ICRA Rating Feature

ICRA Rating Feature

March 2009

TELECOM INFRASTRUCTURE INDUSTRY IN INDIA

Anjan Ghosh

aghosh@icraindia.com

+91-22-30470006

Vikas Aggarwal

vikas@icraindia.com

+91-124-4545300

Nidhi Marwaha

nidhim@icraindia.com

+91-124-4545337

1.0

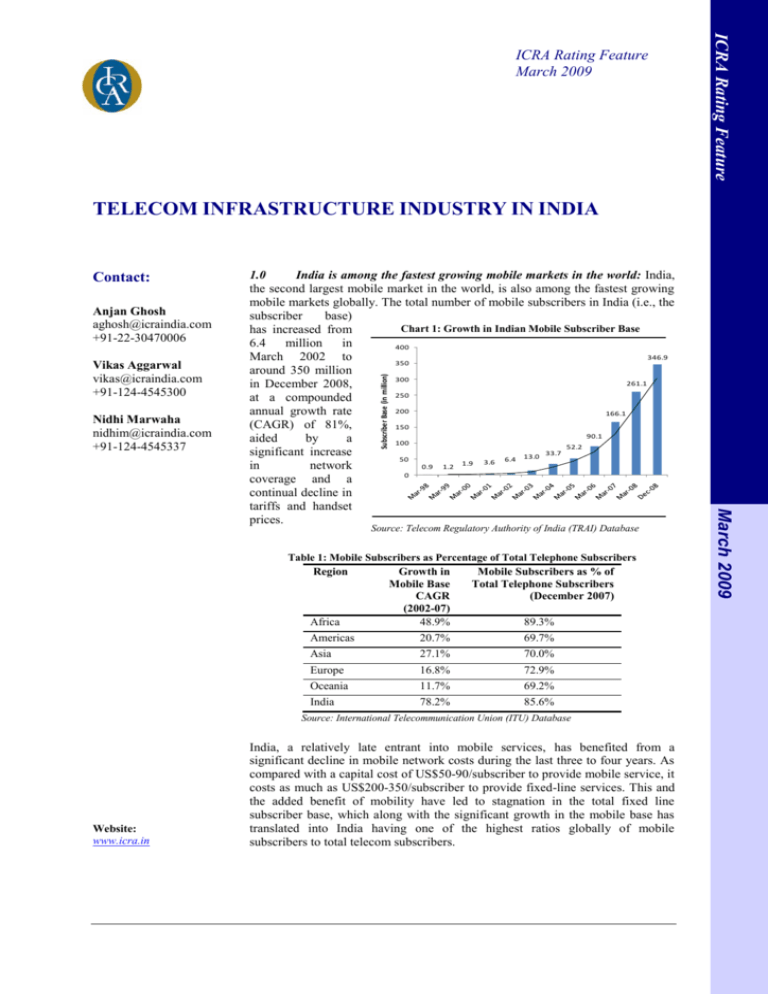

India is among the fastest growing mobile markets in the world: India,

the second largest mobile market in the world, is also among the fastest growing

mobile markets globally. The total number of mobile subscribers in India (i.e., the

subscriber

base)

Chart 1: Growth in Indian Mobile Subscriber Base

has increased from

6.4

million

in

400

346.9

March 2002 to

350

around 350 million

300

261.1

in December 2008,

250

at a compounded

200

annual growth rate

166.1

(CAGR) of 81%,

150

90.1

aided

by

a

100

52.2

significant increase

33.7

13.0

50

3.6 6.4

0.9 1.2 1.9

in

network

0

coverage and a

continual decline in

tariffs and handset

prices.

Subscriber Base (in million)

Contact:

Table 1: Mobile Subscribers as Percentage of Total Telephone Subscribers

Region

Africa

Growth in

Mobile Base

CAGR

(2002-07)

48.9%

Mobile Subscribers as % of

Total Telephone Subscribers

(December 2007)

89.3%

Americas

Asia

20.7%

27.1%

69.7%

70.0%

Europe

Oceania

16.8%

11.7%

72.9%

69.2%

India

78.2%

85.6%

Source: International Telecommunication Union (ITU) Database

Website:

www.icra.in

India, a relatively late entrant into mobile services, has benefited from a

significant decline in mobile network costs during the last three to four years. As

compared with a capital cost of US$50-90/subscriber to provide mobile service, it

costs as much as US$200-350/subscriber to provide fixed-line services. This and

the added benefit of mobility have led to stagnation in the total fixed line

subscriber base, which along with the significant growth in the mobile base has

translated into India having one of the highest ratios globally of mobile

subscribers to total telecom subscribers.

March 2009

Source: Telecom Regulatory Authority of India (TRAI) Database

Telecom Infrastructure Industry in India

March 2009

Chart 2: Mobile Penetration Levels: India vis-à-vis World

2.0

Despite

the

growth,

mobile

penetration remains moderate: As on end

September 2008, India had a mobile penetration

of around 27%, which is relatively lower as

compared to other countries as depicted in

Chart 2.

