ING Commercial Banking - Università degli studi di Bergamo

advertisement

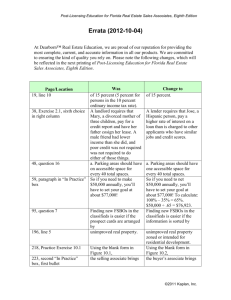

ING Commercial Banking Approach to Real Estate Finance Università di Bergamo, 2 December 2013 Contents • Introduction: ING Real Estate presence in Italy • Main Characteristics of a Commercial Real Estate Lender • Object • Clients • Typical Loan Structure • Eight steps from Origination…to Final Repayment • Q&A 1 Introduction: ING Real Estate presence in Italy ING Direct: • Strong presence in Italy with a solid base of more than one million clients. • Active since 2001, with focus on retail banking RESIDENTIAL MORTGAGES • Main asset class represented by residential mortgages RETAIL CLIENT BASE • Maximum initial LTV 80%, fully amortizing structures • Tenors up to 30 years ING Commercial Banking, Real Estate Finance: • Established player active in Italy with a dedicated branch since 2006, client base largely represented by institutional investors • Specialized lender with focus on Commercial Real Estate loans COMMERCIAL RE LOANS • Coverage on office, retail and logistics property sectors INSTITUTIONAL INVESTORS • Target initial LTV 50-60%, bullet structures can be considered • Standard tenor 5 yr ING Commercial Banking, Lease: • Active in Italy since 1995, currently 5,000 real estate clients • Focus on real estate financial leases, mainly granted to SMEs to finance owned-occupied premises FINANCIAL LEASES END-USERS, SMEs • High initial LTVs mitigated by amortization over the life of the loan • Standard tenor 18 yr 2 Main Characteristics of a Commercial Real Estate Lender Object: • Real Estate lenders are specialized property financiers. Core business is “lending to properties” often on a non-recourse basis rather than “lending to companies”. • Preferred collaterals are top quality income producing properties, assets generating a yield to the investors through rental income. As for financial instruments, yields vary depending on the specific asset class and risk profile of the property. • Main covered property sectors are income producing office, retail and logistics assets. Reduced appetite to pure industrial properties, specific factories, non-income generating residential assets, as well as little exposure on construction/development projects. • Market Value and creditworthiness of the real estate asset to be financed – apart from location and intrinsic quality of the building - is strictly correlated to the capability of the property to attract tenants willing to pay a level of rent sufficient to service the debt and remunerate the owner. • Focus on quality of the tenants and on terms and conditions of rental agreements. Retail: shopping centre Office: multi-tenant scheme Logistics: modern warehouse 3 Main Characteristics of a Commercial Real Estate Lender Clients/Sponsors: • Institutional investors represent the main client base for Commercial Real Estate financiers: • Real Estate investment and asset managers, managing funds on behalf of institutional investors. Funds are generally defined “core”, “core plus” or “speculative”, depending on the targeted risks/reward profile of the underlying properties/portfolios. Normally international funds hold assets via SPVs (Special Purpose Vehicles in the form of limited liability companies holding the property) while German and Italian law funds generally hold assets directly on the fund’s books. • Real Estate property companies, investing in commercial RE either directly or via SPVs with the aim of holding as a long term investment or as short term trading investment. • Real Estate developers, who typically invest in plot of lands to develop new properties with the aim of selling them upon completion or holding as a long term investment. They normally invest via SPVs. • Little exposure on end-users, industrial companies and corporates directly occupying their HQ (mostly corporate risk than pure RE approach), as well as limited lending to private investors. 4 Main Characteristics of a Commercial Real Estate Lender Typical loan structure: • Real Estate financiers primarily lend on a secured basis. • The standard security package includes mortgage on the financed property, pledge on the shares of the SPV, pledge on bank accounts, assignment of receivables arising from lease contracts, insurance policies, hedging contracts. • Preference is lending to SPVs as they are “closed borrowers” with substantially one asset (the property or portfolio of properties financed by the lender) and only one financial indebtedness (the loan issued). They cannot acquire further assets nor take extra indebtedness, unless approved by the lender.. • Strong preference for low initial Loan-to-Value (LTV) financings (50-60%) with ample Interest Service Cover Ratio (ICR) above 2.0x. • Loan maturity is usually in a range between 3 and 6 years. • In view of the above mentioned conservative initial LTV and short tenors, RE lenders are comfortable to structure bullet loans or loans with small amortizations, with substantial bullet repayment at maturity (90%-95% if the initial financed amount). • Interest rate risk is usually fully hedged through hedging instruments such as interest rate swaps (IRS), caps or collars. • Monitoring of the performance during the life of the loan mainly performed through periodic test of covenants (at least on annual basis): • LTV (Maximum Loan To Value) = Outstanding Loan Amount / Market Value of the financed property • ICR (Minimum Interest Cover Ratio) = Net Operative Income / Interest Service • DSCR (Minimum Debt Service Cover Ratio) = Net Operative Income / Debt Service (Interest Service + Amortizations) • Information covenants = delivery of periodic financial statements, valuation report of the financed property, rent-roll, asset/property management report, etc. • Commercial Real Estate Lenders rely on a substantial due diligence (legal, administrative, tax, accounting, valuation, technical and environmental) carried out by reputable external advisors. 