NYSE: MCD

MCDONALD'S CORP

Report created Feb 4, 2014 Page 1 OF 4

McDonald's is the world's largest restaurant chain, with more than 35,000 fast-food restaurants in 119

countries. The company is a member of the Dow Jones Industrial Average and the S&P 500. With a market

capitalization of nearly $93 billion, MCD is generally considered a large-cap growth stock.

Argus Recommendations

Twelve Month Rating SELL HOLD BUY

Analyst's Notes

Five Year Rating SELL HOLD BUY

Analysis by John Staszak, CFA, February 4, 2014

ARGUS RATING: HOLD

Sector Rating

• Margin pressure in 2014; trimming full-year estimate

• On January 23, McDonald's reported 4Q13 operating earnings of $1.40 per share, up from $1.38 in

the same period last year and above the consensus estimate of $1.39.

• In 2014, we expect full-year revenue to increase from $28.1 billion to $29.6 billion, with comp growth

of just 0.9%. We also expect operating margins to decrease slightly this year due to rising labor and

SG&A costs.

• We are lowering our 2014 EPS estimate from $6.12 to $5.95 and establishing a 2015 estimate of

$6.40.

• In our view, the current MCD share price adequately reflects prospects for slower earnings growth in

2014. MCD shares are trading at 15.6-times our revised 2014 EPS estimate, compared to a historical

range of 8-21.

INVESTMENT THESIS

In the near term, we continue to expect soft same-store sales at HOLD-rated

McDonald's Corp. (NYSE: MCD). Operating income increased slightly year-over-year in

4Q13, but same-store sales were down 0.1%.

MCD has surpassed its annual operating income growth target of 6%-7% over the past

several years. However, we think that negative currency effects and high commodity prices

will lead to slower earnings growth over the next two years. Higher G&A expense and

lower margins in Europe are also likely to pressure earnings. If same-store sales leverage

outweighs the impact of higher commodity costs, or foreign exchange is more favorable

than we expect, we would consider placing the stock back on our BUY list.

Based on the company's ability to gain market share and carefully manage operating

expenses, our long-term rating remains BUY.

RECENT DEVELOPMENTS

On January 23, McDonald's reported 4Q13 operating earnings of $1.40 per share, up

from $1.38 in the same period last year and slightly above the consensus estimate of $1.39.

Higher revenue, offset in part by increased expenses and a 0.1% decline in same-store

Market Data

Pricing reflects previous trading week's closing price.

200-Day Moving Average

52 Week High: $103.70

52 Week Low: $92.22

Closed at $95.15 on 2/28

Price

($)

80

70

Rating

BUY

HOLD

SELL

Key Statistics pricing data reflects previous trading day's closing

price. Other applicable data are trailing 12-months unless

otherwise specified

Market Overview

Price

Target Price

52 Week Price Range

Shares Outstanding

Dividend

$93.02

-$92.22 to $103.70

995.03 Million

$3.24

Sector Overview

Consumer Discretionary

Sector

OVER WEIGHT

Sector Rating

12.00%

Total % of S&P 500 Market Cap.

Financial Strength

Financial Strength Rating

Debt/Capital Ratio

Return on Equity

Net Margin

Payout Ratio

Current Ratio

Revenue

After-Tax Income

MEDIUM-HIGH

47.1%

36.8%

19.9%

0.55

1.45

$28.11 Billion

$5.59 Billion

($)

1.23

1.32

1.43

1.38

1.26

1.38

5.36

Annual

1.52

1.40

1.37

5.55

14.53

15.63

3.29

6.10

$15.24

$92.56 Billion

Forecasted Growth

EPS

1.44

1.60

1.54

5.95 ( Estimate)

1.46

1.51

1.70

1.73

6.40 ( Estimate)

Revenue

1 Year EPS Growth Forecast

7.21%

5 Year EPS Growth Forecast

10.00%

1 Year Dividend Growth Forecast

5.77%

Risk

($ in Bil.)

