2014-2015 Commonwealth Budget Report

advertisement

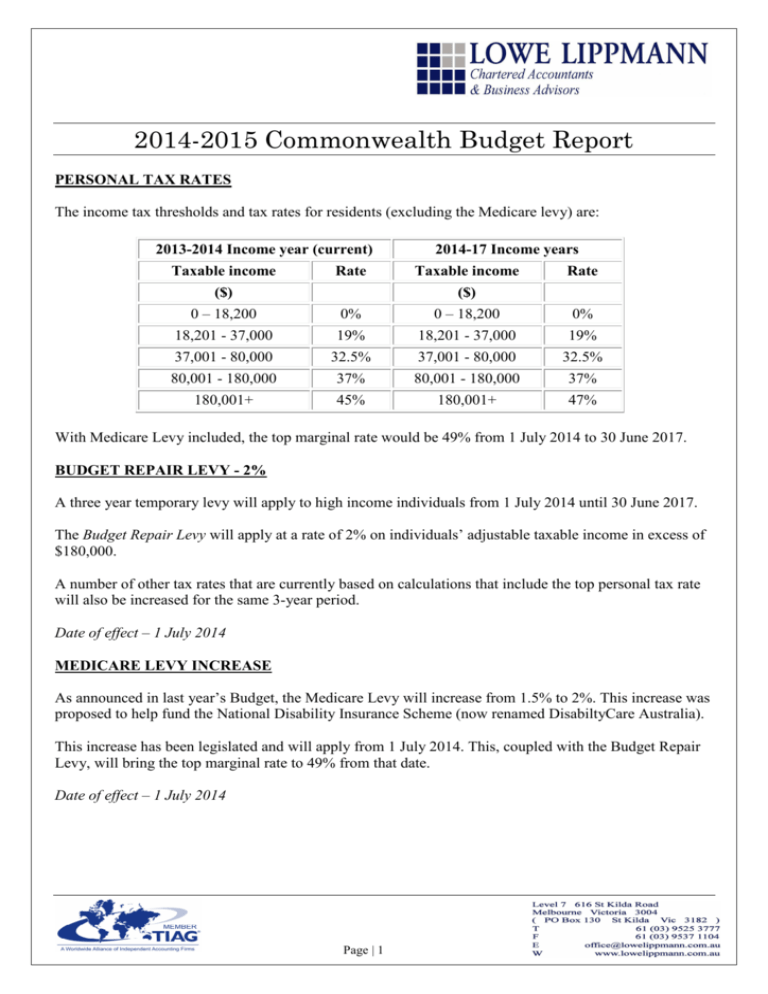

2014-2015 Commonwealth Budget Report PERSONAL TAX RATES The income tax thresholds and tax rates for residents (excluding the Medicare levy) are: 2013-2014 Income year (current) Taxable income 2014-17 Income years Rate Taxable income Rate ($) 0 – 18,200 0% ($) 0 – 18,200 0% 18,201 - 37,000 19% 18,201 - 37,000 19% 37,001 - 80,000 32.5% 37,001 - 80,000 32.5% 80,001 - 180,000 37% 80,001 - 180,000 37% 180,001+ 45% 180,001+ 47% With Medicare Levy included, the top marginal rate would be 49% from 1 July 2014 to 30 June 2017. BUDGET REPAIR LEVY - 2% A three year temporary levy will apply to high income individuals from 1 July 2014 until 30 June 2017. The Budget Repair Levy will apply at a rate of 2% on individuals’ adjustable taxable income in excess of $180,000. A number of other tax rates that are currently based on calculations that include the top personal tax rate will also be increased for the same 3-year period. Date of effect – 1 July 2014 MEDICARE LEVY INCREASE As announced in last year’s Budget, the Medicare Levy will increase from 1.5% to 2%. This increase was proposed to help fund the National Disability Insurance Scheme (now renamed DisabiltyCare Australia). This increase has been legislated and will apply from 1 July 2014. This, coupled with the Budget Repair Levy, will bring the top marginal rate to 49% from that date. Date of effect – 1 July 2014 Page | 1 2014-2015 Commonwealth Budget Report COMPANY TAXATION The company tax rate will be reduced from 30% to 28.5% from 1 July 2015. However, benefits from the company tax rate reduction may not materialise for companies whose taxable income exceeds $5 million per annum, as they will need to pay the 1.5% paid parental leave levy at the same time. Date of effect - from 1 July 2015. FBT RATE INCREASE The Fringe Benefits Tax (FBT) rate will similarly be increased by 2% for a 3-year period, from 1 April 2015 until 31 March 2017 to align with the FBT year. The FBT rate will increase from 47% to 49%. Date of effect – 1 April 2015 MATURE AGE WORKER TAX OFFSET ABOLISHED The mature age worker tax offset (MAWTO) will be abolished from 1 July 2014. The MAWTO is currently available to Australian resident individuals born before 1 July 1957 whose net income from working for the income year is $63,000 or less. The maximum offset is $500. Date of effect – 1 July 2014 DEPENDANT SPOUSE OFFSET ABOLISHED The Dependant Spouse offset will similarly be abolished from 1 July 2014. MEDICARE LEVY THRESHOLDS FOR FAMILIES INCREASED From the 2013-14 income tax year, the Medicare Levy low income thresholds will be increased by $674 to $34,367. The additional amount of threshold for each dependent child or student will increase from $3,094 to $3,156 for 2013-14. The Medicare Levy low income threshold for individuals will remain unchanged at $20,542. The Senior Australians Medicare Levy low income threshold will also remain unchanged at $32,279. Date of effect – 1 July 2013 Page | 2 2014-2015 Commonwealth Budget Report FIRST HOME SAVER ACCOUNTS SCHEME ABOLISHED The First Home Saver Account (FHSA) scheme will be abolished. It was announced that: • New accounts opened from Budget night will not be eligible for concessions • The Government co-contribution will cease from 1 July 2014 • Tax concessions will cease from 1 July 2015 • Income and asset test exemptions for Government Benefits associated with these accounts will cease from 1 July 2015. As of 1 July 2015, account holders will be able to withdraw their account balances without restriction. Date of effect – 1 July 2014 to 1 July 2015 CHANGES TO FAMILY TAX BENEFIT – PART B Access to Family Tax Benefit Part B will be reduced to families with children under six and earning under $100,000 (reduced from $150,000). Payment rates will be frozen for two years. A new FTB allowance is to be introduced from 1 July 