109.90%

Spain

93.90%

Malaysia

91.30%

France

85.60%

Japan

84%

US

Given the moderate penetration levels at

present, mobile growth in India is expected to

continue in the short to medium term albeit at a

lower level because of the larger base effect.

55.90%

Pakistan

27.32%

India

0%

20%

40%

60%

80%

100%

120%

Mobile Penetration

Source: Market Sources

Note: Mobile penetration data for US pertains to June 2008

3.0

Growth expected to be led by B and C Class circles: The growth in the domestic telecom industry has

largely been concentrated in the Metros and Class A circles in the past decade, with coverage reaching around 90%

and 35%, respectively. However, coverage in the Class B and Class C cities is still low at 15-25%.

Moreover, within these circles growth has largely been concentrated in the urban areas while penetration in the rural

areas remains lower. Thus future growth is likely to come largely from Class B and C circles and rural areas.

Keeping this in view, larger players like Bharti Airtel Limited, Reliance Communications Limited, and Bharat

Sanchar Nigam Limited (BSNL) are largely focusing on increasing their geographical coverage in Class B and C

circles.

Chart 4: Circle-wise Population vs. Mobile Subscriber Base (Dec’08)

Circle (Category)

Chart 3: Circle-wise Mobile Penetration (Dec’08)

99%

95%

97%

Delhi (Metro)

Mumbai (Metro)

Chennai (Metro)

Kolkata (Metro)

Karnataka (A)

Andhra Pradesh (A)

Tamil Nadu (A)

Gujarat (A)

Maharashtra (A)

Kerala (B)

West Bengal (B)

Punjab (B)

Haryana (B)

Rajastan (B)

Madhya Pradesh (B)

Uttar Pradesh (B)

Himachal Pradesh (C)

Orissa (C)

Jammu & Kashmir (C)

Bihar (C)

Assam (C)

North-East (C)

70%

36%

33%

37%

37%

28%

44%

16%

48%

Low penetration areas offer

higher growth potential

35%

30%

20%

20%

39%

19%

22%

14%

16%

37%

0%

10%

20%

30%

40%

Mobile Subscriber Base (Dec’08)

50%

60%

70%

80%

90%

100%

Mobile Penetration

Source: TRAI Database, ICRA’s estimates

Note: Mobile penetration does not account for one person having more than one

connection

ICRA Rating Services

www.icra.in

Source: Ministry of Statistics & Programme Implementation Database,

TRAI Database, ICRA’s estimates

Page 2

Telecom Infrastructure Industry in India

March 2009

4.0

Addition of low usage subscribers and competitive pressures lead to fall in ARPUs: With growth coming

from the lower economic strata and on account of strong competition in the mobile industry, average revenues per

user (ARPUs) have moved south over the years. The movements in the ARPUs and minutes of usage (MoUs) for

global system for mobile communications (GSM) and code division multiple access (CDMA) operators are

presented in Charts 5 and 6.

ARPU

350

150

MoU

ARPU

Source: TRAI Database

Sep-08

Jun-08

Mar-08

Sep-07

300

Dec-07

100

Jun-07

Sep-08

Jun-08

Mar-08

Sep-07

Dec-07

Jun-07

Mar-07

Sep-06

Dec-06

Jun-06

Dec-05

300

Mar-06

100

400

200

Dec-06

350

150

450

250

Mar-07

200

300

Sep-06

400

Jun-06

450

250

500

350

Mar-06

300

550

400

Dec-05

500

350

450

ARPU (Rs. per month)

550

400

MoU (per Subscriber per month)

ARPU (Rs. per month)

450

MoU (per Subscriber per month)

Chart 6: All-India ARPU & MoU Trend–CDMA

Chart 5: All-India ARPU & MoU Trend–GSM

MoU

Source: TRAI Database

The chart alongside broadly illustrates the impact

of declining ARPUs on the internal rate of return

(IRR) at different EBITDA margins. Thus, for

new operators especially whose margins are low

because of the high set-up costs, operations can

be unviable at the current level of incremental

ARPUs.

Internal Rate of Return

5.0

Conservation of capital - the need of the industry: In the past, with costs being amortised over a larger

base and steps being taken to rationalise costs,

Chart 7: Impact of Declining ARPUs on IRRs at Different EBITDA Margin Levels

most telecom operators were able to improve

their earnings before interest, taxes, depreciation

25%

& amortisation (EBITDA) margins. However, in

20%

the current market conditions, the margins and

15%

return indicators may come under pressure as

10%

ARPUs continue to fall.

