Nielsen Press Release Template

advertisement

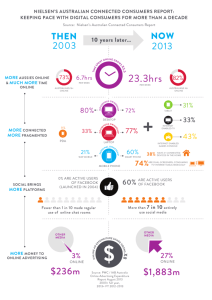

News Release Media enquiries: Ellen Cuijpers Tel: +65 6672 6640 Email: ellen.cuijpers@nielsen.com NIELSEN: CONSUMER CONFIDENCE IN SINGAPORE REBOUNDS Singaporeans are more upbeat about their job prospects and personal finances Southeast Asian consumer confidence levels strengthen in third quarter Saving for the future remains priority for consumers in Singapore and in other SEA markets SINGAPORE, 10 NOVEMBER 2014 – For the first time since three years, consumer confidence levels in Singapore (+5pp) exceeded 100 points to stand at 103 points in Q3 2014, according to the latest Consumer Confidence Index released today by Nielsen, a global information and measurement company. Singapore’s Consumer Confidence has remained below 100 points for three years since Q3 2011. (See Chart 1). The Nielsen Global Survey of Consumer Confidence and Spending Intentions reveals that the steady climb in consumer confidence is mainly driven by a 8-point increase from the previous quarter in the number of consumers who feel that future job prospects would be positive (61%). (See Chart 2). The Nielsen report also revealed a four percentage point increase in consumers’ outlook on their personal finances, with 59 percent of Singaporeans viewing the state of their personal finances in the coming 12 months as good or excellent. In the other markets in Southeast Asia, consumer confidence has gained further momentum in Q3 2014, with three Southeast Asia markets ranking in the top five most optimistic countries globally. Indonesian consumers are the second most confident globally, with the country’s consumer confidence score increasing by two points to 125 in Q3 2014 compared to previous quarter. The Philippines remains third most confident globally, scoring 115 points. Thailand’s Consumer Confidence Index score showed the highest jump in the region with an increase of eight points to 113 compared to last quarter. Vietnam’s Consumer Confidence Index jumped three points to 102, the highest level since late 2010. Malaysians are equally positive with a six point increase compared to last quarter (99 points). Globally consumer confidence remains steady at 98 points. (See Chart 3). “The consistent, steady climb of consumer confidence in the region highlights strong underlying factors that are buoying consumer outlook on the future,” said Vishal Bali, Nielsen’s Managing Director of Consumer Insights in Southeast Asia, North Asia and Pacific. “The recently emerged clarity on the political front in some markets and a variety of underlying economic factors have helped drive the surge in consumer confidence.” The Nielsen Global Survey of Consumer Confidence and Spending Intentions, established in 2005, measures consumer confidence, major concerns, and spending intentions amongst more than 30,000 respondents with 1 Internet access in 60 countries. Consumer confidence levels above and below a baseline of 100 indicate degrees of optimism and pessimism. SAVING FOR THE FUTURE REMAINS PRIORITY Consumers in Singapore remain focused on putting aside savings for the future with two in three (66%) stashing their spare cash into savings after covering essential living expenses. Consumers in other Southeast Asia markets are also diligently building nest eggs, including those in the Vietnam (77%) and Indonesia (74%), Philippines (67%), Thailand (67%) and Malaysia (63%). Along with channelling spare cash into savings and investing in stocks, consumers in the region are also eager to spend on big ticket items. Singaporeans are the most-inclined globally to spend their spare cash on vacations (51%), followed closely by Malaysia (47%) and Indonesia (41%). Meanwhile, around a third of consumers in the Philippines (37%), Vietnam (35%), Thailand (31%) and Singapore (31%) choose to spend their spare cash on new clothes. (See Chart 4). “Southeast Asians are known for prioritising saving over spending, and it is this mentality which influences their careful spending patterns,” observes Bali. “Conversely, rising disposable income is driving the desire to seek out lifestyle upgrades such as vacations and buying new clothes.” Although the majority of Singaporeans said they put their spare cash into savings, Q3 2014 saw an upswing in the number of Singaporeans intending to purchase a holiday (up 8 points to 51%), buying new clothes (up 3 points to 31%) and paying off debts (up 8 points to 30%). (See Chart 5). In the face of rising inflation across the region, a growing number of consumers are looking for ways to reduce their everyday household bills, and five Southeast Asia markets (Thailand, Vietnam, Philippines, Malaysia and Indonesia) rank in the top 10 globally when it comes to changing their spending to save on household expenses. Close to nine in 10 Thais (88%) have changed their spending in the past year to save on household expenses, the highest level globally, followed by 86% in Vietnam, 83% in the Philippines, 79% in Malaysia, 76% in Indonesia and 63% in Singapore. Spending less on new clothes, cutting down on out-of-home entertainment and trying to save on utility bills are some of the most common areas where consumers are looking to save. (See Chart 6). “Consumers in Southeast Asia have a cautious approach when it comes to spending,” states Bali. “As their wealth increases, they remain frugal with their outgoings. And as prices increases they are on the look-out for ways to save on everyday expenses.” 1 While an online survey methodology allows for tremendous scale and global reach, it provides a perspective on the habits of existing Internet users, not total populations. In developing markets where online penetration has not reached majority potential, audiences may be younger and more affluent than the general population of that country. Additionally, survey responses are based on claimed behavior, rather than actual metered data Chart 1: Nielsen Consumer Confidence Index, Singapore, Q3 2005 - Q3 2014 120 103 111 114 100 113 92 96 2008-Q3 2009-Q3 94 98 98 103 2011-Q3 2012-Q3 2013-Q3 2014-Q3 80 60 40 20 0 2005-Q3 2006-Q3 2007-Q3 2010-Q3 Chart 2: Future job prospects over the next 12 months, Singapore, Q3 2014 Chart 3: Nielsen Consumer Confidence Index, Southeast Asia, Q3 2013 Chart 4: Top areas consumers are spending their spare cash, Southeast Asia, Q3 2014 Chart 5: Top areas consumers are spending their spare cash, Singapore, Q4 2013 - Q3 2014 Chart 6: Top three actions Southeast Asian consumers have taken to improve saving urce: Nielsen Global Survey of Consumer Confidence and Spending Intentions, Q3 2014 About the Nielsen Global Survey The Nielsen Global Survey of Consumer Confidence and Spending Intentions was conducted Aug. 13–Sept. 5, 2014 and polled more than 30,000 online consumers in 60 countries throughout Asia-Pacific, Europe, Latin America, the Middle East/Africa and North America. In Singapore, the sample size is 515 respondents. The sample has quotas based on age and sex for each country based on its Internet users and is weighted to be representative of Internet consumers. It has a margin of error of ±0.6%. This Nielsen survey is based only on the behavior of respondents with online access. Internet penetration rates vary by country. Nielsen uses a minimum reporting standard of 60% Internet penetration or an online population of 10 million for survey inclusion. The Nielsen Global Survey, which includes the Global Consumer Confidence Index, was established in 2005. About Nielsen Nielsen Holdings N.V. (NYSE: NLSN) is a global information and measurement company with leading market positions in marketing and consumer information, television and other media measurement, online intelligence and mobile measurement. Nielsen has a presence in approximately 100 countries, with headquarters in New York, USA, and Diemen, the Netherlands. For more information, visit www.nielsen.com. # # #