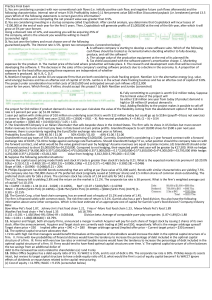

1. General Motors (GM) sells for $66.00 per share. The expected dividend for next year is $2.40. Use the single-period DDM to predict GMs stock price one year from today. The risk-free rate of return is 5.3%, the equity risk premium is 6.0 percent, and GM’s beta is 0.90. 2. The risk-free rate is 6%, the required return on the market is 10%, and Upton company’s stock has a beta coefficient of 2.5. If the dividend expected during the comping year is $2.25 and if g = a constant 5%, at what price should Upton’s stock sell if market is in equilibrium? 3. A stock is expected to pay a dividend of $0.75 at the end of the year. The required rate of return is 12.5%, and the expected constant growth rate is 8.5%. What is the current stock price? 4. A firm's last dividend was $1.50. The dividend growth rate is expected to be constant at 15% for 3 years, after which dividends are expected to grow at a rate of 6% forever. If the required return is 11%, what is the company's current stock price?