PROBLEM FOR SELF

advertisement

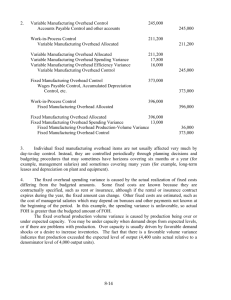

EXHIBIT 8-7

)Columnar Piesenlalion

\ 01 Fixed Selup

'Overhead Variance

> Analysis: LycoBrass

Works for 2007'

Actual Costs

Incurred

(I)

Flexible Budget:

Same Budgeted

lump Sum

las in Static Budget)

Regardless 01

Output level

Allocated:

Budgeted Input Ouantity

Allowed lor

Actual Output

x Budgeted Rate

(2)

(3)

S220,000

5216,000

t

Level 3

t

$4,000 U

Spending variance

t

Level 2

(1,008b batches x 6 hours/batch x $30/hourl

(6,048 hours x $30/hourl

$181,440

Production-volume

$4,000 U

Flexible-budget variance

t

$34,560 U

variance

t

aF = favorable effect on operating income; U = unfavorable effect on operating income.

bl,008 batches:: 151,200 units -:- 150 units per batch.

~,

Study

Tip: To review

~importanttermsandconcepts in Chapters 7 and 8, work

the crossword puzzle (Student

Guide, p. 99). The solution is on

p.l04.

During

2007,

Lyco planned

to produce

180,000

units

duced 151,200 units. The unfavorable production-volume

of Elegance

but actually

pro-

variance measures the amount

of extra fixed setup costs that Lyco incurred for setup capacity it had but did not use. One

interpretation

is that the unfavorable

$34,560

production-volume

variance represents

inefficient use of setup capacity. However, Lyco may have earned higher operating income

by selling

151,200

units at a higher

price than

180,000

units

at a lower price_ As a result,

the production-volume variance should be interpreted cautiously because it does not consider effects on selling

prices and operating

income.

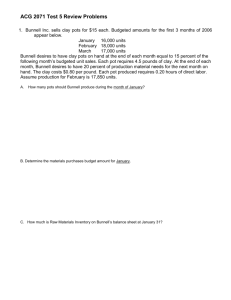

PROBLEM FOR SELF-STUDY

Maria Lopez is the newly appointed president of Laser Products. She is examining the May 2007

results for the Aerospace Products Division. This division manufactures wing parts for satellites.

Lopez's current concern is with manufacturing overhead costs at the Aerospace Products Division.

Both variable and fixed manufacturing overhead costs are allocated to the wing parts on the basis

of laser-cutting-hours. The follov.'ing budget information is available:

Budgeted variable manufacturing overhead rate

Budgeted fixed manufacturing overhead rate

Budgeted laser-cutting time per wing part

Budgeted production and sales for May 2007

Budgeted lixed manufacturing overhead costs for May 2007

S200 per hour

S240 per hour

1.5 hours

5,000 wing parts

51,800,000

Actual results for J\t1ay2007 are:

Wing parts produced and sold

Laser-cutting-hours used

Variable manufacturing overhead costs

Fixed manufacturing overhead costs

4,800 units

8,400 hours

$1,478,400

$1,832,200

Required

1. Compute the spending variance and the efficiency variance for variable manufacturing overhead.

2. Compute the spending variance and the production-volume

overhead.

variance for fixed manufacturing

3. Give t\VOexplanations for each of the variances calculated in requirements 1 and 2.

SOLUTION

280

1. and 2. See Exhibit 8-8.

EXHIBIT

8·8

IZ)

Flexible Budget:

Budgeted Input Uuantity

Allowed for

Actual Output

x Budgeted Rate

13)

Allocated:

Budgeted Input Uuantity

Allowed for

Actual Output

x Budgeted Rate

(4)

18,400hrs. x $176/hr.1

SI,478,400

(8,400 hrs. x SZOO/hr.)

$1,680,000

(1.5 hrs.!unit x 4,800 units x $200/hr.)

(7,200 hrs. x S200/hr.)

$1,440,000

11.5hrs.!unit x 4,800 units x S200/hr.)

(7,200 hrs. x $200/hr.1

$1,440,000

t

t

t

t

Actual Costs

Incurred:

Actual Input Uuantity

x Actual Rate

(I)

Actual Input Uuantity

x Budgeted Rate

$201,600 F

Spending variance

t

$240,000 U

Efficiency variance

t

$38,400 U

Flexible·budget variance

t

t

t

Never a variance

Never a variance

$38,400 U

Underallocated variable overhead

(Total variable overhead variance)

PANELB: Fixed Manufacturing

Actual Cnsts

Incurred

(1)

Overhead

Same Budgeted

lump Sum

(as in Static Budget)

Regardless of

Output level

(2)

$1,832,200

t

t

t

Flexible Budget:

Same Budgeted lump Sum

(as in Static Budgetl

Regardless of

Output level

(3)

$1,800,000

$1,800,000

t

t

t

S32,200 U

Spending variance

Never a variance

$32,200 U

Flexible-budget variance

Allocated:

Budgeted Input Uuantity

Allowed lor

Actual Output

x Budgeted Rate

(4)

(1.5 hrs.!unit x 4,800 units x $240/hr.)

(7,200 hrs. x $240/hr.)

$1,728,000

S72,OOOU

Production-volume

variance

$72,000 U

Production-volume

variance

$104,200 U

Underallocated fixed overhead

(Total fixed overhead variance)

t

t

t

IF = favorable effect on operating income; U = unfavorable effect on operating income.

Source: From kThe Case for Management Accounting~ by Paul Sherman. Used with permission from STRATEGIC FINANCE, October 2003, published by the

Institute of Management Accountants, Montvale, NJ, www.imanet.org.