5%

0%

-5%

200

175

150

125

100

75

-10%

-15%

IRR at 25% margin

ARPUs (Rs. Per month)

IRR at 30% margin

IRR at 40% margin

Source: ICRA’s estimates; Assuming Capital Expenditure of USD 70 per

subscriber and 1 USD=Rs.50

6.0

Competition set to intensify further with market liberalisation: The Indian mobile sector is an intensely

competitive industry, featuring 10 mobile

Chart 8: Market-share Distribution–Mobile Subscribers (Dec’08)

operators, of which four, namely Bharti Airtel

Limited, Reliance Communications Limited,

Sistema Shyam,

HFCL, 0.1%

BPL/ Loop,

Aircel, 4.6%

0.1%

0.6%

Vodafone Essar Limited and BSNL, together

Idea + Spice,

Bharti Airtel,

11.0%

account for almost three-fourths of the entire

24.7%

mobile market share. This is also partly on

account of the fact that these four operators have

Vodaone, 17.6%

their presence in a larger number of circles as

compared with other players.

With licences being granted to some of the

existing operators for new circles and also to new

entrants, competition is expected to intensify

further. The competitive matrix is illustrated in

Chart 9.

ICRA Rating Services

Tata

Teleservices,

9.2%

Reliance

Communication

s, 17.7%

BSNL/ MTNL,

14.5%

Source: TRAI Database

www.icra.in

Page 3

Telecom Infrastructure Industry in India

March 2009

Chart 9: Competitive Matrix

Pan-India Operators ----------------------------------------------------------------------------------

Bharti Airtel

GSM

Existing base of operations

Subscriber Base (million) - Dec'08

BSNL/

Sistema

Swan

MTNL Tata Tele Vodaone Idea/ Spice Aircel

HFCL

Shyam

BPL/ Loop Unitech

Telecom

Stel

Datacom

GSM &

CDMA

CDMA

GSM

GSM

GSM

CDMA

CDMA

GSM

GSM

GSM

GSM

GSM

61.3

50.4

31.8

60.9

38.0

16.1

0.4

0.4

1.9

0

0

0

0

Licensed Circles (Dec'07 vis-à-vis Sep'08)

Total

346.9

Competitive Positioning - New Entrants

25

25

20

Number of Circles

Number of Circles

New Entrants

Reliance

Communications

GSM & CDMA

85.7

Regional Operators ----------------------------------------------------------------------------------

15

10

5

0

23 23

23

23

21

22

20

17

14 13

13

15

10

6

6

5

0

Sistema

Shya m

# of circles licensed (Dec'07)

LEGEND:

Licensed

No Licence

Category

Circles

Delhi

Mumbai

Metros

Chennai

Kolkata

Maharashtra

Gujarat

Class 'A' Circles Andhra Pradesh

Karnataka

Tamil Nadu

Kerala

Punjab

Haryana

Uttar Pradesh (W) (including Uttaranchal)

Class 'B' Circles

Uttar Pradesh (E)

Rajasthan

Madhya Pradesh (including Chhattisgarh)

West Bengal (including Andaman & Nicobar)

Himachal Pradesh

Bihar (including Jharkhand)

Orissa

Class 'C' Circles

Assam

North East

Jammu & Kashmir

New circles licensed between Jan'08-Sep'08

BPL/ Loop

Unitech

Licensed circles

Da ta com

Swa n

Telecom

Sta rt-up spectrum a va ila ble

Circle-wise Market Share of Existing Wireless Operators (December 2008)

