2015/16 Cost Improvement Plan (CIP) QIA update

advertisement

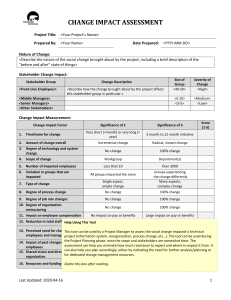

Trust Board Date: 28th May 2015 Agenda Item: 4.3 REPORT TITLE: 2015/16 Cost Improvement Plan (CIP) QIA update EXECUTIVE SPONSOR: Des Holden, Medical Director REPORT AUTHOR (s): Coral Jackson, Head of Financial Reporting Action Required: Approval (√) Discussion () Assurance (√) Purpose of Report: To update the Board and confirm sign-off of 2015/16 CIP QIAs. Summary of key issues The 2015/16 cost improvement plans have now had Quality Impact Assessments (QIAs) signed off by the Chief Nurse and Medical Director. Those that have been signed off have a total CIP value above the total CIP total of £8.2m to take account of contingency schemes, noting that £1.2m of schemes are red-rated in terms of delivery. One QIA (for £40k savings from general supplies costs, including the crèche) has been rejected and is covered by the contingency saving. Contingency schemes totaling £0.5m have been identified. The CIP profile sees an increasing value as we reach Month 4, and no CIPs are in progress without a QIA in place. The procedure note for the Trust’s QIAs is attached in the appendix. Recommendation: For assurance and approval. Relationship to Trust Strategic Objectives & Assurance Framework: Objectives S01 (Safe Services) S02 (Effective) and SO5 (Well led) apply. 1 Corporate Impact Assessment: Legal and regulatory impact No legal breach is reported, or forecast. Financial impact Savings delivery impacts on the overall financial position of the Trust. No adverse impact reported or expected. Patient Experience/Engagement Risk & Performance Management NHS Constitution/Equality & Diversity/Communication All savings plans are subject to Quality Impact Assessments (QIAs). No compliance issues. Risks are stated in the report. No compliance issues. Attachment: None 2 Quality Impact Assessments 2015/16 The QIA group has met in the last week and signed off the final tranche of QIA forms. Some QIA forms required further information to enable the group to better assess their associated risk, and one (£40k in respect of establishment costs including the crèche) was rejected. The table below shows the QIA progress and the situation in respect of signed QIAs. Table: situation report on QIAs: Schemes Total CIP No of QIA's £'000 outstanding Value of QIA's outstanding 1 Car Park Income 301 0 - 2 Catering Income 22 0 - 3 IT 300 0 - 4 Premises 415 0 - 5 Private Patients & Amenity Beds 372 0 - 6 Organisational Restructure (Fully Mitigated) 536 0 - 7 Escalation 600 0 - 8 Medical agency 491 0 - 9 CSS agency 304 0 - 10 Nursing, Midwifery & HCA Temp staff 854 0 - 11 Establishment - Corp 192 0 - 12 Establishment - HR 13 Clinical supplies & services 30 0 - 1,241 0 - 14 Drugs 655 0 - 15 Pathology Network 300 0 - 16 Non Clinical Agency 144 0 - 17 General supplies & services 425 0 - 18 External consultancy 220 0 - 19 Other Income (non patient related) 235 0 - 20 CNST 292 0 21 Contingency schemes 500 0 TOTALS 8,429 0 CIP budget 8,168 0% Variance (adv)/fav 261 Comments One QIA has been rejected (£40k, in respect of CIP for creche) - covered by contingency 0% 3 Annex Procedure for Quality Impact Assessment (QIA) of cost improvement plans (and other relevant service actions) Date 16 January 2014 (amended 25 February 2014, and 26 February 2015 - issue of new template) Author Peter Burnett (Head of Financial Management) Department Finance and Contracting Audience All Divisions and Departments Summary Quality is defined as patient safety, patient experience and clinical effectiveness. As such it is at the centre of the Trust’s working, including how it makes financial decisions. Cost improvement plans must, at the very minimum, not impact adversely on quality (please see National Quality Board principles in the introduction below, section #1). Indeed, we must seek to ensure service efficiency and value for money drives both quality and reduced cost wherever we can – the two are often linked very strongly. The Trust has adopted the National Quality Board’s recommendations on quality impact assessment (QIA) of cost improvement plans (and other relevant actions) and has strengthened its internal QIA process. On 28 November 2013 the Trust Board approved the revised process. This revised procedure incorporates further comment from the Trust Development Authority, who have reviewed that internal process and updates what was circulated to Divisions on 5 December 2013 – changes are procedural only and relatively minor (but provide greater clarity). The 2014 QIA procedure