2014 federal budget summary

advertisement

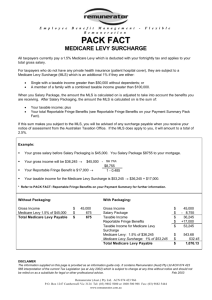

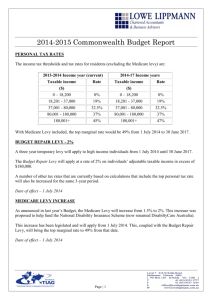

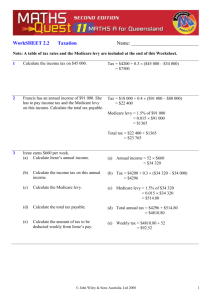

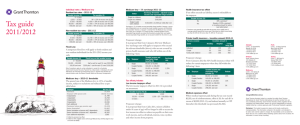

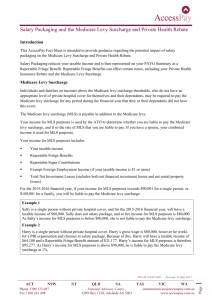

2014 FEDERAL BUDGET SUMMARY Corner Lime & Cuthbert Streets King Street Wharf Sydney NSW Phone: (02) 9249 7600 email@bellpartners.com www.bellpartners.com CEO Message The words “promise” and “commitment” have been thrown around quite a bit by both sides of parliament leading up to this year’s budget. The Labor party has been keen to highlight thatthe proposed Deficit Levy breaks Tony Abbott’s preelection comments that "taxes will always be lower under a Coalition government.” Whilst the Coalition has been at pains to highlight that they have a commitment to protect Australia’s economy and financial position and that “when you're in a difficult position, sometimes there needs to be some short-term pain for permanent and lasting gain." Whatever your political persuasion, most people would agree that clear direction and swift action are needed to ensure the nation’s long term financial health. The national financial scorecard for the last twelve months would best be described as mixed. On the positive side we’ve seen the Australian dollar drop slightly from uncomfortable highs leading to a late run in exports, business and household sentiment improving especially following the September election, the RBA cutting rates to 2.50% where they have remained since and a late pickup in the housing construction sector. Yet we’ve also seen the economy slowing following a drop off in the investment phase of the mining boom, unemployment levels edging higher throughout most of the year, further uncertainty finding its way to Australian shores with spending cuts in the US and issues around China’s financial system and the general volatility that has plagued many markets. The Government has released a budget which they say will fire up the non-mining sectors of the economy, with $50 billion to be invested in new roads, rail, ports and airports over the next decade. This budget also sees a significant commitment to health and medical research with a $20 billion medical research endowment, new free trade agreements with Korea and Japan, the removal of $1 billion annually in red tape and the abolition of the carbon tax and mining tax. Accounting & Tax, Strategy & Advisory, Audit, Wealth Creation, Stockbroking, Finance, Legal, Communications, Digital & Insurance There are also initiatives which will ensure Australia is well positioned globally in education with the deregulation of higher education fees and Government support provided to those learning a trade. That said these initiatives and the need to decrease government spending and reduce benefits have come at a cost to many families and pensioners. A 2% Temporary Budget Repair Levy for people earning more than $180,000 a year, changes to the accessibility of the aged pension and family assistance payments, the introduction of a $7 Medicare co-contribution and the re-introduction of indexation of the fuel excise are among the changes. It also has to be said that there is little in the way of true tax reform in this budget, with negative gearing and superannuation in particular being left unchanged. The budget deficit is projected to fall from its current $49.9 billion to $29.8 billion next year, with a further decline to $2.8 billion in 2017-18. This will be seen by many as the Government delivering on its promise to “fix the economy”. It’s a fine line the Government is trying to walk with a need and indeed action to reduce spending so as a country we live within our means, yet at the same time not wanting to dampen confidence and hence economic growth. There will no doubt be positive and negative ramifications for you from this budget. I encourage you to contact us for specific advice as to what these changes may mean for you. I hope that you find this Budget Summary useful. Warm regards, Anthony Bell Accounting & Tax, Strategy & Advisory, Audit, Wealth Creation, Stockbroking, Finance, Legal, Communications, Digital & Insurance Budget Highlights