CUSTOMER PROFITABILITY APPROACH

advertisement

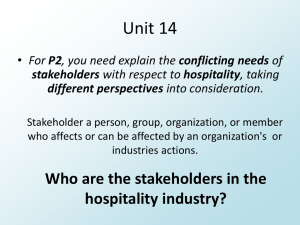

CUSTOMER PROFITABILITY APPROACH: MEASUREMENT AND RESEARCH DIRECTIONS IN THE HOSPITALITY INDUSTRY Sandra JANKOVIĆ Faculty of Hospitality and Tourism Management, University of Rijeka Primorska 42, 51210 Opatija e-mail: sandrai@fthm.hr Milena PERŠIĆ Faculty of Hospitality and Tourism Management, University of Rijeka Primorska 42, 51210 Opatija e-mail: milenap@fthm.hr and Tatiana ZANINI-GAVRANIĆ Solmelia Hrvatska d.o.o., 52470 Umag e-mail: tatiana.zanini@solmelia.htnet.hr ABSTRACT This paper provides a conceptual and methodological framework for measuring customer profitability by introducing a market-oriented managerial accounting system in the hospitality industry. Customer accounting will be examined within the theoretical framework of strategic-oriented accounting. Particular emphasis is placed on the precise specification of the input into a profitability analysis and the measures of the degree of profit concentration among customers. Based on empirical research carried out in Croatian hotels, the aim of this paper is to examine the use of strategic- oriented accounting in the Croatian hotel industry. Key words: customer profitability analysis, activity based costing, hotel industry, customer accounting INTRODUCTION To improve hotel performance, managers often target multiple customer segments, because it seems logical to think that the more customers the hotel has, the wider variety of products and services it offers, the more profitable the hotel will be. However, hotel managers should be aware that some customers are more profitable to the hotel than others. To keep the most profitable customers satisfied, managers must take into account the relevant revenue and costs, to determine the customer segments that generate the greatest profit contribution. The main benefit of customer profitability analysis (CPA) in hospitality industry is to provide decisions-makers with customer –related information. However, calculating the customer profit contribution is essential in order to measure customer costs. Customer cost information is important for managerial decision making, but obtaining accurate information about serving different customers requires the use of a developed hotel accounting information system with an appropriate costing method. Many authors emphasise that the hotel industry still does not have a properly developed management accounting system that could provide useful information for decision making. Rather it is oriented towards the traditional cost accounting system (such as the marginal costing method) and is very slow to adapt their performance measurement system to modern trends (Phillips, 1999; Banker et.al., 2000; Brander-Brown & Aktinson, 2001; Mia&Patiar, 2001; Pavlatos&Paggios 2009, Dittman et al., 2009) Much of the design of management accounting systems in the hotel industry evolved from the Uniform System of Accounts for the Lodging Industry (USALI). Structured using the principles of responsibility accounting, the USALI enables the evaluation of the performance of departmental managers based on revenues and controllable departmental costs. It is designed to facilitate the control of the departmental contribution margin. It does not allocate the hotel overhead costs, but leaves them in the profit and loss account as period costs in the service (cost) departments, where they have arisen. Calculating customer profitability is not possible on the basis of the USALI system. However, marketing planning in hotels focuses on market segmentation, with specific marketing activities and packages targeted at individual market segments or customer groups. Thus there is a mismatch of information, with accountants producing information for departments, whilst revenue managers are making decisions on market segments and customer groups. Therefore, the activity-based costing (ABC) method should be implemented to trace the costs to customer segments (Dunn&Brooks, 1990; Noone & Griffin, 1999; Jankovic, 2001; Collini, 2006; Krahmal 2006) and meet the operating data requirements of revenue decision makers. However, the use of ABC in the hotel industry is very limited (Pavlatos & Paggios 2009). 1. MEASURING CUSTOMER PROFITABILITY Customer profitability analysis (CPA) entails allocation of revenues and costs to specific customers in a way that the profitability of individual customers can be calculated (Kaplan & Narayanan, 2001). They state that understanding CPA is especially important for service companies, because the cost of providing a service is generally determined by customer behaviour. The cost of finding and gaining a new customer in service companies is five times greater than the costs of retaining current customers. (Zeithaml & Bitner, 1996) Therefore, successful implementation of CPA in order to retain profitable relationship with current customers is essential for service companies, and therefore the hospitality industry. Management accounting research literature has devoted limited attention to customer profitability (Luft & Shields, 2003). In marketing literature, there has been a growing interest on this issue. Despite this, the link between customer relationship management (CRM) and the analysis of customer