sees the introduction of a risk scoring process for each cost improvement plan and a “Quality Assessment Group” (nb: as last year part of the regular Chiefs meeting) prior to sign off by the Medical Director and Chief Nurse. This has been revised in 2015 to match the risk scoring used in all other givernance areas. This ensures a fuller audit trail and the “likelihood by impact” risk scoring aligns this with the Trust’s other risk management processes. The process will also see rejected CIPs passed up to either the Executive Team or Board, as necessary. Action: 1. All Divisions/Directors must prepare QIAs in respect of their cost improvement plans, and any other relevant service actions that could require the assessment. 2. Reviews should be taken periodically by Divisions through the year to ensure the QIA remains current 3. Completed QIAs should be physically signed off by the Quality Assessment Group – the Medical Director and Chief Nurse. 4 Cost improvement plans – Quality Impact Assessment (QIA) 1. Introduction: The National Quality Board has produced a useful and informative document that outlines how we as a provider trust should quality impact assess our Cost Improvement Plans (CIPs). The key points they make are a) The majority of CIPs should be on changes to current processes, rather than top slicing current budgets. b) Where possible CIPs should have a neutral or positive impact on quality. c) CIPS should not bring quality below essential common standards. d) CIPs should be categorised by their potential impact on quality. e) QIAs should cover safety, clinical outcomes patient experience. f) Board Assurance is required that CIPs have been assessed for quality. g) Must be mechanism for capturing front line staff concerns h) CIPs should be subject to an on-going assessment of their impact on quality. 5 2. Suggested Checklist (in excel template): Patient Safety: 1 What is the impact on partner organisations and any aspect of shared risk? 2 people and adults? 3 What is the impact on patients? 4 What is the impact on preventable harm? 5 Will it affect the reliability of safety systems? 6 How will it impact on systems and processes for ensuring that the risks of healthcare acquired infections to patients is reduced? 7 What is the impact on clinical workforce capability care and skills? Clinical Effectiveness: 1 What is the impact on implementation of evidence based practice? 2 What is the impact on clinical leadership? 3 Does it reduce or have a negative impact on variations in care provision? 4 Does it affect supporting staff to stay well? 5 Does it promote self care for people with long terms conditions? 6 setting? 7 Does it eliminate inefficiency and waste by design? 8 Does it lead to improvements in care pathways? Patient Experience: 1 What is the impact on race, gender, age, disability, sexual orientation, religion and belief for individual and community health access to services and experience? 2 What is the likely impact on self reported experience of patients and service users? (Response to national/local surveys/complaints/PALS/Incidents). 3 How will it impact on patient choice? 4 How will it impact on compassionate and personalised care? 6 3. QIA Process: The Trust has introduced the pro-forma below (available as an Excel file for completion). [UPDATED FOR 2015/16] Quality Impact Assessment Template Scheme number: Date of QIA: Scheme Name Scheme FYE value (£'000s) Benefits for Patients Project Lead Division Quality Indicator(s) - consider KPIs Extreme = 5 Details (include mitigation) Certain = 5 Insignificant = 1 Rare = 1 Consequence Likelihood Score 1 4 4 Consequence Likelihood Score 2 4 8 Consequence Likelihood Score 5 5 25 Risks to Patient Safety Details (include mitigation) Risks to Clinical Effectiveness Details (include mitigation) Risks to Patient Experience Overall Risk Score (highest from above quality domains) 25 Comments on Above: Name Date Approval status Decision by Divisional AD/Director Approve / Reject Decision by Divisional Chief Approve / Reject Decision by Medical Director Approve / Reject Decision by Chief Nurse Approve / Reject 7 A guide to the risk rating scores is shown in Appendix A QIA templates will be completed by Divisions/Directorates, signed by the relevant Director or Associate Director of Operations and forwarded to the Head of Financial Management for recording and collation. They will then be passed on to a “Quality Assessment Group” for approval. This group consists of the Medical Director (Chair) and Chief Nurse. If accepted, completed QIA templates would then be