Investment phase still going strong

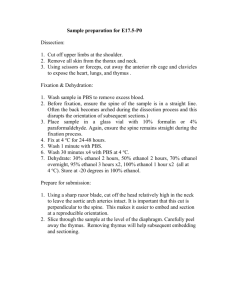

advertisement

Spot Colors: OCTOBER 2015 www.ringneckenergy.com info@ringneckenergy.com 605.258.2900 • Onida, SD Investment phase still going strong Pantone 1675, Pantone 349 & Pantone 109 Ringneck Energy has wrapped up its initial round of equity drive meetings, hosting 72 meetings in four states between July 29 and Sept. 28. While attendance varied at meetings, interested investors indicated willingness to invest a total of between $25 and 30 million in the proposed 70 million gallon per year dry mill ethanol plant to be located near Onida, SD. With harvest in full swing now, company leaders have turned attention toward working to arrange meetings with potential higher net worth investors who have experience in the ethanol industry. There will be more evening meetings scheduled in late November, in key areas near Onida, according to Walter Wendland, president and CEO. “I feel like a lot of farmers are waiting until they get their crop out to make a decision,” he said. He also encourages current investors to spread the word to others who may be interested in investing. “We’re pursuing every opportunity to reach people through calls, meetings, and the internet,” Wendland said. “Personal contact is still a great approach.” Complete information about the project, including a video of a shortened presentation, the prospectus and the subscription agreement, company updates, and industry information can all be found on the Ringneck Energy website at www.ringneckenergy.com. “We are working hard to meet the equity goal by mid-December,” Wendland said. Moving dirt, moving ahead toward construction A number of behind-the-scenes steps have been taken in recent months that will soon lead to the first visible progress on Ringneck Energy’s plant, with dirt about to start moving. Here’s a look at recent developments: July 20: Conditional use permit approved by Sully County Sept. 17: Contract for Phase I site grading awarded to AGE Corporation of Ft. Pierre, SD. Sept. 23: Received $250,000 USDA grant toward company start-up costs Oct. 2: Submitted application for Title V air permit from South Dakota Department of Environment and Natural Resources; expected 60-90 day turnaround to approval. Oct. 6: Agreement signed with Brosz Engineering of Pierre, SD, for testing and staking during construction Oct. 14: Received SD DNR construction stormwater permit Ongoing: Interviewing marketers for ethanol, DDGs and other co-products In progress: Central South Dakota Enhancement District is applying for up to $1.8 million in grant funds to improve Continued on Page 2 2 RINGNECK Energy October 2015 Board of Directors: President, CEO, Chairman & Director Walt Wendland Secretary/Treasurer & Director Janet Wendland Directors Ed Eller Jeff Goebel Kenton Johnson Pat Voorhees Gary Wickersham Kirk Yackley Our Mission: To produce renewable energy that adds value to grain and livestock production, enhances the income of our investor partners, provides a safe and rewarding work environment that creates economic opportunities for the community. Goals for the Company: •Produce 70 million gallon per year of bio-fuel ethanol focusing on the local, regional and national markets by the fall of 2016. •Produce a high-protein feed source for the local livestock. •Return maximum profits to member investors. •Add value to agriculture in the area. •Meet the standard 20% reduction in greenhouse gas emissions. •Improve efficiency with the latest technology. Address: PO Box 68 215A South Main Onida, SD 57564 Why Onida & South Dakota Make Sense Onida is a perfect location for building a new ethanol plant, both because of its proximity to both corn supply and a market for distillers grain, and because of the low cost of production compared to other states. The chart above shows the “crush margin” for Iowa, Nebraska, South Dakota, and specifically, the Onida area over the past six months, with Onida and South Dakota consistently showing a cost of production below that of the other states. Progress about to be obvious Continued from Page 1 road to the plant site. “It is exciting to see all these pieces come together,” said Gary Johnson, owner of AGE Corporation and a seed investor in Ringneck Energy. “I see it as a super win-win for Sully County and central South Dakota. And I say that from the standpoint of the jobs that will come directly and indirectly, and the benefits to the agricultural “Knowing the commitment of Sully County farmers to this project made me heavily interested in it. It was a natural fit for us and it is close to home.” — Gary Johnson, AGE Corporation & seed investor community as a corn market and source for livestock feed.” DISCLAIMER This newsletter is for informational purposes only and does not constitute or form part of, and should not be construed as, any offer for sale, or any invitation to offer to buy, any securities of Ringneck Energy LLC, nor should it be relied on in connection with any purchase or sale of securities whatsoever. The offering described herein is only suitable, intended and available for accredited investors. Any offer or invitation for offers to buy will be made only by means of Ringneck Energy LLC’s official private placement memorandum and only in accordance with the terms of all applicable securities and other laws. This newsletter contains historical information, as well forward-looking statements about Ringneck Energy LLC and our future performance and prospects, project financing, and expected future operations and actions. All statements that are not historical or current facts are forward-looking statements. In some cases you can identify forward-looking statements by words such as “believe”, “hope”, “expect”, “anticipate” and similar expressions. We caution readers not to place any undue reliance on any forward-looking statements. Forward looking statements are only our predictions based on current information and involve numerous assumptions, risks and uncertainties including, without limitation, changes in the availability of credit, demand and supply of ethanol, corn production, plant operations and the actions of regulatory authorities. Our actual results or actions may differ materially from these forward looking statements for many reasons, including risks associated with the ethanol industry generally, and the ability of the company to timely meet all requirements of financing and construction of the plant. We undertake no responsibility to update any forward looking statement. Additionally, certain information contained in this newsletter was obtained from own research and other sources believed to be credible and reliable. However, we have not independently verified the information. In particular, we have used information provided by trade organizations for the ethanol industry, which may present information in a manner that is more favorable to that industry than would be presented by an independent source. Although we believe these sources are reliable, we have not independently verified the information and make no guarantees as to its accuracy or completeness.