profitability has not been researched enough in the hospitality industry. Hotel managers usually have two main sources of information: accounting information and market research. Traditional, accounting information is used to analyse past performance, evaluate departmental income and establish the budget. Market research is used to evaluate customer needs and satisfaction and forecast future business. There is a strong degree of interdependency between these two sources of information. (Downie, 1997). The emphasis should be to develop accounting information and reports to support marketing decision making in hotels, to increase customer profitability. Customer profitability can be assessed in a number of ways. Assessment may vary from sales minus direct customer costs to budgeted lifetime sales minus direct and indirect costs (Van Raaij et al.2003). However, marketing literature uses different terms (customer value, customer lifetime value, customer equity) and assessment methods. The objective of customer profitability analysis is to assign the revenues, expenses, assets and liabilities of a hotel to the customer who causes them. To calculate customer profitability, hotels need to establish a customer account. Usually the customer account is the customer’s code in the system. The account is created at the same time as the customer is created in the account system and becomes the hotel’s client. The purpose of an account is to accumulate the customer’s periodic profitability data. (Krakhmal, 2006). While usually information on customer costs is not available in a hotel, and activity-based costing (ABC) system should be implemented to calculate them, information on customer revenue is available from the hotel’s sales system. Individual items (revenue and costs) in periodic reports can vary from hotel to hotel. Krakhmal suggested the following (Krahamal, 2006) MEASURING CUSTOMER PROFITABILITY: Sales revenue from customer (+) Other income from customer (- ) Discounts (- ) Direct marketing support (-) Customer distribution costs (-) Cost of sales (-) Equipment costs (-) Inventory holding costs (-) Service costs (-) Credit costs (-) Other costs…. etc. (=) Customer profitability Several approaches to analysing customer profitability are suggested in literature. Kaplan & Narayannan (2001) suggested customer comparison by using a matrix combining customer profitability and level of customer focus. 2. COST ALLOCATION IN THE HOSPITALITY INDUSTRY Although revenue data by customer group can be sourced directly from many property management systems or revenue management systems, the key problem lies in the identification of customer costs. In order to measure the costs of serving each customer or customer group, it is required to implement ABC method. The issue in ABC lies in the identification of good cost drivers to attribute them to different customer groups. In hospitality industry, ABC should be an integrated part of the management accounting system, which means that USALI, the turnkey of hotel management accounting systems, should be enhanced with the ABC method. 2.1. Uniform System of Accounts for Lodging Industry - USALI USALI establishes standardized formats and account classifications for the preparation and presentation of hotel departmental statements, which originated in the USA and was first published in 1926. It represented the first successful organized effort to establish a uniform responsibility accounting system for the hotel industry and one of the first such efforts in any industry. Although ten editions have been published since then, the basic principles have remained the same. It is structured using the principles of responsibility accounting and marginal costing method, and enables the evaluation of the performance of departmental managers based on revenues and costs within their control. The departmental statements of income provide some of the most important internal sources of information for hotel managers. To help ensure report uniformity, which is important for the benchmarking of operating units, the department (profit centre) income is calculated by charging only a limited number of costs (controllable costs) against revenues that are traceable to the department. Because of this approach, departmental expenses omit a number of significant costs that may be incurred by a profit centre. For most hotel properties, undistributed operating expenses (including administrative and general, marketing, property operation and maintenance, and utility expenses), combined with management fees, rent, property taxes and insurance comprise a considerable portion of the total expenses. However, the result of profit centres does not go far enough to derive a comprehensive contribution analysis. For example, each profit centre uses a proportion of the energy costs and attains certain benefits from marketing activity. But, energy and marketing costs remain as undistributed operating expenses and are not allocated to profit centres. Although the 8th edition of USALI suggested several bases for allocating undistributed operating expenses to profit centres, the 9th edition recommends only the use of a systematic and logical approach that reflects resource consumption. The 10th edition does not deal with the allocation