5 Eight steps from Origination…to Final Repayment 1. Origination • Finance request received by front office staff by client/sponsor after direct meeting and discussions. Scope can be financing of an initial acquisition or refinancing of an existing financial indebtedness close to maturity. • Finance request shall contain at least indication of requested amount, characteristics of the property or portfolio object of requested facility, desired tenor, information on the borrower and track record of the sponsor. • Subsequent meetings between lender’s deal principal with client representatives aimed at discussing the structure and characteristics of the potential transaction. • Preliminary analysis on the borrower and sponsor is performed by dedicated staff within the bank, including site visit of the asset and internal/external valuation. • If both client (KYC/CDD process) and structure fit with bank lending policies, next steps can be processed. 2. Indicative Term Sheet • Proposal is submitted to the appropriate commercial committees (green light committees) and discussed among front office representatives. • In case of positive outcome and satisfactory risk/return profile of the potential transaction, an Indicative TS is issued to the client/sponsor. The document contains indicative terms and conditions (amount, margin, fees, tenor, security package, covenant structure) on the basis of which the lender can seek final approval in front of bank credit committees. • Indicative TS is reviewed by the client and in case of acceptance the lender can process the formal credit request to the committee (phase 3). 6 Eight steps from Origination…to Final Repayment 3. Credit Application • A credit package is prepared by dedicated staff (usually front office with combination of specialized real estate and financial skills), containing at least: • Executive Summary with main conditions presented in the Indicative Term Sheet • Detailed analysis of the financials of the borrower/sponsor • Real Estate analysis of the property object of financing with site vist report/inspection sheet • Calculation of Rating of the borrower • Sanity Check of the transaction (ratio between expected income and risk weighted assets of the financing) • The credit package is extensively analyzed and discussed with credit risk management department, who is in charge of assessing risk metrics behind the transaction and validating the terms and conditions presented in the application. • As advice is circulated by credit risk management department to final decision makers/mandates (credit committee composed by management of the bank), for the final decision. 4. Binding Term Sheet • In case of approval, a Binding Term Sheet is issued to the client, reporting binding terms and conditions of the financing that will be reflected in the loan agreement (amount, margin, fees, tenor, security package, covenant structure, undertakings, set of reps&warranties conditions precedent to be satisfied before closing/disbursement). • Binding Term Sheet have a validity usually not exceeding one month and shall be signed-off by the client in case of full acceptance. 7 Eight steps from Origination…to Final Repayment 5. Execution Phase • Draft of full set of legal documentation (loan agreement and security package) is prepared by lender’s external legal counsel and reviewed by lender’s deal principals. • Negotiation of the legal documentation between lender and client with the assistance of respective legal counsels. • Active involvement of external advisors, due diligence reports delivered to the lender as main condition precedent for signing. Set of due diligence to cover: • Valuation of the property/collateral • Legal and administrative issues • Tax/Fiscal and accounting issues • Technical and environmental areas. • Sign off of the loan agreement and security package in front of a Notary. 6. Disbursement • All conditions precedent are checked and verified by lender and legal counsel, including request of drawdown submitted by the client at least 2 days before disbursement date. • Facility is funded by lender treasury department and finally disbursed by accounting team directly to the client bank account. • Disbursement is usually net of arrangement fee paid upfront to the lender and net of substitute tax. 8 Eight steps from Origination…to Final Repayment 7. Monitoring • After disbursement, the outstanding loan starts to produce interest and shall be periodically monitored by the lender. • Monitoring of the performance of the loan is carried out by lender deal principal together with portfolio management department. • Main monitoring tools are periodic checks of financial covenants (LTV, ICR. DSCR), as well as well as regular delivery of information covenants (financial statements, asset/property management reports, information on the cash flow of the property, tenancy schedule with detail of the active tenants). • Periodic meetings with clients are held to discuss performance of the borrower as well as of the financed property. • Waivers and modifications can be negotiated and implemented – if necessary – during the life of the loan, subject to approval of relevant lender credit committees. 8. Last but not least….Final Repayment • Remaining amount of the outstanding facility is repaid at expiry date. • Refinancing/extension can be implemented upon request of the client/sponsor, subject to lender approval and to new market conditions. • All securities are released by the lender upon full repayment of the facility amount. 9 Q&A Session Thank you for your attention! 10