Australian Crime Commission [PDF 194KB]

advertisement

![Australian Crime Commission [PDF 194KB]](http://s3.studylib.net/store/data/008217269_1-8c1d35b17bda98899c4a4748abd9af41-768x994.png)

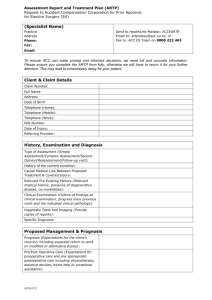

AUSTRALIAN CRIME COMMISSION Section 1: Entity overview and resources 1.1 STRATEGIC DIRECTION STATEMENT The Australian Crime Commission (ACC) is Australia’s national criminal intelligence agency with specialist investigative capabilities. The ACC is the only agency in Australia solely dedicated to combating serious and organised crime of national significance. It is uniquely empowered to work across national boundaries to bring together law enforcement, regulatory, intelligence and government agency partners to unite Australia’s efforts in this pursuit. The ACC is focused on achieving the outcome of a reduction in serious and organised crime threats of most harm to Australians and the national interest. This includes providing the ability to discover, understand and respond to such threats. In 2015–16 the ACC will continue to work with its partners to build the national picture and to break the business of serious and organised crime. The ACC does this by proactively discovering new and emerging threats, bringing together its specialist capabilities to fill intelligence gaps and to create innovative ways to prevent and disrupt serious and organised crime activity. Organised crime represents a serious threat as it is sophisticated, flexible, resilient, pervasive and globalised. While serious and organised crime has evolved in areas such as cyber and technology-enabled crime, financial crime and investment frauds, traditional criminal business, including trade in illicit commodities, continues to threaten Australians. In response, the ACC allocates resources and staff to projects dealing with the highest organised crime threats to our community. The ACC will continue to develop existing capabilities, people, processes and technology and create opportunities to share partners’ capabilities. The ACC is developing more sophisticated ways of sharing, mining and fusing data to enhance Australia’s criminal intelligence holdings. The ACC is continually evolving and seeking new solutions where traditional serious and organised crime treatments are ineffective or inefficient. The ACC works with a diverse range of partners and industries to discover and apply new intervention and prevention responses against organised crime. To position the ACC to effectively respond to the challenges, the agency’s approach for 2015–16 is embedded in the ACC Strategic Plan 2013–18. The plan’s development was guided by national frameworks and the ACC’s understanding of the threats posed by serious and organised crime. 109 Australian Crime Commission The ACC’s approach is as follows: • Discover—by proactively identifying new and emerging threats. The ACC’s collection work is focused on filling gaps in criminal intelligence. • Understand—the ACC provides a national intelligence picture on current and emerging threats; this is contributed to by partner agencies and in turn used to guide responses to serious and organised crime. • Respond—drawing upon the national picture of current and emerging threats, the ACC (often with partners) is able to: – prioritise its work to better understand and respond to the highest risks – initiate preventative actions to reduce opportunities to exploit vulnerabilities – disrupt, disable and dismantle criminal enterprises through enforcement, regulation, policy and legislation. Among its key priorities for 2015–16, the ACC will continue to contribute to the national security effort, supporting partners by identifying previously unknown individuals and groups seeking to be, or already, involved in terrorist activity. The ACC will sustain its efforts against criminal gangs through the Australian Gangs Intelligence Coordination Centre. The centre brings together the collective resources of the ACC, the Commonwealth, and the states and territories to directly support the state-based National Anti-Gang Squad strike teams and respond to these criminal elements harming our communities. The ACC will have key responsibilities in the revised National Organised Crime Response Plan 2015–17. The ACC will maintain its focus on capability development to enhance its ability to identify high-risk cash flows, patterns of crime, and individuals, businesses and corporate structures that may be involved in criminal enterprises in Australia and overseas, and, with its partners, respond to those threats. By detecting criminal finances, the ACC will detect new predicate crimes, including the manufacture, supply and trafficking of the highest risk drugs, such as crystal methylamphetamine or ‘ice’, that are impacting on the Australian community. The ACC will continue to work with national security partners to discover, understand and respond to cyber and technology-enabled crime threats, including in its role as administrator of the Australian Cybercrime Online Reporting Network. The ACC is uniquely placed to bring disparate partners together and coordinate shared capabilities to optimise results. Traditional partners remain critical to the fight against serious and organised crime, but the ACC will work with others, such as policy makers, private industry and international partners, to discover, better understand and respond to the threat posed to Australia from serious and organised crime. 