signed by the Medical Director and Chief Nurse, those rejected noted as such. All of the reviewed QIA forms should then be returned to the Head of Financial Management for summarising and reporting back to the Executive Team or the Board. I say “all” so that there is an audit trail of all CIPs coming through this process and for the recording of rejected plans. The Programme Management Office’s role is to ensure the QIAs get done and will include progress chasing among its actions. The ToRs of the PMO are attached at Appendix B. 8 Appendix A Risk scoring Risk scoring has been changed between 2014/15 and 2015/16 to match risk scoring in all other governance areas. CONSEQUENCE Insignificant = 1 No obvious or significant impact on quality, safety, effectiveness or experience Minor = 2 Minor/short term/non permanent impact on quality, safety, effectiveness or experience Moderate = 3 Unsatisfactory or semi permanent impact on quality, safety, effectiveness or experience Major = 4 Extensive or permanent impact on quality, safety, effectiveness or experience Extreme = 5 Catastrophic impact on quality, safety, effectiveness or experience LIKELIHOOD Almost Certain = 5 Will occur Likely Will probably occur = 4 Possible = 3 Might happen or recur Unlikely = 2 Do not expect to happen/recur Rare Will probably never happen = 1 RISK QUANTIFICATION MATRIX Consequence Insignificant Minor Major Extreme 1 2 3 4 5 Almost certain - 5 5 10 15 20 25 Likely - 4 4 8 12 16 20 Possible - 3 3 6 9 12 15 Unlikely - 2 2 4 6 8 10 Remote - 1 1 2 3 4 6 RISK RATING LOW Low (1-6). Insignificant potential impact on quality, safety, effectiveness and experience MEDIUM Medium (8-12). Minimal potential impact on quality, safety, effectiveness and experience = ( Likelihood x severity ) HIGH Moderate Likelihood High (15-25) Adverse potential impact on quality, safety, effectiveness and experience 9 Programme Management Office (PMO) ToRs Appendix B Programme Management Office – cost improvement plans and financial performance Terms of Reference Subject: Written by: Terms of Reference for the PMO Paul Simpson (Chief Finance Officer) Applicable to; Responsible Person: Members of Surrey & Sussex Healthcare Chief Finance Officer NHS Trust PMO - cost improvement plans and income delivery Date ratified: December 2014 Contribution from: For ratification: Version: 3.0 Ratification Committee; Re-write to reflect new PMO structure Executive Committee Review date: Keywords; December 2015 Cost improvement plans, savings, income, transformation 2 An Associated University Hospital of Brighton and Sussex Medical School Programme Management Office (PMO) ToRs 1 Strategic Statement The PMO’s purpose is two-fold and there will be two types of meeting: 1) CIP PMO: to create and ensure delivery of the Trust’s cost improvement plans programme without adverse impact on safety and quality. Meetings will be with Directors and the team responsible for workstreams as required and may be weekly, depending on level of risk and specific issues; 2) Financial Performance PMO: to monitor overall delivery of financial budgets by Divisions (Medicine, surgery, CSS, WaCH, Cancer and Estates) and Director’s corporate departments. Meetings will normally be monthly for Divisions and quarterly for Directors. These will be based around monthly Finance Reporting. PMO’s will be more frequent when performance is adverse, and may be weekly. The CIP task is a challenging one for the whole Trust. These regular and frequent meetings have three prime intentions: 1. to drive action and ownership of CIPs and financial management within the Division/Directorate and recognise delivery; 2. connect the Trust’s executive to timely feedback on progress and issues (maximising responsiveness); 3. Ensure Quality Impact Assessments (QIA) and judgements that affect quality are embedded in financial management. The PMO also has the authority to approve the filling of vacancies in the same way as the Executive Committee. The PMO does not have authority to sign off business cases and savings can only proceed if a QIA has been signed off. 2 Constitution The PMOs are established under the direction of the Executive Committee. 3 Relationships Executive Committee upwards. No sub committees. There will be a “dotted” line to the Quality Assurance Group, but that will remain independent of the PMOs to ensure separation of formal quality consideration. 