issue at all. Figure 1: From USALI to ABC USALI GIVES ANSWERS TO DEPRTMENTAL CONTRIBUTION MARGIN DOES NOT GIVE ANSWERS T O OVERALL DEPATRMENTA L RESULT CUSTOMER PROFITABILITY GIVES ANSWERS TO ACTIVITY BASED COSTING To better understand the impact of decisions on operating costs and revenues, managers need to know the overall cost of profit or cost centre. In order to identify costs to support also the revenue management decisions, cost object calculation should include all support and fixed costs as well as the specific variable costs. For this purpose USALI is insufficient and must be supplemented with the ABC method, to provide information on strategic business issues that the hotel faces as well as to meet the operating data requirements of revenue decision makers. The issue in the implementation of ABC lies in the identification of activity and their good drivers to attribute costs to the different customer groups. 2.2. Activity based costing - ABC ABC is the methodology that measures cost and performance of activities, resources and cost objects. Resources are assigned to activities, then activities are assigned to cost objects based on their use. ABC recognizes the causal relationship of cost drivers to activities (Raffisch & Turney, 1991). ABC has two dimensions: the process view and the cost assignment view. Activity exists at the intersection of the cost and process view. The process view is the horizontal dimension and shows what causes work (cost drivers) and how well it is done (performance measures). It helps identify improvement opportunities and ways to improve. The vertical dimension assigns cost from resources to activities and from the activities to the cost objects (product, service, customer, market segment). Information produced by the ABC system is able to reduce the information gap between marketing and accounting. Kaplan and Cooper emphasise that service firms can benefit from using ABC as they have the same set of issues as manufacturers, e.g. analyzing operating expenses, activities being performed, which services demand resources, etc. (King, 2001) Research conducted on applying the ABC system in the hospitality industry is very limited. Noone and Griffin (1999) developed a case study, where hotel activities were determined and the costs of these activities were assigned to specific customers using ABC. Raab and Mayer (2003) surveyed restaurant controllers in the USA and they found that the use of ABC was almost non-existent in restaurants. Raab et.al. (2010) developed an ABC model to support kitchens in order to eliminate the monthly allocation of overhead based on variable costs. The first attempt to use a time-driven ABC in the hospitality industry to implement a customer profitability analysis was introduced by Dalci et.al. (2009). Their results showed that some of the customer segments which were found unprofitable under the conventional ABC method were determined profitable using TDABC. From a cost accounting viewpoint, ABC can be considered as a two-stage allocation procedure. The first stage of this procedure assigns indirect resource costs to cost pools by means of resource drivers, or first stage cost drivers. In the hospitality industry the first stage represents the tracing of cost items from USALI reports to activity, according to resource drivers. Resource drivers are chosen to reflect the use of the resources by the activities. Typically, related activities are enclosed in an activity centre that reports pertinent information about activities in a function or process. Each type of resource that is traced to an activity becomes a cost element and is included in an activity cost pool. The second stage of the process traces costs from the cost pools to objects by means of an activity driver, or second stage driver. In the hospitality industry the second stage represents the assigning of activity to cost objects, according to activity drivers. The activity driver is a measure of the use of the activity by the cost objects. The cost object is the final point to which costs are traced and in hospitality industry it refer to customer groups, services, market segments, sales channels, ect. Common activities in a hotel include check-in, booking group business, room service, cleaning of guest rooms, public area maintenance, and sales blitzes. Decisions regarding activities include learning how to perform activities more efficiently, substituting less expensive activities for expensive ones, continuous improvement, redesigning business processes, and providing services that make fewer demands on activities. ABC helps hotel managers determine which services to provide, which customers are profitable, whether its product mix needs changing, and where it should direct its market focus. ABC points out opportunities for cost reduction. 