6.5

7.2

7.2

7.0

6.6

7.1

7.3

7.4

7.0

Q1

Q2

Q3

2012

Q4

Q1

Q2

Q3

2013

Q4

Q1

27.9

Annual

FY ends

Dec 31

Key Statistics

Current FY P/E

Prior FY P/E

Price/Sales

Price/Book

Book Value/Share

Market Capitalization

90

Quarterly

Argus assigns a 12-month BUY, HOLD, or SELL rating to each

stock under coverage.

• BUY-rated stocks are expected to outperform the market (the

benchmark S&P 500 Index) on a risk-adjusted basis over the

next year.

• HOLD-rated stocks are expected to perform in line with the

market.

• SELL-rated stocks are expected to underperform the market

on a risk-adjusted basis.

The distribution of ratings across Argus' entire company

universe is: 44% Buy, 50% Hold, 6% Sell.

Valuation

100

Quarterly

Under Market Over

Weight Weight Weight

28.4

7.5

7.6

7.5

29.6 ( Estimate)

Q2

Q3

2014

Q4

7.0

Q1

7.6

7.7

7.6

29.9 ( Estimate)

Q2

Q3

2015

Beta

Institutional Ownership

0.79

64.70%

Q4

Please see important information about this report on page 4

©2014 Argus Research Company

Argus Analyst Report

NYSE: MCD

MCDONALD'S CORP

Report created Feb 4, 2014 Page 2 OF 4

Analyst's Notes...Continued

sales, led to the slightly better-than-expected earnings.

Fourth-quarter revenue of $7.1 billion was up 2% from the prior

year, matching the consensus estimate. Same-store sales were up

1.0% in Europe, but declined 1.4% in the U.S. and 2.4% in the

APMEA region. In the U.S, aggressive competition, flat customer

traffic and extreme weather in December hurt same-store sales. In

Europe, the higher comps reflected continued strength in Russia,

the United Kingdom and France, offset in part by weakness in

Germany. In the APMEA region, weakness in Japan and flat comps

in China and Australia hurt same-store sales. The operating margin

fell to 31.0% in 4Q13 from 31.6% in 4Q12. The margin

deterioration primarily reflected higher company-operated

restaurant expense and increased occupancy expense at franchised

locations. Interest expense rose moderately to $133.5 million.

Reflecting share repurchases during the quarter, the share count

decreased from 1.01 billion to just over 999 million.

In 2013, McDonald's earned $5.55 per share, up from $5.36 in

the prior-year period. Full-year revenue grew 2% to $28.1 billion

on 0.2% higher same-store sales.

During the 4Q conference call, management said that January

comps were likely to come in 'relatively flat.' This comment is

especially disappointing in that January 2014 follows weak results

in the prior-year period, when comps fell 1.9%. January 2014 also

includes an additional weekend day, which is expected to benefit

comps by 100 basis points. Management's January comp forecast

was well below the 2.4% consensus estimate.

EARNINGS & GROWTH ANALYSIS

In 2014, we expect revenue to increase from $28.1 billion to

$28.8 billion, in line with consensus. We now project 0.8% higher

same-store sales and 36,300 stores in 2014 (versus 1.0% higher

comps and 36,700 stores previously). In the U.S., we expect slightly

higher same-store sales. In Europe, driven by the implementation of

value menus and seasonal food events, we also project modestly

higher comps.

We look for a slightly lower operating margin in 2014 as labor

costs rise and SG&A increases. We think that food costs will rise as

fast as the company is able to raise menu prices. Primarily

reflecting continued modest same-store sales and reduced unit

growth, we are lowering our 2014 EPS estimate from $6.12 to

$5.95. For 2015, we are establishing an estimate of $6.40.

FINANCIAL STRENGTH & DIVIDEND

Our financial strength rating for McDonald's remains

Medium-High, the second-highest rank on our five-point scale. We

are encouraged by the company's plans to refranchise stores, as

these locations require no capital expenditures and improve free

cash flow. The company did not include a balance sheet with its

fourth-quarter earnings announcement. The debt/capitalization

ratio was 47.1% at the end of 3Q13, unchanged from the end of

4Q12. Operating income covered interest expense by a factor of

16.4 in 4Q13.