110 Australian Crime Commission The manner in which the ACC achieves these outcomes is increasing in complexity— complexity in the depth and breadth of the ACC’s relationships with partner agencies and stakeholders, in the way in which criminal intelligence is collected and produced, in the criminal environment and its enablers, in the legal environment in which the ACC operates, and in the choices of responses to overcome criminal threats. The ACC will pursue opportunities to participate in law reform discussions to enable it to best face the legislative inhibitors that restrict its ability to evolve its capabilities in line with the capabilities of the criminals. 1.2 ENTITY RESOURCE STATEMENT Table 1.1 shows the total resources from all sources. Table 1.1: Entity resource statement—Budget estimates for 2015–16 as at Budget May 2015 Actual available appropriation 2014–15 $’000 Estimate of prior year amounts available in 2015–16 $’000 Proposed at Budget 2015–16 $’000 Total estimate 2015–16 $’000 – 98,170 7,893 106,063 35,089 – – 35,089 – 90,822 6,148 96,970 35,089 90,822 6,148 132,059 200 200 – – 2,650 2,650 2,650 2,650 ORDINARY ANNUAL SERVICES(a) Departmental appropriation Prior year appropriations(b) Departmental appropriation(c) s 74 retained revenue receipts(d) Total ordinary annual services OTHER SERVICES(e) Departmental non-operating Equity injections Total other services Total available annual appropriations 106,263 35,089 99,620 134,709 Total net resourcing for entity 106,263 35,089 99,620 134,709 All figures are GST exclusive. (a) Appropriation Bill (No. 1) 2015–16. (b) Estimated adjusted balance carried forward from previous year. (c) Includes an amount of $2.673m in 2015–16 for the departmental capital budget (see Table 3.2.5 for further details). For accounting purposes this amount has been designated as ‘contributions by owners’. (d) Estimated retained revenue receipts under section 74 of the Public Governance, Performance and Accountability Act 2013. (e) Appropriation Bill (No. 2) 2015–16. 1.3 BUDGET MEASURES Budget measures announced since the 2014–15 Mid-Year Economic and Fiscal Outlook (MYEFO) relating to the ACC are detailed in Budget Paper No. 2 and are summarised in Part 1 of Table 1.2. MYEFO measures and other measures not previously reported in a portfolio statement are summarised in Part 2. 111 Australian Crime Commission Table 1.2: Entity 2015–16 Budget measures Part 1: Measures announced since the 2014–15 MYEFO Programme 2014–15 $’000 Expense measures National Security— Implementation of mandatory telecommunications data retention(a) 1.1 Departmental expenses – Total expense measures – Prepared on a Government Finance Statistics (fiscal) basis. (a) This measure will be funded out of existing resources. 2015–16 $’000 2016–17 $’000 2017–18 $’000 2018–19 $’000 – – – – – – – – Part 2: MYEFO measures and other measures not previously reported in a portfolio statement Programme 2014–15 $’000 Measures Communications and Public Affairs Functions—targeted savings 1.1 Departmental expenses (23) Total (23) Prepared on a Government Finance Statistics (fiscal) basis. 2015–16 $’000 2016–17 $’000 2017–18 $’000 2018–19 $’000 (46) (46) (46) (46) (47) (47) – – Section 2: Outcomes and planned performance 2.1 OUTCOMES AND PERFORMANCE INFORMATION Government outcomes are the intended results, impacts or consequences of actions by the government on the Australian community. Commonwealth programmes are the primary vehicle by which government entities achieve the intended results of their outcome statements. Entities are required to identify the programmes that contribute to government outcomes over the budget and forward years. The ACC’s outcome is described below together with its related programme, specifying the performance indicators and targets used to assess and monitor the performance of the ACC in achieving government outcomes. Outcome 1: Reduced serious and organised crime threats of most harm to Australians and the national interest including through providing the ability to discover, understand and respond to such threats 112 Australian Crime Commission Outcome 1 strategy