FOR INSTITUTIONAL INVESTOR USE ONLY

october 2012

GLOBAL markets

SG GLOBAL Quality Income Index

capital growth | LOW VOLATILITY | INCOME RESILIENCE

SGQI CONCEPT

The aim of the index is to create a robust compounding machine

via the creation of a portfolio of companies selected solely on the

basis of their ability to provide a high quality income stream to their

owners. The relatively high yield - currently 4.9% compared to an

historic average of 5% - gives a solid basis upon which to compound

capital over time. The requirement that selected businesses enjoy

high quality economics ensures dividends are unlikely to be cut. The

nature of dividend flows as a share of revenues suggest they will

tend to rise, thus affording yield hungry investors a degree of inflation

protection absent in fixed income markets.

Key features

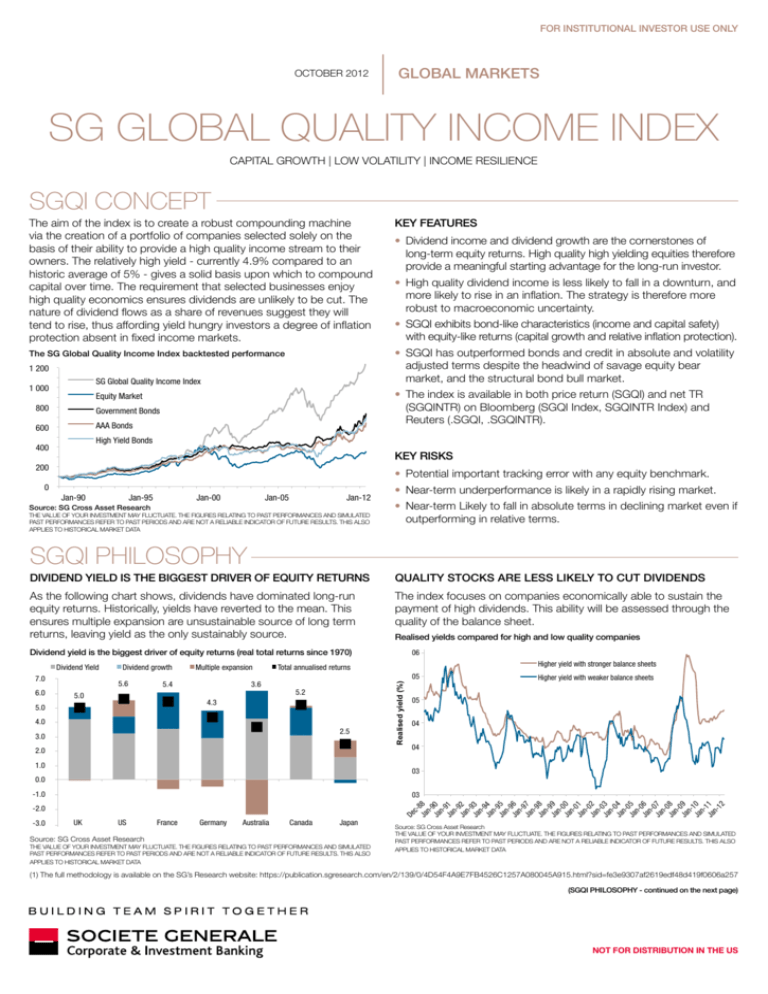

The SG Global Quality Income Index backtested performance

• SGQI has outperformed bonds and credit in absolute and volatility

adjusted terms despite the headwind of savage equity bear

market, and the structural bond bull market.

1 200

SG Global Quality Income Index

1 000

Government Bonds

600

AAA Bonds

• High quality dividend income is less likely to fall in a downturn, and

more likely to rise in an inflation. The strategy is therefore more

robust to macroeconomic uncertainty.

• SGQI exhibits bond-like characteristics (income and capital safety)

with equity-like returns (capital growth and relative inflation protection).

