22 October 2014

CIO WM Research

US fixed income

Benefits of investing in mortgage

IOs

James Rhodes, CFA, Fixed Income Strategist, UBS FS

james.rhodes@ubs.com, +1 212 713 9017

IO price

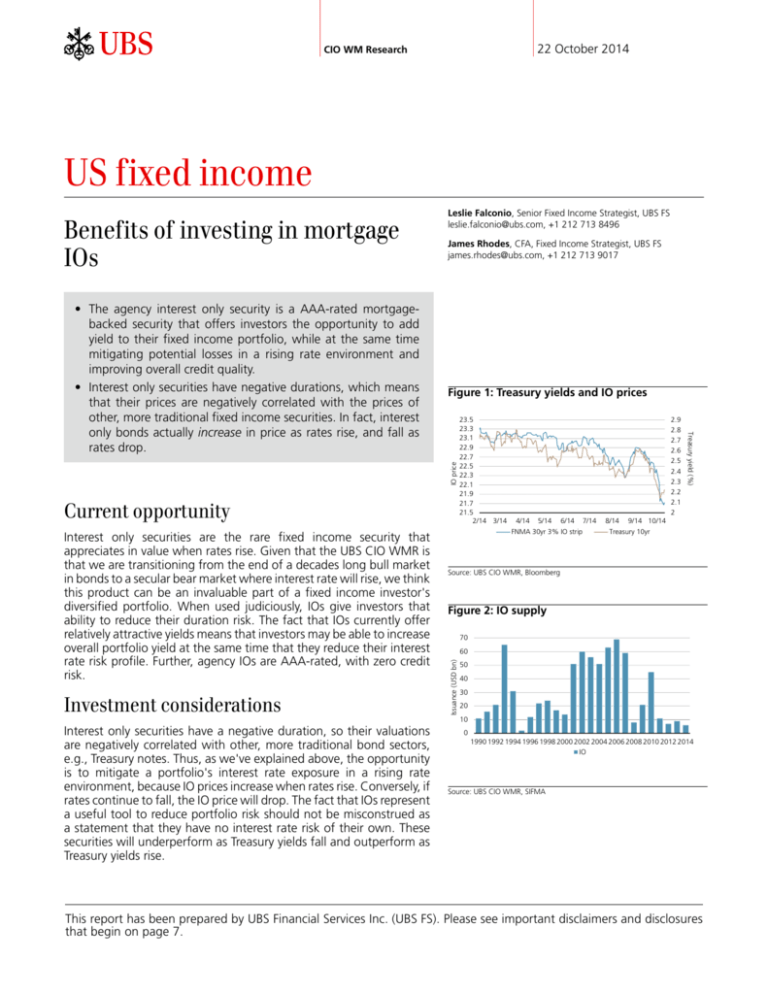

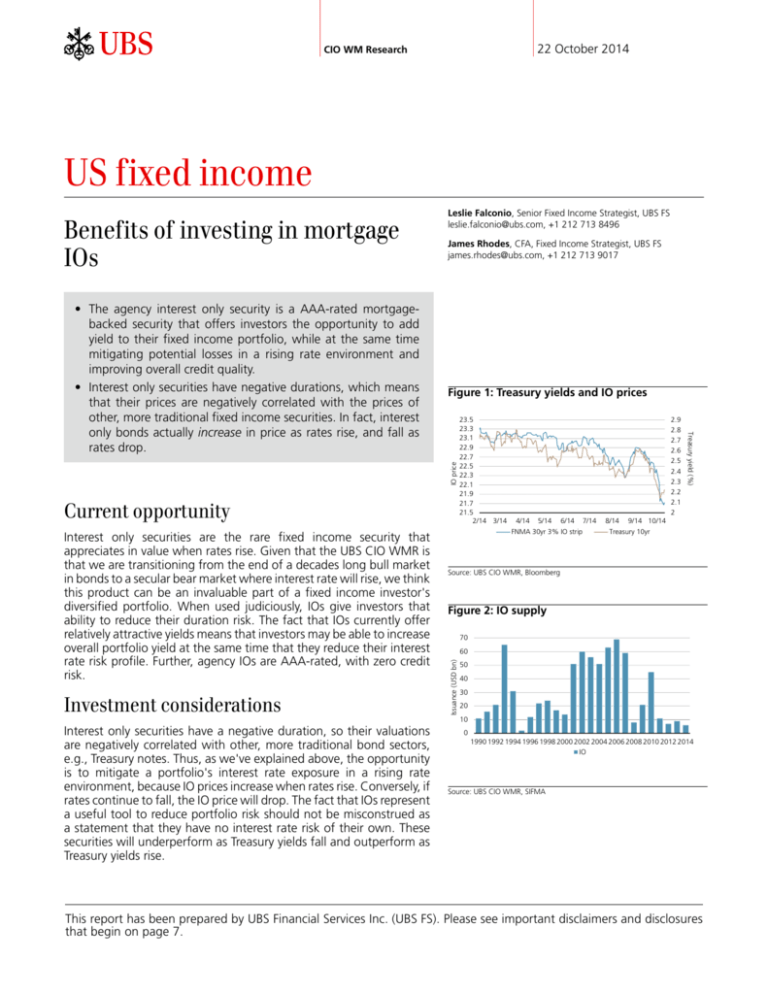

Figure 1: Treasury yields and IO prices

Current opportunity

Investment considerations

Interest only securities have a negative duration, so their valuations

are negatively correlated with other, more traditional bond sectors,

e.g., Treasury notes. Thus, as we've explained above, the opportunity

is to mitigate a portfolio's interest rate exposure in a rising rate

environment, because IO prices increase when rates rise. Conversely, if

rates continue to fall, the IO price will drop. The fact that IOs represent

a useful tool to reduce portfolio risk should not be misconstrued as

a statement that they have no interest rate risk of their own. These

securities will underperform as Treasury yields fall and outperform as

Treasury yields rise.

2.9

2.8

2.7

2.6

2.5

2.4

2.3

2.2

2.1

2

4/14

5/14

6/14

FNMA 30yr 3% IO strip

7/14

8/14

9/14 10/14

Treasury 10yr

Source: UBS CIO WMR, Bloomberg

Figure 2: IO supply

70

60

Issuance (USD bn)

Interest only securities are the rare fixed income security that

appreciates in value when rates rise. Given that the UBS CIO WMR is

that we are transitioning from the end of a decades long bull market

in bonds to a secular bear market where interest rate will rise, we think

this product can be an invaluable part of a fixed income investor's

diversified portfolio. When used judiciously, IOs give investors that

ability to reduce their duration risk. The fact that IOs currently offer

relatively attractive yields means that investors may be able to increase

overall portfolio yield at the same time that they reduce their interest

rate risk profile. Further, agency IOs are AAA-rated, with zero credit

risk.

23.5

23.3

23.1

22.9

22.7

22.5

22.3

22.1

21.9

21.7

21.5

2/14 3/14

Treasury yield (%)

• The agency interest only security is a AAA-rated mortgagebacked security that offers investors the opportunity to add