The ACC’s strategic approach of discovering new and emerging threats, understanding them more deeply, and initiating preventative or disruptive responses with partners, will direct the allocation of resources and ACC capabilities to the serious and organised crime threats of most harm to Australians and the national interest. Core elements of this strategy include providing national strategic advice on serious and organised crime threats and coordinating and participating in national responses with partners. A highly developed understanding of the threats posed by serious and organised crime will underpin the ACC’s provision of specialised criminal intelligence capabilities including special coercive powers and will focus response strategies on targets that pose the highest risk to Australians. The ACC will specifically focus on two core areas—building capability and working with partners—to deliver its outcomes and guide internal strategy development. Outcome 1 expense statement Table 2.1 provides an overview of the total expenses for Outcome 1, by programme. Table 2.1: Budgeted expenses for Outcome 1 Outcome 1: Reduced serious and organised crime threats of most harm to Australians and the national interest including through providing the ability to understand, discover and respond to such threats Programme 1.1: Australian Crime Commission Departmental expenses Departmental appropriation(a) Expenses not requiring appropriation in the budget year(b) Total expenses for Outcome 1 2014–15 Estimated actual expenses $’000 2015–16 Estimated expenses $’000 100,141 9,580 109,721 94,297 10,361 104,658 2014–15 2015–16 Average staffing level (number) 535 518 Note: Departmental appropriation splits and totals are indicative estimates and may change in the course of the budget year as government priorities change. (a) Departmental appropriation combines ‘Ordinary annual services (Appropriation Bill No. 1)’ and ‘Revenue from independent sources (s 74)’. (b) Expenses not requiring appropriation in the budget year are made up of depreciation expenses, amortisation expenses and resources received free of charge. 113 Australian Crime Commission Contributions to Outcome 1 Programme 1.1: Australian Crime Commission Programme 1.1 objective Aiming to reduce threats of most harm to Australians and the national interest, the ACC will discover and understand new and emerging threats and will fill intelligence gaps, enabling it to build the national picture of serious and organised crime. The ACC will respond by developing new prevention strategies and contributing or leading nationally coordinated actions and activities through ACC Board-approved special investigations, special intelligence operations and joint task forces. The ACC will collaborate with partners to better understand the serious and organised crime environment and to influence or enable responses. The ACC will provide strategic criminal intelligence for its partner agencies across all levels of government. When combined with the ACC’s specialist capabilities, including the ACC’s coercive powers, this will enable the ACC to further develop a more comprehensive national picture of serious and organised crime. Efforts will continue to be focused on preventing and disrupting serious and organised crime groups by disabling or dismantling them through enforcement, as well as through regulation, policy or legislative responses that harden the environment. Programme 1.1 expenses 2014–15 Estimated actual $’000 2015–16 Budget $’000 2016–17 Forward estimate $’000 2017–18 Forward estimate $’000 2018–19 Forward estimate $’000 Annual departmental expenses 100,141 94,297 91,955 88,188 88,174 Expenses not requiring appropriation in the budget year(a) 9,580 10,361 9,920 8,148 7,259 Total programme expenses 109,721 104,658 101,875 96,336 95,433 (a) Expenses not requiring appropriation in the budget year are made up of depreciation expenses, amortisation expenses and resources received free of charge. 114 Australian Crime Commission Programme 1.1 deliverables • Collect, correlate and analyse criminal information and intelligence, resulting in the dissemination of intelligence products and information; this includes the use of coercive powers, incorporating examinations as approved by the ACC Board. • Advise and influence national decision-making through the provision of strategic criminal intelligence assessments and advice. • Undertake special intelligence operations relating to federally relevant criminal activity. • Undertake special investigations of federally relevant criminal activity. • Unite and facilitate national responses against serious and organised crime by: – establishing and participating in joint agency task forces – utilising national criminal intelligence-sharing mechanisms with partners – managing and maintaining the National Criminal Target List and National Targeting System – maintaining and providing relevant intelligence and information holdings (including national databases) to partners. Programme 1.1 key performance indicators The ACC has a commitment to the quality of its performance reporting. The performance measurement framework that commenced in 2013 is being developed over the life of the ACC Strategic Plan 2013–18. New systems are being developed to collect performance data for assessment against the following indicators. This will enhance current performance monitoring with more meaningful qualitative data, as well as improve traditional quantitative performance data. • The ACC produces useful intelligence that identifies and provides insights on new and emerging serious and organised crime threats. • The ACC fills intelligence gaps through the identification of vulnerabilities and indicators of serious and organised crime. • The ACC collects and maintains national holdings of serious and organised crime threats and targets. • The ACC interprets and analyses national holdings to create a national serious and organised crime intelligence picture. • The ACC informs and influences the hardening of the serious and organised crime environment. • The ACC influences or enables the disruption, disabling or dismantling of serious and organised crime entities. • The ACC participates in or coordinates collaboration in joint operations and investigations to prevent and disrupt serious and organised crime. 115 Australian Crime Commission Section 3: Explanatory tables and budgeted financial statements Section 3 presents explanatory tables and budgeted financial statements that provide a comprehensive snapshot of entity finances for the 2015–16 budget year. It explains how budget plans are incorporated into the financial statements and provides further details of the reconciliation between appropriations and programme expenses. 3.1 EXPLANATORY TABLES 3.1.1 Movement of administered funds between years The ACC has no administered funds. 3.1.2 Special accounts The ACC has no special accounts. 3.1.3 Australian Government Indigenous expenditure The ACC has no Indigenous-specific expenses. 3.2 BUDGETED FINANCIAL STATEMENTS 3.2.1 Differences in entity resourcing and financial statements There is no material difference between the entity resourcing and financial statements. 3.2.2 Analysis of budgeted financial statements Income statement In 2015–16, the estimated appropriation revenue is $88.149m, which is a decrease of $5.209m compared to 2014–15. The decrease is attributed to the termination of Project Wickenby ($1.945m) and whole-of-government and targeted savings measures. The operating surplus of $1.110m in 2015–16 is solely due to the receipt of section 74 revenue from the Confiscated Assets Taskforce for capital investments. In 2016–17 and 2017–18, the decrease in appropriation revenue is also due to a number of terminating funding measures and savings measures. Balance sheet The ACC’s assets decrease over the forward estimates period as assets are depreciating at a rate that is faster than the replacement rate. Liabilities also decrease across the forward estimates, reflecting the amortisation of lease incentive liabilities and lower employee provisions. The equity decreases across the forward estimates are due to depreciation exceeding the departmental capital budget appropriation for asset replacement. 116 Australian Crime Commission 3.2.3 Budgeted financial statements tables Table 3.2.1: Comprehensive income statement (showing net cost of services) for the period ended 30 June 2014–15 Estimated actual $’000 2015–16 Budget $’000 2016–17 Forward estimate $’000 2017–18 Forward estimate $’000 2018–19 Forward estimate $’000 65,472 31,013 7,580 5,656 109,721 61,716 28,925 8,361 5,656 104,658 59,875 28,424 7,920 5,656 101,875 56,873 27,659 6,148 5,656 96,336 57,248 27,270 5,259 5,656 95,433 LESS: OWN-SOURCE INCOME Own-source revenue Sale of goods and rendering of services Total own-source revenue 7,293 7,293 7,258 7,258 4,886 4,886 3,535 3,535 2,895 2,895 Gains Other Total gains 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 2,000 EXPENSES Employee benefits Suppliers Depreciation and amortisation Other expenses Total expenses Total own-source income Net cost of (contribution by) services 9,293 9,258 6,886 5,535 4,895 100,428 95,400 94,989 90,801 90,538 Revenue from government Surplus (deficit) attributable to the Australian Government 93,358 88,149 87,069 84,653 85,279 (7,070) (7,251) (7,920) (6,148) (5,259) OTHER COMPREHENSIVE INCOME Changes in asset revaluation surplus Total other comprehensive income Total comprehensive income (loss) – – (7,070) – – (7,251) – – (7,920) – – (6,148) – – (5,259) Total comprehensive income (loss) attributable to the Australian Government (7,070) (7,251) (7,920) (6,148) (5,259) 2014–15 $’000 2015–16 $’000 2016–17 $’000 2017–18 $’000 2018–19 $’000 510 1,110 – – – 8,361 7,920 6,148 5,259 (7,251) (7,920) (6,148) (5,259) Note: Impact of net cash appropriation arrangements Total comprehensive income (loss) excluding depreciation/amortisation expenses previously funded through revenue appropriations Less depreciation/amortisation expenses previously funded through revenue appropriations 7,580 Total comprehensive income (loss) as per the statement of comprehensive income (7,070) Prepared on Australian Accounting Standards basis. 