CHAPTER 1 – INTRODUCING THE FIRM AND ITS GOALS

advertisement

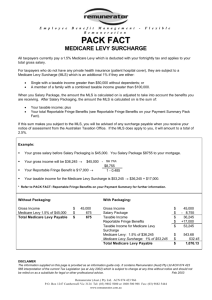

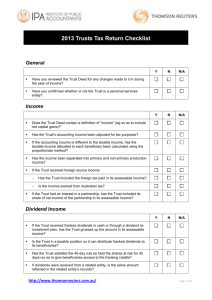

Additional Problems to accompany Introducing Corporate Finance Prepared by Michelle Goyan John Wiley & Sons Australia, Ltd CHAPTER 1 – INTRODUCING THE FIRM AND ITS GOALS PROBLEM 1 A company paid Australian tax on $3m dollars at the corporate tax rate of 30% last year. They then paid a dividend of $1m. a) What reduction would there be to the franking account if the dividend was fully franked? b) Show why the dividend can be fully franked PROBLEM 2 Your taxable income last year was $25 000. How much tax will you have to pay? PROBLEM 3 Lilly Leeuw is a fashion designer who operates her clothing business as a sole trader. Lilly sold $5 000 000 of clothing. Her cost of goods sold was $3 000 000 and she had additional operating expenses of $500 000 for the year. Lilly paid $75 000 interest on her factory mortgage. a) Calculate Lilly’s taxable income and the amount of tax she will have to pay on it. Use Table 1.2 for the personal tax rates and ignore the Medicare levy. b) Using the information above, how much tax would Lilly’s have to pay if she made a capital gain of $100 000 on the sale of an asset? PROBLEM 4 Abul and Zahrina have formed an equal partnership. They make jewellery and sell it at the local market. Their sales for the year were $80 000. Their cost of goods sold was $45 000. They paid $500 a month to the market organisers for their stall. Use Table 1.2 for the personal tax rates and ignore the Medicare levy. a) Calculate the taxable income and the amount of tax Abul will have to pay. b) Zahrina also works in her Aunt’s restaurant. For this, she receives $30 000 per annum and has work-related deductions of $1 500 per annum. Calculate Zahrina’s taxable income and the amount of tax she will have to pay. PROBLEM 5 Rejoyce and Moses are in partnership in to operate a landscaping business. The business had revenue of $350 000 last year and a cost of goods sold of $89 000. Administration and other expenses were $17 500. The interest on the partnership loans was $3 150. Use Table 1.2 for the personal tax rates and ignore the Medicare levy. a) Calculate the taxable income and the amount of tax each of the partners will have to pay. b) Rejoyce and Moses are thinking about changing their business structure to a company. The corporate tax rate is 30%. i) Using the information above, how much could they pay as fullyfranked dividends? ii) Calculate what the taxable income and tax payable would be for each of the owners if their business were a company. iii) Is there a tax advantage for Rejoyce and Moses if they adopt a corporate structure. PROBLEM 6 Anikin works full-time as a pest controller. His income for the year was $47 000. He has allowable deductions of $2 500 for protective clothing and laundry. Anikin owns 1 750 shares in Vader Ltd. Vader paid $0.20 per share this year. Use Table 1.2 for the personal tax rates and a corporate tax rate of 30% (ignore Medicare levy). a) What is Anikin’s total tax payable if the dividends are fully franked? b) What is Anikin’s tax liability for the dividends when they are fully franked? c) What is Anikin’s total tax payable if the dividends are unfranked? d) What is Ankin’s tax liability for the dividends when they were unfranked? PROBLEM 7 Padma is a sales representative whose income for the year was $75 000. She has deductible travel expenses of $15 400. During the year, Padma sold property for $450 000. She had purchased the property two years earlier for $350 000. Use Table 1.2 for the personal tax rates and ignore the Medicare levy. a) Calculate Padma’s taxable income and the amount of tax she will have to pay on it. b) How much tax would Padma have to pay if she had a capital gains carry forward loss of $5 000 from the previous year? PROBLEM 8 Clotilde is a sword maker who operates her business as a sole-trader. Her sales for the year were $150 000 and her cost of goods sold was $30 000. Her operating and administration costs were $25 000. She can claim $3 500 depreciation for tools. Clotilde received a fully-franked dividend of $2 350. Calculate Clotilde’s tax payable. Use Table 1.2 for the personal tax rates and ignore the Medicare levy. PROBLEM 9 Milly is an Australian resident who earned $65 000 this year. Her father Frank is retired and received a pension of $18 000 this year. Milly and Frank own shares in a company that paid a fully franked dividend of $2 100 to each of them. The corporate tax rate is 30%. Using Table 1.2 for the personal tax rates and ignoring the Medicare levy, calculate the taxable income and the tax payable for Milly and Frank. PROBLEM 10 Yung is the sole proprietor of Westlake Traders. Yung had a taxable income of $49 500 last year. What is his tax liability including the Medicare levy of 1.5%? Use Table 1.2 for the personal tax rates. PROBLEM 11 Forestry Planning Ltd had annual sales of $3 000 000 last year. The company also had allowable deductions of $750 000 for the year. a) Using a corporate tax rate of 30%, calculate Forestry Planning’s tax liability for the year. b) Now assume that Forestry Planning had a carry-forward tax loss of $2 500 000. What is Forestry Planning’s tax position at the end of the year? PROBLEM 12 You own a number of shares in your Australian equity portfolio. During the last year, you received the following fully-franked dividends: $750, $980, $1 300, $2 450 and $3 675. You also received unfranked dividends of $985, $1 630 and $2 789. If this is your only income for the year, will you receive a refund or have to pay tax? What will the amount be? Use Table 1.2 for the personal tax rates and ignore the Medicare levy.