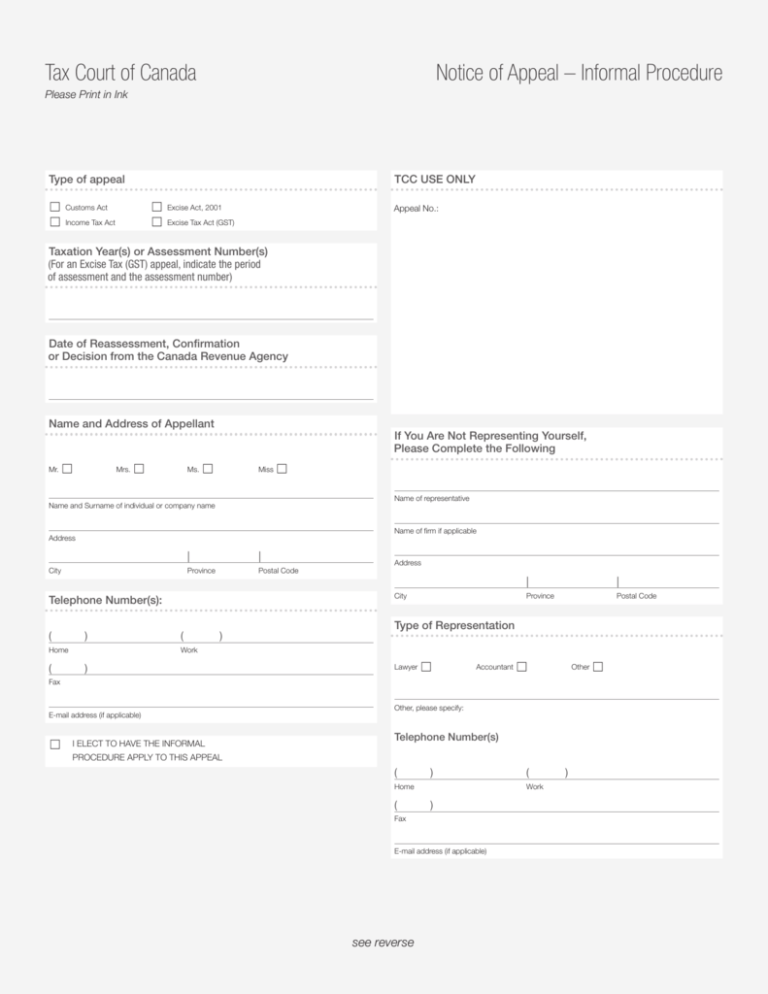

Tax Court of Canada Notice of Appeal – Informal Procedure

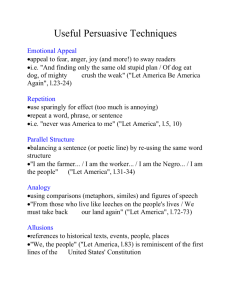

advertisement

Tax Court of Canada Notice of Appeal – Informal Procedure Please Print in Ink Type of appeal ☐ ☐ TCC USE ONLY ☐ ☐ Customs Act Income Tax Act Appeal No.: Excise Act, 2001 Excise Tax Act (GST) Taxation Year(s) or Assessment Number(s) (For an Excise Tax (GST) appeal, indicate the period of assessment and the assessment number) Date of Reassessment, Confirmation or Decision from the Canada Revenue Agency Name and Address of Appellant If You Are Not Representing Yourself, Please Complete the Following Mr. ☐ Mrs. ☐ Ms. ☐ Miss ☐ Name of representative Name and Surname of individual or company name Name of firm if applicable Address City | | Province Postal Code City Telephone Number(s): ( ) Home ( Address ( ) | | Province Postal Code Type of Representation Work ) Lawyer ☐ Accountant ☐ Other Fax E-mail address (if applicable) ☐ I ELECT TO HAVE THE INFORMAL Other, please specify: Telephone Number(s) PROCEDURE APPLY TO THIS APPEAL ( ) Home ( ) Fax E-mail address (if applicable) see reverse ( Work ) ☐ Statement of relevant facts and reasons in support of your appeal in which you say why you disagree with the Canada Revenue Agency’s decision (use another sheet, if required) . Date Signature