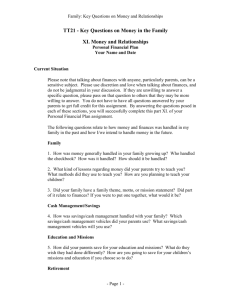

making financial decisions - The Money Carer Foundation

advertisement