yield to their fixed income portfolio, while at the same time

mitigating potential losses in a rising rate environment and

improving overall credit quality.

• Interest only securities have negative durations, which means

that their prices are negatively correlated with the prices of

other, more traditional fixed income securities. In fact, interest

only bonds actually increase in price as rates rise, and fall as

rates drop.

Leslie Falconio, Senior Fixed Income Strategist, UBS FS

leslie.falconio@ubs.com, +1 212 713 8496

50

40

30

20

10

0

1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014

IO

Source: UBS CIO WMR, SIFMA

This report has been prepared by UBS Financial Services Inc. (UBS FS). Please see important disclaimers and disclosures

that begin on page 7.

US fixed income

Figure 3: Mortgage loans collateralize myriad

mortgage-backed securities, including IOs

Different Risk and Return for Different Investors

B

B

B

AAA/Aaa

B

B

B

Pool of

Mortgage

Loans

B

B

B

B

B

B

AA/Aa

A/A

BBB/Baa

B

BB/Ba

B

Unrated

B/B

B

B

First

Loss

Highest

Higher

Risk

Expected

Yield

Source: UBS CIO WMR

Prepay Speed (CPR)

Figure 4: Mortgage prepayment speeds and IO

prices

60

35

50

30

25

40

20

30

15

20

10

10

0

-300

5

0

-200

-100

0

100

Interest rate shock (bps)

CPR

IO

200

300

IO Price (vs 100 par)

This is an important distinction that makes IO securities very different

than most other fixed income securities. That's because, all else equal,

prepayment activity is negatively related to the level of interest rates

(i.e., as rates fall, the incentive for a borrower to prepay a loan incrementally increases) – and since IO valuations are also negatively related to prepayment activity – the IO valuations are actually expected to

increase as interest rates rise, unlike most other fixed income counterparts. In fact, IOs have negative durations. This means that not only

do IO prices move in the opposite direction as, for example, Treasury

notes; but do so in an asymmetrical fashion, with the IO showing price

declines in Treasury market rallies.

