Manufacturing Opportunities and Challenges in Indonesia

advertisement

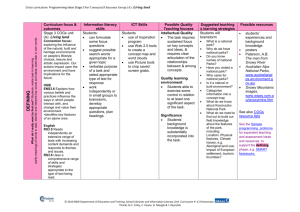

Manufacturing Opportunities and Challenges in Indonesia Lukman The Chief Marketing Officer Investment Promotion (Indonesia) Sembcorp Parks Management Pte Ltd © Sembcorp Parks Management Pte Ltd 2015 1 Indonesia Singapore Jakarta Semarang Surabaya Central Java Large Pool of Competitive Manpower Population – 250 million (World’s 4th) Population growth rate – 3.4 mil (1.4%) p.a. © Sembcorp Parks Management Pte Ltd 2015 2 Economic Data Baa3 6% US$5,200 GDP per capital (Purchasing power parity adjusted, 2013) • Stable GDP Growth • Average 6% in recent years • Back to Investment Grade Rating • Regained investment credit rating from Ba1 to Baa3 © Sembcorp Parks Management Pte Ltd 2015 • Strong domestic consumption with a rising middle income group 3 Abundant of Manpower Growing Trend of Working Population Mil 300 250 205.8 203.5 228.5 225.6 222.2 219.2 217.9 215.3 212 244.47 241 237.6 231.4 247.95 200 Total Population 150 Employed Person 118.05 100 89.9 90.8 91.6 90.8 93.7 94.9 95.5 99.9 102.6 104.9 108.2 110 118.19 Employed Person (Less than 35hours a week) 50 31.8 30.2 31.4 30.9 30.2 0 © Sembcorp Parks Management Pte Ltd 2015 32.1 31.5 32.7 33.3 31.6 33.3 34.6 34.3 36.81 Source : BPS 4 Abundant of Resource Production and proven reserve amount of Major Natural Resources Proven Reserved Amount Type or Recourses Total Share Rank Total Share Rank Oil 4 bil barrel 0.2% 28 942,000 barrels/ day 1.1% 20 Natural Gas 104.Tcf 1.4% 15 7.3bcf / day 2.3% 10 Coal 5.5 bil Ton 0.6% 13 325 mil ton 5.1% 6 OIL Production / Consumption Natural Gas Production / Consumption Million ton 80 60 40 20 0 Production 70 60 50 40 30 20 10 0 Consumption Production comparison of OIL, Natural Gas and Coal 500 Million ton 100 Million ton Production 400 300 200 100 0 Production Consumption Oil Natural Gas Coal Production and proved reserve amount of other resources besides Coal Type of Resource Unit Alloy Proved Reserve amount (2011) Production amount (2011) Total Share Rank Total Share Rank Ton 800,000 16.3% 2 42,000 17.2% 2 Copper 1000 ton 28,000 4.1% 8 543 3.4% 9 Nickel Ton 3,900,000 5.2% 7 290,000 14.9% 1 Bauxite 1000 ton 900,000 3.2% 6 37,100 14.3% 3 © Sembcorp Parks Management Pte Ltd 2015 Above Source : BP Statistical Review of World Energy 2014 Left Source : USGS 5 Growth Rate of Real GDP Less fluctuation stable economy growth 20 15 Indonesia 10 7.82 5 4.7 0.79 0 China 5.69 5.5 6.35 6.01 4.63 6.22 6.49 6.26 5.78 5.16 4.2 3.64 4.5 4.78 5.03 India Singapore Thailand -5 Malaysia -10 -13.13 -15 Source : IMF Market Trend of Durable Goods Car 1400 1200 1000 800 600 400 200 0 1116 765 483 604 534 319 434 Motor Bike ,000 ,000 1000 1230 894 600 486 740 800 Car 400 509 389 628 588 804 706 774 447 471 Motor Bike 200 0 Source : GAIKINDO © Sembcorp Parks Management Pte Ltd 2015 Source : AISI 6 Market Trends of White goods 7000 ,000 6000 5000 4000 3000 2000 1000 0 2004 2005 TV 2006 Fridge 2007 2008 Washing Machine 2009 2010 2011 Air con Source : EMC, GABEL © Sembcorp Parks Management Pte Ltd 2015 7 Demographic Trend Indonesia From 1975 to 2030 (55 years) China 2030~ From 1970 to 2015 (45 years) India 2015~ From 1970 to 2045 (75 years) 2045~ Singapore From 1970 to 2015 (45 years) 2015~ Thailand From 1970 to 2015 (45 years) 2015~ Japan From 1930 to 1995 (65 years) 1930 1940 1950 1960 1970 1995 1995 ~ 1980 1990 1995 2000 2010 2015 2020 2030 2035 2040 2045 2050 Working population (age between 15 ~ 64 years old) Risk of declining in the working population Source : Euromonitor International from National Statistics Indonesia’s Middle Income (Household disposable income US$ 5,000 ~ US$ 35,000 annually) Year 2009 : 80 million Year 2020 : 190 million Source : Euromonitor International 2010 © Sembcorp Parks Management Pte Ltd 2015 8 Some challenges... 