3. ACHIEVED LEVEL OF STRATEGIC-ORIENTED MANAGERIAL ACCOUNTING IN CROATIAN HOTEL INDUSTRY For the successful implementation of customer relationship management (CRM), it is necessary to enable the preparation of accounting information system to process relevant internal and external data, within the framework of customer profitability analysis (CPA). For this purpose, the research was conducted in the Croatian hospitality industry, to assess the achieved level of customer accounting development, as a part of strategic-oriented accounting. Based on the defined research questions, the study aimed to assess and identify the main dimensions of data and information, that are of importance for customer management, regardless of where (the department) and how (type of evidence) they are identified in the practice. The data was collected by applying an empirical study, using a self-administered questionnaire. The survey was carried out during late 2009 and early 2010 in the largest hotel companies in Croatia. The sample was taken from the hotel managers and staff in the Croatian hospitality industry. The sample can be regarded as representative, since it covers 35% of the entire hotel capacity in all regions of Croatia (45% from Istra, 35% from Kvarner, 8% from Dalmatia and 11% from continental Croatia and Zagreb). Within the sample, 73% of companies are completely privatized and the remaining 27% are majority-owned by the state. The participation in this survey was voluntary, and the questionnaires were distributed to the participants in an electronic manner to the hotel manager of 199 four and five star hotels. The rate of return was 69%. The following research questions were empirically investigated: § Indicate which are the most common sources of information for the decision making process in the Croatian hospitality industry? § What types of data and information are compared in “benchmarking” systems in the Croatian hospitality industry (rank their importance)? § How is the environmental complexity and dynamism of the environment assessed? § What is the most important information in assessing the achievement of competitive advantages of hotel companies in the target tourist market? § What are the main sources of information for customer relationship management (CRM) in hotel companies? § Which are the core starting points (operating, strategic, etc.) of the cost assessment in hotel companies? § What cost information, and to what extent, is used for evaluating the achieved competitive advantages of a hotel company in the target tourist market? § How is the possibility for influencing the costs of the product / service and customer lifecycle assessed? § How is the role of the instruments, methods and techniques (BSC, TC, BSC, Benchmarking) assessed and used to improve the quality of information for strategic management? Data collected included descriptive statistics, which was analyzed by using the statistical package SPSS. To make business decisions, the highest percentage of respondents use internal information, primarily from accounting (22%), planning and analysis (11 - 14%), sales (12%), finance (11%), marketing (8%), purchasing (7%) etc., while information from the environment (customer, market, statistics is not used enough (5 - 9%). The survey results lead to the conclusion that, managers in the Croatian hospitality industry use different sources of information, but what is dominant is value expressed accounting information in which data from other sources is insufficient and has not yet been integrated. The continuation will show the views of the management with regard to who would like to compare the information available in the benchmarking system, in order to assess their own competitive advantages (figure 2). Figure 2 shows that managers in the hospitality industry are ready to compare financial information about internally and externally achieved results (6 - 10%), but not information relating to the cost structure (3%), customer satisfaction (2%), supplier, lifelong education and quality (1%), and especially not about investment in environmental protection. This may be caused by the need to protect business secrets or because such information is not available to a sufficient extent. Figure 2: How do managers in the Croatian hospitality industry assess the character of information to be compared in the benchmarking system Information about investment in the environmental protection 10% Realized overnights Operating revenues and total revenues Operating expenses 0% 8% Information about the suppliers’ offer The costs of investing in lifelong education Information about the quality of products and services Total expenses 1% 7% INFORMATION OF CUSTOMER SATISFACTIN (survey results) 2% Variable costs Fixed costs Relative relationships in the cost structure Internal results according to the USALI standards G.O.P Gross profit rate Selling price 6% 3% Contribution margin Source: Author’s research results Table 1: The rating of the complexity and dynamics of the environment and operating processes in the Croatian hospitality industry The degrees of Dynamics within the complexity and dynamics Environment of the hotel company hotel company complexity dynamism Low 9% 0% 19% middle 36% 45% 36% High 55% 55% 45% Source: Author’s research results Based on these questions, the next step was to assess whether the management is aware of the complexity and dynamics of the environment, but also the dynamics within the company (table 1). The management maintains the opinion, that the environment is of middle (36%) or high complexity (55%), or that the dynamics is on a middle (45%) or high (45%) level. A minority of the management considers that the dynamics within the company