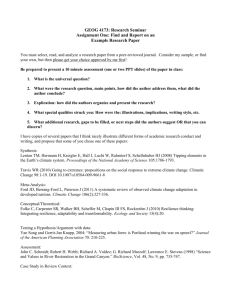

International Academy for Case Studies (IACS)

advertisement