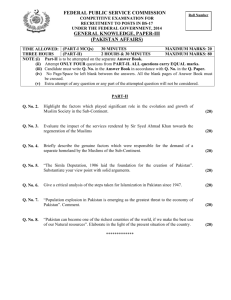

Mr. Saifuddin N. Zoomkawala, Chairman, EFU General Insurance Ltd.

advertisement

Mr. Saifuddin N. Zoomkawala, Chairman, EFU General Insurance Ltd. Mr. Saifuddin Nooruddin Zoomkawala is the Chairman of EFU General Insurance Limited, Chairman of Allianz - EFU Health Insurance Limited and Director of EFU Life Assurance Limited. Having spent most of his professional career with the Company, Mr. Zoomkawala has risen through the ranks, from sales representative to the position of Chairman of Pakistan's oldest insurance company. Business Recorder Research recently met with the industry veteran. The following transcript is based on key takeaways from that meeting. Brief History of the company Prior to independence of Pakistan, Muslims of the Indian sub-continent had not fared well in terms of professional qualifications, higher education and employment opportunities. In order to improve their conditions and also to generate economic activity for the Muslims, Quaid-e-Azam Muhammad Ali Jinnah and other prominent Muslim leaders of the sub-continent urged them to pursue higher education and enter into the financial and manufacturing industries. In order to create more job opportunities, these leaders called on influential Muslims to invest in new business ventures that could employ Muslims and also equip them with modern and professional skills. In response to this emergent need, Eastern Federal Union Insurance Limited was created in 1932 through the efforts of Mr. Ghulam Muhammad. He was supported in this endeavour by the Nawab of Bhopal and the Aga Khan III. Mr. Abdul Rehman Siddiqui became the founder chairman of the new company, which was registered in Calcutta. The Company continued to expand over the years. After the independence of Pakistan, its head office was shifted to Chittagong, in then-East Pakistan. By 1971, the Company had grown to become the largest insurance company in the AfroAsian region (excluding Japan). In subsequent years, the company faced certain challenges. The Fall of Dhaka affected it operations because a significant portion of the portfolio was in that part of the country. A few years later, when the Government of Pakistan decided to nationalise large industries and life insurance a large chunk of the company's portfolio went into what later emerged as the State Life Insurance Corporation. Through such tumultuous times, EFU has persevered to remain one of the most significant players in the insurance sector of Pakistan. Replacing the visionary leader, Mr. RoshenAli Bhimjee at the helm of affairs, came Mr. Saifuddin Nooruddin Zoomkawala. Bringing insurance cover to all Pakistanis Chairman EFU General Insurance highlighted three major hurdles in the growth of insurance industry in the country: low per capita income, religious considerations and lack of awareness. He highlighted the need for concerted efforts by the industry, regulators and all other stakeholders for creating awareness regarding the need and benefits of seeking insurance cover. The industry veteran pointed out that the insurance companies in the country should be encouraged by the regulators to split their operations into two separate departments: corporate and retail. At present, all insurance companies cater to both the categories of clients. As a result senior managers predominantly remain focused on expanding their corporate portfolio because the size of the policies and the consequent revenue stream per client is much higher as compared to individual clients. If the companies split their operations into two separate departments the newly created department will be able to dedicate more time for increasing the number of individual policy holders. They would also devote more energy towards raising awareness among individuals and pursuing prospective clients. When asked about the growth prospects for general insurance and life insurance in the country, Mr. Zoomkawala stated that life insurance enjoys better growth opportunities. He explained that this is because life insurance policies are longer term policies and that once a client is acquired, he or she is more likely to continue contributing towards the policy over subsequent years. Continued on Page 22 07