Medicare levy - Great-teaching

advertisement

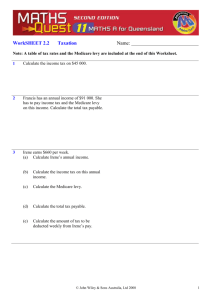

WorkSHEET 2.2 Taxation Name: ___________________________ Note: A table of tax rates and the Medicare levy are included at the end of this Worksheet. 1 Calculate the income tax on $45 000. Tax = $4200 + 0.3 ($45 000 – $34 000) Tax = $7500 2 Francis has an annual income of $91 000. She has to pay income tax and the Medicare levy on this income. Calculate the total tax payable. Tax = $18 000 + 0.4 ($91 000 – $80 000) Tax = $22 400 Medicare levy = 1.5% of $91 000 Medicare levy = 0.015 $91 000 Medicare levy = $1365 Total tax = $22 400 + $1365 Total tax = $23 765 3 Irene earns $660 per week. (a) Calculate Irene’s annual income. (a) Annual income = 52 $660 Annual income = $34 320 (b) Calculate the income tax on this annual income. (b) Tax = $4200 + 0.3 ($34 320 – $34 000) Tax = $4296 (c) Calculate the Medicare levy. (c) Medicare levy = 1.5% of $34 320 Medicare levy = 0.015 $34 320 Medicare levy = $514.80 (d) Calculate the total tax payable. (d) Total annual tax = $4296 + $514.80 Total annual tax = $4810.80 (e) Calculate the amount of tax to be deducted weekly from Irene’s pay. (e) Weekly tax = $4810.80 52 Weekly tax = $92.52 © John Wiley & Sons Australia, Ltd 2008 1 Maths Quest A Year 11 for Queensland 2e 4 WorkSHEET 2.2 Taxation Karen earns $3600 per fortnight. Calculate the PAYG tax owing on this fortnightly income. (Remember to include the Medicare levy.) Annual income = 26 $3600 Annual income = $93 600 Tax = $18 000 + 0.4 ($93 600 – $80 000) Tax = $23 440 Medicare levy = 1.5% of $93 600 Medicare levy = 0.015 $93 600 Medicare levy = $1404 Total annual tax = $23 440 + $1404 Total annual tax = $24 844 Fortnightly tax = $24 844 26 Fortnightly tax = $955.54 5 Last year, Alan had a taxable income of $108 450 and he paid $33 577 in PAYE tax. Alan has no private health insurance and so must pay the Medicare levy surcharge of an extra 1% of gross pay. Determine the amount of Alan’s tax refund or tax debt. Tax = $18 000 + 0.4 ($108 450 – $80 000) Tax = $29 380 Medicare levy (including surcharge) Medicare levy = 2.5% of $108 450 Medicare levy = 0.025 $108 450 Medicare levy = $2711.25 Total tax = $29 380 + $2711.25 Total tax = $32 091.25 Refund = $33 577.00 – $32 091.25 Refund = $1485.75 6 Jeremy earned $57 200 from his salary and $550 from bank interest. He had $1730 of tax deductions and paid PAYG tax of $11 300. Determine whether or not Jeremy has paid sufficient tax. Taxable income = $57 200 + $550 – $1730 Taxable income = $56 020 Tax = $4200 + 0.3 ($56 020 – $34 000) Tax = $10 806 Medicare levy = 1.5% of $56 020 Medicare levy = 0.015 $56 020 Medicare levy = $840.30 Total tax = $10 806 + $840.30 Total tax = $11 646.30 Debt = $11 646.30 – $11 300 Debt = $346.30 © John Wiley & Sons Australia, Ltd 2008 2 Maths Quest A Year 11 for Queensland 2e WorkSHEET 2.2 Taxation 7 The pre-GST price of a set of golf clubs is $450. Calculate the GST payable on the purchase of the golf clubs. GST = 10% of $450 GST = 0.1 $450 GST = $45 8 The pre-GST price of a tennis racquet is $80. Calculate the selling price including GST. GST = 10% of $80 GST = 0.1 $80 GST = $8 Selling price = $80 + $8 Selling price = $88 9 A pizza meal costs $16.50 including GST. Calculate the pre-GST price of the meal. GST = 111 of $16.50 GST = $1.50 Cost pre-GST = $16.50 – $1.50 Cost pre-GST = $15 10 A VAT of 12.5% is levied in New Zealand. Calculate the VAT paid if Georgia pays $90 (including VAT) for a day trip. 112.5% of cost = $90 Cost = $90 1.125 = $80 VAT = $10 © John Wiley & Sons Australia, Ltd 2008 3 Maths Quest A Year 11 for Queensland 2e WorkSHEET 2.2 Taxation Taxation rates Taxable income $0 – $6000 $6001 – $34 000 $34 001 – $80 000 $80 001 – $180 000 Over $180 000 Tax on this income Nil 15c for each $1 over $6000 $4200 plus 30c for each $1 over $34 000 $18 000 plus 40c for each $1 over $80 000 $58 000 plus 45c for each $1 over $180 000 Medicare levy The basic Medicare levy is 1.5% of taxable income. The Medicare levy surcharge applies for those without private hospital cover. The income threshold upon which families are charged the Medicare levy surcharge (an extra 1% of gross income) is $150 000 per annum. This threshold changes depending on the number of children in the family. For a single person, the surcharge applies if their income exceeds $100 000 per annum. © John Wiley & Sons Australia, Ltd 2008 4