We're pleased to provide the following summary of some of the major changes arising from this year's Federal Budget. This report aims to summarise the key implications that might be relevant to you, but it is not exhaustive. We would be happy to assist with any questions you may have regarding how these changes may affect you. $50 billion over the next 10 years for key infrastructure projects (particularly roads, rail, ports and airports). Reintroduction of the indexation of the fuel excise with money raised to contribute towards the road-building budget. Establishing the $20 billion Medical Research Future Fund to be financed by, inter alia, the $7 Medicare co-contribution. Temporary Budget Repair Levy of 2% on incomes over $180,000 for 3 years commencing 2014-15. Increase in the pension age eligibility to 70 by 2035 whilst starting to incentivise businesses to employ Australians over the age of 50 through the new Restart programme. $820 million to expand access to higher education and deregulating tuition fees from 1 January 2016. Intention to reduce the corporate tax rate by 1.5 percentage points to 28.5% from 1 July 2015 for 800,000 businesses. In addition to the budget itself there have been many changes that have been announced in prior budgets that are not yet law but are important to consider. Our report addresses some of the major points. The Economy - Forecast at a glance The current $49.9 billion deficit is projected to be reduced to $29.8 billion in 2014-15, falling to $2.8 billion in 2017-18. Growth at 2.5% for 2014/15 increasing to 3.0% for 2015-16. Unemployment rate is forecast to be 6.25% by the June quarter 2015. Net debt projected to rise to 14.6% of GDP by 2016-17. Budget Summary Area Impact Effective Date Individuals & Families Temporary Budget Repair Levy Budget repair (deficit) levy of 2% will apply for incomes over $180,000 for 3 years (until 30 June 2017). Dependent Spouse These tax offsets will be abolished. Tax Offset and Mature Age Workers Tax The government will make a payment of up to Offset $10,000 to employers who hire a senior job seeker to support mature age seekers in reentering the workforce. Age Pension The age pension qualifying age will continue to increase by six months every two years until it reaches a qualifying age of 70 by 2035. This means that anyone born after 1/1/66 will not qualify until age 70. 1/7/14 1/7/14 By 1/7/35 Changes to deeming rules will reduce pension entitlement for some pensions. Pension increases will now be linked to CPI which will reduce the amount of future rises in pension payments. Medicare levy low income thresholds Increased to $34,367 for families (the threshold will remain at $20,542 for individuals). 1/7/13 Medicare Patient Contribution A $7 patient contribution per service will be collected by the service provider (capped to the first 10 visits to the doctor by concession card holders and children under 16). 1/7/15 First Home Saver Accounts Scheme The scheme will be abolished on 1 July 2015. 1/7/15 The government co-contributions for first home savers will cease on 1 July 2014. 1/7/14 HELP Repayments The income threshold for repayments will be reduced and the annual indexation of HELP debt will be adjusted with a rate equivalent to the yield on 10 year government bonds. 1/7/16 Family Tax Benefit The Family tax benefit payments will freeze at the current levels for 2 years. 1/7/14 The primary earner income limit for the family tax benefit part B will be reduced to $100,000 p.a. from $150,000 p.a. 1/7/15 A new allowance of $750 for single parents; subject to eligibility. Business - General Corporate Tax Rate Reduction Intention to cut the corporate tax rate by 1.5% to 28.5% for 800,000 businesses. 1/7/15 Fringe Benefits Tax Rate Change Rate has increased from 47% to 49% due to the introduction of temporary budget repair levy. 1/4/15 The current rates of the refundable (45%) and non-refundable (40%) offsets will be reduced by 1.5 percentage points each. 1/7/14 R & D Tax Incentive Superannuation Excess Contribution Tax The government will allow individuals to withdraw any excess contributions made and associated earnings. 