117 Australian Crime Commission Table 3.2.2: Budgeted departmental balance sheet (as at 30 June) 2014–15 Estimated actual $’000 2015–16 Budget $’000 2016–17 Forward estimate $’000 2017–18 Forward estimate $’000 2018–19 Forward estimate $’000 ASSETS Financial assets Cash and cash equivalents Trade and other receivables Total financial assets 1,317 34,574 35,891 1,317 28,892 30,209 1,317 27,460 28,777 1,317 25,135 26,452 1,317 24,049 25,366 Non-financial assets Land and buildings Property, plant and equipment Intangibles Other non-financial assets Total non-financial assets 8,285 4,980 5,968 2,046 21,279 6,640 6,186 4,887 2,046 19,759 3,869 6,336 3,229 2,046 15,480 1,979 6,089 2,114 2,046 12,228 2,222 4,111 1,306 2,046 9,685 57,170 49,968 44,257 38,680 35,051 3,124 5,794 8,918 3,098 3,162 6,260 2,916 3,338 6,254 3,058 3,324 6,382 3,185 3,321 6,506 6,288 6,288 5,375 5,375 4,464 4,464 3,874 3,874 3,296 3,296 Provisions Employee provisions Other provisions Total provisions 17,471 2,252 19,723 16,563 1,457 18,020 16,430 1,473 17,903 15,742 497 16,239 15,607 – 15,607 Total liabilities 34,929 29,655 28,621 26,495 25,409 Net assets 22,241 20,313 15,636 12,185 9,642 33,091 5,873 (16,723) 22,241 38,414 5,873 (23,974) 20,313 41,657 5,873 (31,894) 15,636 44,354 5,873 (38,042) 12,185 47,070 5,873 (43,301) 9,642 Total equity 22,241 Prepared on Australian Accounting Standards basis. 20,313 15,636 12,185 9,642 Total assets LIABILITIES Payables Suppliers Other payables Total payables Interest-bearing liabilities Leases Total interest-bearing liabilities EQUITY Parent entity interest Contributed equity Reserves Retained surplus (accumulated deficit) Total parent entity interest 118 Australian Crime Commission Table 3.2.3: Departmental statement of changes in equity—summary of movement (budget year 2015–16) Opening balance as at 1 July 2015 Balance carried forward from previous period Adjustment for changes in accounting policies Adjusted opening balance Comprehensive income Surplus (deficit) for the period Total comprehensive income Of which: Attributable to the Australian Government Transactions with owners Contributions by owners Equity injection—appropriation Departmental capital budget Sub-total transactions with owners Estimated closing balance as at 30 June 2016 Closing balance attributable to the Australian Government Prepared on Australian Accounting Standards basis. Retained earnings $’000 Asset revaluation reserve $’000 Contributed equity/ capital $’000 Total equity $’000 (16,723) – (16,723) 5,873 – 5,873 33,091 – 33,091 22,241 – 22,241 (7,251) (7,251) – – – – (7,251) (7,251) (7,251) – – (7,251) – – – – – – 2,650 2,673 5,323 2,650 2,673 5,323 (23,974) 5,873 38,414 20,313 (23,974) 5,873 38,414 20,313 119 Australian Crime Commission Table 3.2.4: Budgeted departmental statement of cash flows (for the period ended 30 June) 2014–15 Estimated actual $’000 2015–16 Budget $’000 2016–17 Forward estimate $’000 2017–18 Forward estimate $’000 2018–19 Forward estimate $’000 OPERATING ACTIVITIES Cash received Appropriations Sale of goods and rendering of services Total cash received 88,174 7,893 96,067 93,831 6,148 99,979 88,501 4,886 93,387 86,978 3,535 90,513 86,365 2,895 89,260 Cash used Employees Suppliers Other Total cash used 64,965 26,425 3,656 95,046 64,146 30,659 3,656 98,461 59,832 29,501 3,656 92,989 57,575 29,083 3,656 90,314 57,386 28,218 3,656 89,260 Net cash from (used by) operating activities 1,021 1,518 398 199 – INVESTING ACTIVITIES Cash used Purchase of property, plant and equipment Total cash used 6,033 6,033 6,841 6,841 3,641 3,641 2,896 2,896 2,716 2,716 Net cash from (used by) investing activities (6,033) (6,841) (3,641) (2,896) (2,716) FINANCING ACTIVITIES Cash received Contributed equity Total cash received 5,012 5,012 5,323 5,323 3,243 3,243 2,697 2,697 2,716 2,716 Net cash from (used by) financing activities 5,012 5,323 3,243 2,697 2,716 – – – – – 1,317 1,317 1,317 1,317 1,317 1,317 1,317 1,317 Net increase (decrease) in cash held Cash and cash equivalents at the beginning of the reporting period 1,317 Cash and cash equivalents at the end of the reporting period 1,317 Prepared on Australian Accounting Standards basis. 