In November 2013, the company raised its quarterly dividend

Growth & Valuation Analysis

GROWTH ANALYSIS

($ in Millions, except per share data)

Revenue

COGS

Gross Profit

SG&A

R&D

Operating Income

Interest Expense

Pretax Income

Income Taxes

Tax Rate (%)

Net Income

Diluted Shares Outstanding

EPS

Dividend

GROWTH RATES (%)

Revenue

Operating Income

Net Income

EPS

Dividend

Sustainable Growth Rate

VALUATION ANALYSIS

Price: High

Price: Low

Price/Sales: High-Low

P/E: High-Low

Price/Cash Flow: High-Low

Financial & Risk Analysis

2009

22,745

13,953

8,792

2,234

—

6,841

454

6,487

1,936

30

4,551

1,107

4.11

2.05

2010

24,075

14,437

9,637

2,333

—

7,473

431

7,000

2,054

29

4,946

1,080

4.58

2.26

2011

27,006

16,319

10,687

2,394

—

8,530

454

8,012

2,509

31

5,503

1,045

5.27

2.53

2012

27,567

16,751

10,816

2,455

—

8,605

489

8,079

2,614

32

5,465

1,020

5.36

2.87

2013

28,106

17,203

10,903

2,386

—

8,764

522

8,205

2,619

32

5,586

1,006

5.55

3.12

-3.3

6.2

5.5

9.3

26.2

16.6

5.8

9.2

8.7

11.4

10.2

17.5

12.2

14.1

11.3

15.0

11.9

19.7

2.1

0.9

-0.7

1.7

13.4

17.1

2.0

1.9

2.2

3.7

8.7

17.1

$64.75

$50.44

3.2 - 2.5

15.8 - 12.3

12.5 - 9.7

$80.94

$61.06

3.6 - 2.7

17.7 - 13.3

13.8 - 10.4

$101.00

$72.14

3.9 - 2.8

19.2 - 13.7

14.8 - 10.5

$102.22

$83.31

3.8 - 3.1

19.1 - 15.5

15.0 - 12.2

$103.70

$89.25

3.7 - 3.2

18.7 - 16.1

14.7 - 12.7

FINANCIAL STRENGTH

Cash ($ in Millions)

Working Capital ($ in Millions)

Current Ratio

LT Debt/Equity Ratio (%)

Total Debt/Equity Ratio (%)

2011

2,336

894

1.25

84.3

86.9

2012

2,336

1,519

1.45

89.1

89.1

2013

2,799

1,880

1.59

88.3

88.3

RATIOS (%)

Gross Profit Margin

Operating Margin

Net Margin

Return On Assets

Return On Equity

39.6

31.6

20.4

16.9

37.9

39.2

31.2

19.8

16.0

36.8

38.8

31.2

19.9

15.5

35.7

RISK ANALYSIS

Cash Cycle (days)

Cash Flow/Cap Ex

Oper. Income/Int. Exp. (ratio)

Payout Ratio

-1.8

—

17.3

40.6

-2.4

—

16.6

48.0

-3.5

—

16.7

53.6

The data contained on this page of this report has been

provided by Morningstar, Inc. (© 2014 Morningstar, Inc.

All Rights Reserved). This data (1) is proprietary to

Morningstar and/or its content providers; (2) may not be

copied or distributed; and (3) is not warranted to be

accurate, complete or timely. Neither Morningstar nor its

content providers are responsible for any damages or

losses arising from any use of this information. Past

performance is no guarantee of future results. This data

is set forth herein for historical reference only and is not

necessarily used in Argus’ analysis of the stock set forth

on this page of this report or any other stock or other

security. All earnings figures are in GAAP.

Please see important information about this report on page 4

©2014 Argus Research Company

Argus Analyst Report

NYSE: MCD

MCDONALD'S CORP

Report created Feb 4, 2014 Page 3 OF 4

Analyst's Notes...Continued

popular with diners. This segment combines the quality of

restaurants that offer table service with the rapid service of fast

food, and has grown rapidly over the past several years.

from $0.77 per share to $0.81, or $3.24 annually, for a yield of

about 3.4%. By comparison, YUM! Brands and Wendy's both

yield about 2.2%. Our dividend estimates are $3.30 for 2014 and

$3.60 for 2015.