• The index is available in both price return (SGQI) and net TR

(SGQINTR) on Bloomberg (SGQI Index, SGQINTR Index) and

Reuters (.SGQI, .SGQINTR).

Equity Market

800

• Dividend income and dividend growth are the cornerstones of

long-term equity returns. High quality high yielding equities therefore

provide a meaningful starting advantage for the long-run investor.

High Yield Bonds

400

Key risks

200

• Potential important tracking error with any equity benchmark.

0

Jan-90

Jan-95

Jan-00

Jan-05

Jan-12

Source: SG Cross Asset Research

THE VALUE OF YOUR INVESTMENT MAY FLUCTUATE. THE FIGURES RELATING TO PAST PERFORMANCES AND SIMULATED

PAST PERFORMANCES REFER TO PAST PERIODS AND ARE NOT A RELIABLE INDICATOR OF FUTURE RESULTS. THIS ALSO

APPLIES TO HISTORICAL MARKET DATA

• Near-term underperformance is likely in a rapidly rising market.

• Near-term Likely to fall in absolute terms in declining market even if

outperforming in relative terms.

SGQI PHILOSOPHY

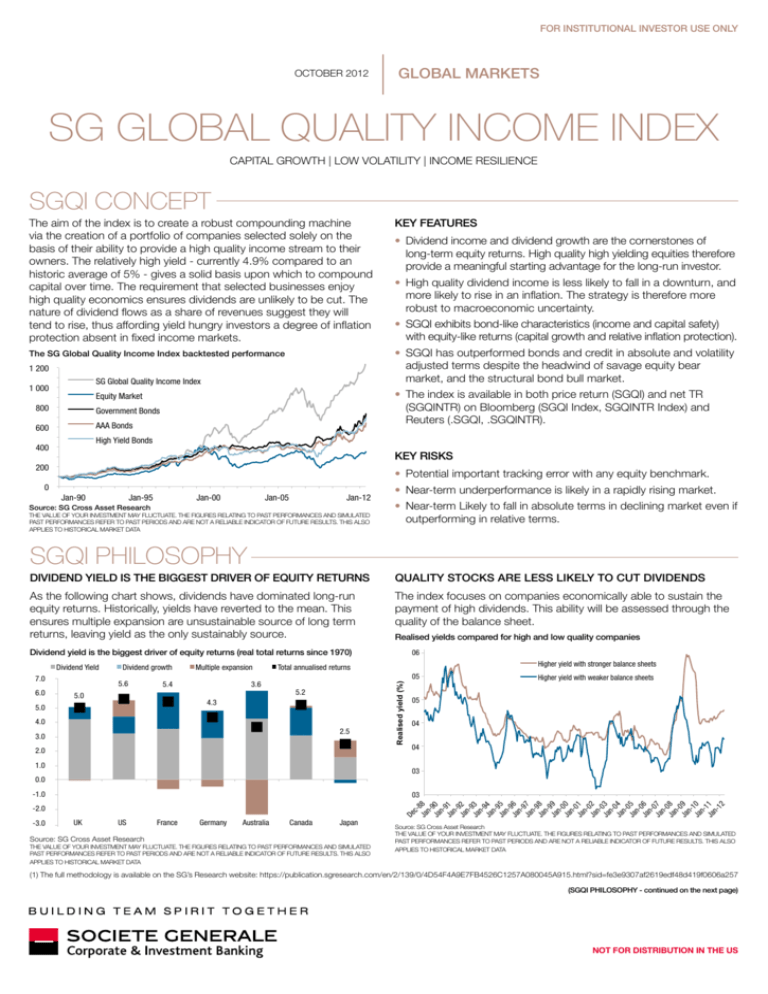

DIVIDEND YIELD IS THE BIGGEST DRIVER OF EQUITY RETURNS

QUALITY STOCKS ARE LESS LIKELY TO CUT DIVIDENDS

As the following chart shows, dividends have dominated long-run

equity returns. Historically, yields have reverted to the mean. This

ensures multiple expansion are unsustainable source of long term

returns, leaving yield as the only sustainably source.

