Convenience Report - Feb 2012

advertisement

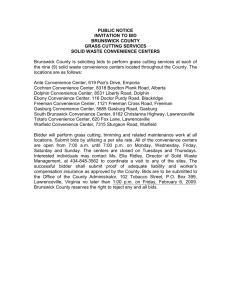

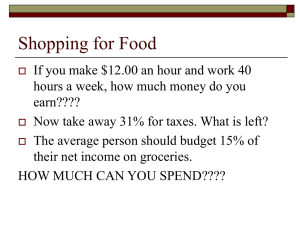

PCL BRIEFING THE CONVENIENCE MARKET Feb 2012 The convenience market - understanding the needs of the ‘quick shopper’ and how to maximise the potato offer IN BRIEF 48,000 convenience stores £33bn market 21% of all grocery sales 25% growth in next 5 years Mainly used for ‘quick shop’ top-up Key life stage - families but also the time-poor Convenience stores increasing While the size of the convenience segment varies according to who is defining it, there is no doubt it has seen a significant increase in the number of outlets over recent years and looks set to continue to grow in the near future as the multiple retailers build their convenience offering. A convenience store is usually defined as being under 3,000sq ft. mainly because stores above this size are subject to Sunday trading laws, below that, opening hours can be determined by the neighbourhood and local competition. IGD estimates there are some 48,000 convenience stores in the UK covering cooperatives, convenience multiples, symbol groups, non-affiliated independents and forecourts, with a total retail value of c.£33bn. Kantar estimates the market value at just under 50% of this but based on the multiples only. IGD forecasts the sector has grown by 4.6% in 2011 and expects compound growth of 25% over the next five years. Twenty-one per cent of all grocery sales now come through convenience. Convenience shoppers Their neighbourhood locations mean that convenience stores are generally used for top-up shopping. According to Mintel, typical shoppers will be in the 25 to 44-year age group that are in the family life stage, topping up on groceries between main shops. Larger households, where items bought during a large shop can easily run out and other time-poor individuals, such as those working fulltime, are also key groups for convenience stores. This latter group are often buying for their next meal on their way home, hence the rise in ready and assembly meals in convenience stores. Mintel further notes that convenience stores have also, at least in part, replaced the likes of Woolworths and other newsagents as a place for children to spend their pocket money. Information Sources Kantar , Mintel, IGD, him!, Oxford Partnership, AHDB MI Understand — provide consumer and market research 1 PCL BRIEFING THE CONVENIENCE MARKET Feb 2012 Drivers and barriers According to the IGD the main drivers of the convenience sector are as follows: Increased demand for convenience-based products Developing market for fresh food and food-to-go offers Improved operational standards Multiples expanding in the sector and developing their offer Changes in shopper lifestyles, with increasing numbers of working women, single person households and longer working hours pushing demand for convenience-based products Further development of fresh food and food-to-go propositions High levels of recruitment of nonaffiliated independent stores into symbol groups Improved operational standards The main barriers in the sector are seen as follows. Increasing pressure on household budgets making value key Decline in store numbers, particularly independents, as market conditions toughen Unconsolidated nature of the sector means store standards can vary widely What’s happening in the sector Some of the more interesting details from IGD about the multiple retailer’s convenience offers are shown below. Waitrose/Little Waitrose – high dependence on fresh and designed to fulfill daily shopper needs while also covering everyday essentials including non-food. A range of 150+ lines under the Good to Go brand has now been launched with a specific focus on capturing more of the ‘food-on-themove’ convenience market. The range can also be found in selected Boots stores. Tesco Express – 1,271 stores, typically 2,500 SKUs c.10,000 customers per week (Tesco also owns One Stop which is operated as a stand-alone business with 521 stores) The Co-operative – convenience makes up 52% of the portfolio, communityorientated stores which are located in suburban areas with typically small catchments, aims to be leading convenience retailer in the UK. Sainsbury’s Local – Wide range of fresh and ambient products focused on ‘eat-now’ and ‘eat-later’ eating occasions. Strong emphasis on health and well-being, premium and indulgence. Sainsbury’s Fresh Kitchen – one store, sells a mixture of freshly made instore hot and cold meals. M&S Simply Food – strategic focus on convenience and top-up shopping markets. Franchise schemes in conjunction with Moto at motorway service areas and on forecourt sites with BP Connect. Information Sources Kantar , Mintel, IGD, him!, Oxford Partnership, AHDB MI Understand — provide consumer and market research 2 PCL BRIEFING THE CONVENIENCE MARKET Feb 2012 M&S Food on the Move (one store trial) – sells a selection of hot and cold takeaway foods. Range aimed at commuters. Shoppers typically spend 6-10 secs at the potato fixture Decision to buy often made earlier in the day Main occasion is for a simple adult meal Baking and new potatoes over index Want smaller pack sizes Size and usage are the main decision variables Impact of promotions is less in convenience Morrisons ‘M Local’ – following a successful trial, Morrisons plans another roll-out of convenience stores. Strong focus on fresh, prices that are in line with its core supermarkets, strong availability and easy navigation. SPAR – Proposition is tailored to meet five distinct shopping missions, under the Stores of the Future programme: Neighbourhood affluent, Community supermarket, Neighbourhood value, Urban lifestyle, In transit. Potato shoppers and convenience Our own PCL research conducted for the ‘shopper journey’ project in 2010 looked to understand the potato shopper in different store formats, including convenience, with some interesting results. When speaking to potato shoppers in store we found that 86% of shopping trips are ‘quick shop’ topups As such, shoppers spend the shortest time at the potato fixture of all store formats - typically between 6-10 seconds The decision to buy potatoes is most likely to be made earlier in the day but over one third of shoppers still decide when they are in the store Potato shoppers in convenience stores over index for shopping for the ‘simple adult meal’ occasion Not surprisingly, they are more likely to look for and buy smaller pack sizes if available They also over index on buying baking and new potatoes Two thirds of shoppers cannot recall any signage at the potato fixture In terms of the shopper’s decision hierarchy, size of potato and how they are going to be used are the key factors in shoppers’ minds followed by price For shoppers looking for something for that evening’s meal they can also be more impulsive and open to suggestion The effects of promotions may, however, be less in the convenience sector. A recent survey by him! of over Information Sources Kantar, Mintel, IGD, him!, Oxford Partnership, AHDB MI Understand — provide consumer and market research 3 PCL BRIEFING THE CONVENIENCE MARKET Feb 2012 Understand the shopper mission 4,000 convenience shoppers revealed that 63% had not bought anything on promotion. Of those who did buy a promoted product, 43% were planning to buy it anyway. In the same survey, 79% claimed not to have a budget. Match the offer to the mission Match the offer to the mission Inspire and entice Different segments of the market require very different approaches, so aligning function correctly is key to getting the most from the opportunities. For potatoes to maximise their potential in the convenience sector, the offer must be matched to the shopper mission. Shoppers are evolving and seek excitement and innovation from the sector. For those who know what they want, the range of potatoes and pack sizes should be right for their planned purchase. For those who are undecided, they need to be inspired and prompted at the fixture to make sure they choose potatoes over other carbohydrate alternatives. Information Sources Kantar, Mintel, IGD, him!, Oxford Partnership, AHDB MI Understand — provide consumer and market research 4