VALUATION

In our view, the current MCD share price adequately reflects

prospects for decelerating same-store sales in 2014. MCD shares

are trading at 15.6-times our revised 2014 EPS estimate and at

14.4-times our 2015 estimate, compared to a historical range of

8-21. They are also trading at a 2014 EV/EBITDA multiple of 9.2,

in line with the peer average. Based on our expectations for higher

near-term commodity costs and below-peer-average earnings

growth, we expect limited share price gains in the coming quarters

and are reiterating our HOLD rating. If same-store sales leverage

outweighs the impact of higher commodity costs or foreign

exchange is more favorable than we expect, we would consider

placing the stock back on our BUY list.

On February 4 at midday, HOLD-rated MCD traded at $93.17,

up $0.15.

RISKS

A key risk to our estimates and target price is the cost of beef.

We estimate that a 7%-9% increase in beef prices would reduce

annual EPS by a penny. Since 65% of the company's revenue is

generated outside the U.S., unfavorable foreign currency

movements also hurt earnings.

COMPANY DESCRIPTION

McDonald's is the world's largest restaurant chain, with more

than 35,000 fast-food restaurants in 119 countries. The company is

a member of the Dow Jones Industrial Average and the S&P 500.

With a market capitalization of nearly $93 billion, MCD is

generally considered a large-cap growth stock.

INDUSTRY

Restaurants face some tough headwinds. Domestically,

unemployment remains high, and the housing market is still

depressed, despite recent signs of improvement. Restaurant chains

with international operations could also be hurt by a recession in

Europe and slower growth in China.

We expect the 'fast casual' segment, exemplified by Chipotle

Mexican Grill and the Brinker International chains, to remain

Peer & Industry Analysis

Ticker Company

MCD McDonald's Corp

SBUX Starbucks Corp

YUM Yum Brands Inc

CMG Chipotle Mexican Grill Inc

DRI

Darden Restaurants Inc

DNKN Dunkin' Brands Group Inc

DPZ Domino's Pizza Inc

WEN Wendy's Co

EAT

Brinker International Inc

Peer Average

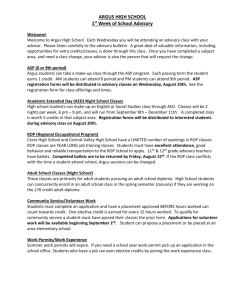

Growth

CMG

50

P/E

MCD vs.

Market

MCD vs.

Sector

More Value

More Growth

Price/Sales

40

MCD vs.

Market

MCD vs.

Sector

WEN

30

More Value

DNKN

DPZ

20

SBUX

MCD vs.

Market

MCD vs.

Sector

DRI

EAT

MCD

Value 10

15

20

Market Cap

($ in Millions)

92,558

52,134

29,463

16,809

6,211

4,912

3,765

3,422

3,143

23,602

Current

FY P/E

15.6

25.5

22.4

49.8

18.5

29.5

27.6

33.5

16.5

26.6

Net

Margin

(%)

19.9

11.9

8.3

10.2

4.1

20.1

7.7

1.4

5.8

9.9

1-yr EPS

Growth

(%)

7.6

18.5

20.0

21.1

9.4

20.5

13.1

19.2

9.2

15.4

More Value

More Growth

More Value

More Growth

PEG

25

5-yr Growth Rate(%)

5-yr

Growth

Rate (%)

10.0

20.0

12.0

23.0

11.0

16.0

10.0

11.0

11.0

13.8

More Growth

Price/Book

YUM

P/E

The graphics in this section are designed to

allow investors to compare MCD versus its

industry peers, the broader sector, and the

market as a whole, as defined by the Argus

Universe of Coverage.

• The scatterplot shows how MCD stacks

up versus its peers on two key

characteristics: long-term growth and

value. In general, companies in the lower

left-hand corner are more value-oriented,

while those in the upper right-hand corner

are more growth-oriented.

• The table builds on the scatterplot by

displaying more financial information.

• The bar charts on the right take the

analysis two steps further, by broadening

the comparison groups into the sector

level and the market as a whole. This tool

is designed to help investors understand

how MCD

might fit into or modify a

diversified portfolio.