The index focuses on companies economically able to sustain the

payment of high dividends. This ability will be assessed through the

quality of the balance sheet.

Realised yields compared for high and low quality companies

Dividend yield is the biggest driver of equity returns (real total returns since 1970)

7.0

6.0

Dividend growth

5.6

Multiple expansion

5.4

5.0

3.6

5.2

4.0

2.5

3.0

2.0

1.0

Higher yield with weaker balance sheets

05

04

04

03

0.0

-1.0

Ja 88

nJa 90

nJa 91

nJa 92

nJa 93

nJa 94

nJa 95

nJa 96

nJa 97

nJa 98

nJa 99

nJa 00

nJa 01

nJa 02

nJa 03

nJa 04

nJa 05

nJa 06

nJa 07

nJa 08

nJa 09

nJa 10

nJa 11

n12

03

De

c-

-2.0

-3.0

Higher yield with stronger balance sheets

05

4.3

5.0

06

Total annualised returns

Realised yield (%)

Dividend Yield

UK

US

Source: SG Cross Asset Research

France

Germany

Australia

Canada

Japan

THE VALUE OF YOUR INVESTMENT MAY FLUCTUATE. THE FIGURES RELATING TO PAST PERFORMANCES AND SIMULATED

PAST PERFORMANCES REFER TO PAST PERIODS AND ARE NOT A RELIABLE INDICATOR OF FUTURE RESULTS. THIS ALSO

APPLIES TO HISTORICAL MARKET DATA

Source: SG Cross Asset Research

THE VALUE OF YOUR INVESTMENT MAY FLUCTUATE. THE FIGURES RELATING TO PAST PERFORMANCES AND SIMULATED

PAST PERFORMANCES REFER TO PAST PERIODS AND ARE NOT A RELIABLE INDICATOR OF FUTURE RESULTS. THIS ALSO

APPLIES TO HISTORICAL MARKET DATA

(1) The full methodology is available on the SG’s Research website: https://publication.sgresearch.com/en/2/139/0/4D54F4A9E7FB4526C1257A080045A915.html?sid=fe3e9307af2619edf48d419f0606a257

(SGQI PHILOSOPHY - continued on the next page)

NOT FOR DISTRIBUTION IN THE US

FOR INSTITUTIONAL INVESTOR USE ONLY

SGQI PHILOSOPHY - continued from previous page

QUALITY STOCKS ARE SYSTEMATICALLY UNDERVALUED

To the extent that high quality companies are ‘boring’ they are less

bid relative to their intrinsic value. In contrast, higher beta stocks

offer managers excitement and the possibility of game-changing

near-term performance outperformance. They therefore tend to be

over bid relative to their intrinsic value. Emphasising higher quality

businesses is therefore a worthy endeavour in its own right.

High quality stocks are systematically undervalued

800

700

600

QUALITY INCOME

VS. JUNK BONDS

The hunt for yield has seen both high dividend yielding equity and

high yield corporate bonds perform almost in lockstep in recent

years. SG basket of quality income stocks has experienced almost

identical gains to the IBOXX High Yield Corporate Bond Index over

the past few years.

Appearances can be deceptive though. Exposure to future unknown

scenarios differs considerably:

High Quality

• The type of companies backing each index is not comparable. By

design, junk bonds indices contain the lowest quality companies

whereas SGQI seeks exposure to the better quality companies as

a subset of the high yield equity universe.

Low Quality Equities

500

400

200

• The absence of coupon growth exposes fixed income investors

to inflation risk, whilst for equity investors dividends typically track

inflation higher.

