LYXOR ETFs: QUALITY INCOME - the Societe Generale Listed

advertisement

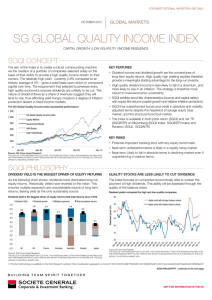

expert OPINION J u ne 2014 I N V E S T M E N T I N S I G H T S F R O M LY X O R ET F LY X OR E TFs: QUA LITY INCOM E “Stock market fashions may come and go. But buying higher quality companies that pa y sensible and sustainable dividend yields is an investment strategy that has stood the test of time. In our opinion such companies should form the back-bone of any sensible portfolio.” An drew La pthor ne G lobal Qu ant itativ e R e s e a rc h Strategis t a t S G CIB The importance of re-investing dividends is one of the first rules of investing, and one that has proven its worth time and time again. However, dividends are one of the first things to be cut when markets are stressed. So how can investors access a Dividend Yield that is attractive now, and will stand the test of time? The Quality Income Indices created by Andrew Lapthorne, the Global Quantitative Research Strategist at Societe Generale Corporate & Investment Bank provide an income strategy with a difference. These indices are designed to not only provide a high yield now, but one that can be sustained over different economic cycles. They do this by focusing on ‘High Quality’ companies, whose financial strength makes them more likely to sustain their dividend if markets fall, and grow it when they rise. These ‘High Quality’ companies are some of the most stable companies in the world. In order to be selected they must have a robust underlying business, be from the developed world, and be able to demonstrate a financially strong balance sheet. The allocations are reviewed by the Quantitative Strategy team of Societe Generale and updated each quarter to ensure that each company continues to meet the selection criteria. THIS COMMUNICATION IS FOR PROFESSIONAL CLIENTS AND SOPHISTICATED RETAIL CLIENTS IN THE UK. This communication uses quotations from Andrew Lapthorne. Andrew Lapthorne is part of Societe Generale’s Research department which is subject to regulatory provisions designed to promote the independence of investment research. This publication should be treated as a marketing communication and should not be treated as a research report issued by Societe Generale’s Research Department. See page 11 for more information. Societe Generale Listed Products | 0800 328 1199 | listedproducts@sgcib.com | www.sglistedproducts.co.uk 1 expert OPINION J u ne 2014 I N V E S T M E N T I N S I G H T S F R O M LY X O R ET F S G GL OBA L QUALITY I N COME STRATEG IE S Andrew Lapthorne, commented that “global equity markets have delivered low returns over the past decade, and that equity market volatility has driven many investors away from equities and into bonds”. Andrew maintains that quality income stocks can provide the bond-like characteristics of income and capital safety, but also offer scope for capital growth like equities. Over a period of nine years Andrew refined his Quality Income Strategy, and in 2012 he launched the Societe Generale Global Quality Income Index (SGQI) to enable investors to access a portfolio of high quality global companies in one simple Index. Following the success of SGQI, the team have now launched the SG European Quality Income Index (SGQE), which follows the same strategy as SGQI, but instead of investing in a universe of global stocks, it restricts investment to high quality European stocks. CHART 1: Compounding effects of dividend yield has dominated returns in the long term (1970-September, 2013) 7.0 5.2 5.8 5.0 5.0 4.0 4.7 5.2 3.4 3.0 1.0 -1.0 -3.0 UK US France Germany Australia Canada Japan Dividend Yield Multiple expansion Dividend growth Total annualised returns Source: SG Cross Asset Research. September, 2013 CHART 2: Realised income of high yield stocks according to balance sheet strength (September 93 to September 2013) 5.5 5.0 4.5 4.0 3.5 3.0 2.5 The philosophy of SGQI and SGQE is based around the following three principles; Higher yield with stronger balance sheets 1. Dividend Yield is the driver of equity returns A key philosophy of the Quality Indices is that dividend yield is the biggest driver of equity returns. As Chart 1 shows, dividends have dominated long-run equity returns in most major equity markets between1970 – 2013. This would suggest that the key to long term growth is not in capturing dividend growth or equity returns, but a strong dividend yield. Higher yield with weaker balance sheets Source: SG Cross Asset Research. September, 2013 CHART 3: High Quality stocks are systematically undervalued (September 93 to September 2013) 700 2. Quality stocks are less likely to cut dividends Quality Indices focus on companies which are deemed economically able to sustain the payment of high dividends. Chart 2 opposite shows that historically higher yielding stocks with a stronger balance sheet have typically maintained a higher dividend than those with a weaker balance sheet where the dividend may have been cut. We look at how we define balance sheet strength on page 4. 