NL

Bharti Airtel

22.4%

16.0%

23.5%

22.1%

19.7%

17.6%

30.2%

43.6%

22.9%

13.7%

27.4%

14.1%

12.4%

23.0%

31.2%

23.0%

23.0%

30.5%

37.7%

34.9%

25.0%

28.3%

48.6%

Reliance

Communications

15.7%

20.6%

15.6%

23.8%

13.1%

14.0%

18.1%

16.0%

13.4%

17.0%

9.6%

14.6%

17.5%

16.9%

11.7%

30.7%

19.9%

31.1%

29.8%

25.7%

25.7%

15.7%

0.0%

BSNL/

MTNL

9.8%

13.0%

12.0%

12.0%

13.3%

11.8%

11.1%

11.2%

12.4%

19.5%

18.2%

17.0%

14.2%

22.4%

14.5%

15.7%

13.0%

25.7%

14.5%

18.7%

17.5%

23.1%

31.6%

Tata Tele

21.5%

12.6%

4.9%

14.1%

14.6%

5.8%

10.9%

6.2%

2.9%

4.9%

9.3%

14.1%

11.4%

5.9%

12.0%

6.2%

6.4%

4.3%

8.4%

8.1%

0.3%

0.0%

0.2%

Vodaone

19.2%

24.6%

17.1%

24.2%

14.6%

34.2%

12.9%

16.1%

19.1%

18.7%

15.1%

23.2%

23.2%

24.9%

22.9%

0.5%

30.5%

0.3%

1.0%

2.4%

1.3%

1.6%

0.0%

Idea/ Spice

11.4%

1.9%

Aircel

26.9%

3.8%

24.7%

16.6%

16.7%

6.9%

29.3%

26.2%

17.5%

17.0%

21.4%

7.0%

5.8%

23.9%

4.1%

1.5%

7.2%

3.9%

7.1%

10.2%

30.1%

31.2%

19.5%

HFCL

NL

NL

NL

NL

NL

NL

NL

NL

NL

NL

2.9%

NL

NL

NL

NL

NL

NL

NL

NL

NL

NL

NL

NL

Sistema

Shyam

BPL/ Loop

Unitech

Swan

Telecom

11.4%

NL

1.8%

NL

NL

NL

NL

NL

NL

NL

NL

Stel

NL

NL

NL

NL

NL

NL

NL

NL

NL

NL

NL

NL

NL

NL

NL

NL

NL

Datacom

NL

Source: TRAI Database, ICRA’s estimates

ICRA Rating Services

Stel

www.icra.in

Page 4

Circle-wise expected

number of operators

12

12

12

11

12

12

12

12

12

12

12

12

12

12

12

11

11

12

12

12

12

12

12

Telecom Infrastructure Industry in India

March 2009

7.0

Passive infrastructure sharing (tower-sharing) gaining signficance: Passive infrastructure being one

of the most important components of a mobile network, the same has been a critical area of operations for

telecom companies in the past. However, with increasing competition posing an urgent need for telecom

companies to expand their coverage and sharpen their focus on core operations so that they can sustain and

improve their market position, passive infrastructure has assumed the status of an independent industry during

the past few years.

Chart 10: Constituents of a Mobile Network

Mobile Networks

Passive Infrastructure

or

Non-Electronic

Infrastructure

Backhaul

Active Infrastructure

or

Electronic Infrastructure

The backhaul part of the

network consists of the

intermediate links between the

core of the network and the

various sub-networks

Key components include:

Spectrum (radio

frequency)

Base tower station

Microwave radio

equipment

Switches

Antennas

Transceivers for signal

processing and

transmission, etc.

Key components include:

Steel tower/antenna

mounting structures

Base tower station shelter

Power supply

Battery bank

Invertors

Diesel generator (DG) set

for power backup

Air conditioner

Fire extinguisher

Security cabin, etc.

According to ICRA’s estimates, passive infrastructure accounts for 60-70% of the total cost of setting up a

wireless network.

Overall, sharing of infrastructure, passive as well as active, is beneficial for all parties involved as it brings

along significant operational as well financial savings, thus enabling the companies to minimise duplication of

efforts and costs and improve profitability.

ICRA Rating Services

www.icra.in

Page 5

Telecom Infrastructure Industry in India

March 2009

7.1

Functioning of a Tower Infrastructure

Company: A tower infrastructure company provides

passive infrastructure on a sharing basis to telecom

operators.

The role of a tower infrastructure company may be

summarised as follows:

-

Site planning, keeping in view the network

rollout plans of prospective customers.

-

Site acquisition, including entering into

long-term agreements with land owners.

-

Obtaining

approvals.

-

Erection and commissioning of tower and

allied equipment.

-

-

of

necessary

Figure 1: Telecom Tower Structure with Key Components

Antennas

Microwave

Feeders

Steel

Tower

regulatory

Shelter

Room

Provision of support services such as backup power, air-conditioning and security.

DG Set

Provision of turnkey solutions to telecom

companies such as sourcing of equipment,

testing and maintenance.

7.1.1

Types of Towers

Telecom towers are broadly classified on the basis of their placement as Ground-based and Roof-top.

(i)

Ground-Based Tower: Erected on the ground, ground-based towers (GBTs) are taller (typically 200

to 400 feet) and are mostly used in rural and semi-urban areas because of the easy availability of realestate space there. GBTs involve a capital expenditure in the range of Rs. 2.4 to 2.8 million, depending

on the height of the tower.

(ii)

Roof-Top Tower (RTT): Roof-top towers (RTTs), which are generally placed on the roofs of highrise buildings, are shorter (than GBTs) and more common in urban and highly populated areas, where

there is paucity of real-estate space. Typically, these involve a capital expenditure of Rs. 1.5 to 2

million.

It is the height of a telecom tower that determines the number of antennas that can be accommodated, which in

turn determines the capacity of the towers, apart from factors such as location and geographical conditions

(wind speeds, type of terrain, etc.). Hence, typically, while GBTs can accommodate up to six tenants, RTTs can

accommodate two to three tenants.

7.1.2

Master Service Agreements

A tower infrastructure company normally enters into separate Master Service Agreements (MSAs) with its

occupants/tenants. MSAs are signed between tower infrastructure companies and telecom operators (tenants),

and clearly spell out the overall tower requirements of the tenants, the pricing terms, and other binding terms

and conditions between the two parties.

ICRA Rating Services

www.icra.in

Page 6

Telecom Infrastructure Industry in India

March 2009

Broadly, an MSA specifies the following terms and conditions:

Table 2: Key Terms under MSAs between Tower Infrastructure Companies and Telecom Operators

Rentals are specified, depending on factors such as:

Rental

Type of tower (GBT or RTT): Tower rentals are normally higher for GBTs as

compared with RTTs. In some cases, the rentals may also be computed as a percentage

of the capital invested.

