True or False 1

advertisement

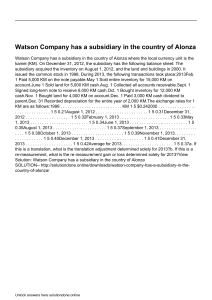

Consolidations - Changes in Ownership... True or False 1 . Dividends paid by the subsidiary prior to acquisition are eliminated for consolidation purposes because they are not part of the equity acquired. True False 2 . If a parent company increases its interest in a subsidiary from 60% to 65% during the course of an accounting period, minority interest on the consolidated financial statements prepared at year end would reflect a minority interest of 35%. True False 3 . If a parent company sells shares that were acquired through several different purchases, the last-in-first-out method is generally used to determine the cost basis of the shares. True False 4 . When a parent company sells an interest in the subsidiary during the middle of an accounting period, the total impact on the parent company's net income is the same regardless of whether the sale is recorded as of the beginning of the year or as of the date of sale. True False 5 . When a subsidiary corporation sells additional shares, the parent company's books must be adjusted to reduce the additional paid-in-capital and investment account balance for the change in underlying equity. True False