Lower

Expected

Yield

Credit Risk

The IO is sold at a deep discount price, relative to the notional principal (e.g., an IO strip today might trade with a dollar price in the

low 20s, versus a par amount of 100 on the notional principal). As

the notional principal amount declines, because of either scheduled

or unscheduled principal payments (e.g., loan amortization, borrower

prepayments), the IO cash flows will likewise decline. Thus, faster prepayments are bad for the IO investor because they reduce the principal balance on which future interest payments are made; conversely, slower prepayments are good because they preserve the principal

balance on which interest payments are made.

Lowest

Risk

B

B

B

Another type of MBS that we think deserves more attention in today's

environment is the Interest Only (IO) security3. Mortgage IOs, as the

name suggests, consist of (only) the interest portion of the cash flows.

That is, 100% of the interest is passed through to IO, but it receives

0% of the principal. There is, just in case you're wondering, a related Principal Only (PO) security, which receives the all principal and no

interest. Together, an IO and PO on the same set of mortgage loans

equates to the underlying passthrough, although they differ dramatically in terms of their risk characteristics.

Last

Loss

Loss position

If you've ever financed your home with a mortgage loan, there's a

good chance that your loan was collateral for a publicly traded mortgage backed security (MBS). That's because a high percentage of the

individual mortgages originated by lenders like banks are ultimately

pooled as collateral that backs MBS, which are then sold to investors

all over the world. In the most basic type of MBS, called passthrough

securities1, principal and interest are passed through to the investor,

meaning that she receives monthly payments. Some other securities

are "tranched" (i.e., mathematically "sliced and diced") to create collateralized mortgage obligations (CMOs)2, which allow investors to

customize both the risk and reward through sequential allocation of

the underlying principal and interest payments.

Source: UBS CIO WMR

[1] "Mortgage backed securities, Chapter One: Passthroughs," 4 July 2014.

[2] "Mortgage backed securities, Chapter Two: Agency CMO," 9 October 2014.

[3] "Mortgage backed securities, Chapter Three: Interest Only Securities," 21 October 2014.

UBS CIO WM Research 22 October 2014

2

US fixed income

The fact that IOs offer a combination of relatively high yields, negative duration and AAA credit quality gives investors an opportunity to diversify their fixed income portfolios, while at the same time

positioning for better total return performance in a rising rate environment. As a reminder, UBS CIO WMR believes that the FOMC will

imminently end new QE-related bond purchases, then begin hiking

overnight rates sometime mid-2015. UBS CIO WMR expects both Fed

policy and robust US economic growth to motivate higher interest

rates going forward. We believe that fixed income investors should

therefore, in turn, be motivated to find ways to mitigate the interest

rate risk in their bond portfolios.

Figure 5: Interest rate scenarios

We highlight some comparative rates of return for different fixed

income securities, including a Treasury note, two corporate bonds,

and an IO strip. Specifically, we project total returns over a six month

horizon using option adjusted spread (OAS) analysis, assuming that

UBS CIO WMR's rates forecasts are realized and prepayment activity evolves in a manner consistent with recent history. The results are

presented on both an absolute and relative basis (i.e., for both the

individual security and duration-weighted comparisons).

Figure 6: Interest rate scenarios

WMR

12mo

1.20

1.60

2.30

3.00

3.50

Lower

rates

0.01

0.01

0.91

1.70

2.48

4

Yield to maturity (%)

3.5

3

2.5

2

1.5

1

0.5

0

0

5

WMR 3mo

10

15

20

Interest rate scenarios

WMR 6mo

WMR 12mo

25

30

Lower rates

Source: UBS CIO WMR

Figure 7: Comparative total return analysis

8

6

4

2

0

(2)

(4)

(6)

(8)

1.2

0.9

0.6

0.3

0.0

-0.3

-0.6

-0.9

-1.2

Comp total return (%)

One final note about the analysis: while the effective durations of the

paired trades (aka, comparison portfolios) are "zeroed out," please

note that this is for the sake of analysis only. We are not recommending that investors completely avoid duration risk in their fixed income

portfolios; rather, we are merely attempting to highlight the potential benefits of including IO securities in a diversified portfolio returns.

Namely, those are yield enhancement and risk reduction, both with

respect to duration risk and credit risk.

WMR

6mo

0.50

1.00

2.00

2.80

3.40

Source: UBS CIO WMR

Security total return (%)

As the chart shows, the IO strip is expected to outperform the more

traditional fixed income securities in the rising rate environment that

we expect to manifest. We think the comparative return profiles here

look consistent with what a moderately conservator investor should

find attractive.