Location: In the case of strategically located sites (congested areas, city centre,

highways) and in hilly terrains, tower infrastructure companies may charge a premium

over the standard rentals.

Level of sharing on towers: As sharing increases, tower infrastructure companies

usually pass on a percentage of the cost saving to their tenants. At present, discounts

range from 10 to 20% for twin sharing and from 20 to 30% for triple sharing.

Tenure: Tower infrastructure companies usually offer more attractive terms for longer

tenure MSAs as they lower occupancy risks for them.

Number of sites: Tower infrastructure companies may also offer discounts on standard

rentals, which may range from 2 to 5%, depending on the number of sites to be rolled

out in accordance with the MSA. So, a larger number of sites may mean higher

discounts for the telecom operator.

Tenure

The tenures of MSAs generally range between 10 and 25 years. The rentals stated in the MSAs

are generally applicable over the tenure of the contract, with provisions of periodic revision

(mostly annual).

Tenancy

Generally, each active electronic module is considered a separate tenant. For instance, if a player

has entered into an agreement with a tower company for its GSM services and thereafter wants to

install additional equipment for alternative services (Third Generation (3G), Wi-max, CDMA,

etc.), the same would be treated as additional tenant(s) for the purpose of the agreement.

Statutory

Clearances/ MSAs clearly specify the list of approvals and clearances to be taken by the tower companies.

Approvals

Generally, all the approvals pertaining to passive infrastructure are obtained by the tower

infrastructure company. However, any approvals pertaining to active components are largely

obtained by the telecom operators.

Operating Expenses

Fixed Charges

Expenses such as security and maintenance are usually

borne by the tower infrastructure companies.

Space/Ground Rental

Space/ground rentals are usually borne by the tower

infrastructure company. Any excess over a pre-specified

level is generally shared with the tenants.

Variable Costs like Fuel and Energy Such costs are charged from tenants on the basis of their

Charges

actual consumption.

Increase in Variable Costs

Most MSAs also provide for pass-on of any escalations in

variable costs to the tenants.

Lock-in-Period

Most MSAs specify a lock-in period. Moreover, in the case of termination of contract by the

telecom operator during the lock-in period, there is generally a provision of penalty on the tenant.

Penalty Clauses

Rollout: Usually MSAs provide for penalties for delay in the deployment of towers beyond the

date specified in the agreed rollout plan.

Service Level: Most MSAs specify the services levels with respect to power availability, uptime

for regular and strategic sites, and other operations and maintenance parameters, and also the

penalties on tower infrastructure companies in the case of failure to achieve the same.

8.0

Industry Structure: At present, there are broadly two kinds of operators in the domestic tower

infrastructure industry:

Tower infrastructure subsidiaries, which are the spun-off tower divisions of the telecom-operator

companies; and

Independent tower infrastructure companies (ITICs)

8.1 Tower Infrastructure Subsidiaries: In India, Bharti Airtel Limited, Reliance Communications

Limited, and Tata Teleservices Limited have hived off their tower assets into separate tower infrastructure

subsidiaries, namely Bharti Infratel Limited, Reliance Infratel Limited, and Wireless TT Infoservices

Limited, respectively. Also Bharti Infratel Limited together with Vodafone Essar Limited and Idea Cellular

Limited in a joint-venture agreement has created India’s largest tower infrastructure company – Indus

Towers Limited, which has an estimated portfolio of around 85,000 towers.

ICRA Rating Services

www.icra.in

Page 7

Telecom Infrastructure Industry in India

March 2009

Table 3: Tower Portfolios of Operator-Promoted Tower Infrastructure Companies/ Telecom Operators

Company Name

Reliance

Infratel

Limited

Bharti Infratel Limited

Indus Towers Limited

Wireless

TT

Info

Services

Limited

(WTTIL) + Quippo

Others

Background

Reliance Communications Limited’s subsidiary

Tower Portfolio

~ 44,000

Bharti Airtel Limited’s subsidiary

Joint venture of Bharti Infratel Limited, Vodafone Essar Limited,

and Idea Cellular Limited

Tata Teleservices Limited’s subsidiary WTTIL merged with

Quippo Telecom Infrastructure

~ 27,000

~ 85,000

BSNL, Mahanagar Telephone Nigam limited (MTNL), Sistema

Shyam TeleServices, Aircel etc.

~ 70,000

~18,000

Source: Market sources, ICRA’s estimates

Hiving off of tower divisions into separate companies is strategically beneficial for telecom operators as it

leads to significant unlocking of value while simultaneously improving operational and capital efficiencies.

The parent telecom company benefits from reduced incremental capital requirements, lower operating costs,

and a favourable capital structure, while the tower infrastructure subsidiaries gain an advantage in terms of

an assured occupancy from their parent, which in turn may serve to attract other tenants.