3. iI. Variable manufacturing overhead spending variance, 520l,600 E One possible reason for this

variance is that actual prices of individual items included in variable overhead (stich as cut·

ting fluids) are lower than budgeted prices. A second possible reason is that the percentage

increase in the actual quantity usage of individual items in the variable overhead cost pool

is less than the percentage increase in laser-cutting-hours compared to the flexible budget.

b. Variable manufacturing overhead efficiency variance, $240,000 U. One possible reason for

this variance is inadequate maintenance of laser machines, causing them to take more

laser-cutting time per wing part. A second possible reason is use of undermotivated, inexperienced, or underskilled workers with the laser-cutting machines, resulting in more lasercuning time per wing part.

c. Fixed manufacturing overhead spending variance, $32,200 U. One possible reason for this

variance is that the actual prices of individual items in the fixed-cost pool unexpectedly

increased from the prices budgeted (mch as an unexpected increase in machine leasing

costs). A second possible reason is misclassification of items as fixed that are in fact variable.

d. Production-volume variance, $72,000 U. Actual production of wing parts is 4,800 units,

compared with 5,000 units budgeted. One possible reason for this variance is demand fac·

tOfS, such as a decline in an aerospace program that led to a decline in demand for aircraft

parts. A second possible reason is supply factors, such as a production

stoppage due to

labor problems or machine breakdowns.

I

DECISION

POINTS

The following Question·and-answer

format summarizes the chapter's learning objectives. Each decision

presents a key Question related to a learning objective. The guidelines are the answer to that question.

Decision

Guidelines

1. How do managers plan variable

overhead costs and fixed

Planning of both variable and fixed overhead costs involves undertaking only activities that

add value and then being efficient in that undertaking. The key difference is that for variablecost planning, ongoing decisions during the budget period playa much larger role; whereas

for fixed-cost planning, most key decisions are made before the start of the period.

overhead costs?

'"w

'"....

"'":I:

U

282

2. Why do companies use

standard costing?

Standard costing traces direct costs to a cost object by multiplying standard prices or

rates times standard inputs allowed for actual output produced and allocates overhead

costs on the basis of standard overhead rates times standard quantities of the allocation

bases allowed for actual output produced. The standard costs of products are known

at the start of the period. To manage costs, managers compare actual costs to standard

costs.

3. What variances can be calculated

for variable overhead?

When the flexible budget for variable overhead is developed, an overhead efficiency

variance and an overhead spending variance can be computed. The variable overhead

efficiency variance focuses on the difference between the actual quantity of the cost·

allocation base used relative to the budgeted quantity of the cost-allocation base. The variable

overhead spending variance focuses on the difference between the actual cost per unit of the

cost-allocation base relative to the budgeted cost per unit of the cost-allocation base.

4. Is the variable overhead efficiency

variance similar to the efficiency

variance for a direct-cost item?

These two efficiency variances are not similar. The variable overhead efficiency variance

indicates whether more or less of the cost-allocation base per output unit was used than

was included in the flexible budget. The efficiency variance for a direct-cost item indicates

whether more or less of the input per unit of output of that direct-cost item was used than

was included in the flexible budget

5. How is a budgeted fixed overhead

cost rate calculated?

The budgeted fixed overhead cost rate is calculated by dividing the budgeted fixed

overhead costs by the denominator level of the cost-allocation base.

6. How should managers interpret the

production-volume variance?

Managers should interpret cautiously the production~volume variance as a measure of the

economic cost of unused capacity. One caution: management may have maintained some

extra capacity to meet uncertain demand surges that are important to satisfy. Another

caution: the production-volume variance focuses only on fixed overhead costs. The

production-volume variance does not take into account any decreases in the selling

price of output necessary to spur extra demand that would, in turn, make use of any

idle capacity.

7. What is the most detailed way for

a company to reconcile actual

overhead incurred with the amount

allocated during a period?

A 4·variance analysis presents spending and efficiency variances for variable overhead

costs and spending and production-volume variances forfixed overhead costs. By analyzing

these four variances together, managers can reconcile the actual overhead costs with the

amount of overhead allocated to output produced during a period.

8. Can the flexible-budget variance

approach for analyzing overhead costs

be used in activity-based costing?

Yes, flexible budgets in ABC systems give insight into why actual overhead activity costs

differ from budgeted overhead activity costs. Using output and input measures for an

activity, a 4-variance analysis can be conducted.

TERMS

TO

LEARN

Thechapter and the Glossary at the end of the book contain definitions of

denominator level (p. 264)

output-level overhead variance

denominator-levelvariance Ip. 2661

fixed overhead flexible-budget

variance

(p.2651

fixedoverhead spending variance

(p.2651

(p.2661

production-denominator

level (p. 264)

production-volume variance (p. 2661

standard costing (p. 2571

total-overhead variance (p. 2731

variable overhead efficiency variance

Ip.2601

variable overhead flexible-budget

variance (p. 2591

variable overhead spending variance

Ip.2611

Prentice Hall Grade Assist (PHGA)

Your professor may ask you to complete selected exercises and problems in Prentice Hall

PHGrad'A~ist

Grade Assist IPHGAI. PHGAis an online tool that can help you master the chapter's topics.

It provides you with multiple variations of exercises and problems designated by the PHGA

icon. You can rework these exercises and problems-each time with new data-as many

times as you need. You also receive immediate feedback and grading.

ASSIGNMENT

MATERIAL

Questions

8-1 How do managers plan for variable overhead costs?

8-2 How does the planning of fixed overhead costs differ from the planning of variable overhead

costs?

8-3 How does standard costing differ from actual costing?