1/7/13 If this option is used, no excess contribution tax will be payable and any related earnings will be taxed at marginal tax rates. Employer Superannuation Guarantee Rate The government will increase the rate to 9.5% (as currently legislated) and the rate will remain at this level until 30 June 2018. 1/7/14 The rate then will increase by 0.5% each year until it reaches 12% in 2022/2023. Accounting & Tax, Strategy & Advisory, Audit, Wealth Creation, Stockbroking, Finance, Legal, Communications, Digital & Insurance Other Changes Federal budgets in prior years have included a number of announcements that come into effect from 1 July 2014 and future periods. Some of the major ones follow. Previous Announcements: Legislated Changes from 1 July 2014 & Beyond Area Impact Effective Date Medicare Levy Increased from 1.5% to 2.0% to support the Disability Care Australia. 1/7/14 Fringe Benefits Tax Rate Change Rate has increased from 46.5% to 47% due to the increase in Medicare Levy. 1/4/14 Superannuation Concessional Contributions Cap For 2013-14, $25,000 (up to age 60) and $35,000 (age 60+). 1/7/13 For 2014-15, $30,000 (up to age 50) and $35,000 (age 50+). 1/7/14 Previous Announcements: Not Yet Legislated There have also been a number of changes announced in prior years’ budgets that are yet to be legislated (passed into law) and/or have been amended in some way since they were originally announced. Some of the key items are; Area Impact Status HECS/HELP Discount Discounts for upfront or voluntary payments are to be removed from 1 January 2014. Before Senate Company Loss Carry Back Provisions The government proposes to repeal the loss carry back rules for assessments for the 2013/14 and later income years with effect from 1 July 2013. On hold Instant Asset Write Off (Small Businesses) Instant asset write off threshold of $6,500 will be reduced to $1,000 and immediate write off of first $5,000 for cars will be removed from 1 January 2014. On hold Low Income Super The low income super contribution scheme is Contribution ("LISC") to be abolished with effect from 1 July 2013. On hold Non-resident sale of properties Proposal Where a non-resident sells certain taxable property of greater than $2.5 million, the purchaser must withhold 10% to pay to the tax office from 1 July 2016. Tax Rates Resident Individual Tax Rates Personal Income Tax Rates and Thresholds (excluding Medicare levy) Taxable Income ($) 0 - 18,200 18,201 - 37,000 37,001 - 80,000 80,001 - 180,000 Over 180,000 2013/14 2014/15 Rate (%) Rate (%) 0 5 19.0 5 32.5 5 37.0 % % 45.0 0 19.0 32.5 37.0 47.0 Medicare Levy The Medicare levy is currently 1.5% for 2013/14 but to rise to 2% from 1 July 2014. With Medicare levy included, the top marginal tax rate will be 49% from 1 July 2014. Low Income Tax Offset ("LITO") For the 2014/15 year (as for 2013/14), the maximum value of the LITO is $445. It begins to be phased out at the rate of 1.5 cents for each dollar of taxable income over $37,000 and is phased out completely by $66,667. With the low income tax offset, tax free threshold effectively becomes $20,542. Non-Resident Tax Rates Non Resident Income Tax Rates and Thresholds Taxable Income ($) 0 – 80,000 80,001 - 180,000 Over 180,000 2013/14 2014/15 Rate (%) Rate (%) 32.5 55% 37.0 % 45.0 33.0 37.0 47.0 Medicare Levy Surcharge & Health Insurance Rebate The Medicare Levy Surcharge applies when private health insurance cover is not held and your / your family income (taxable income & reportable fringe benefits & other items) exceeds the following amounts from 1 April 2014. It is in addition to the basic Medicare Levy. The Health Insurance Rebate provides a reduction on the health insurance premium. Full Entitlement Tier 1 Tier 2 Tier 3 Taxable Income Singles $88,000 or less $88,000 - $102,000 $102,001 - $136,000 >$136,000 Families $176,000 or less $176,001 - $204,000 $204,001 - $272,000 >$272,000 Health Insurance Rebate Aged under 65 29.04% 19.36% 9.68% 0% Aged 65 – 69 33.88% 24.20% 14.52% 0% Aged 70 or over 38.72% 29.04% 19.36% 0% 1.25% 1.5% Medicare Levy Surcharge All ages 0.0% 1.0% The income thresholds for the private health insurance offset and the Medicare levy surcharge will be frozen for 3 years after 1 July 2015.