3. Less volatile equity returns These are not just dividend compounding machines. The high quality stocks selected for both SGQI and SGQE are some of the most stable companies in the world. This stability and lack of game-changing near-term performance has deemed them “boring” by some investors. But for those looking for a less volatile investment, they represent an opportunity to access a more stable, and typically undervalued area of the equity market. On page 4 we look at what makes a ‘High Quality’ company. 600 500 400 300 200 100 0 High Quality Equities Low Quality Equities Source: SG Cross Asset Research, October, 2013 The value of an investment may fluctuate. The figures relating to past performances and simulated past performances refer to past periods and are not a reliable indicator of future results. This also applies to historical market data. 2 expert OPINION J u ne 2014 I N V E S T M E N T I N S I G H T S F R O M LY X O R ET F W H Y N O T JU ST INVE S T IN HIG H Y I E LD S B O ND S ? Some investors have flocked to High Yield bonds in an effort to beat the low returns available on Gilts or AAA bonds. The potential yield available on High Yield Corporate Bonds for example may be higher than SGQI or SGQE. However, by design, ‘High Yield’ bond indices contain the lowest quality companies in the market, whereas SGQI and SGQE seek exposure to higher quality companies. This creates a very different risk profile for the Quality Income Indices. Also, the absence of coupon growth exposes fixed income investors to inflation risk, whilst for equity investors dividends typically track inflation higher as companies can increase their dividend yield as markets rise. CHART 4: Maximum loss on assets (1990 – 2013) 60.0 Maximum Loss (%) 50.0 40.0 30.0 20.0 10.0 0.0 Quality Income Quality Equities High Yield Equities Equity Markets Government Bonds AAA Bonds High Yield Bonds Source: SG Quantitative Research/ Equity Quant, FactSet. September, 2013. Past performance is not a reliable of future performance. Portfolio presented assumes no transaction costs. Chart 5 compares the quality of companies used within the SGQI Index and those of the iShares iBoxx HY, which is used as an example of a High Yield bond exposure. As you can see from the chart, SGQI typically invests in higher quality companies. CHART 5: Quality of company invested in 25.00% 20.00% 15.00% 10.00% 5.00% /C C 3 C C C -/ C C C C +/ C aa 1 aa B2 B/ a3 BB -/ B 1 Ba +/ Ba B/ BB SG Quality Income BB a2 3 A/A A1 A+ / 2 Aa AA / AA A/ Aa a 0.00% IShares IBOXX HY Source: SG Cross Asset Research, Bloomberg, October, 2013. Past performance is not a reliable of future performance. WH AT D O THE INDICE S INVE S T I N? SGQI and SGQE aim to provide an equally weighted portfolio of between 25 and 75 high quality companies from either the global (SGQI) or european (SGQE) stock markets. Stocks are selected according to the following criteria: Listed on a regulated market Not a financial company Have a free float adjusted market capitalisation of at least US$ 3bn (SGQI) or US $1bn (SGQE) Include a liquidity filter (six month average daily traded value of at least 1M EUR) Have always a 4% dividend yield entry level 3 expert OPINION J u ne 2014 I N V E S T M E N T I N S I G H T S F R O M LY X O R ET F HO W D O TH E INDICE S DE TERMIN E WHI CH S T O CK S ARE I NCLUDE D? For both SGQI and SGQE, the stocks are selected according to a 3 stage process which is designed to assess the profitability, operating efficiency and balance sheet strength of the company: 1. Q uality 2. s trength Stage 1: A Piotroski quality score of 7 or better The first stage of the stock selection process is to assess the financial strength of a company based on its profitability, level of debt, working capital, source of funds and operating efficiency. In order to do this the Piotroski scoring system is used. First published in 2000, Piotroski’s nine-criteria stock-scoring system can be used to evaluate a stock’s financial strength using data from the company’s financial statements. One point is awarded for each test that a stock passed with a maximum possible score of 9. In order to be selected for the Index, the company must score 7 or better on the Piotroski scoring system. The table below summarises the main measures used, and describes how these are calculated. 