is low (19%), and most of them consider it to be on a middle (38%) or high (45%) level. A high level of awareness about the complexity and dynamics of the hotel company environment requires an adaptation of their information and accounting systems, oriented towards a long term decision making process, in order to assess the competitive advantages in the entire hospitality industry and in relation to the customer’s needs and the level of their profitability. In this sense, the next question was to determine what the most important information is to be able to assess the achievement of competitive advantages of hotel companies in the target tourist market (figure 3). It may be noticed that managers are aware that the use of customer information is of particular importance for the business success of hotel companies (choice of the best sales channels, product / service differentiation, introduction of brands, etc.) and for evaluating the competitive advantage on the target market (benchmarking). This research was, therefore, oriented to determining the main sources of information, important for customer relationship management (CRM), that lie within the hotel company. Of the 100% of participants, the largest number of participants in Croatian hotel companies use (30% each) guest survey results about the quality of the hotel offer and tourist market research as a source of customer information, followed by research on competition in the hospitality industry (20%), and only a small minority use (5% each) budgeted costs, feasibility studies on specific investments, statistics and interviews. Core starting points of costs assessment in hotel companies are mainly oriented towards preparing information for short time decision making (73%), which indicates a lack of relevant information for strategic decision making, which also includes information relevant for customer relationship management (CRM). The previously mentioned research results are also confirmed by the results which are shown below. Figure 3: The most important information for assessing the achievement of competitive advantages of hotel companies in the target tourist market Source: Author’s research results Namely, managers in Croatian hotel companies use the following indicators in order to assess the competitive advantage on the market: - the impact of each product / service on G.O.P. (82%) - comparing actual costs against the planned on the operating segments level (73%) - comparing the structure of costs with other companies within the hospitality industry as a branch of business and providing information about costs of existing competitors (64%) - providing information about the customer costs, evaluation of realized costs in relation to the target costs, assessment of the impact of each product / service on N.O.P. and assessment of the impact of each product / service on the contribution margin (55%) - providing information about suppliers and about new competitors (45%) - providing information about the costs of substitution (the replacement products / services) (36%) - providing information about each product / service and costumer lifecycle costs (18%) - providing information about lifecycle (LCA) environmental costs assessment (9%) Regardless of the fact that operating information is still predominantly used by managers, they are aware of the necessity for strategic oriented information, which could enable decision making about the costs level of all stages of the product / service and customer in their whole lifecycle. In this survey, managers evaluated their ability and rank of impact on the costs in all phases of the product / service lifecycle. They graded the period of design and development of products / services as the stage in which it is possible to achieve a significant impact (45%), followed by a somewhat higher impact at the stage of production and market positioning (47%) and, alternatively, significantly less in the post-market period (8%). Among the various instruments, methods and techniques of strategic accounting, they have chosen some of them, which can improve the quality of information for strategic management. First of all, they recognized the necessity for the application of benchmarking (100%), to compare their own performance with similar companies in the hospitality industry, and to assess relationships with competitors. They also believe that the costs and selling prices of products / services should be adjusted according to the customers’ financial ability of different target markets. This is based on the target costing (TC) method (91%), which is connected to the need to apply the activity based costing (ABC) method (45%) and capture the activity costs. Furthermore, the same applies to the role of the balanced scorecard (BSC) method (45%) in translating strategy into the operative activity. This suggests the need to undertake additional efforts in order to prepare quality information for strategic decision making, at the same high quality as the operational information, prepared by applying USALI standards (Uniform System of Accounts for the Lodging Industry), which is successfully applied in hospitality practice for short time decision making and in performance benchmarking. CONCLUSION The results of this survey indicate