A. Assuming East Coast Yachts maintains a constant

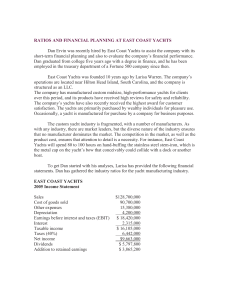

advertisement

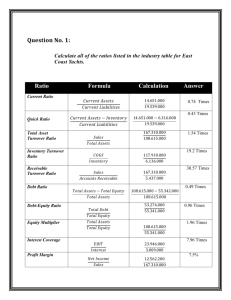

if you are satisfied accept it and leave positive feedback. A. Calculate the following ratios for East Coast Yachts and compare them to those for the industry: Liquidity or Short-Term Solvency Ratios Calculate and compare to industry ratios: East Coast Yachts Current Ratio Quick Ratio 0.75 0.44 Lower Median Upper Positive, Quartile Quartile Negative, or Neutral Relative to Industry 0.50 1.43 1.89 negative 0.21 0.38 0.62 positive Asset Management or Turnover Ratios Calculate and compare to industry ratios: East Lower Median Upper Positive, Coast Quartile Quartile Negative, or Yachts Neutral Relative to Industry 1.54 positive 0.68 0.85 1.38 Assets Turnover Inventory 19.22 Turnover Receivables 30.57 Turnover 4.89 6.15 10.89 positive 6.27 9.82 14.11 positive Long-Term Solvency Ratios Calculate and compare to industry ratios: East Coast Yachts Debt Ratio DebtEquity Ratio Equity Multiplier Interest Coverage 0.49 Lower Median Upper Positive, Quartile Quartile Negative, or Neutral Relative to Industry positive 0.44 0.52 0.61 .99 0.79 1.08 1.56 positive 1.96 1.79 2.08 2.56 neutral 7.96 5.18 8.06 9.83 neutral Profitability Measures Calculate and compare to industry ratios: East Coast Yachts Profit 7.51 Margin Return on 11.57 Assets Return on 22.70 Equity Lower Median Upper Positive, Quartile Quartile Negative, or Neutral Relative to Industry positive 4.05% 6.98% 9.87% 6.05% 10.53% 13.21% positive 9.93% 16.54% 26.15% positive B. Based on your calculations and comparisons above, how would you characterize East Coast Yacht's performance relative to its industry? Except for current ratio, in all other ratios the company is neutral means near to median and in most of the ratios it is positive means more than median. Overall company’s performance is satisfactory. Company’s inventory turnover is more than the industry and company’s debt ratios are less than industrial average, it means that company rely less on debt as compare to industrial average. Part II: Please answer the following questions: A. Assuming East Coast Yachts maintains a constant retention ratio, i. Calculate the firm's internal growth rate: 0.46 or 46% ii. In words, what does this rate mean? retained earnings / total assets. It means the level of growth achievable with outside financing. iii. Calculate the firm's sustainable growth rate: __9.08 %______ iv. In words, what does this rate mean? The maximum growth rate that a firm can sustain without increasing financial leverage. Calculated as: ROE x (1 - dividend-payout ratio)