8.2 Independent Tower Infrastructure Companies: Over the past few years, a number of ITICs have

ventured into the domestic telecom tower industry. These include, among others, GTL Infrastructure

Limited, Quippo Telecom Infrastructure Limited 1, Essar Telecom Infrastructure Limited, Xcel Telecom

Private Limited, Tower Vision India Private Limited, Aster Infrastructure Private Limited and TVS

Interconnect Systems Limited.

Table 4: Illustrative List of Some Third Party Tower Companies in India

Company Name

GTL Infrastructure

Xcel Telecom

Existing Tower Portfolio

~9,500 towers

~1,500 towers

Essar Telecom Infrastructure

Aster Infrastructure

~4,000 towers

~1,000 towers

Others

~2000

Source: Market sources, ICRA’s estimates

These companies have their business model based largely on the following two approaches:

Contract Approach

Anticipatory Approach

Under the contract approach, tower companies set up tower sites going by the requirements of the

telecom operators, and the terms of the contract are specified beforehand in the MSAs signed by the two

parties. Under the anticipatory approach however, tower companies set up tower infrastructure at sites

with reasonable demand potential and subsequently invite telecom operators to set up their network on

these towers. The latter model involves higher business risks as the tower company may not be able to

achieve reasonable tenancy for its tower infrastructure and at profitable terms.

8.3 ITICs versus Tower Companies: ITICs, especially those following the anticipatory approach, are

usually at a disadvantage as compared with tower subsidiaries as ITICs do not have assured occupancy on

their tower portfolios. Moreover, as most large telecom companies in the country have their own tower

subsidiaries, the market for ITICs consists largely of regional operators and new entrants, in whose case

credit quality can also be a concern. Nevertheless, in certain cases, ITICs are in a better position to address

the needs of growing telecom operators who have recently received licences and spectrum to launch

operations in new circles because of flexible rollout plans that are more suited to new entrants. Moreover,

ITICs differentiate themselves by offering flexible payment terms to mobile operators (for instance, backended payment structure), which enables the mobile operators to reduce their costs in the initial years.

1

Now merged with WTTIL, tower subsidiary of Tata Teleservices Limited

ICRA Rating Services

www.icra.in

Page 8

Telecom Infrastructure Industry in India

March 2009

9.0 Economics of the Model—Tower Infrastructure Companies

The key points relating to the working of tower infrastructure companies are discussed in following bullet list.

-

High initial capital investments: On an average, while a roof-top tower involves a capital expenditure

of Rs. 1.5 to 2 million; a ground-based tower requires a capital expenditure of Rs. 2.4 to 2.8 million.

Given the high capital investments required in the business, tower companies are generally highly

leveraged.

-

Stable and predictable cash flow business: Once a tower asset is rented out, it usually generates a

stable and predictable cash flow in the form of tower rentals from occupants over the term of the MSA

between the two parties.

-

Low working capital requirement: The tower business is also characterised by low working capital

requirements, as most of the operating expenses (such as electricity and fuel and other variable

operating expenses) are reimbursable by the tenants on actual basis. Moreover, the larger companies

with a bigger and geographically spread out portfolio of networks may be able to get rentals for the

towers in advance and also obtain better credit terms from their suppliers, thus further improving their

working capital cycle.

-

High incremental profitability: The costs of operating a tower, particularly the ones borne by the

tower company such as security and maintenance and ground rent, are largely fixed in nature. Thus

each increment in tenancy is accompanied by a minimal increase in costs. This leads to a more than

proportionate increase in profits for every increase in occupancy.

Table 5: Illustration - Improvement in a Tower Company’s Profitability with Increase in Tower-Sharing Ratio

Particulars

Sharing

Ground-Based Tower

1

2

3

4

2,600,000

2,600,000

2,600,000

2,600,000

Rental per Tenant

34,000

34,000

30,000

27,000

(A) Sharing Adjusted Revenue

34,000

68,000

90,000

108,000

(B) Operating Expenses *

18,250

19,450

20,650

21,850

(C) Contribution

15,750

48,550

69,350

86,150

46%

71%

77%

80%

1,000

1,000

1,000

1,000

Interest** @12%

17,333

17,333

17,333

17,333

(E) Profit before depreciation & tax (PBDT)

-2,583

30,217

51,017

67,817

PBDT as % of Gross Revenues

-7.6%

44.4%

56.7%

62.8%

14,444

14,444

14,444

14,444

(F) Profit before tax (PBT)

-17,027

15,773

36,573

53,373

PBT as % of Gross Revenues

-50.08%

23.19%

40.64%

49.42%

Capital Expenditure

Contribution as % of Gross Revenues

(D) Other Fixed Expenses

Depreciation (assuming an asset life of 15 years)

Source: ICRA’s estimates

*Includes site rentals, security expenses, operations and maintenance (tower) etc. Some of these expenses can vary significantly with

location

** Assuming capital expenditure to be funded at a debt: equity ratio of 2:1

ICRA Rating Services

www.icra.in

Page 9

Telecom Infrastructure Industry in India

Chart 11: Impact of Increasing Occupancy on IRRs

Internal Rate of Return (IRR)

According to ICRA’s estimates, the

telecom infrastructure business generates

strong financial metrics once the average

occupancy ratio (indicating average

number of tenants per tower) crosses 1.7

times. Assuming an initial capital

expenditure of Rs. 2.6 million and a life of

15 years, the manner in which the IRR

moves at various occupancy levels is

depicted in Chart 11.