that customer accounting (as a part of strategic accounting) has a modest presence in the Croatian hospitality industry. The current level of customer accounting is not well developed, and a high quality of strategic accounting information for the managerial decision making process is therefore lacking. However, many individual awards and recognitions of some processes, projects and facilities, especially the increased awareness in the area of market orientation are a positive basis for the implementation of holistic customer and competition accounting in the future. Research results show that today an informal approach to evidence about customer relationships is still present, but increasingly tight competition requires that all customer performance information has to be integrated into a single database and more present in accounting reports. In order to achieve this, it is necessary to be converted into a formal system, which will be applied and also systematically implemented in hotels, as well as in hotel companies, and in the hospitality industry as well. In order to achieve this, it is advisable to follow the principles that have lead to the successful implementation of internal reporting USALI standards. Today, however, we have little empirical evidence on how hotels assess customer profitability, and what the performance implications of customer profitability assessment are, although research has shown that certain customer information is present in management reports. For this purpose, it is necessary to provide stronger external support and incentives, with an emphasis on improving benchmarking systems, also on the level of information enabling strategic decision making. REFERENCES: Brander-Brown, J., Atkinson, H. (2001). Rethinking performance measures: Assessing progress in UK hotels. International Journal of Contemporary Hospitality Management, 13, 128–135. Banker, R., Potter, G., & Srinivasan, D. (2000). An empirical investigation of an incentive plan that includes non-financial performance measures. The Accounting Review, 75, 65–92. Collini, P., (2006). Cost analysis in the hotel industry: an ABC customer focused approach and the case of joint revenues, Accounting and Financial Management, Ed. Peter Harris and Marco Mongiello, Elsevier, pp 165-187 Dittman, D., Hesford, J., Potter, G., (2009). Managerial Accounting in the Hospitality Industry. Handbook of Management Accounting Research, Elsevier, pp. 1353-1368. Downie, N., The use of accounting information in hotel marketing decisions, International Journalaof Hospitality Management, Vol.16 No.3, pp.305-312 Dunn, K.D., Brooks, D.E. (1990). Profit analysis: beyond yield management. The Cornell Hotel and Restaurant Administration Quarterly, 31, (3), 90-90 Jankovic, S., (2001), Activity-based costing as a Instrument for Market- and Value-based Management in Hospitality Industry, PhD Thesis, Vienna University of Economics Kaplan, R., Narayanan, V.G. (2001), Measuring and managing customer profitability. Journal of Cost Management, 15 (5), pp.5-15 King, A.M. (1991) The current status of ABC: an interview with R.Cooper and R. Kaplan – where is ABC on the path to total implementation?, MA, September 1991, pp.22-26 Krakhmal, V., (2006), Customer profitability accounting in the context of hotels, Accounting and Financial Management, Ed. Peter Harris and Marco Mongiello, Elsevier, pp 188-210 Lind, J., Stromsten, T., (2006), When do firms use different types of customer accounting? Journal of Business Research, Vol. 59, Issues 12, November 2006, pp. 1257-1266 Luft, J., Shields, M., (2003). Mapping management accounting: graphics and guidelines for theory-consistent empirical research, Accounting, Organization and Society, Vol. 28, pp. 169-249 Mia, L., & Patiar, A. (2001). The use of management accounting systems in hotels: an exploratory study. International Journal of Hospitality Management, 20, 111–128. Noone, B., Griffin, P., (1999). Managing the long term profit yield from market segments in a hotel environment: a case study on the implementation of customer analysis. International Journal of Hospitality Management, Vol. 18 No.2, pp.111-128 Pavlatos, O., Paggios, I., (2009). A survey of factors influencing the cost system design in hotels. International Journal of Hospitality Management 28, 263-271 Phillips, P. A. (1999). Hotel performance and competitive advantage: A contingency approach. International Journal of Contemporary Hospitality Management, 11, 359–365. Raab, C., Vaughn, P., Nelson, K. (2010). The application of ABC to support kitchen in a Las Vegas casino. International Journal of Contemporary Hospitality Management, Vol. 22 No. 7, 2010, pp 1033-1047 Raffisch, N., Turney, P. (1991) Glossary of Activity Based Management. JCM, Fall/1991, S.53-56 Roslender, R., Hart, S. (2010) Taking the customer into account. Critical Perspective on Accounting, Vol 21, Issuse 8, November 2010, pp. 739-753 USALI (2006) Uniform System of Accounts for Lodging Industry, 10th revised Edition, American hotel and Lodging Educational Institute Van Raaij, F., Vernooij M.J.A., Van Triest S. (2003). The Implementation of customer profitability analysis: A case study. Industrial Marketing Management, 32, 573-583. Zeithaml, V., Bitner, M. (1996). Service Marketing. McGraw Hill