8-4 What are the steps in developing a budgeted variable overhead cost-allocation rate?

8-5 The spending variance for variable manufacturing overhead is affected by several factors.

Explain.

8-6 Assume variable manufacturing overhead is allocated using machine-hours. Give three possible reasons for a favorable variable overhead efficiency variance.

8-7

Describe the difference between a direct materials

facturing overhead efficiency variance.

efficiency

variance

and a variable

manu-

~

.-•

.-

8-8 What are the steps in developing a budgeted fixed overhead rate?

8-9 Why is the flexible-budget variance the same amount as the spending variance for fixed manufacturing overhead?

iT

'"

"'~

C

0-

8·10 Explain how the analysis of fixed manufacturing overhead costs differs for lal planning and

control on the one hand and (bl inventory costing for financial reporting on the other hand.

8·11 Provide one caveat that will affect whether a production-volume variance is a good measure

of the economic cost of unused capacity.

8·12 "The production-volume variance should always be written off to Cost of Goods Sold." Do you

agree? Explain.

8-13 What are the variances in a 4-variance analysis?

8-14 "Overhead variances should be viewed as interdependent rather than independent." Give an

example.

0

<

~

~

""D"

0-

"

g,

if

"

Q'

,

n

8-15 Describe how flexible-budget variance analysis can be used in the control of costs of activity

~

'!'

areas.

,

D

0-

Exercises

:r

,

"'•3

•a

D

8-16 Variable manufacturing

overhead, variance analysis. Esquire Clothing is a manufacturer of

designersuits. The cost of each suit is the sum of three variable costs (direct material costs, direct manufacturinglabor costs, and manufacturing overhead costs) and one fixed-cost category (manufacturing overheadcosts). Variable manufacturing overhead cost is allocated to each suit on the basis of budgeted direct

manufacturing labor-hours per suit. For June 2007, each suit is budgeted to take four labor-hours. Budgeted

variablemanufacturing overhead cost per labor-hour is $12. The budgeted number of suits to be manufac-

turedinJune 2007is 1,040.

D

~

PIl Clade Assisl

"a

D

2..

283

------Required

Actual variable manufacturing costs in June 2007 were $52,164 for 1,080 suits started and completed. There

were no beginning or ending inventories of suits. Actual direct manufacturing labor-hours for June were 4,536.

1. Compute the flexible-budget

manufacturing overhead.

2. Comment on the results.

variance, the spending variance, and the efficiency variance far variable

8-17

Fixed manufacturing overhead, variance analvsis (continuation of 8-161. Esquire Clothing allocates fixed manufacturing overhead to each suit using budgeted direct manufacturing labor-hours per suit

Data pertaining to fixed manufacturing overhead costs for June 2007 are budgeted, $62,400, and actual,

------~

Required

$63,916.

1. Compute the spending variance tor fixed manufacturing overhead. Comment on the results.

2. Compute the production-volume variance for June 2007. What inferences can Esquire Clothing draw

from this variance?

8-18 Variable manufacturing overhead variance analysis, The French Bread Company bakes baguettes

for distribution to upscale grocery stores. The company has two direct-cost categories: direct materials

and direct manufacturing labor. Variable manufacturing overhead is allocated to products on the basis of

standard direct manufacturing labor-hours. Following is some budget data for the French Bread Company:

Direct manufacturing labor use

Variable manufacturing overhead

0.02 hours per baguette

$10.00 per direct manufacturing

labor-hour

The French Bread Company provides the following additional data for the year ended December 31, 2007:

Planned Ibudgeted) output

Actual production

Direct manufacturing labor

Actual variable manufacturing

RequIred

3,200,000 baguettes

2,800,000 baguettes

50AOO hours

overhead

S680,400

1. What is the denominator level used for allocating variable manufacturing overhead? (That is, for how

many direct manufacturing labor-hours is French Bread budgeting?)

2. Prepare a variance analysis of variable manufacturing overhead. Use Exhibit 8-5 (p. 272) for reference.

3. Discuss the variances you have calculated and give possible explanations for them.

8-19 Fixed manufacturing overhead variance analvsis. The French Bread Company bakes baguettes for

distribution to upscale grocery stores. The company has two direct-cost categories: direct materials and

direct manufacturing labor. Fixed manufacturing overhead is allocated to products on the basis of standard

direct manufacturing labor·hours. Following is some budget data for the French Bread Company:

Direct manufacturing labor use

Fixed manufacturing overhead

0.02 hours per baguette

$4.00 per direct labor-hour

The French Bread Company provides the following additional data for the year ended December 31, 2007:

Planned Ibudgeted) output

Actual production

Actual direct manufacturing labor

Actual fixed manufacturing overhead

RequIred

3,200,000 baguettes

2,800,000 baguettes

50,400 hours

$272,000

1. Prepare a variance analysis of fixed manufacturing overhead cost. Use Exhibit 8-5 (p. 272) as a guide.

2. Is fixed overhead underallocated or overallocated? By what amount?

3. Comment on your results. Discuss the variances and explain what may be driving them.

8-20 Manufacturing overhead, variance analvsis. Zircon, Inc., assembles its CardioX product at its

Scottsdale plant. Fixed and variable manufacturing overheads are allocated to each CardioX unit using budgeted assembly-hours. Budgeted assembly time is two hours per unit. The following table shows the budgeted amounts and actual results related to overhead for March 2007.

A

00

'"

w

>--

1

2

3

4

5

B

Actual

Results

5,400

10,280

Zircon (March 2007)

Units of CardioX assembled and sold

Houre of assembly lime

Variable manufacturing overhead cosl per hour of assembly lime

Variable manufacturing overhead costs

$310,500

6 Fixed manufacturing overhead costs

$514,000

C

Static

B

t

5,000

$ 30.00

$480,000

Q,

«

:J:

v

284

If you want to use Excel to solve this exercise, go to the Excel Lab at www.prenhall.com/horngren/cost12e

and download the template for Exercise 8-20.

