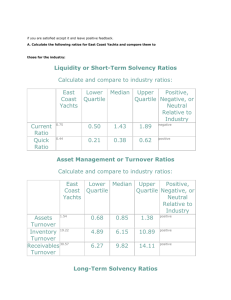

Wood-harvesting enterprise financing and investment

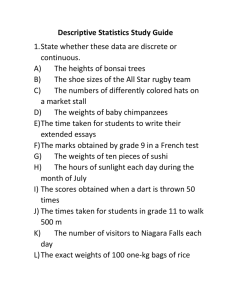

advertisement