3. yield Assessment Profitability Debt, working capital and source of funds Definition Calculation Point Awarded? Positive Return On Assets (ROA). Net Income divided by the total assets of the company. If last year’s net income is positive. Positive Cash Flow from Operations (CFO). Cash Flow from Operations divided by total assets. If last year’s cash flow is positive. Improving profitability. Positive year-on-year change in ROA. If last year’s ROA exceeds the prioryear’s ROA. Sales driving profit growth. i.e. what is the quality of earnings. Was the change in CFO greater last year? Decreasing debt. Negative year-on-year change in the ratio of long-term debt to total assets. If the ratio of long-term debt to assets is down from the previous year. Increasing working capital. Positive year-on-year change in the Current Ratio (CR) of assets to liabilities. If the ratio of assets to liabilities has increased from the prior year, it is a sign of increased working capital. No new shares issued. No year-on-year increase in the number of shares issued by the company. If the number of shares outstanding is no greater than it was a year ago. Increase in the Gross Operating Margin. Positive year-on-year change in the Gross Operating Margin (GOM). If full-year GOM exceeds the prioryear GOM. Increasing Turn Over (A sign of increased productivity). Increase of sales relative to the size of assets held by the company. If the percentage increase in sales exceeds the percentage increase in total assets. Operating efficiency If last year’s CFO exceeds Net Income for that year Source: Societe Generale, October, 2013. Based on the Piotroski quality score founded in 2000. Stage 2: Balance sheet strength The universe of stocks that survives the scrutiny of the financial strength testing is then assessed according to their balance sheet strength. In order to make this assessment, the SG Research team use a widely known measure called the ‘Distance to Default Model’, which is a mathematical measure that implies that a company is worth nothing and will default (i.e. go bankrupt) at the point that the value of its debt is greater than the value of its assets. According to the model, by looking at the current value of a company’s assets and how volatile they are, and comparing this to the current value of the company’s liabilities, it is possible to determine how likely a company is to default. Only those deemed unlikely to default will be selected. Stage 3: Selection of stocks with a high dividend yield The final filter of the stock selection process is the expected dividend yield. Both SGQI and SGQE target companies paying a dividend yield of at least 4% at the point of selection. Where available, the one year forward dividend yield from the Institutional Brokers’ Estimate System (IBES) is used in order to establish the expected dividend yield. Where it is not available through IBES, the reported dividend yield stated by Factset fundamentals is used instead. The Indices are rebalanced quarterly and weights are reset to ensure equal weighting. 4 expert OPINION J u ne 2014 I N V E S T M E N T I N S I G H T S F R O M LY X O R ET F T HE IMPORTANCE OF QUALITY & IN C O ME Chart 6 uses the SGQI Index to demonstrate the importance of using both ‘Quality’ and ‘Income’ filters to select stocks. In this chart we compare the simulated performance of the SGQI Index with a number of other possible groups that could have been created from the same equally-weighted universe of global stocks that SGQI starts with i.e. stocks that have a free float market capitalisation of US$3bn and are non-financial. The “High Yield Equities” selection consists purely of the top 20% of stocks from the SGQI universe according to dividend yield and ignores the ‘Quality’ screening. The “Quality Equities” selection consists of the quality stocks as defined by the Piotroski score of 7 described earlier, and ignores their dividend yield. The overall ‘Equity Market‘ consists of the full portfolio of global ex financial stocks with a free float market capitalisation of US$3bn and ignores both ‘Quality’ and ‘Yield’ filters. The performance of these four groups is also compared to both Government and AAA bonds to provide context. From this analysis we can note the following: Quality stocks and high yield stocks outperformed the market. SGQI has outperformed them both. CHART 6: Simulated performance of the SGQI Index versus other alternative selections or indices. 