1. Prepare an analysis of all variable manufacturing overhead and fixed manufacturing overhead variances using the columnar approach in Exhibit 8-5(p. 272).

2. Prepare journal entries for Zircon's March 2007 variable and fixed manufacturing overhead costs and

variances; write off these variances to cost of goods sold for the quarter ending March 2007.

3. How does the planning and control of variable manufacturing overhead costs differ from the planning

and control of fixed manufacturing overhead costs?

8-21 4-variance analysis, fill in the blanks. Use the following manufacturing

following blanks:

Actual costs incurred

Costs allocated to products

Flexible budget: Budgeted input allowed for

actual output produced x budgeted rate

Actual input x budgeted rate

Re••ulred

overhead data to fill in the

Variable

Fixed

$11,900

9,000

$6,000

4,500

9,000

10,000

5,000

5,000

PHGlidtAssin

Use Ffor favora ble and U for unfavorable:

Variable

Fixed

111 Spending variance

(2) Efficiency variance

(3) Production-volume variance

141 Flexible-budget variance

151 Underallocated {overallocatedl

manufacturing overhead

8-22 Straightforward 4-variance overhead analysis. The Lopez Company uses standard costing in its

manufacturing plant for auto parts. The standard cost of a particular auto part, based on a denominator level

of4,000output units per year, included 6 machine-hours of variable manufacturing overhead at $8 per hour

and6 machine-hours of fixed manufacturing overhead at $15 per hour. Actual output produced was 4,400

units.Variable manufacturing overhead incurred was $245,000. Fixed manufacturing overhead incurred was

1373,000.Actual machine-hours were 28,400.

1. Prepare an analysis of all variable manufacturing overhead and fixed manufacturing overhead variances, using the 4-variance analysis in Exhibit 8-5Ip. 2721.

2. Prepare journal entries using the 4-variance analysis.

3. Describe how individual variable manufacturing overhead items are controlled from day to day. Also,

describe how individual fixed manufacturing overhead items are controlled.

PHCiradeAssisl

Required

8-23 Straightforward

coverage of manufacturing overhead, standard-costing system. The Singapore

divisionof a Canadian telecommunications company uses standard costing for its machine-paced production of telephone equipment. Data regarding production during June are as follows:

Variable manufacturing overhead costs incurred

Variable manufacturing overhead cost rate

Fixed manufacturing overhead costs incurred

Fixed manufacturing overhead budgeted

Denominator level in machine-hours

Standard machine-hour allowed per unit of output

Units of output

Actual machine-hours used

Ending work-in-process inventory

$155,100

$12 per standard machine-hour

$401,000

$390,000

13,000

0.30

41,000

13,300

o

1. Prepare an analysis of all manufacturing overhead variances. Use the 4-variance analysis framework

illustrated in Exhibit 8-5 (p. 272).

2. Prepare journal entries for manufacturing overheads and their variances.

3. Describe how individual variable manufacturing overhead items are controlled from day to day. Also,

describe how individual fixed manufacturing overhead items are controlled.

8-24

Overhead variances, service sector. Meals on Wheels (MOW) operates a meal home-delivery service. It has agreements with 20 restaurants to pick up and deliver meals to customers who phone or fax

ordersto MOW. MOW allocates variable and fixed overhead costs on the basis of delivery time. MOW's

owner,Josh Carter, obtains the following information for May 2007 overhead costs:

Re••ulred

,

Q

"-3:

,

Q

Q

"'•3

•

"-n

"-£.

Q

285

A

Meals on Wheels (Ma 2001)

Output units (numberofdelMries)

HoUIS per delM>y

HoUIS of delM>y time

5,720

Variable overhead cost p.r l10ur of delM>y time

$ 150

Variable overhead costs

$10,296

Fixed overhead costs

$38,600 $35,000

1

2

3

4

5

6

7

If you want to use Excel to solve this exercise, go to the Excel Lab at www.prenhall.com/horngren/cost12e

------•••• ul•• d

and download the template for Exercise 8-24.

1. Compute spending and efficiency variances for MOW's variable overhead in May 2007.

2. Compute the spending variance and production-volume variance for MOW's fixed overhead in May 2007.

3. Comment on MOW's overhead variances and suggest how Josh Carter might manage MOW's variable

overhead differently from its fixed overhead costs.

8·25

Total overhead, J·variance analysis. Wright-Patterson

Air Force Base has an extensive repairfacil-

ity for jet engines. It developed standard costing and flexible budgets to account for this activity. Budgeted

variable overhead at a level of 8,000 standard monthly direct labor-hours was 864,000; budgeted total overhead at 10,000 standard direct labor-hours was $197,600. The standard cost allocated to repair output

------•• qul•• d

included a total overhead rate of 120% of standard direct labor costs. Total overhead incurred for October

was $249,000. Direct labor costs incurred were $202,440. The direct labor price variance was $9,640 unfa·

vorable. The direct labor flexible-budget variance was $14,440 unfavorable. The standard labor price was

$16 per hour. The production-volume variance was $14,000, favorable.

1. Compute the direct labor efficiency variance and the spending, efficiency, and production-volume

variances for overhead. Also, compute the denominator level.

2. Describe how individual variable manufacturing overhead items are controlled from day to day. Also,

describe how individual fixed manufacturing overhead items are controlled.

