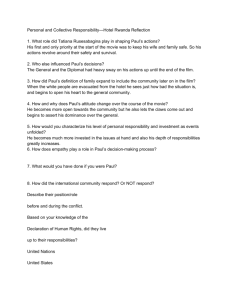

Annual Report

advertisement