Preemptive Bidding, Target Resistance and Takeover Premia: An

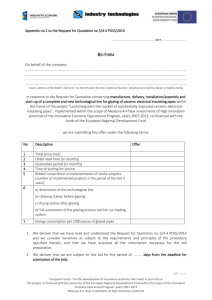

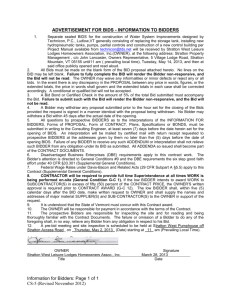

advertisement