8-26 Overhead variances,

PHGradtAssil1

------•• qulr.d

missing information. Blakely Printing budgets 12,000 machine-hours

ance for fixed overhead. For the pages actually printed, they should have used 9,900 machine-hours,

they actually used 10,000 machine-hours. Total overhead costs were 880,000.

1. In the columnar presentation below for June 2007's variable manufacturing

By how much'

Actual Input Guantity x Actual Rate

Actual Input Guantity x

Budgeted Rate

Flexible Budget:

Budgeted Input Guantity Allowed for

Actual Output x Budgeted Rate

(11

(2)

(l)

Actual Costs Incurred:

(b)

levell

level 2

•

•

lal

$250 F

Spending variance

(c)

•

•

•

(d)

Ie)

Flexible-budget variance

2. In the columnar presentation below for June 2007's fixed manufacturing

overhead variance analysis,

calculate lal through (e). Will fixed manufacturing overhead be over- or underallocated'

Actual Costs Incurred:

Allocated: Budgeted

Input Guantity Allowed for

Actual Output x Budgeted Rat.

II)

121

(l)

lal

level 2

'"

w

>-

8-27

:r:

u

286

~

PHG!adtAssist

By how much?

Flexible Budget:

Same Budgeted lump Sum

las in Static Budget)

Regardless of Output level

levell

"-••

but

overhead variance analy-

sis, calculate (al through (el. Will variable overhead be over- or underallocated?

""

for June

2007. The budgeted variable overhead rate is $6 per machine-hour. At the end of June, its managers

reported a 5250 favorable spending variance for variable overhead and a $1,050 unfavorable spending vari-

•

•

(bl

81,050 U

Spending variance

lei

Flexible-budget variance

9,900 hours x (cl

•

Id)

•

Production volume variance

•

Identifying favorable and unfavorable variances. Consider a company that uses standard costing

and allocates variable and fixed manufacturing overhead based on machine-hours. For each independent

scenario given, indicate whether each of the variances will be favorable or unfavorable or, in case of insufficient information, indicate "cannot be determined."

month of sandal manufacturing for the plant lall amounts in U.S.

dollars). Overhead is allocated based on machine·hours.

Actual

Results

Output units (pairs of sandals)

150,000

Machine-hours

67,500

Machine-hours per output unit

0.45

Variable manufacturing

$1,950,000

overhead costs

Variable manufacturing

$2889

overhead cost per machine-hour

Variable manufacturing

$13.00

overhead cost per output unit

FlexibleBudget Amount

150,000

60,000

0.40

$1,800,000

$30.00

$12.00

The plant manager's performance bonus is tied, in part, to his or

her control of manufacturing overhead costs. There is an unfavorable variable overhead flexible-budget variance of $150,075

for this month's production of 150,000 pairs of sandals. The manager is interested in finding out what happened and why.

QUESTIONS

1. Compute the spending variance and the efficiency vari·

ance for variable manufacturing overhead.

2. What do the spending and efficiency variances mean?

What are possible causes?

3. What explanationlsl should the plant manager give for the

unfavorable variable overhead flexible-budget variance

this month?

293

Collaborative

Learning Probtem

8-41 Overhead variances. ethics. New Mexico Company uses standard costing. The company prepared its static budget for 2007 at 1,000,000 machine-hours for the year. Total budgeted overhead cost

is $12,500,000. The variable overhead rate is $10 per machine-hour 1$20 per unit). Actual results for 2007

follow:

Machine-hours

Output

Variable overhead

Fixed overhead spending variance

Required

960,000 hours

498,000 units

$10,080,000

$600,000 U

1. Compute for the fixed overhead

a. Budgeted amount

b. Budgeted cost per machine-hour

c. Actual cost

d. Production-volume

variance

2. Compute the variable overhead spending variance and the variable overhead efficiency variance.

3. Jerry Remich, the controller, prepares the variance analysis. It is common knowledge in the company

that he and Ron Monroe, the production manager, are not on the best at terms. In a recent executive

committee meeting, Monroe had complained about the lack of usefulness of the accounting reports he

receives. To get back at him, Remich manipulated the actual fixed overhead amount by assigning a

greater-than-normal share of allocated costs to the production area. And, he decided to depreciate all

of the newly acquired production equipment using the double-declining-balance

method rather than

the straight-line method, contrary to the company practice. As a result, there was a sizable unfavorable fixed overhead spending variance. He boasted to one of his confidants, "I am just returning the

favor." Discuss Remich's actions and their ramifications.

Get Connected:

Cost Accounting

in the News

Go to www.orenhall.com/hornoren/cost12e

for additional online exercise(s~ that explore issues affecting

the accounting world today. These exercises offer you the opportunity to analyze and reflect on how cost

accounting helps managers to make better decisions and handle the challenges of strategic planning and

implementation.

CHAPTER

8

Case

TEVA SPORT SANDALS: Variable Overhead

00

'"0..

•...

w

••J:

U

292

Teva Sport Sandals was founded in the 1980s by a seasoned

river guide, Mark Thatcher, who was tired of losing his flip-flop

sandals every time he took a raft ride down the Colorado River.

Thatcher knew firsthand how thong-style rubber sandals abandoned his feet when he was slogging through mud and water.

He figured a thong-style sandal with a heel strap on the back

would be the answer to keeping sandals on. His new sandal creation was called the "Teva" (which means "nature" in Hebrew),

and it was an immediate hit with water sports enthusiasts on

the river and with others nowhere near a river.

Today Teva sandals are manufactured under license by

Deckers Outdoor Corporation of Goleta, California. More than 60

styles for men, women, and children are available through retail

sports stores, catalogs, and department stores around the world.

The entire line of sandals also is sold direct to consumers through

Teva's Web site at www.teva.com. Sandal styles are updated by

designers at Deckers annually for each new selling season.