1,000 900 800 700 600 500 400 300 200 100 0 SGQI High Yield Equities Government Bonds Quality Equities Equity Market AAA Bonds Source: SG Cross Asset Research, September, 2013. Simulated past performance is not a reliable of future performance. Performance shown for SGQI prior to May 15, 2012 and March 21, 2013 for SGQE is simulated. Data is re-based to 100 to enable comparison between the different assets. Performance does not include transaction costs. Despite the bull market in bonds, SGQI has outperformed fixed income assets such as Government Bonds and AAA Bonds (even adjusting for volatility). 5 expert OPINION J u ne 2014 I N V E S T M E N T I N S I G H T S F R O M LY X O R ET F P E R F O R MA NCE AND RI S K S TATI S T I C S The table below shows the relative performance of SGQI and SGQE versus a selection of similar indices. We can see that European equities have out performed Global equities over a one year period but only SGQE was higher over 5 years. Both SGQE and SGQI have performed strongly over 5 years. However, SGQI has suffered over a one year period as global high yield stocks have been sold. Total Return (%) Over the last 12 months, the volatility of the SGQI Index has been 8.29%, which is lower than that of SGQE (10.21%), and the MSCI World Index (10.11%) of global equities. Finally, SGQE and SGQI also delivered a good dividend yield (4.39% & 3.56% gross respectively) versus 2.17% for MSCI World and 3.01% for MSCI World Europe over the course of last year. Price Return (%) Yield (Total Return – Price Return) Annualized Volatility (%) Maximum Loss (%) 1 Year 5 Year 1 Year 5 Year 1 Year 5 Year 1 Year 5 Year 1 Year 5 Year 0.23 100.90 -3.33 59.13 3.56 41.77 8.29 9.41 11.08 11.08 MSCI World (EUR) 10.88 100.96 8.72 80.62 2.17 20.34 10.11 12.71 9.26 20.58 SG European Quality Income** 12.32 101.59 7.93 63.79 4.39 37.80 10.21 12.91 10.86 16.47 MSCI Europe 16.29 92.33 13.28 65.07 3.01 27.25 11.95 17.03 11.04 24.31 Index SG Global Quality Income* Source: SG Cross Asset Research, Bloomberg. May, 2014. *Performance shown prior to May 15, 2012 is simulated. ** Performance shown prior to March 21, 2013 is a back-test. Performance does not include transaction costs. Simulated past performance is not indicative of future performance. CHART 7: SGQI Index Performance* 250 SG Quality Income Index MSCI World (in EUR) 200 MSCI World High Yield (in EUR) MSCI World Minimum Volatility (in EUR) 150 100 50 0 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Source: SG Cross Asset Research, Bloomberg. May 2014. Performance shown prior to May 15, 2012 is simulated. Performance does not include transaction costs. Simulated past performance is not indicative of future performance. CHART 8: SGQE Index Performance* 300 SG European Quality Income Index MSCI Europe (in EUR) 250 MSCI Europe High Yield (in EUR) MSCI Europe Minimum Volatility (in EUR) 200 150 100 50 0 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Source: SG Cross Asset Research, Bloomberg. May 2014. Performance shown prior to March 21, 2013 is a back-test. Performance does not include transaction costs. Simulated past performance is not indicative of future performance. 6 expert OPINION J u ne 2014 I N V E S T M E N T I N S I G H T S F R O M LY X O R ET F CU RREN T IN DEX CON S TITUE NT S FO R S G G LO BAL Q UALI T Y I NCO M E ( S G QI ) BREAKDOWN OF ASSETS BY GEOGRAPHY BREAKDOWN OF ASSETS BY INDUSTRY Australia Canada France Hong Kong Italy Japan Netherlands Norway Singapore Spain Sweden Switzerland United Kingdom United States Consumer Goods Consumer Services Health Care Industrials Oil & Gas Telecommunications Utilities Country Name Country Name Australia AGL ENERGY LTD Singapore SINGAP TECH ENG Australia AMCOR LTD Singapore SINGAPORE TELECO Australia APA GROUP Spain ENAGAS SA Australia COCA-COLA AMATIL Sweden HENNES & MAURI-B Australia SONIC HEALTHCARE Sweden TELIASONERA AB Australia TATTS GROUP LTD Switzerland SWISSCOM AG-REG Australia TELSTRA CORP United Kingdom BP PLC Australia TRANSURBAN GROUP United Kingdom BRIT AMER TOBACC Australia WESFARMERS LTD United Kingdom CENTRICA PLC Australia WOODSIDE PETRO United Kingdom IMPERIAL TOBACCO Australia WOOLWORTHS LTD United Kingdom INFORMA PLC Canada BAYTEX ENERGY CO United Kingdom NATIONAL GRID PL Canada ARC RESOURCES LT United Kingdom SEVERN TRENT Canada BCE INC United Kingdom SSE PLC Canada HUSKY ENERGY INC United Kingdom UNITED UTILITIES Canada SHAW COMM-B United States DUKE ENERGY CORP Canada TELUS CORP United States ALTRIA GROUP INC Canada THOMSON REUTERS United States AMERICAN ELECTRI Canada TRANSCANADA CORP United States AT&T INC France EUTELSAT COMMUNI United States CMS ENERGY CORP France SES United States CONS EDISON INC Hong Kong CLP HLDGS LTD United States DTE ENERGY CO Italy SNAM SPA United States ENSCO PLC-CL A Japan CANON INC United States LEGGETT & PLATT Japan EISAI CO LTD United States PINNACLE WEST Japan NTT DOCOMO INC United States PUB SERV ENTERP Japan TAKEDA PHARMACEU United States SCANA CORP Netherlands WOLTERS KLUWER United States SOUTHERN CO Netherlands ZIGGO NV United States TECO ENERGY INC Norway ORKLA ASA United States VERIZON COMMUNIC Norway TELENOR ASA United States XCEL ENERGY INC Singapore SINGAP PRESS HLG Source: SG Cross Asset Research/Equity Quant, May 2014. The allocations refer to past allocations and past allocations are not a reliable indicator of future allocations. 