Financial Services Act

Corporate

Kuala Lumpur

MEMBER FIRM OF BAKER & MCKENZIE INTERNATIONAL

Client Alert

April 2013

In This Issue:

For further information, please contact:

Brian Chia

+603 2298 7999 brian.chia@wongpartners.com

Wong Sue Wan

+603 2298 7884 suewan.wong@wongpartners.com

Level 21,

The Gardens South Tower,

Mid Valley City,

Lingkaran Syed Putra,

59200 Kuala Lumpur

Malaysia

Financial Services Act

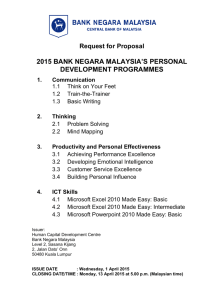

The Financial Services Act (" FSA ") was passed by Parliament, and recently received the Royal Assent. It is anticipated to come into force in mid-2013.

The FSA will consolidate the Banking and Financial Institutions Act 1989,

Insurance Act 1996, Payment Systems Act 2003 and Exchange Control Act

1953.

We had in our previous Client Alert outlined the salient changes introduced by the FSA that will affect banking and financial institutions and insurers, and their shareholders.

This Client Alert sets out the key changes to payment systems and exchange control under the FSA.

Payment Systems

Generally, there are no substantive changes to the regulation of the operational aspects of carrying on of a payment system business and the business of issuing payment instruments. Numerous provisions of the

Payment Systems Act 2003 have been retained and carried over into the

FSA. By way of example, the FSA continues to require that an operator of a payment system or approved issuer of a designated payment instrument must establish rules, procedures and requirements delineating the rights, liabilities or other obligations of the operator and the participants, and also put in place measures to ensure the safety, security and operational reliability of the payment system or payment instrument. Thus, there would not be a need to overhaul the existing infrastructure and systems utilized by an operator of a payment system or issuer of a payment instrument.

However, streamlining of the licensing and approval procedures for all participants in the financial sector under the FSA have a consequential effect on businesses that intend to operate a payment system or issue designated payment instruments (" Operators ").

Under the FSA, the criteria by which any applicant for a licence from the

Minister of Finance (i.e. banks and insurers) or an applicant for an approval from BNM (i.e. an Operator) would be assessed is the same. An applicant will need to, amongst others, provide sound and feasible plans for the conduct of the business, evidence of financial resources and justify how its participation would be in the best interest of Malaysia.

The FSA has also extended the application of prudential requirements to the

Operators. Prudential requirements have hitherto generally applied only to financial institutions. The approval of BNM must now be sought for the appointment, election, re-appointment and re-election of the chairman, directors, chief executive officer and the auditors of the Operators. Financial statements of the Operators will also have to be published and therefore made generally available to the public.

These changes acknowledge that Operators play a crucial role and can have an impact on the stability of the financial sector.

Accordingly, the FSA gives power to BNM to assume control over the whole or part of the business, affairs or property of the Operators, manage it and/or appoint any person to do so on behalf of BNM, in a situation where it considers that the financial stability of the Operator is at risk (which would consequentially detrimentally affect the participants, users, creditors of the

Operator or the general public). As with financial institutions, BNM can alternatively choose to designate a bridge institution to be vested with the business, assets and liabilities of the distressed Operator. The bridge institution will then be granted reprieve from compliance with certain provisions of the FSA pending the regularization of the business of the

Operator.

Exchange Control

Over the course of the last decade, the exchange control regime in Malaysia has been gradually liberalised. The FSA takes a further step in this direction by further simplifying the regime. In this regard, the FSA merely prescribes a list of transactions that requires the prior approval of BNM . In this regard, any proposed transaction falling within the list (e.g. borrowing or lending of Ringgit

Malaysia between non-residents, retaining or using the Ringgit Malaysia by a non-resident, giving or obtaining any guarantee in respect of any debt or liability, importing into or exporting from Malaysia of the Ringgit Malaysia, foreign currency, gold or other precious metals) would require the prior approval of BNM. Regardless of the type of transaction, an application must be submitted to BNM for approval. In granting any approval, BNM is granted the discretion to impose any requirement, restriction or condition.

The Exchange Control Act is currently supplemented by the exchange control notices (" ECM notices ") that are issued from time to time by the Controller of

Foreign Exchange (i.e. BNM). It is anticipated that the ECM notices will continue to apply when the FSA comes into force.

©2013 Baker & McKenzie. All rights reserved. Baker & McKenzie International is a Swiss Verein with member law firms around the world. In accordance with the common terminology used in professional service organizations, reference to a “partner” means a person who is a partner, or equivalent, in such a law firm. Similarly, reference to an “office” means an office of any such law firm.

This may qualify as “Attorney Advertising” requiring notice in some jurisdictions. Prior results do not guarantee a similar outcome.

2 Financial Services Act

April 2013