Variances

Those new sandal specifications are converted into sandal prototypes by the in-house Fabrication Department.

Upon approval of the prototype designs, detailed sandal specifications are given to Pat Devaney, Deckers' vice president of

production, development, and sourcing. Pat has responsibility for

negotiating the best possible prices for finished sandals with the

plant in China that manufactures the sandals. The specifications

are critical to the negotiations. Some of the direct materials are

sourced within China to help reduce the costs and prices of finished goods. Other direct materials must be imported. Either way,

Deckers and the manufacturing plant in China work together to

arrive at the best price. Once the specification and price negotiations are finished, the plant begins production according to the

schedule set during negotiations.

The managers at the manufacturing plant in China have

responsibility for controlling production costs. For illustration

purposes, let's assume the following data apply to a recent

Althe 40,000 budgeted direct manufacturing labor-hour level for August, budgeted direct manufacturing

labor is 5800,000, budgeted variable manufacturing overhead is $480,000, and budgeted fixed manufacturing

overhead is $640,000.

The following actual results are for August:

Direct materials price variance {based on purchases}

Direct materials efficiency variance

Direct manufacturing labor costs incurred

Variable manufacturing overhead flexible-budget variance

Variable manufacturing overhead efficiency variance

Fixed manufacturing overhead incurred

Fixed manufacturing overhead spending variance

$176,000 F

69,000 U

522,750

10,350 U

18,000 U

597,460

42,540 F

The standard cost per pound of direct materials is $11.50. The standard allowance is three pounds of direct

materials for each unit of product. During August, 30,000 units of product were produced. There was no

beginning inventory of direct materials. There was no beginning or ending work in process. In August, the

direct materials price variance was $1.10 per pound.

In July, labor unrest caused a major slowdown in the pace of production, resulting in an unfavorable

direct manufacturing labor efficiency variance of $45,000. There was no direct manufacturing labor price

variance. labor unrest persisted into August. Some workers quit. Their replacements had to be hired at

higher wage rates, which had to be extended to all workers. The actual average wage rate in August

exceeded the standard average wage rate by $0.50 per hour.

------------------------------

1. Compute the following for August:

a. Total pounds of direct materials purchased

b. Total number of pounds of excess direct materials used

c. Variable manufacturing overhead spending variance

d. Total number of actual direct manufacturing labor-hours used

e. Total number of standard direct manufacturing labor-hours allowed for the units produced

f. Production-volume variance

2. Describe how Mancusco's control of variable manufacturing overhead items differs from its control of

fixed manufacturing overhead items.

.equlre"

840 Review of Chapters 7 and 8, J-variance analysis. (CPA, adapted) The Seal Manufacturing

Company's costing system has two direct-cost categories: direct materials and direct manufacturing labor.

Manufacturing overhead (both variable and fixed) is allocated to products on the basis of standard direct

manufacturing labor-hours (OLH). Althe beginning of 2007, Seal adopted the following standards for its manufacturing costs:

Direct materials

Direct manufacturing labor

Manufacturing overhead:

Variable

Fixed

Standard manufacturing cost per output unit

Input

Cost per

Output Unit

3lbs. at $5 per lb.

5 hrs. atS15 per hr.

S 15.00

75.00

$6 per OLH

$8 per OLH

30.00

40.00

$160.00

The denominator level for total manufacturing overhead per month in 2007 is 40,000 direct manufacturinglabor-hours. Beal's flexible budget for January 2007 was based on this denominator level. The records

forJanuary indicated the following:

Direct materials purchased

Direct materials used

Direct manufacturing labor

Total actual manufacturing overhead

(variable and fixed)

Actual production

25,000 Ibs. at $5.20 per lb.

23,1001bs.

40,100 hrs. at$14.60 per hr.

$600,000

7,800 output units

1. Prepare a schedule of total standard manufacturing costs for the 7,800 output units in January 2007.

2. Forthe month of January 2007, compute the following variances, indicating whether each is favorable (F)

or unfavorable (U):

a. Direct materials price variance, based on purchases

b. Direct materials efficiency variance

c. Direct manufacturing labor price variance

d. Direct manufacturing labor efficiency variance

e. Total manufacturing overhead spending variance

I. Variable manufacturing overhead efficiency variance

g. Production-volume variance

.equlre"

291

Setup overhead costs consist of some costs that are variable and some that are fixed with respect to the

number of setup-hours. The following information pertains to 2007.

Static-Budget

Units of TGC produced and sold

Batch size (number of units per batchl

Setup-hours per batch

Variable overhead cost per setup-hour

Total fixed setup overhead costs

.equlred

Amounts

Aclual

Results

30,000

250

5

$25

$18,000

22,500

225

5.25

$24

$17,535

1. For variable setup overhead costs, compute the efficiency and spending variances. Comment on the results.

2. Forfixed setup overhead costs, compute the spending and the production-volume variances. Comment

on the results.

8-37 Activity·based costing, variance analysis. Asma Surgical Instruments, Inc., makes a special line of forceps, SFA,in batches. Asma randomly selects forceps from each SFAbatch for quality-testing purposes. Quality

testing costs are batch-level costs. A separate quality-testing section is responsible for SFA quality testing.

Quality-testing casts consist of same variable and some fixed costs in relation to quality-testing hours.