1. Emerging countries competing for FDIs (Vietnam, Myanmar, the Philippines, Cambodia, Thailand, India, China) 2. Commitment of the Indonesian government to achieve the targeted GDP growth of 5.8% for 2015 -90% of the budgeted expenditure for 2015 has to be absorbed -Promote FDI into the country 3. Implementing structural reforms aimed at transforming the civil service to be more customer centric 4. Need to build massive infrastructure (Roads, Ports, Utilities, etc) © Sembcorp Parks Management Pte Ltd 2015 9 Sembcorp Development Projects in Indonesia 1990 Batamindo Industrial Park (No longer managed by SCD) 1994 Bintan Industrial Estate (No longer managed by SCD) 2013 Kendal Industrial Park (2700 ha) © Sembcorp Parks Management Pte Ltd 2015 10 Kendal Industrial Park A Cost-Competitive Location for Global Market © Sembcorp Parks Management Pte Ltd 2015 11 About Developers Sembcorp A Singapore Government-Linked Organisation (49.5%) © Sembcorp Parks Management Pte Ltd 2015 13 Sembcorp October 1998 Temasek Holdings (49.5%)* Public Shareholders (50.5%) 100% 100% Utilities Urban Development 60.6*% Public Shareholders 39.4% Marine * As at July 2013 © Sembcorp Parks Management Pte Ltd 2015 14 Positioned in key growth areas 11 projects in 700 tenants US$14bn in direct 3,579 ha Vietnam, China and Indonesia VIETNAM comprising MNCs and leading local enterprises investments attracted CHINA to our integrated developments remaining saleable land Vietnam China 5 projects strategically located in the southern, central and northern economic zones Key growth regions. Well placed to benefit from shift towards centralwestern China development Enhancing value through selective C&R developments Java, Indonesia Central Java expected to benefit from investment spillovers from Jakarta *Sembcorp also pioneered the developments of Batamindo Industrial Park and Bintan Industrial Estate © Sembcorp Parks Management Pte Ltd 2015 15 Our Business Model Value Creation Industrial Park Model Urban Development Model Land Developer Land Developer • Industrial land sales • Industrial land sales • Commercial & Residential land sales Real Estate Developer Real Estate Developer • Ready-built factories (RBF) • Built-to-suit factories • Commercial & Residential - Within the Parks - Around the Parks • Ready-built factories (RBF) • Built-to-suit factories Facilities Management Facilities Management Utilities Utilities 1990 © Sembcorp Parks Management Pte Ltd 2015 2007 Future potential 16 PT Jababeka Tbk • • Established in 1989 and listed in Jakarta Stock Exchange Other businesses include power plant (PT Bekasi Power) and logistics (PT Cikarang Dry Port) Leading Industrial Township Developer in Indonesia Kota Jababeka Cikarang 5600ha Jakarta Tanjung Lesung 1500ha Tanjung Lesung © Sembcorp Parks Management Pte Ltd 2015 Kota Jababeka 17 Indonesia Central Java Semarang Right Place, Well Positioned Amenities Cultural & Tourism © Sembcorp Parks Management Pte Ltd 2015 Good Living Leisure & Relax 18 Central Java • Area: 39,800.69 km2 • Population: 32.9 million which provides a young and technically trained workforce • GDP Growth (2013): 6% • Provincial Capital: Semarang SEMARANG SURABAYA SOLO © Sembcorp Parks Management Pte Ltd 2015 19 Central Java Offers Higher Education Level Home to many Vocational Training Institutes Garment Vocational