Consumer Search and Double Marginalization

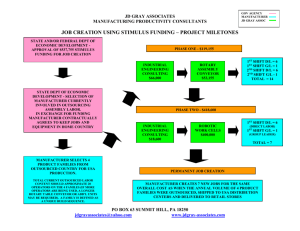

advertisement