7 expert OPINION J u ne 2014 I N V E S T M E N T I N S I G H T S F R O M LY X O R ET F CU RREN T IN DEX CON S TITUENT S FO R S G E URO P E AN Q UALI T Y I NCO M E ( S GQ E) BREAKDOWN OF ASSETS BY GEOGRAPHY BREAKDOWN OF ASSETS BY INDUSTRY Denmark Basic Materials Finland France Consumer Goods Germany Consumer Services Italy Health Care Netherlands Industrials Norway Oil & Gas Spain Technology Sweden Telecommunications Switzerland Utilities United Kingdom Country Name Country Name Denmark TDC A/S Sweden HOLMEN AB-B SHS Finland ELISA OYJ Sweden SKANSKA AB-B Finland NOKIAN RENKAAT Sweden TELIASONERA AB France EUTELSAT COMMUNI Switzerland SWISSCOM AG-REG France RUBIS United Kingdom BP PLC France SANOFI United Kingdom BRIT AMER TOBACC France SES United Kingdom CENTRICA PLC Germany DRILLISCH AG United Kingdom COBHAM PLC Germany FREENET AG United Kingdom ELECTROCOMPONENT Germany HUGO BOSS -ORD United Kingdom IMPERIAL TOBACCO Germany RTL GROUP United Kingdom INFORMA PLC Italy ENI SPA United Kingdom MICRO FOCUS INTL Italy SNAM SPA United Kingdom NATIONAL GRID PL Italy TERNA SPA United Kingdom PEARSON PLC Netherlands WOLTERS KLUWER United Kingdom PENNON GRP PLC Netherlands ZIGGO NV United Kingdom SEVERN TRENT Norway ORKLA ASA United Kingdom SSE PLC Norway TELENOR ASA United Kingdom TESCO PLC Spain ENAGAS SA United Kingdom UNITED UTILITIES Source: SG Cross Asset Research/Equity Quant, May 2014. The allocations refer to past allocations and past allocations are not a reliable indicator of future allocations. K EY RI S KS AND BE NEFIT S A SS OC I AT E D WI T H T HE S G Q E AND S G Q I I NDI C E S KEY RISKS KEY BENEFITS »» Potential tracking error versus any equity benchmark »» Dividend income and dividend growth are considered by many to be the cornerstones of long-term equity returns. High quality and high yielding equities can therefore provide an attractive option for long-term investors. »» Near-term underperformance is likely in a rapidly rising market »» Near-term likely to fall in absolute terms in declining market even if outperforming in relative terms »» High quality dividend income is less likely to fall in a downturn, and more likely to rise during periods of inflation. The strategy may therefore be more robust during times of macroeconomic uncertainty. »» SGQE & SGQI exhibit bond-like characteristics (income and capital safety) with equity-like returns (capital growth and relative inflation protection). 8 expert OPINION J u ne 2014 I N V E S T M E N T I N S I G H T S F R O M LY X O R ET F LYXOR ETF QUALITY INCOME Lyxor’s Exchange Traded Funds(ETF) on the SG Global Quality Income and SG European Quality Income Indices are Luxembourg SICAV, UCITS compliant ETFs which are listed and tradable on the London Stock Exchange. The objective of these ETFs is to replicate the performance of the Index that they track. There are three different variations of the Lyxor ETF Global Quality Income NTR. The first two are priced in GBp and give investors the choice to either receive the Dividend Yield (SGQP), or have the dividends re-invested in the Fund (SGQL). The third option is for investors who would prefer to invest in the SGQI Index via a USD denominated fund. There are also two versions of Lyxor UCITS ETF SG European Quality Income NTR; SGQE which is tradeable in Euros and SGQG which trades in GBp. Both of these funds distribute income to investors. Importantly investors in these ETFs will be exposed to currency risk on any of the underlying companies that are listed in a currency different to that of the ETF. If the exchange rate moves against you this will impact the return that you receive. HOW DO THE FUNDS TRACK THE INDEX? In order to track their Indices, Lyxor ETFs purchase a basket of physical assets to provide security to the fund, and a Performance Swap (Swap) to provide the performance. A Swap is a contractual agreement which is negotiated over-the-counter (OTC) between two parties: the ETF and the issuer of the Swap, which in Lyxor’s case is Societe Generale. Under the terms of the Swap, Societe Generale commits to pay the precise daily performance of the Benchmark Index, including any dividends to the Lyxor ETF. In return, the Lyxor ETF pays