120 Australian Crime Commission Table 3.2.5: Departmental capital budget statement (for the period ended 30 June) NEW CAPITAL APPROPRIATIONS Capital budget—Bill 1 (DCB) Equity injections—Bill 2 Total new capital appropriations Provided for: Purchase of non-financial assets Total items PURCHASE OF NON-FINANCIAL ASSETS Funded by capital appropriations(a) Funded by capital appropriation—DCB(b) Funded internally from departmental resources(c) Total purchases of non-financial assets 2014–15 Estimated actual $’000 2015–16 Budget $’000 2016–17 Forward estimate $’000 2017–18 Forward estimate $’000 2018–19 Forward estimate $’000 4,812 200 5,012 2,673 2,650 5,323 2,671 572 3,243 2,697 – 2,697 2,716 – 2,716 5,012 5,012 5,323 5,323 3,243 3,243 2,697 2,697 2,716 2,716 200 4,812 2,650 2,673 572 2,671 – 2,697 – 2,716 3,194 8,206 1,518 6,841 398 3,641 199 2,896 – 2,716 RECONCILIATION OF CASH USED TO ACQUIRE ASSETS TO ASSET MOVEMENT TABLE Total purchases 8,206 6,841 3,641 2,896 2,716 Less additions by capitalising prior year work in progress (2,173) – – – – Total cash used to acquire assets 6,033 6,841 3,641 2,896 2,716 Prepared on Australian Accounting Standards basis. DCB = departmental capital budget. (a) Includes both current Bill 2 and prior year Act 2, 4 and 6 appropriations and special capital appropriations. (b) Does not include annual finance lease costs. Includes purchases from current and previous years’ DCBs. (c) Includes funding from current Bill 1 and prior year Act 1, 3 and 5 appropriations (excluding amounts from the DCB) and section 74 retained revenue receipts. 121 Australian Crime Commission Table 3.2.6: Statement of asset movements (budget year 2015–16) As at 1 July 2015 Gross book value Accumulated depreciation/amortisation and impairment Opening net book balance Buildings $’000 Other property, plant & equipment $’000 Computer software & intangibles $’000 Total $’000 29,880 26,839 15,396 72,115 (21,595) 8,285 (21,859) 4,980 (9,428) 5,968 (52,882) 19,233 980 980 4,355 4,355 1,506 1,506 6,841 6,841 (2,625) (2,625) (3,149) (3,149) (2,587) (2,587) (8,361) (8,361) CAPITAL ASSET ADDITIONS Estimated expenditure on new or replacement assets By purchase—appropriation ordinary annual services(a) Total additions Other movements Depreciation/amortisation expense Total other movements As at 30 June 2016 Gross book value 30,860 31,194 16,902 78,956 Accumulated depreciation/amortisation and impairment (24,220) (25,008) (12,015) (61,243) Closing net book balance 6,640 6,186 4,887 17,713 Prepared on Australian Accounting Standards basis. (a) ‘Appropriation ordinary annual services’ refers to funding provided through Appropriation Bill (No. 1) 2015–16 for depreciation and amortisation expenses, departmental capital budgets or other operational expenses. 122 Australian Crime Commission 3.2.4 Notes to the financial statements Basis of accounting The budgeted financial statements have been prepared on an accrual accounting basis, having regard to Statements of Accounting Concepts, and in accordance with the Public Governance, Performance and Accountability (Financial Reporting) Rule 2015, Australian Accounting Standards and other authoritative pronouncements of the Australian Accounting Standards Board. Revenue from government Amounts appropriated for departmental outcomes are recognised as revenue, except for certain amounts that relate to activities that are reciprocal in nature, in which case revenue is recognised only when it has been earned. Appropriations receivable are recognised at their nominal amounts. Goods and services The ACC receives funding from state and territory law enforcement agencies and portfolio entities under various memorandums of understanding. Gains Gains consist of resources and assets received free of charge that are recognised as revenue when a fair value can be reliably measured and the service or asset would have been purchased if it had not been donated. Use of those resources is recognised as an expense, and the assets are included on the balance sheet. Employee expenses Employee expenses consist of salaries, leave entitlements, redundancy expenses, superannuation and non-salary benefits. Supplier expenses Supplier expenses consist of operational expenditure, consultant costs, travel expenses, property operating expenses and legal costs. Other expenses Other expenses consist of resources received free of charge and paid resources received from partner law enforcement agencies. Assets Assets consist of cash, receivables, leasehold improvements, plant and equipment, intangibles and other assets (prepaid expenses). All assets are held at fair value. Liabilities Liabilities consist of unearned leasehold incentives, employee entitlements, property lease make-good provisions and amounts owed to creditors. 123