Tesco Strategic Report 2014

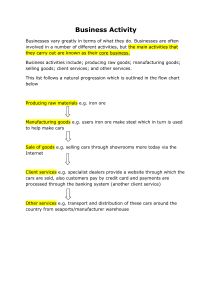

advertisement