Province 1.189 Vocational Training Institutes (150.000 graduates / year) 274 Universities, 20 Polytechnics (103.000 graduates / year) Training Centre (1200 graduates / year) Electrical & Electronics © Sembcorp Parks Management Pte Ltd 2015 Carpentry Automotive IT 20 International Airport in Semarang Ahmad Yani International Airport Direct Flight: Singapore – Semarang : 2h05mins Jakarta – Semarang : 55mins © Sembcorp Parks Management Pte Ltd 2015 21 International Sea Port in Semarang Tanjung Emas (3rd largest Sea Port in Indonesia) The Export data as of June 2014 reported by Statistical Board of Central Java CHANNEL -10 M BASIN -10 M United States China Japan 21% Germany 13% 9% 3% 4% 7% 3% 3% SAMUDERA WHARF Malaysia 31% 3% BASIN -9 M CONTAINER TERMINAL Singapore BASIN -7 M NUSANTARA WHARF BASIN -6 M EX PLTU WHARF Korea Turkey BASIN -6 M CPO WHARF 3% Taiwan United Kingdom Other countries © Sembcorp Parks Management Pte Ltd 2015 22 Manufacturing Industry Sectors in Semarang Manufacturing Industries in Semarang Area Source: Colliers International Indonesia – Research and Advisory in 2013 © Sembcorp Parks Management Pte Ltd 2015 23 Working-Living Environment City Centre Residential Township Golf & Country Club © Sembcorp Parks Management Pte Ltd 2015 Accommodation Borobudur Temple 24 Kendal Industrial Park Cost Competitive, Integrated, Sustainable © Sembcorp Parks Management Pte Ltd 2015 25 Strategic Location International Airports: Ahmad Yani Airport – 20 km Semarang City : 21 km International Seaport : Tanjong Emas Port – 25 km © Sembcorp Parks Management Pte Ltd 2015 26 Kendal Industrial Park Phase 1 (860 Hectares) On-site Port Waste-water Treatment Plant Proposed Power Plant Industrial Land Plots Commercial & Residential Ready-built Factories © Sembcorp Parks Management Pte Ltd 2015 • Total Development: 2,700 Hectares • Mixed use development: encompassing mainly industrial use, as well as residential & commercial • Water-front land: facing northern coast of Central Java 27 Target Industries Garment, Textile & Leather Products Abundant teak wood raw materials Consumer Electronics / Automotive Parts Wooden Furniture Heavy Industries / Steel Food Processing Ideal sea front land for mineral ores processing/smelting Basic Chemical Consumer Care © Sembcorp Parks Management Pte Ltd 2015 28 Competitive Manpower - Kendal Kendal Minimum Wage : 2015 : Rp 1,383,450 per month (USD 110) (Exchange rate used is US$1 : Rp 12,500) © Sembcorp Parks Management Pte Ltd 2015 29 One-Stop-Service Kendal Industrial Park provides total customer support for fast start-up and hassle-free operation Manpower Recruitment Assistant Business Licence One-Stop Services Estate Maintenance & Security © Sembcorp Parks Management Pte Ltd 2015 Logistics 30 Excellent Infrastructure Kendal Industrial Park will be equipped with international standard infrastructure and supporting amenities to take care of your business needs • Prepared land plots for custom-built factory • Ready-built factories • Reliable electricity, water & waste-water treatment • Executive housing with full-fledge amenities • Well-managed worker dormitories Prepared land plots Ready-built factories © Sembcorp Parks Management Pte Ltd 2015 31 Milestones JVA Signing - Investors to start building factories - Absorption of workforce 2020 2013 & 2014 2012 Begin Phase 2 (1910 Ha) 2020 beyond 2014 & 2015 - Land Resettlement & Infrastructure Development for Phase 1 (860 Ha) © Sembcorp Parks Management Pte Ltd 2015 Completion of Phase 1 32 We welcome you to be our partner Thank You © Sembcorp Parks Management Pte Ltd 2015 33