100

SGQI Index versus the IBOXX High Yield Corporate Bond Index

300

170

De

c8

Ja 9

n91

Ja

n9

Ja 2

n9

Ja 3

n9

Ja 4

n9

Ja 5

n96

Ja

n9

Ja 7

n98

Ja

n9

Ja 9

n00

Ja

n0

Ja 1

n02

Ja

n0

Ja 3

n04

Ja

n0

Ja 5

n06

Ja

n0

Ja 7

n08

Ja

n0

Ja 9

n10

Ja

n1

Ja 1

n12

0

SG Global Quality Income Index

Source: SG Cross Asset Research

THE VALUE OF YOUR INVESTMENT MAY FLUCTUATE. THE FIGURES RELATING TO PAST PERFORMANCES AND SIMULATED

PAST PERFORMANCES REFER TO PAST PERIODS AND ARE NOT A RELIABLE INDICATOR OF FUTURE RESULTS. THIS ALSO

APPLIES TO HISTORICAL MARKET DATA

Total

150

130

110

THE POWERFUL COMBINATION OF QUALITY AND INCOME

It is important to emphasise how powerful a role quality plays in

the selection of robust income: quality income isn’t just an income

strategy. The following chart compares SGQI’s total returns with a

similarly constructed “high yield equities index” (consisting purely

of high income stocks without regard to quality), a “quality index”

(consisting purely of quality stocks regardless of their yield) and the

overall market index. Note the following:

• Both quality stocks and high yield stocks have outperformed the

market.

• Quality Income as represented by the SGQI has outperformed

them both.

• Despite the bull market in bonds, SGQI has outperformed risk

income (even adjusting for volatility).

1 200

1 000

SG Global Quality Income Index

Quality Equities

High Yield Equities

Equity Market

Government Bonds

AAA Bonds

Aug-09

Jul-10

Jan-11

jul-12

Jan-12

Jul-12

Source: SG Cross Asset Research, Bloomberg

THE VALUE OF YOUR INVESTMENT MAY FLUCTUATE. THE FIGURES RELATING TO PAST PERFORMANCES AND

SIMULATED PAST PERFORMANCES REFER TO PAST PERIODS AND ARE NOT A RELIABLE INDICATOR OF FUTURE

RESULTS. THIS ALSO APPLIES TO HISTORICAL MARKET DATA

Dividend growth and long run inflation

12%

10%

8%

6%

4%

2%

0%

-2%

-4%

-6%

-8%

Annualised 10y dividend growth

Annualised 10y CPI growth

Asset backing compared: Credit ratings of SGQI vs IBOXX HY constituents

600

25%

400

% of portfolio

20%

200

0

Jan-10

Source: SG Cross Asset Research, Bloomberg

THE VALUE OF YOUR INVESTMENT MAY FLUCTUATE. THE FIGURES RELATING TO PAST PERFORMANCES AND SIMULATED

PAST PERFORMANCES REFER TO PAST PERIODS AND ARE NOT A RELIABLE INDICATOR OF FUTURE RESULTS. THIS ALSO

APPLIES TO HISTORICAL MARKET DATA

High Yield Bonds

800

90

18

8

18 1

8

18 4

87

18

9

18 1

9

18 4

98

19

0

19 1

0

19 4

08

19

1

19 1

1

19 5

18

19

2

19 2

2

19 5

2

19 8

3

19 2

3

19 5

39

19

42

19

4

19 5

4

19 9

5

19 2

5

19 6

5

19 9

6

19 3

6

19 6

6

19 9

7

19 3

76

19

8

19 0

8

19 3

8

19 6

9

19 0

93

19

9

20 7

0

20 0

0

20 4

0

20 7

10

SG Global Quality Income Index performance (total return in Euros )