The following information is for 2007:

Static-Budget

Units of SFA produced and sold

Batch size (number of units per batch)

Testing-hours per batch

Variable overhead cost per testing-hour

Total fixed testing ovarhead costs

R.qul ••••

Amounts

Actua'

Results

21,000

500

5.5

540

$28,875

22,000

550

5.4

$42

527,216

1. For variable testing overhead costs, compute the efficiency and spending variances. Comment on the results.

2. For fixed testing overhead costs, compute the spending and the production·volume variances. Comment on the results.

8-38 Comprehensive overhead variance analvses. Happy Valley is a large wine-producing region in south·

ern Oregon. The Branda Brothers Wine Company, which has a huge following among wine connoisseurs, buys

select wines in bulk from the area's wineries and blends and bottles the wine for sale under its own label. Its

variable overhead costs (power, cleaning supplies, and the like} and fixed overhead costs (salaries of skilled

vintners involved in quality-control and building-related costs) are allocated on the basis of bottling machine·

hours. For the quarter ending September 30,2008, the Brando operation reports the following:

A

1

2

3

4

5

R.qulr."

'"w

'"•...

"-

"'"

J:

V

290

Production volUlll<(bottle,)

Bottling ",adune-MUIS

Variableoverhead

Fixed overhead

B

C

A<1ual

Result>

Slam

B

t

450,000

3,000

$153,000

$960,000

420,000

2,800

$140,000

$980,000

A total of 66,000 output units requiring 315,000 DLH was produced during May 2007. Manufacturing overhead (MDH) costs incurred for May amounted to $375,000. The actual costs, compared with the annual bud1

get and 12 of the annual budget, are as follows:

Annual

Manufacturing

Total

Amount

Variable MOH

Indirect manufacturing labor

Supplies

Fixed MOH

Supervision

Utilities

Depreciation

Total

Calculate the following

Overhead Budget

Per

Output

Per OlH

Unit

Input Unit

2007

Monthly

MOH Budget

May 2007

Actual MOH

Costs for

May 2007

$ 900,000

1,224,000

$1.25

1.70

$0.25

034

$ 75,000

102,000

S 75,000

111,000

648,000

540,000

1,008,000

$4,320,000

0.90

0.75

1.40

$6.00

0.18

0.15

028

$1.20

54,000

45,000

84,000

$360,000

51,000

54,000

84,000

$375,000

amounts for Nolton Products for May 2007:

Required

1. Total manufacturing overhead costs allocated

2. Variable manufacturing overhead spending variance

3. Fixed manufacturing overhead spending variance

4. Variable manufacturing overhead efficiency variance

5. Production-volume variance

Besure to identify each variance as favorable (F) or unfavorable

(U).

8-34 Overhead analvsis. sensitivity to denominator volume. Armstrong Corporation produces thermostats

andhas no inventories. Armstrong uses standard costing and allocates all overhead an the basis of machinehours.It budgets 0.30 of a machine-hour to manufacture each unit. The following information is for 2007:

A

B

Actual

1

.2..

Production and sales in units

.}, Machine-hours

_'L. Fixed manufacturing overhead

.1- Variable manufacturing overhead

..Q.. Variable manuf. overhead rate per machine-hour

Results

110,000

30,000

$440,000

$960,000

C

I

Siati,

Bud:!;et

120,000

36,000

$450,000

$

30

It you want to use Excel to solve this problem, go to the Excel lab at www.prenhall.comjhorngren/cost12e

anddownload the template tor Problem 8-34.

1. Calculate the variable manufacturing overhead spending and efficiency variances .•

2. Calculate the fixed manufacturing overhead spending and production-volume

variances.

3. Suppose Armstrong had budgeted for 150,000 units instead of 120,000 units and 45,000 (150,000 x 0.301

machine-hours instead of 36,000 machine-hours. All other information in the table remains the same.

Recalculate the variable manufacturing overhead variances and the fixed manufacturing overhead

variances in requirements 1 and 2.

4. Armstrong writes off all variances to cast of goods sold. How would Armstrong's operating income

change if it budgeted for 150,000 units of production and sales rather than 120,000 units?

equl •.• d

8-35 Sales-volume variance, production-volume variance. Morano Company budgeted production and

salesat its maximum capacity of 20,000 units for 2006. However, Morano was able to produce and sell only

18,000units for the year. There are no beginning or ending inventories. Other data for 2006 follow:

Budgeted fixed overhead costs

Budgeted selling price

Budgeted variable cost per unit

S500,000

$100

$40

1. Calculate the static-budget operating income, the flexible-budget operating income, and the operating

income based an the budgeted profit per unit.

2. Compute sales-volume variance, production-volume variance, and operating income volume variance.

What do each of these variances measure?

8-36 Activity-based costing. variance analysis. Toymaster, Inc., produces a plastic toy car, TGC, in

batches.To manufacture a batch of TGCs, Toymaster must set up the machines. Setup costs are batch-level

costs.A separate Setup Department is responsible for setting up machines for TGC.

•••• ul •.•d

~

b1I

PIlGladtA.ssist

239

8-30 Journal entries Icontinuation

Require"

of 8-29).

1. Prepare journal entries for variable and fixed manufacturing overhead (you will need to calculate the

various variances to accomplish this).

2. Overhead variances are written off to the Cost of Goods Sold (COGSI account at the end of the fiscal

year. Show how COGS is adjusted through journal entries.

PHGradtAlsist

8-31

Graphs and overhead variances. The Carvelli Company is a manufacturer of housewares and uses

standard costing. Manufacturing overhead (both variable and fixedl is allocated to products on the basis of

budgeted machine-hours. The budget for 2007 included:

Variable manufacturing overhead

Fixed manufacturing overhead

Denominator level

Require"

$9 per machine-hour

$72,000,000

4,000,000 machine-hours

1. Prepare two graphs, one for variable manufacturing overhead and one for fixed manufacturing overhead. Each graph should display how Carvelli's total manufacturing overhead costs will be depicted for

the purposes of la) planning and control and Ibl inventory costing.

