2014 - Cogeco Inc.

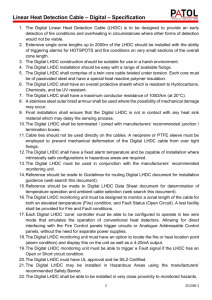

advertisement