IBOXX High Yield Corporate Bonds Index

Jan-91

Jan-95

Jan-00

Jan-05

Jan-12

SG Global Quality Income Index

iShares IBOXX High Yield

15%

10%

5%

Source: SG Cross Asset Research, Bloomberg

THE VALUE OF YOUR INVESTMENT MAY FLUCTUATE. THE FIGURES RELATING TO PAST PERFORMANCES AND

SIMULATED PAST PERFORMANCES REFER TO PAST PERIODS AND ARE NOT A RELIABLE INDICATOR OF FUTURE

RESULTS. THIS ALSO APPLIES TO HISTORICAL MARKET DATA

0%

Source: SG Cross Asset Research, Bloomberg

THE VALUE OF YOUR INVESTMENT MAY FLUCTUATE. THE FIGURES RELATING TO PAST PERFORMANCES AND SIMULATED

PAST PERFORMANCES REFER TO PAST PERIODS AND ARE NOT A RELIABLE INDICATOR OF FUTURE RESULTS. THIS ALSO

APPLIES TO HISTORICAL MARKET DATA

SG Global Quality Income Index

2

NOT FOR DISTRIBUTION IN THE US

FOR INSTITUTIONAL INVESTOR USE ONLY

SGQI METHODOLOGY(1)

• THE INDEX COMPRISES BETWEEN 25 AND 75 STOCKS OF THE UNIVERSE, WHICH GATHERS STOCKS THAT:

• are listed on a regulated market of an Eligible Country

• are not financial companies (our methodology isn’t able to assess financial sector balance sheet risks)

• have a free float adjusted market capitalization of at least US$ 3bn

THREE STEP SELECTION PROCESS:

1]SELECTION OF THE STOCKS WITH A

QUALITY SCORE HIGHER THAN 7

Piotroski’s 9 quality factors are considered:

Profitability factors

• Positive ROA (calculated as net income before extraordinary items

divided by total assets)

• Positive CFO (cashflow from operations divided by total assets)

• Improving profitability (positive year on year change of ROA)

• Sales driving profit growth (change in CFO greater than the change

in ROA)

2] S

ELECTION OF THE 40% BEST SCORED

STOCKS WITH RESPECT TO BALANCE

SHEET

This score is measured through a distance to default model that looks

at the equity of the firm as a contingent claim on the firm’s capital

structure. It assumes that the corporation is financed through a single

debt instrument and a single equity issue. At the maturity of the bond,

the firm liquidates its assets and cease to exist. Bondholders receive

back the face value of the bond while shareholders receive any residual

payment (and nothing in the case where the firm is not capable of

paying off its creditors). The Distance to Default is calculated as:

Distance to default =

Leverage, liquidity and source of funds

• Decreasing leverage (negative year on year change of the ratio of

long-term debt to total assets)

• Increasing liquidity (positive year on year change of the ratio of

current assets to current liabilities)

• No issue of equity (no year on year increase of shares)

Operating efficiency

• Increase in operating margin (positive year on year change in the

gross operating margin)

• Increasing turn over (increase of sales relative to the size of the asset

base, which means generating more business from existing assets)

Assets value — Default point

Assets value x Asset Volatility

Where, Default Point (F) is the book value of current liabilities plus half

the long term liabilities.

3] S

ELECTION OF STOCKS WITH HIGH

DIVIDEND YIELD

The trigger is an adjusted dividend yield greater than highest value of

either 4% or 125% of the market cap-weighted dividend yield of the

universe in the event that all market yields rise. Where available, the

one year forward dividend yield based on IBES consensus forecast

is used. Where unavailable the reported dividend sourced from

Factset fundamentals are used.

(1) The full methodology is available on the SG’s Research website: https://publication.sgresearch.com/en/2/139/0/4D54F4A9E7FB4526C1257A080045A915.html?sid=fe3e9307af2619edf48d419f0606a257

SG Global Quality Income Index

3

NOT FOR DISTRIBUTION IN THE US

FOR INSTITUTIONAL INVESTOR USE ONLY

IMPORTANT DISCLAIMER:

This note was prepared by the GEF Engineering and Strategy Team of Societe Generale.

This communication is exclusively directed and available to Institutional Investors as defined by the 2004/39/CE Directive on markets in financial instruments acting for their own account and categorized as

eligible counterparties or professional clients.

