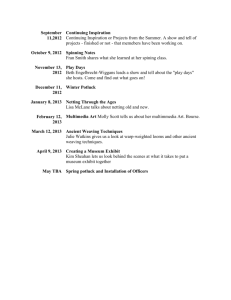

Netting and Offsetting

advertisement