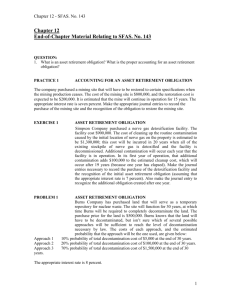

Retirement Obligations - Financial Reporting and Assurance

advertisement