USD 3M Libor

USD 2Y Treasury

USD 5Y Treasury

USD 10Y Treasury

USD 30Y Treasury

WMR

3mo

0.40

0.80

1.80

2.50

3.20

WMR 3mo forecast WMR 6mo forecast WMR 1yr forecast

Lower rates

Treasury 10yr

IBM 5yr

IBM 10yr

FNMA 30yr 3% IO

IO strip vs Treasury 10yr

IO strip vs IBM 5yr

IO strip vs IBM 10yr

Source: UBS CIO WMR, Yield Book

UBS CIO WM Research 22 October 2014

3

US fixed income

Glossary

Callable bond: Allows redemption of the debt before maturity and

therefore can be treated as an option. The issuer benefits from

decreasing interest rates that allow cheaper debt refinancing.

Accordingly, the investor expects the borrower not to call the bond

and interest rates to at least stay stable or to increase slightly. If

interest rates fall, the mortgage owners can refinance their debt at

the lower rate, leading to asset loss by the agencies. Fannie and

Freddie have been thought of as strategic issuers of callable debt

because they issue structures that help to hedge the interest rate

and cash flow risk characteristics of their retained mortgage

portfolios. Issuance of callable bonds generates a natural hedge.

Collateralized Mortgage Obligation (CMO): A security which

pools together mortgages and separates them into short-, medium-,

and long-term positions (called tranches). Tranches are set up to pay

different rates of interest depending upon their maturity. Interest

payments are usually paid monthly. In "plain vanilla" CMOs,

principal is not paid on the final tranche until the other tranches

have been paid off. This system provides interest and principal in a

more predictable manner.

Convexity (positive): A decrease in a bond's yield will raise the

bond's price by an amount that is greater in size than the

corresponding fall in the bond's price that would occur if there were

an equal-sized increase in the bond's yield.

Convexity (negative): When the shape of a bond's yield curve is

concave. A bond’s convexity is the rate of change of its duration,

and is measured as the second derivative of price with respect to

yield.

Conditional prepayment rate (CPR): Equals the proportion of the

principal that is likely to be repaid before maturity in every period.

Several factors like historical prepayment rates are used in the

analysis.

Duration: A measure of the average maturity of the stream of

payments generated by a financial asset. This is the weighted

average of the lengths of time until the asset's remaining payments

are made.

Effective convexity: A measure of the sensitivity of a bond’s price

to an assumed shift in interest rates, which cannot be explained by

the effective duration alone. Effective convexity takes into account

the fact that the bond has embedded options.

Effective duration: A duration calculation for bonds that have

embedded options. Effective duration takes into account the fact

that expected cash flows will fluctuate as interest rates change.

Fannie Mae, Freddie Mac: constitute the so-called agency issuers,

UBS CIO WM Research 22 October 2014

4

US fixed income

since they are all in some way related to the US government (i.e.,

they are called "agents" of government public policy).

Ginnie Mae: is government-owned and operates as a unit of the

Department of Housing and Urban Development (HUD). The

mortgage obligations of GNMA are backed by the “full faith and

credit” of the US government.

Interest Only Strip (IO): The interest portion of mortgage,

Treasury or bond payments, which is separated and sold individually

from the principal portion of those same payments. The periodic

payments of several bonds can be "stripped" to form synthetic

zero-coupon bonds. Also, an IO strip might be part of a larger

collateralized mortgage obligation (CMO) structure.

Modified duration: The approximation of the marginal shift of

bond/mortgage price caused by a marginal change of the yield to

maturity.

Planned Amortization Class CMO (PAC): A class of tranche in a

planned amortization class (PAC) bond that receives a primary

payment schedule. As long as the actual prepayment rate is

between a designated range of prepayment speeds, the life of the

PAC tranche will remain relatively stable. This tranche of the PAC

bond receives some measure of protection against prepayment risk.

Principal Only Strip (PO): A type of fixed-income security where

the holder is only entitled to receive regular cash flows that are

derived from incoming principal repayments on an underlying loan

pool. The loan is often a pool of mortgages in the form of a

mortgage-backed security.

Private label issuers (i.e. those not related to the US government):

constitute the remaining part of the market. This segment of the

market predominantly provides a secondary market for jumbo loans,

which are those loans that do not qualify for involvement by Fannie,

Freddie or Ginnie. Typically, this is because the loan amount is larger

than the conforming loan limits set by the Federal Housing

Administration (FHA). These loans are not backed by the

government.

