Annual Report 2014 - Coca

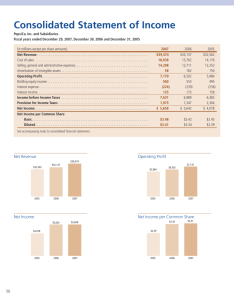

advertisement