Argus

Rating

HOLD

BUY

HOLD

BUY

HOLD

BUY

BUY

BUY

BUY

MCD vs.

Market

MCD vs.

Sector

5 Year Growth

MCD vs.

Market

MCD vs.

Sector

More Value

More Growth

Debt/Capital

MCD vs.

Market

MCD vs.

Sector

More Value

More Growth

Please see important information about this report on page 4

©2014 Argus Research Company

Argus Analyst Report

NYSE: MCD

METHODOLOGY & DISCLAIMERS

Report created Feb 4, 2014 Page 4 OF 4

About Argus

Argus Research, founded by Economist Harold Dorsey in 1934,

has built a top-down, fundamental system that is used by Argus

analysts. This six-point system includes Industry Analysis, Growth

Analysis, Financial Strength Analysis, Management Assessment,

Risk Analysis and Valuation Analysis.

Utilizing forecasts from Argus’ Economist, the Industry Analysis

identifies industries expected to perform well over the next

one-to-two years.

The Growth Analysis generates proprietary estimates for

companies under coverage.

In the Financial Strength Analysis, analysts study ratios to

understand profitability, liquidity and capital structure.

During the Management Assessment, analysts meet with and

familiarize themselves with the processes of corporate management

teams.

Quantitative trends and qualitative threats are assessed under

the Risk Analysis.

And finally, Argus’ Valuation Analysis model integrates a

historical ratio matrix, discounted cash flow modeling, and peer

comparison.

THE ARGUS RESEARCH RATING SYSTEM

Argus uses three ratings for stocks: BUY, HOLD, and SELL.

Stocks are rated relative to a benchmark, the S&P 500.

• A BUY-rated stock is expected to outperform the S&P 500 on

a risk-adjusted basis over a 12-month period. To make this

determination, Argus Analysts set target prices, use beta as the

measure of risk, and compare expected risk-adjusted stock

returns to the S&P 500 forecasts set by the Argus Market

Strategist.

• A HOLD-rated stock is expected to perform in line with the

S&P 500.

• A SELL-rated stock is expected to underperform the S&P 500.

Argus Research Disclaimer

Argus Research is an independent investment research provider and is not a member of the FINRA or the SIPC. Argus Research is not a registered broker dealer and does not have

investment banking operations. The Argus trademark, service mark and logo are the intellectual property of Argus Group Inc. The information contained in this research report is

produced and copyrighted by Argus, and any unauthorized use, duplication, redistribution or disclosure is prohibited by law and can result in prosecution. The content of this report

may be derived from Argus research reports, notes, or analyses. The opinions and information contained herein have been obtained or derived from sources believed to be reliable,

but Argus makes no representation as to their timeliness, accuracy or completeness or for their fitness for any particular purpose. This report is not an offer to sell or a solicitation of

an offer to buy any security. The information and material presented in this report are for general information only and do not specifically address individual investment objectives,

financial situations or the particular needs of any specific person who may receive this report. Investing in any security or investment strategies discussed may not be suitable for

you and it is recommended that you consult an independent investment advisor. Nothing in this report constitutes individual investment, legal or tax advice. Argus may issue or may

have issued other reports that are inconsistent with or may reach different conclusions than those represented in this report, and all opinions are reflective of judgments made on the

original date of publication. Argus is under no obligation to ensure that other reports are brought to the attention of any recipient of this report. Argus shall accept no liability for any

loss arising from the use of this report, nor shall Argus treat all recipients of this report as customers simply by virtue of their receipt of this material. Investments involve risk and an

investor may incur either profits or losses. Past performance should not be taken as an indication or guarantee of future performance. Argus has provided independent research

since 1934. Argus officers, employees, agents and/or affiliates may have positions in stocks discussed in this report. No Argus officers, employees, agents and/or affiliates may

serve as officers or directors of covered companies, or may own more than one percent of a covered company’s stock.

Morningstar Disclaimer

© 2014 Morningstar, Inc. All Rights Reserved. Certain financial information included in this report: (1) is proprietary to Morningstar and/or its content providers; (2) may not be

copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising

from any use of this information. Past performance is no guarantee of future results.

©2014 Argus Research Company

Argus Analyst Report