2. Suppose that 3,500,000 machine-hours were allowed for actual output produced in 2007, but 3,800,000

actual machine-hours were used. Actual manufacturing overhead was S36,100,000, variable, and

$72,200,000, fixed. Compute lal the variable manufacturing overhead spending and efficiency variances and (bl the fixed manufacturing overhead spending and production-volume variances. Use the

columnar presentation illustrated in Exhibit 8-5Ip. 2721.

3. What is the amount of the under- or overallocated variable manufacturing overhead and the under· or

overallocated fixed manufacturing overhead? Why are the flexible-budget variance and the under· or

overallocated overhead amount always the same for variable manufacturing overhead but rarely the

same for fixed manufacturing overhead?

4. Suppose the denominator level was 3,000,000 rather than 4,000,000 machine-hours. What variances in

requirement 2 would be affected? Recompute them.

8-32 4-variance analysis, find the unknowns. Consider each of the following situations-cases

A, B,

and C-independently.

Data refer to operations for Apri12007. For each situation, assume standard costing.

Also assume the use of a flexible budget for control of variable and fixed manufacturing overhead based on

machine-hours.

(1) Fixed manufacturing overhead incurred

(2) Variable manufacturing overhead incurred

(3) Denominator level in machine-hours

(4) Standard machine-hours allowed for actual output achieved

151 Fixed manufacturing overhead Iper standard machine-houri

Flexible-budget data:

(6) Variable manufacturing overhead (per standard machine-hour)

171 Budgeted fixed manufacturing overhead

(8) Budgeted variable manufacturing overheada

191 Total budgeted manufacturing overhead'

Additional dala:

110) Standard variable manufacturing overhead allocated

(11) Standard fixed manufacturing overhead allocated

(12) Production-volume variance

l13) Variable manufacturing overhead spending variance

114) Variable manufacturing overhead efficiency variance

(15) Fixed manufacturing overhead spending variance

(16) Actual machine-hours used

ilFor standard machine-hours

Required

'"w

'"

>-

"«

J:

u

288

allowed for actual output produced.

Fill in the blanks under each case. [Hint: Prepare a worksheet similar to that in Exhibit 8-5Ip. 272}. Fill in

the knowns and then solve for the unknowns.]

8-33 Flexible budgets, 4-variance analvsis. ICMA, adapted) Nolton Products uses standard costing.

It allocates manufacturing overhead (both variable and fixed) to products on the basis of standard direct

manufacturing labor·hours (DLH). Noltan develops its manufacturing

overhead rate from the current

annual budget. The manufacturing overhead budget for 2007 is based on budgeted output of 720,000

units, requiring 3,600,000 DLH. The company is able to schedule production uniformly throughout the year.

Fixed

Variable

Overhead

Spending

Scenario

Variance

Variable

Overhead

Fixed

Overhead

Spending

Efficiencv

Variance

Variance

Overhead

ProductionVolume

Variance

Actual machine hours are 10% greater

than flexible-budget machine-hours

Production output is 20% less than

budgeted

Production output is 10% more than

budgeted; actual machine-hours are

5% less than budgeted

Production output is 15% more than

budgeted, and actual fixed overhead

is 6% more than budgeted

Relative to the flexible budget, actual

machine-hours are 10% greater, and

actual variable overhead costs are

8% greater

8-28 Flexible-budget variances, review of Chapters 7 and 8, The Monthly Herald uses standard

and reports the following results in August 2008 for its monthly newspaper:

A

J

2

3

4

5

6

C

Static

B

Number of copies

Number of pages of newsprint

Cost of newsprint (dixect materials)

Variable overhead costs

Fixed overhead costs

Attua!

Re,ulu

320,000

17,280,000

$ 224,640

$

63,936

$

97,000

costing

t

300,000

15,000,000

$ 180,000

$

60,000

$

90,000

B

Newsprint-the

special paper on which the newspaper is printed-is

the only direct-cost category.

Variable and fixed overhead costs are allocated using budgeted rates on the basis of newsprint pages. Each

copyof the Monthly Herald has only 50 newsprint pages, but in August 2008, the printing machines jammed

frequently during printing runs and damaged a lot of newsprint pages.

Ilyou want to use Excel to solve this exercise, go to the Excel Lab at www.prenhall.com/horngren/cost12e

and download the template for Exercise 8-28,

1. Prepare a comprehensive set of flexible-budget variances

direct materials, variable overhead, and fixed overhead.

2. Comment on the results in requirement 1.

at the Monthly Herald in August 2008 for

•• qul ••••

Problems

8-29 Comprehensive variance analysis, FlatScreen manufactures

flat-panel LCO displays, The displays

are sold to major PC manufacturers.

overhead data for FlatScreen for the

Following is some manufacturing

year ended December 31, 2006:

Overhead

Actual

Results

Flexihle

8udget

Allocated

Amount

Variable

Fixed

$1,532,160

7,004,160

$1,536,000

6,961,920

$1,536,000

7,526,400

Manufacturing

FlatScreen's budget was based on the assumption that 17,760 units (panels) would be manufactured

during2006. The planned allocation rate was 2 machine-hours

per unit. Actual number of machine-hours

used during 2006 was 36,480, The static-budget variable manufacturing overhead costs equal $1,4_2_0,_80_0_,

_

Compute the following quantities Iyou should be able to do so in the prescribed order):

•• qulr."

a. Budgeted number of machine-hours planned

b. Budgeted fixed manufacturing overhead costs per machine-hour

c. Budgeted variable manufacturing overhead costs per machine-hour

d. Budgeted number of machine-hours allowed for actual output produced

e. Actual number of output units

f. Actual number of machine-hours used per panel

287