Societe Generale a fee for the SWAP arrangement, and the performance of its physical assets, including any dividends. This means that before taxes and replication costs, the daily performance of the ETF is a precise replication of the Index. SEGREGATED ASSETS The performance of each fund is secured by a basket of UCITS eligible physical assets that are owned by the fund and held in a segregated account. Collateral is subject to stringent minimum quality criteria. The level of the Collateral is managed daily in order to maintain a target Counterparty Risk level of 0%. ETF NAME CCY DIVIDEND DISTRIBUTION EPIC CODES ISIN CODE TOTAL EXPENSE RATIO* Lyxor ETF Global Quality Income NTR GBp Semi-Annual SGQP LU0855671011 0.45% Lyxor ETF Global Quality Income NTR GBp N/A SGQL LU0855692520 0.45% Lyxor ETF Global Quality Income NTR USD N/A SGQD LU0855692520 0.45% Lyxor UCITS ETF SG European Quality Income NTR EUR Semi-Annual SGQE LU0959210278 0.45% Lyxor UCITS ETF SG European Quality Income NTR GBp Semi-Annual SGQG LU0959210278 0.45% Source: Lyxor Asset Management, May, 2014 F U N D H OL DING S The physical assets held in a Lyxor ETF have no impact on the performance of the fund, and as such, they can be different to that of the Underlying Index. This means that regardless of the Benchmark Index, Lyxor ETFs can restrict the securities held as collateral to highly liquid, high quality UCITS eligible stocks. The result is that the physical stocks held in a Lyxor ETF can be more liquid, and better diversified than those of the indices that they follow. All directly owned securities, counterparty risk levels, and fund information is published daily on our website, www.sglistedproducts.co.uk. 9 expert OPINION J u ne 2014 I N V E S T M E N T I N S I G H T S F R O M LY X O R ET F I LL U STRATIVE RETURN S The objective of the Lyxor ETF Global Quality Income NTR and Lyxor UCITS ETF SG European Quality Income NTR are to replicate the performance of the their Benchmark Index. This means that before charges and fees the ETF will rise and fall according to changes in the Index it tracks. The following table provides a simple illustration of the returns that you could expect to achieve from an investment in the Lyxor ETF Global Quality Income NTR (SGQL) for example. It is important to note that these figures to not take into account the Total Expense Ratio or the impact of movements in the Euro/GBP exchange rate. COST PER UNIT AT INVESTMENT SGQL INDEX LEVEL AT PURCHASE % CHANGE IN SGQI INDEX SGQL INDEX LEVEL AT SALE PERFORMANCE OF SGQL (%) PAYOUT ON SALE PER UNIT PROFIT/LOSS AT SALE PER UNIT 11,361 p 1,161.00 +10 1,277.10 +10 12,497p + 1,136p 11, 361p 1,161.00 0 1,161.00 0 11,361p 0.00p 11, 361p 1,161.00 -1 1,044.90 -1 10,225p - 1,136p Please note: This is for illustrative purposes only and is based on an investment in The Lyxor Global Quality Income (SGQL) on October 22nd,2013 at the price of 11,361 pence per unit when the SG Global Quality Income Index NTR (EUR) was trading at 1,161.00 (Source Bloomberg). The figures do not include the impact of charges or fees. The Total Expense Ratio for SGQL is 0.45% per annum. This amount is calculated and deducted daily from the value of SGQL at approximately 0.00152% per day. The figures are examples only and used to illustrate the return that could be achieved based on a number of example Index levels that could occur. K EY BEN EF IT S AND RI SK S OF E T F I NVE S T M E NT S BENEFITS OF ETFS RISKS OF ETFS Visibility: Live intraday bid/ offer pricing on the London Stock Exchange. Capital at Risk: ETFs are tracking instruments. Their risk profile is similar to a direct investment in the Underlying Index. Investors’ capital is fully at risk and you may not get back the amount you originally invested. Underlying Risk: The underlying indices may be complex and volatile. Cost Efficiency: Low Total Expense Ratio (TER)* comprises of management fee and structural costs. Replication Risk: The fund objectives might not be reached due to unexpected events on the underlying markets which will impact the index calculation and the efficient fund replication. Transparency: All documents, counterparty information and fund holdings are available on the website. Counterparty Risk: Investors may be exposed to risks resulting from the use of an OTC Swap with Societe Generale. In line with UCITS guidelines, the exposure to Societe Generale cannot exceed 10% of the total fund assets. Swap Exposure is targeted at 0%. Eligibility: SIPP, ISA, CGT, UCITS IV Funds. Currency Risk: ETFs may be exposed to currency risk if the ETF is denominated in a currency different to that of the Index that it tracks. The Benchmark Index may be exposed to Currency Risk if it is denominated in a currency different to that of the constituents of the Benchmark Index. This means that exchange rate fluctuations could have a negative or positive effect on returns. *The Total Expense Ratio (TER) covers all costs incurred by the Management Company to manage the underlying assets. It comprises of the Management Fee and Structural Costs described as follows. The Management Fee represents the compensation for the Management Company services. The Structural Costs represent the custodian fee, the administrative fee, the audit fee and all other operating costs that will be paid by the Management Company to operate the funds. 