This publication includes investment recommendations issued from Société Générale’s investment Research department which has set, in accordance with applicable regulation, effective administrative and

organizational arrangements, including information barriers to prevent and avoid conflicts of interest with respect to the investment recommendations contained in this publication.

Research publications supporting this document were issued on their stated publication date and may have already been acted upon by clients of Société Générale.

Without prejudice to its legal or regulatory obligations, Societe Generale may not be held responsible for any financial or other consequences that may arise from investing in a product having as its underlying

the index described herein (the “Index”), and investors are responsible, prior to making any investment in a product having the Index as its underlying, for making their own appraisal and, if they deem it

necessary, to seek and obtain professional advice on the risks and merits of the product.

This document does not constitute an offer, a solicitation, an advice or a recommendation from Societe Generale to purchase or sell the Index, which cannot be invested in directly. The purpose of this

document is simply to describe the principles and main financial characteristics of the Index.

The level of the Index may be subject to signifi cant volatility due to, inter alia, the evolution of the price of the underlying instrument(s) and of the interest rates.

A product having the Index as underlying may be subject to restrictions with regard to certain persons or in certain countries under national regulations applicable to such persons or in said countries. It is

each investor’s responsibility to ascertain that it is authorised to conclude, or invest into, this product. By undertaking such an investment, each investor is deemed to certify to Societe Generale that it is duly

authorised to do so.

The Index is the sole and exclusive property of Societe Generale.

Societe Generale does not guarantee the accuracy and/or the completeness of the composition, calculation, dissemination and adjustment of the Index, nor of the data included therein.

Societe Generale shall have no liability for any errors, omissions, interruptions or delays relating to the Index.

Societe Generale makes no warranty, whether express or implied, relating to (i) the merchantability or fitness for a particular purpose of the Index, and (ii) the results of the use of the Index or any data included

therein.

Societe Generale shall have no liability for any losses, damages, costs or expenses (including loss of profits) arising, directly or indirectly, from the use of the Index or any data included therein.

The levels of the Index do not represent a valuation or a price for any product referencing such Index. The Index rules (the “Index Rules”) define the calculation principles of the Index and the consequences

on this Index of extraordinary events which may affect one or several of the underlying programmes on which it is based.

This document is of a commercial and not of a regulatory nature.

The accuracy, completeness or relevance of the information which has been drawn from external sources is not guaranteed although it is drawn from sources believed to be reliable. Societe Generale shall

not assume any liability in this respect.

The market information presented in this document is based on data at a given moment and may change from time to time. The potential performance may increase or decrease as a result of currency

fluctuations.

The roles of the different teams involved within Societe Generale in the design, maintenance and replication of the Index have been strictly defi ned. Where Societe Generale holds the product and other

positions exposing it to the Index for its own account, the replication of the Index is made in the same manner by a single team within Societe Generale, be it for the purpose of hedging the product held by

external investors or for the purpose of the positions held by Societe Generale acting for its own account. Societe Generale may take positions in the market of the financial instruments or of other assets

involved in the composition of the Index, including as liquidity provider.

Structured Solutions AG is the Calculation Agent of the Index. The iBoxx index referred to here is the property of Markit Indices Limited (“the index sponsor”).

This document is confidential and may be neither communicated to any third party (with the exception of external advisors on the condition that they themselves respect this confidentiality undertaking) nor

copied in whole or in part, without the prior written consent of Societe Generale.

Societe Generale is authorised and regulated by the Autorité de Contrôle Prudentiel and the Autorité des Marchés Financiers, and subject to limited regulation by the Financial Services Authority for the conduct

of its UK business. Details about the extent of our regulation by the Financial Services Authority are available from us on request.

712989(A) - Réalisation Studio Société Générale - 09/2012

IMPORTANT DISCLOSURES: Please refer to our websites http://www.sgcib.com/

Copyright: Societe Generale 2012. All rights reserved.

NOT FOR DISTRIBUTION IN THE US