4 Membership CFO (Chair) – Deputy CFO if CFO not available COO HR Director Deputy CFO or Assistant Director of Finance o 5 Note: CEO, Medical Director and Chief Nurse are formal members but are not expected to attend regularly. Attendance A quorum shall be no fewer than 2 members present, including the Chair – if fewer are 2 Programme Management Office (PMO) ToRs present vacancy forms cannot be approved. 6 At CIP PMO’s: the lead Director and their team should attend; At Financial Performance PMOs: Divisions must be represented at least by their Assistant Director of Operations (or a nominated deputy) and Chiefs of Service are expected to attend. Finance staff supporting CIP delivery or Finance Managers for divisions/departments. Administration Action points from previous meetings shall be available prior to each meeting and allow for additional items to be added at the commencement of each meeting The CFO’s Executive Assistant will take notes of CIP PMO’s and a member of the Finance Team will take notes of monthly financial performance PMOs. Review 7 Review Date December 2015 Frequency 8 The CIP PMO shall meet weekly unless it is agreed not to do so. The Financial Performance PMO shall meet monthly unless performance requires more frequent meetings. Nominally 30 to 60 minute meetings, subject to issues - dates and times advertised in advance Notification of changes will be made available to all members in advance by the CFO Authority The PMOs shall be responsible to and report to the Executive Committee. Judgements or disputes about which Divisions and Directors are required to report to the PMO will be managed by the CEO. 9 Core Duties The PMO does not have the authority to sign off Business Cases (which must go to the Executive Committee or Board). Savings can only proceed once a Quality Impact Assessment has been signed off by the Quality Assurance Group. A: CIP Workstream PMO: 1. This PMO will be held with the Director responsible for a CIP workstream and their project management team. It will be as frequent as necessary and may be discontinued if all action is delegated into a Division. 2. To facilitate the development and scoping of cost improvement plans (and additional income) up to required targets and by required deadlines; 3. Validate CIPs, test coherence, coordination with service delivery and quality impact 3 Programme Management Office (PMO) ToRs to finalise what is accepted within the CIP. The PMO will support the Quality Assurance Group by requiring that QIAs are completed; 4. Provide immediate confirmation, permission or advice in respect of specific actions (eg: around HR requirements); 5. Facilitate identification of contingency and validate control actions; 6. Monitor cost improvement plans against relevant benefits tracking, financial targets and timescales as appropriate. 7. Monitor delivery of cost improvement plans and income additions, providing reporting on delivery to the Executive Committee and CEO. 8. Support the autonomy of Divisions delivering cost improvement plans by minimising additional controls and providing recognition of delivery. Prescribe controls (such as expenditure approval) to Divisions not delivering. 9. Connect workstream PMOs with Divisional and Directorate delivery. 10. Agree vacancy recruitment. B: Financial Performance PMO (for Divisions/Directorates) 1. This will be a regular meeting to review financial performance with Divisions(Medicine, Surgery, CSS, WaCH, Cancer and Estates) and for Director’s corporate departments. 2. Meetings will normally be monthly for Divisions and quarterly for Directors. These will be based around monthly Finance Reporting. PMO’s will be more frequent when performance is adverse, and may be as frequent as weekly. 3. PMO will use management accounts, service line reports, income performance and workforce data as necessary within its remit. 4. If financial performance is adverse, including from savings non-delivery, or there is risk in financial forecasts, agree action plans to correct performance and work with Divisions to identify contingency. 5. Triangulate outputs from other Executive Sub-Committees (eg: clinical effectiveness, workforce) that help to describe drivers for financial performance, or are symptoms of it. Ensure connection between clinical and operational issues, money and risk. Use outputs to inform Trust financial reporting; 6. Gain commitment of staff in the Trust to deliver their financial budgets and ensuring effective communication. 7. Receive information from Divisions relevant to financial management and allow Divisions the opportunity to feedback issues as necessary that they feel they wish to raise; 8. Agree vacancy recruitment. To be reviewed by the Executive Committee in December 2015 [END] 4