10 expert OPINION J u ne 2014 I N V E S T M E N T I N S I G H T S F R O M LY X O R ET F I M PO RTA N T INFORMATION This publication should be treated as a marketing communication providing general investment recommendations and should not be treated as a research report issued by Société Générale’s Research Department. This document has not been prepared in accordance with regulatory provisions designed to promote the independence of investment research, and Société Générale is not subject to any prohibition on dealing in the financial instrument or instruments ahead of the dissemination of this publication. This publication includes investment recommendations issued from Société Générale’s investment Research department which has set, in accordance with applicable regulation, effective administrative and organizational arrangements, including information barriers to prevent and avoid conflicts of interest with respect to the investment recommendations contained in this publication. Research publications supporting this document were issued on their stated publication date and may have already been acted upon by clients of Société Générale. DI S C L A IMER This document is issued in the U.K. by the London Branch of Societe Generale. Societe Generale is a French credit institution (bank) authorised by the Autorité de Contrôle Prudentiel et de Résolution (the French Prudential Control and Resolution Authority) and the Prudential Regulation Authority and subject to limited regulation by the Financial Conduct Authority and Prudential Regulation Authority. Details about the extent of our authorisation and regulation by the Prudential Regulation Authority, and regulation by the Financial Conduct Authority are available from us on request. The products described within this document are not suitable for everyone. Investors’ capital may be lost. Investors should not deal in these products unless they understand their nature and the extent of their exposure to risk. The value of these products can go down as well as up and can be subject to volatility due to factors such as price changes in the underlying instrument and interest rates. Prior to any investment in one of these products, investors should make their own appraisal of the risks from a financial, legal and tax perspective, without relying exclusively on the information provided by us, both in this document and the Pricing Supplement of the product which is available on the website www.sglistedproducts.co.uk. We recommend that investors consult their own independent professional advisers. Investors should note that holdings in these products will not be covered by the provisions of the Financial Services Compensation Scheme, or by any similar compensation scheme. The securities can be neither offered in nor transferred to the United States. Any statement in relation to tax, where made, is generic and non-exhaustive and is based on our understanding of the laws and practice in force as of the date of this document and is subject to any changes in law and practice and the interpretation and application thereof, which changes could be made with retroactive effect. Any such statement must not be construed as tax advice and must not be relied upon. The tax treatment of investments will, inter alia, depend on an individual’s circumstances. Investors must consult with an appropriate professional tax adviser to ascertain for themselves the taxation consequences of acquiring, holding and/or disposing of any investments mentioned on this document. Telephone calls may be recorded and/or monitored for training and quality purposes. Societe Generale Listed Products | 0800 328 1199 | listedproducts@sgcib.com | www.sglistedproducts.co.uk 11 expert OPINION J u ne 2014 I N V E S T M E N T I N S I G H T S F R O M LY X O R ET F I ND EX D I S C LAIMER Without prejudice to its legal or regulatory obligations, Societe Generale may not be held responsible for any financial or other consequences that may arise from investing in a