WS-2 - Great-teaching

advertisement

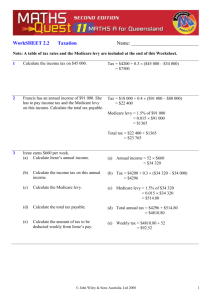

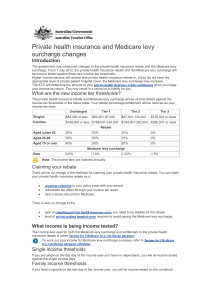

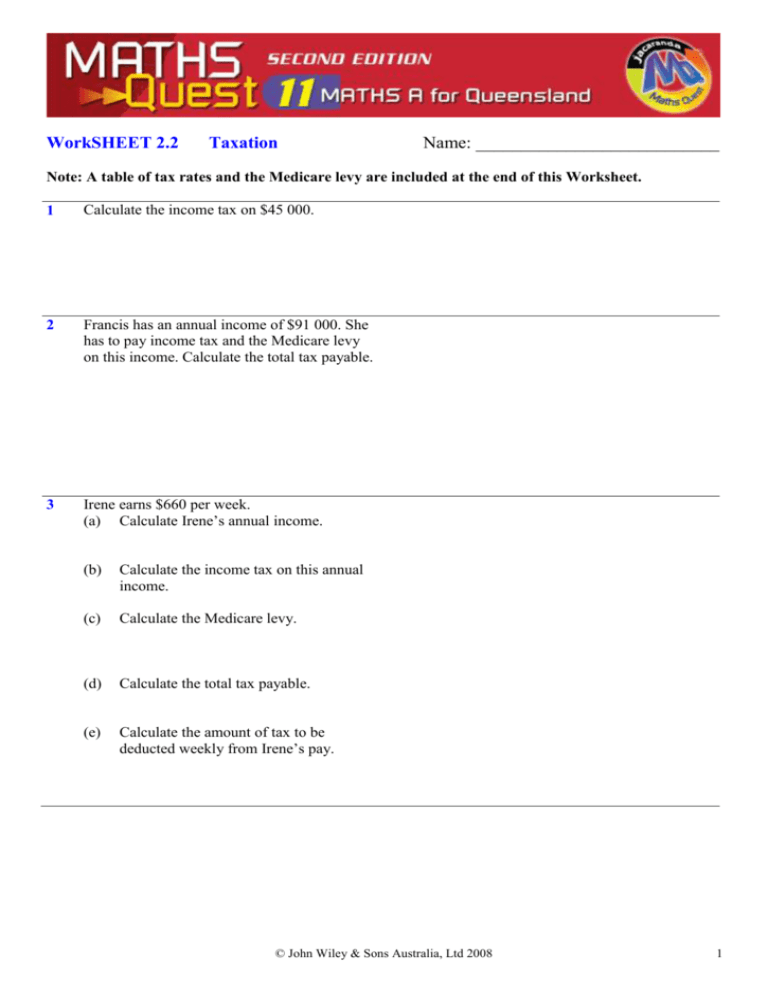

WorkSHEET 2.2 Taxation Name: ___________________________ Note: A table of tax rates and the Medicare levy are included at the end of this Worksheet. 1 Calculate the income tax on $45 000. 2 Francis has an annual income of $91 000. She has to pay income tax and the Medicare levy on this income. Calculate the total tax payable. 3 Irene earns $660 per week. (a) Calculate Irene’s annual income. (b) Calculate the income tax on this annual income. (c) Calculate the Medicare levy. (d) Calculate the total tax payable. (e) Calculate the amount of tax to be deducted weekly from Irene’s pay. © John Wiley & Sons Australia, Ltd 2008 1 Maths Quest A Year 11 for Queensland 2e WorkSHEET 2.2 Taxation 4 Karen earns $3600 per fortnight. Calculate the PAYG tax owing on this fortnightly income. (Remember to include the Medicare levy.) 5 Last year, Alan had a taxable income of $108 450 and he paid $33 577 in PAYE tax. Alan has no private health insurance and so must pay the Medicare levy surcharge of an extra 1% of gross pay. Determine the amount of Alan’s tax refund or tax debt. 6 Jeremy earned $57 200 from his salary and $550 from bank interest. He had $1730 of tax deductions and paid PAYG tax of $11 300. Determine whether or not Jeremy has paid sufficient tax. © John Wiley & Sons Australia, Ltd 2008 2 Maths Quest A Year 11 for Queensland 2e WorkSHEET 2.2 Taxation 7 The pre-GST price of a set of golf clubs is $450. Calculate the GST payable on the purchase of the golf clubs. 8 The pre-GST price of a tennis racquet is $80. Calculate the selling price including GST. 9 A pizza meal costs $16.50 including GST. Calculate the pre-GST price of the meal. 10 A VAT of 12.5% is levied in New Zealand. Calculate the VAT paid if Georgia pays $90 (including VAT) for a day trip. © John Wiley & Sons Australia, Ltd 2008 3 Maths Quest A Year 11 for Queensland 2e WorkSHEET 2.2 Taxation Taxation rates Taxable income $0 – $6000 $6001 – $34 000 $34 001 – $80 000 $80 001 – $180 000 Over $180 000 Tax on this income Nil 15c for each $1 over $6000 $4200 plus 30c for each $1 over $34 000 $18 000 plus 40c for each $1 over $80 000 $58 000 plus 45c for each $1 over $180 000 Medicare levy The basic Medicare levy is 1.5% of taxable income. The Medicare levy surcharge applies for those without private hospital cover. The income threshold upon which families are charged the Medicare levy surcharge (an extra 1% of gross income) is $150 000 per annum. This threshold changes depending on the number of children in the family. For a single person, the surcharge applies if their income exceeds $100 000 per annum. © John Wiley & Sons Australia, Ltd 2008 4