March 2009

20%

18%

16%

14%

12%

10%

8%

6%

4%

2%

0%

18.7%

15.5%

12.2%

9.6%

5.3%

0.3%

1

1.2

1.4

1.6

1.8

2

Tenancy/ Occupancy Ratio

Source: ICRA’s estimates

9.1

Factors driving growth for passive infrastructure sharing: Apart from favourable industry

prospects, there are several other factors too that drive increase in tower sharing, as discussed in the following

bullet list.

Viability of business at low ARPUs: At present, incremental growth in the subscriber base is coming

mainly from rural/semi-urban

Chart 12: Impact of Declining ARPUs on IRRs at Different EBITDA Margin

areas (also in these areas, the

Levels in an Infrastructure Sharing Scenario

incremental ARPUs are relatively

50%

lower). Further, network design

and planning in rural areas is

40%

different from that in urban areas,

30%

given that the population in rural

areas is widely dispersed, which

20%

increases the tower requirements

10%

to cover the same number of

subscribers

(vis-à-vis

urban

0%

areas). But as Chart 12 shows,

200

175

150

125

100

75

-10%

even at low ARPUs, business

ARPUs (Rs. Per month)

viability

can

increase

IRR at 25% margin

IRR at 30% margin

IRR at 40% margin

significantly on the strength of

infrastructure sharing (please Source: ICRA’s estimates

refer Chart 7 also).

High usage and limited spectrum availability: India has one of the highest MoUs in the world, which

increases the number of base tower stations (BTS) required to handle the same subscriber base. Thus

while on an average, a GSM BTS can handle around 1,100 subscribers, in the case of high usage areas

the figure can be as low as 600-700 subscribers, which means a larger number of cell sites would be

required for the same area. Moreover, the country has the problem of spectrum scarcity, which

increases the requirement of towers to maintain a reasonable level of service quality.

Quality of service: In the past, domestic telecom operators competed largely on the pricing plank.

However, as mobile tariffs in India are currently one of the lowest in the world, the scope for further

tariff reduction is low. Given this fact, going forward, quality of service (QoS) would become the

prime distinguishing factor among the competing companies. Moreover, a rapidly increasing subscriber

base and spectrum crunch would further add to the problem of telecom operators having to maintain

the minimum level of QoS. Besides, with the likely introduction of mobile number portability, QoS

will become more important as customers will then have a broader range of options available with

limited switching costs. Thus to retain existing subscribers by preventing subscriber churn, operators

will require additional infrastructure in their existing areas of operation to be able to offer better QoS.

Enhancement of profitability: Tower sharing helps operators lower their operating costs and capital

expenditure and thereby earn better margins and higher Return on Capital Employed (RoCE); the

overall impact on Profit and Loss is also positive. Analysis suggests that there would be net annual cost

savings for mobile operators if they opt to lease towers from a tower company rather than own them.

Internal Rate of Return

ICRA Rating Services

www.icra.in

Page 10

Telecom Infrastructure Industry in India

March 2009

Table 6: Incremental Costs in Owning vs. Leasing a Tower

Amounts in Rs.

Operating Expenses

Tower Rentals

Depreciation

Cost of Capital

Overall Saving

Owned

543,000

0

173,333

312,000

Leased

312,000

408,000

0

0

Difference

231,000

-408,000

173,333

312,000

308,333

Source: ICRA’s estimates

Note: Calculations assume a tower cost of Rs. 2.6 million, life of

asset of 15 years and 12% cost of capital. The operating expenses

are indicative.

Entry of new players and expansion plans of existing operators: Recently, several regional

operators such as Vodafone Essar Limited, Idea Cellular Limited, Aircel Cellular Limited and Shyam

Telelink Limited (now Sistema Shyam Teleservices Limited) have received licences as well spectrum

in new circles, which would enable them to become pan-India operators in the next one-two years.

Also, new licences have been issued to players such as Unitech, Swan Telecom, and S Tel Limited.

Given the significant expansion plans of new entrants over the medium term and the need for them to

optimise investments in order to maintain returns, demand for towers is expected to report a sharp

increase.

Shorter rollout time, a key necessity: As the domestic telecom industry is highly competitive, doing

business may not be easy for the new entrants. Moreover, given that the incumbents already have the

competitive advantages of widespread distribution networks, established brand names and strong

subscriber base, shorter network-rollout time would be a critical success factor for the new entrants; a

longer rollout time could mean loss of substantial market share to other operators. Tower companies

allow players to start operations in a particular region just by installing their electronics on the readyto-use towers, thereby significantly shortening the rollout time.