product having as its underlying the index described herein (the “Index”), and investors are responsible, prior to making any investment in a product having the Index as its underlying, for making their own appraisal and, if they deem it necessary, to seek and obtain professional advice on the risks and merits of the product. This document does not constitute an offer, a solicitation, an advice or a recommendation from Societe Generale to purchase or sell the Index, which cannot be invested in directly. The purpose of this document is simply to describe the principles and main financial characteristics of the Index. The level of the Index may be subject to significant volatility due to, inter alia, the evolution of the price of the underlying instrument(s) and of the interest rates. A product having the Index as underlying may be subject to restrictions with regard to certain persons or in certain countries under national regulations applicable to such persons or in said countries. It is each investor’s responsibility to ascertain that it is authorised to conclude, or invest into, this product. By undertaking such an investment, each investor is deemed to certify to Societe Generale that it is duly authorised to do so. The Index is the sole and exclusive property of Societe Generale. Societe Generale does not guarantee the accuracy and/or the completeness of the composition, calculation, dissemination and adjustment of the Index, nor of the data included therein. Societe Generale shall have no liability for any errors, omissions, interruptions or delays relating to the Index. Societe Generale makes no warranty, whether express or implied, relating to (i) the merchantability or fitness for a particular purpose of the Index, and (ii) the results of the use of the Index or any data included therein. Societe Generale shall have no liability for any losses, damages, costs or expenses (including loss of profits) arising, directly or indirectly, from the use of the Index or any data included therein. The levels of the Index do not represent a valuation or a price for any product referencing such Index. The Index rules (the “Index Rules”) define the calculation principles of the Index and the consequences on this Index of extraordinary events which may affect one or several of the underlying programmes on which it is based. This document is of a commercial and not of a regulatory nature. The accuracy, completeness or relevance of the information which has been drawn from external sources is not guaranteed although it is drawn from sources believed to be reliable. Societe Generale shall not assume any liability in this respect. The market information presented in this document is based on data at a given moment and may change from time to time. The potential performance may increase or decrease as a result of currency fluctuations. The roles of the different teams involved within Societe Generale in the design, maintenance and replication of the Index have been strictly defined. Where Societe Generale holds the product and other positions exposing it to the Index for its own account, the replication of the Index is made in the same manner by a single team within Societe Generale, be it for the purpose of hedging the product held by external investors or for the purpose of the positions held by Societe Generale acting for its own account. Societe Generale may take positions in the market of the financial instruments or of other assets involved in the composition of the Index, including as liquidity provider. Structured Solutions AG is the Calculation Agent of the Index. MSCI DISCLAIMER: The MSCI sourced information is the exclusive property of Morgan Stanley Capital International Inc. (MSCI). Without prior written permission of MSCI, this information and any other MSCI intellectual property may not be reproduced, redisseminated or used to create any financial products, including any indices. This information is provided on an “as is” basis. The user assumes the entire risk of any use made of this information. MSCI, its affiliates and any third party involved in, or related to, computing or compiling the information hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of this information. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in, or related to, computing or compiling the information have any liability for any damages of any kind. MSCI, Morgan Stanley Capital International and the MSCI indexes are service marks of MSCI and its affiliates or such similar language as may be provided by or approved in advance by MSCI. Societe Generale Listed Products | 0800 328 1199 | listedproducts@sgcib.com | www.sglistedproducts.co.uk