2015 for single parents with children aged between six and twelve years old. Date of effect – 1 July 2014 to 1 July 2015 CHANGES TO NEWSTART ALLOWANCE Eligibility for Newstart Allowance and Sickness Allowance will increase from 22 to 24 years of age. Jobseekers up to 30 years of age will be prevented from accessing Newstart or Youth Allowance for a six month ‘waiting period’. Jobseekers can access a maximum period of six months income support. Date of effect – 1 July 2015 CO-PAYMENT FOR GP VISITS & RISE IN PBS CO-PAYMENT From 1 January 2015, there will be a $7 co-payment for GP visits. Savings from this are to be directed to a new Medical Research Fund. There will be a rise in the Pharmaceutical Benefit Scheme (PBS) co-payment of $5. For concession card holders, this will result in an extra 80 cents payable per subscription. The PBS Safety Net will be increased to $1,597.80 from 1 January 2015 meaning taxpayers will need to spend almost $150 more before becoming eligible for cheaper medicines. Date of effect – 1 January 2015 Page | 3 2014-2015 Commonwealth Budget Report HECS & HELP MEASURES The income threshold for repayment of Higher Education Loan Programme (HELP) debts will be reduced from 1 June 2016. The new minimum threshold is estimated to be $50,638 in 2016-17. HELP debts (which are currently indexed annually based on Consumer Price Index (CPI) will have annual indexation applied at a rate equivalent to yields on 10 year bonds issued by the Australian Government. The 25% loan fee currently applied to FEE-HELP loans and the 20% loan fee currently applied to VET FEE-HELP loans will be removed, reducing the inequity that existed between students with HELP loans who are not required to pay such fees. Date of effect – 1 June 2016 INCREASE IN AGE PENSION QUALIFYING AGE The Budget confirmed the Treasurer's earlier announcement that the Government would raise the eligibility age for the Age Pension to 70 by 2035. This measure will not affect those born before 1 July 1958. The following table sets out the Age Pension eligibility age by date of birth: Date of birth between Age at which eligible for Age Pension 1 July 1952 and 31 December 1953 1 January 1954 and 30 June 1955 1 July 1955 and 31 December 1956 1 January 1957 and 30 June 1958 1 July 1958 and 31 December 1959 1 January 1960 and 30 June 1961 1 July 1961 and 31 December 1962 1 January 1963 and 30 June 1964 1 July 1964 and 31 December 1965 1 January 1966 and later 65½ 66 66½ 67 67½ 68 68½ 69 69½ 70 Page | 4 2014-2015 Commonwealth Budget Report AGE PENSION CHANGES The government will change how it deems the return from a person's financial assets for the purposes of the pension income test. The deeming thresholds will be reset from $46,600 to $30,000 for single pensioners and from $77,400 to $50,000 for pensioner couples from 1 September 2017. As from 1 September 2017, pension increases will be linked only to the Consumer Price Index (CPI). Date of effect – 1 September 2017 COMMONWEALTH SENIORS HEALTH CARD CHANGES The Government will change the income test for eligibility for Commonwealth Seniors Health Card (CSHC) to include untaxed superannuation income in the assessment of income as from 1 January 2015. The assessment of superannuation income will be the same for CSHC holders as for Age Pension recipients and will align with the 2013-14 Budget measure to deem the balances of account-based superannuation of pensioners from 1 January 2015. All superannuation account-based income streams held by CSHC holders before the implementation date will be grandfathered under the existing rules. In addition the income thresholds for the CHSC will be indexed annually to the CPI from 20 September 2014. Payments of the Senior Supplement will also cease after the June 2014 payment Date of effect – 1 January 2015 NEW SUBSIDY FOR EMPLOYERS HIRING AUSTRALIANS 50 YEARS OR OVER The Government has announced that employers can receive up to $10,000 in Government assistance if they hire a job-seeker aged 50 or older under its new "Restart" program. The program will replace the current Seniors Employment Incentive Payment and will be partly funded through savings from the abolition of the Mature Age Workers Offset. Under the program, eligible employers will receive $3,000 if they hire a full-time mature-age job seeker who was previously unemployed for a period of 6 months and employ that person for at least 6 months. Further, once that jobseeker has been working for the same employer for 12 months, the employer will receive another payment of $3,000. Finally the employer will then receive a further $2,000 once the same job seeker has been with them for 18 months and $2,000 again at 24 months. To be eligible for the assistance, employers will need to demonstrate that the job they are offering is "sustainable and ongoing", and that they are not displacing existing workers with subsidised job seekers. Date of effect - 1 July 2014 Page | 5 2014-2015 Commonwealth Budget Report REDUCTION IN R&D OFFSET RATES The rates of the refundable and non-refundable R&D tax offsets will be reduced by 1.5 percentage points, with effect from 1 July 2014: • • The refundable offset is available to R&D entities with an aggregated annual turnover of less than $20m and will be reduced from 45% to 43.5%. The non-refundable offset is available to R&D entities that do not qualify for the refundable offset and will be reduced from 40% to 38.5%. Date of effect - from 1 July 2014. SUPERANNUATION – WITHDRAWAL OF EXCESS CONTRIBUTIONS Non-concessional superannuation contributions are contributions which are not included in the assessable income of the receiving superannuation fund, (eg non-deductible personal contributions made from the member's after-tax income) The annual non-concessional contributions cap is currently $150,000 (but rising to $180,000 from 201415). The bring-forward rule currently allows a one-off non-concessional contribution for those under 65 of up to $450,000 over 3 years (or $540,000 over 3 years from 2014-15). Currently, superannuation contributions that exceed the non-concessional contributions cap are taxed punitively at 46.5% (47% from 1 July 2014). For any excess contributions made after 1 July 2013, the penalty regime for certain breaches will be relaxed. The Government will allow individuals the option of withdrawing superannuation contributions in excess of the non-concessional contributions cap made from 1 July 2013 and any associated earnings, with these earnings to be taxed at the individual’s marginal tax rate, This measure seeks to provide relief for superannuation members where an inadvertent breach the contribution caps would result in a disproportionate tax penalty, however those who leave the excess contributions in the super fund will still face punitive tax penalties. Date of effect - from 1 July 2013 Page | 6 2014-2015 Commonwealth Budget Report SUPERANNUATION – DEFERRAL OF SUPERANNUATION GUARANTEE INCREASE Compulsory superannuation guarantee contributions will rise from the current rate of 9.25 per cent to 9.5 per cent from 1 July 2014 and remain frozen for four years until June 2018. It will then rise by 0.5 percentage points each year until it reaches 12 per cent in 2022-23. SUPERANNUATION GUARANTEE CHARGE RATES FINANCIAL YEAR 2013-14 RATE (%) 9.25 % 2014-15 9.50 % 2015-16 9.50 % 2016-17 9.50 % 2017-18 9.50 % 2018-19 10.00 % 2019-20 10.50 % 2020-21 11.00 % 2021-22 11.50 % 2022-23 12.00 % Date of effect - from 1 July 2014 Please Note: Many of the comments in this publication are general in nature and anyone intending to apply the information to practical circumstances should seek professional advice to independently verify their interpretation and the information's applicability to their particular circumstances. Liability limited by a scheme approved under Professional Standards Legislation. Page | 7