New technologies to further stimulate demand: 3G services are expected to be launched in the

country in 2009-10. Moreover, in order to augment their services, various operators plan to launch WiMax services as soon as they receive additional spectrum from Government. This would further

increase the demand for sharing of passive infrastructure.

10.0

Industry on the path of consolidation: Within the span of the last one to two years, with several

players spinning off their tower portfolios and independent operators expanding their operations, competition

has intensified significantly in the domestic Chart 13: Market Share Distribution–Tower Infrastructure Industry

tower infrastructure industry. The market

Reliance Infratel

Others

shares of the various players are depicted in

Aster

16.8%

27.5%

Infrastructure

Chart 13.

0.4%

Essar Telecom

Infrastructure

1.5%

With leading GSM players forming a

consortium (Indus Towers) and other larger

players such as Tata Teleservices and

Xcel Telecom

Reliance Communications entering into long0.6%

term agreements for passive infrastructure

GTL

Infrastructure

sharing mostly with their tower subsidiaries,

WTTIL +

3.6%

the new and smaller third-party infrastructure

Quippo

6.9%

providers are likely to get most of their

Source:

Industry

sources,

ICRA’s estimates

business from smaller players and new

entrants, as the following table shows.

Bharti Infratel

10.3%

Indus Towers

32.4%

Table 7: Telecom operators and their potential passive infrastructure suppliers

Incumbent Operators

Subscriber Base

(million) Dec'08

Main Suppliers of Incremental Passive Infrastructure

Bharti Airtel

85.65

Reliance Communications

Vodafone Essar

61.35

60.93

Bharti Infratel - for 7 circles;

Indus Towers - for 16 circles

Reliance Infratel - for all circles

Indus Towers

BSNL

46.23

MTNL, own tower portfolio and other tower companies

ICRA Rating Services

www.icra.in

Page 11

Telecom Infrastructure Industry in India

Incumbent Operators

March 2009

Subscriber Base

(million) Dec'08

Main Suppliers of Incremental Passive Infrastructure

Idea Cellular/ Spice

Tata Teleservices

38.01

31.76

Indus Towers

WTTIL

Aircel Cellular

MTNL

16.08

4.19

Own and other tower companies

BSNL, own tower portfolio and other tower companies

BPL Mobile Communications

1.95

Own and other tower companies

HFCL Infotel

0.38

Own and other tower companies

Sistema Shyam TeleServices

0.37

Own and other tower companies

Overall, the domestic telecom infrastructure industry is expected to see consolidation in the near future given the

rapidly increasing number of independent tower infrastructure companies and following the entry of several

large telecom companies in the infrastructure business.

Summary: ICRA is of the view that demand for passive telecom infrastructure in India would continue to grow

at a healthy rate, at least over the medium term, and that this increased demand would be accompanied by

greater sharing of infrastructure by the existing as well as new telecom players. The need for such sharing, in

ICRA’s view, would be dictated by the imperative of remaining profitable in an increasingly competitive

market.

ICRA Rating Services

www.icra.in

Page 12

Telecom Infrastructure Industry in India

March 2009

ICRA Limited

An Associate of Moody’s Investors Service

CORPORATE OFFICE

Building No. 8, 2nd Floor, Tower A, DLF Cyber City, Phase II, Gurgaon 122 002

Tel: +91 124 4545300 Fax: +91 124 4545350

Email: info@icraindia.com, Website:www.icra.in

REGISTERED OFFICE

1105, Kailash Building, 11th Floor, 26 Kasturba Gandhi Marg, New Delhi 110001

Tel: +91 11 23357940-50 Fax: +91 11 23357014

Branches: Mumbai: Tel.: + (91 22) 24331046/53/62/74/86/87, Fax: + (91 22) 2433 1390 Chennai: Tel + (91 44) 2434

0043/9659/8080, 2433 0724/ 3293/3294, Fax + (91 44) 2434 3663 Kolkata: Tel + (91 33) 2287 8839 /2287 6617/ 2283

1411/ 2280 0008, Fax + (91 33) 2287 0728 Bangalore: Tel + (91 80) 2559 7401/4049 Fax + (91 80) 559 4065

Ahmedabad: Tel + (91 79) 2658 4924/5049/2008, Fax + (91 79) 2658 4924 Hyderabad: Tel +(91 40) 2373 5061/7251,

Fax + (91 40) 2373 5152 Pune: Tel + (91 20) 2552 0194/95/96, Fax + (91 20) 553 9231

© Copyright, 2009, ICRA Limited. All Rights Reserved.

Contents may be used freely with due acknowledgement to ICRA.

All information contained herein has been obtained by ICRA from sources believed by it to be accurate and reliable.

Although reasonable care has been taken to ensure that the information herein is true, such information is provided ‘as

is’ without any warranty of any kind, and ICRA in particular, makes no representation or warranty, express or

implied, as to the accuracy, timeliness or completeness of any such information. All information contained herein

must be construed solely as statements of opinion and ICRA shall not be liable for any losses incurred by users from

any use of this publication or its contents.

ICRA Rating Services

www.icra.in

Page 13