Public Securities Association Standard Prepayment model

(PSA): One of several models used for calculation and management

of prepayment risk . This model includes the changing prepayment

assumptions that might influence the lifetime of the security and its

yield. The underlying assumption is that prepayments rise gradually

until the 30th month. There are several real-world explanations for

this: lower likelihood of moving to a different home or refinancing,

or no financial means to allow for additional payments. The

standard model, "100% PSA," goes from a month-zero annualized

prepayment rate of 0% with 0.2% increases each month until

reaching 6% after 30 months (see Fig. 12).

UBS CIO WM Research 22 October 2014

5

US fixed income

Sequential Pay CMO (SEQ): A type of collateralized mortgage

obligation (CMO) in which there are several tranches. Each tranche's

holder receives interest payments as long as the tranche's principal

amount has not been completely paid off. The senior tranche

receives all initial principal payments until it is completely paid off,

after which the next most senior tranche receives all the principle

payments, and so on.

Z Bond CMO (Z): The final tranche in a series of mortgage-backed

securities that is the last one to receive payment. Used in some

collateralized mortgage obligations (CMO), Z-bonds pay no coupon

payments while principal is being paid on earlier bonds. Interest that

would have been paid on Z-bonds is used instead to pay down

principal more rapidly on the earlier series of bonds.

Single mortality rate (SMM): In the context of MBS, this is the

proportion of the principal amount to be prepaid in a given month.

The higher the proportion, the less interesting an investment

becomes for financial investors due to lost future interest. This rate

refers to prepayment risk.

UBS CIO WM Research 22 October 2014

6

US fixed income

Appendix

Global Disclaimer

Chief Investment Office (CIO) Wealth Management (WM) Research is published by UBS Wealth Management and UBS Wealth Management

Americas, Business Divisions of UBS AG (UBS) or an affiliate thereof. CIO WM Research reports published outside the US are branded as Chief

Investment Office WM. In certain countries UBS AG is referred to as UBS SA. This publication is for your information only and is not intended as

an offer, or a solicitation of an offer, to buy or sell any investment or other specific product. The analysis contained herein does not constitute

a personal recommendation or take into account the particular investment objectives, investment strategies, financial situation and needs of

any specific recipient. It is based on numerous assumptions. Different assumptions could result in materially different results. We recommend

that you obtain financial and/or tax advice as to the implications (including tax) of investing in the manner described or in any of the products

mentioned herein. Certain services and products are subject to legal restrictions and cannot be offered worldwide on an unrestricted basis and/

or may not be eligible for sale to all investors. All information and opinions expressed in this document were obtained from sources believed

to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness (other than

disclosures relating to UBS and its affiliates). All information and opinions as well as any prices indicated are current only as of the date of this

report, and are subject to change without notice. Opinions expressed herein may differ or be contrary to those expressed by other business

areas or divisions of UBS as a result of using different assumptions and/or criteria. At any time, investment decisions (including whether to buy,

sell or hold securities) made by UBS AG, its affiliates, subsidiaries and employees may differ from or be contrary to the opinions expressed in

UBS research publications. Some investments may not be readily realizable since the market in the securities is illiquid and therefore valuing

the investment and identifying the risk to which you are exposed may be difficult to quantify. UBS relies on information barriers to control

the flow of information contained in one or more areas within UBS, into other areas, units, divisions or affiliates of UBS. Futures and options

trading is considered risky. Past performance of an investment is no guarantee for its future performance. Some investments may be subject to

sudden and large falls in value and on realization you may receive back less than you invested or may be required to pay more. Changes in FX

rates may have an adverse effect on the price, value or income of an investment. This report is for distribution only under such circumstances

as may be permitted by applicable law.

Distributed to US persons by UBS Financial Services Inc., a subsidiary of UBS AG. UBS Securities LLC is a subsidiary of UBS AG and an affiliate

of UBS Financial Services Inc. UBS Financial Services Inc. accepts responsibility for the content of a report prepared by a non-US affiliate when

it distributes reports to US persons. All transactions by a US person in the securities mentioned in this report should be effected through a

US-registered broker dealer affiliated with UBS, and not through a non-US affiliate. The contents of this report have not been and will not be

approved by any securities or investment authority in the United States or elsewhere.

UBS specifically prohibits the redistribution or reproduction of this material in whole or in part without the prior written permission of UBS and

UBS accepts no liability whatsoever for the actions of third parties in this respect.

Version as per May 2014.

© UBS 2014. The key symbol and UBS are among the registered and unregisteredtrademarks of UBS. All rights reserved.

UBS CIO WM Research 22 October 2014

7