Surprise

The Zacks Rank also factors in the last few quarters of earnings surprises. Companies that have

positively surprised in the recent past have a tendency of positively surprising again in the future (or

missing if they recently missed).

A stock with a recent track record of positive surprises will score better on this factor than a stock

with a history of negative surprises. These stocks will have a greater likelihood of positively

surprising again.

Zacks Style Score Education

The Zacks Style Score is as a complementary indicator to the Zacks Rank, giving investors a way to

focus on the best Zacks Rank stocks that best fit their own stock picking preferences.

Academic research has proven that stocks with the best Growth, Value, and Momentum

characteristics outperform the market. The Zacks Style Scores rate stocks on each of these

individual styles and assigns a rating of A, B, C, D and F. An A, is better than a B; a B is better than

a C; and so on.

Growth Score

Value Score

Momentum Score

As an investor, you want to buy stocks with the highest probability of success. That means buying stocks with a Zacks Rank #1 or #2,

Strong Buy or Buy, which also has a Style Score of an A or a B.

Zacks Equity Research: WBA

www.zacks.com

Page 7 of 8

Disclosures

The analysts contributing to this report do not hold any shares of this stock. The EPS and revenue forecasts are the Zacks

Consensus estimates. Additionally, the analysts contributing to this report certify that the views expressed herein accurately reflect the

analysts' personal views as to the subject securities and issuers. Zacks certifies that no part of the analysts compensation was, is, or

will be, directly or indirectly, related to the specific recommendation or views expressed by the analyst in the report. Additional

information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources we

believe to be reliable, but is not guaranteed as to accuracy and does not purport to be complete. Because of individual objectives, the

report should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed

herein are subject to change. This report is not to be construed as an offer or the solicitation of an offer to buy or sell the securities

herein mentioned. Zacks or its officers, employees or customers may have a position long or short in the securities mentioned and buy

or sell the securities from time to time. Zacks uses the following rating system for the securities it covers which results from a

proprietary quantitative model using trends in earnings estimate revisions. This model is proven most effective for judging the timeliness

of a stock over the next 1 to 3 months. The model assigns each stock a rank from 1 through 5. Zacks Rank 1 = Strong Buy. Zacks Rank

2 = Buy. Zacks Rank 3 = Hold. Zacks Rank 4 = Sell. Zacks Rank 5 = Strong Sell. We also provide a Zacks Industry Rank for each

company which provides an idea of the near-term attractiveness of a company s industry group. We have 264 industry groups in total.

Thus, the Zacks Industry Rank is a number between 1 and 264. In terms of investment attractiveness, the higher the rank the better.

Historically, the top half of the industries has outperformed the general market.

Zacks Equity Research: WBA

www.zacks.com

Page 8 of 8