Case Studies in Global Business Journalism No. 6

Management at Yahoo Inc.

Prepared by Patrick SMITH

The Assignment

The case study focuses on the Internet giant’s apparent fall from grace. It was written in mid–2009

as markets awaited the completion of a long-awaited agreement between Yahoo and Microsoft to

combine the search capacities of the former with the latter’s technological strengths. The core of the

case concerns management questions, and your ability to comprehend and report on corporate

decision-making in the high-tech sector. How, in what ways, and in what segments of its business

did Yahoo mismanage itself such that it has dropped so far behind Google, its main competitor?

What is the company’s strategy to remedy its misfortunes? Image problems have also beset Yahoo,

notably related to how Yahoo (and other companies) responded to censorship practices in China.

How were the China decisions made, and what impact did they have on the company in the context

of its broader difficulties? Important here are the questions of the ethics of the China case and what

damage, if any, Yahoo's chosen course caused the company. Please read the accompanying

instructions, How to Approach Case Studies in Global Business Journalism, before beginning your

work.

This case is intended to suggest the possible directions a reporter might take in developing a

complex analysis of corporate management in the high-technology sector. Your assignment is to

choose and pursue interpretive themes across a range of apparently unrelated issues. Prominent

among these are the following:

The nature and role and strengths and weaknesses of management models that have

emerged in Silicon Valley corporate cultures.

The role management played in determining the course of Yahoo’s development.

Why management played this role.

The role of management in determining the responsibilities of corporations that, while

engaged with media, are not traditional media companies with a grasp of issues commonly

facing the media industry.

Yahoo's Managers

In June 2007, Jerry Yang, a co-founder of Yahoo Inc., took over as chief executive of the pioneering

Internet company from Terry Semel. Semel, previously a senior film and entertainment executive,

had served for six years. Yang’s assumption of control was the latest signal—and the clearest to

date—that Yahoo was in turmoil and that the company located its problems at the management

level. Semel had been brought in partly to counter a tendency toward techie insularity within

management ranks; now the company would be run by one of the techies who had launched it.

Yahoo’s difficulties were already reflected in its financial data at the time Yang took over. While the

company survived the bursting of the “dotcom” bubble in 2001, five years later it appeared to be

slipping as a competitor, notably against Google Inc., its primary rival as a search engine. Net

income from continuing operations was $751.4 million in 2006, a drop of 60 percent, from a record

high the previous year. In 2007, the year Yang assumed control, it declined a further 12 percent, to

$660 million. Revenues rose in both years; at end–2007 they were $6.97 billion, a gain of 8.5

percent over the previous year.

Management problems continued during Yang’s tenure. There were ever-more consistent reports

that executive practices based on consensus had blunted the company’s ability to innovate in an

industry noted for its competitive velocity. Equally, a company that took pride in its upstart roots

had developed critical organizational problems. Yang himself was said to be notably unable to make

decisions. Reflecting these weaknesses, new products and services were slow in reaching the

market. Neither was Yahoo successful in developing an alternative to its income model based on

banner advertising in its search products. In 2006, some 90 percent of revenue came from these

ads. Google employed another model, one that generated revenue derived from sponsored links to

websites.

In January 2008, as it announced results for the previous year, Yahoo disclosed that it would lay off

1,000 employees, about 7 percent of its work force. The following November, the company

announced that Yang would step down as CEO as soon as a replacement could be found. Yahoo’s

stock ended at $9.39 the day after the Yang announcement, its lowest price since the dotcom

collapse. One month later, Yahoo began another (and larger) round of layoffs.

Among the most critical questions facing Yang during his time as CEO concerned efforts by

Microsoft to absorb all or part of Yahoo in an effort to compete with Google. Talks between the two

companies had begun in 2005, but had proven fruitless by the time Yang took control. In January

2008, Microsoft made a takeover offer worth $44.6 billion in cash and stock; Yahoo rejected this bid

10 days later. By May the momentum behind a shareholder revolt, led by financier Carl Icahn, was

evident. A proxy fight was averted several months before Yang stepped down; Icahn won three

seats on an expanded board of directors.

In January 2009, Yahoo named Carol Bartz to replace Yang as CEO. Bartz, like Terry Semel, had little

experience in Internet-related businesses—a critical weakness, some analysts said at the time she

was hired. She had previously been chief executive of Autodesk, a software-development company.

Bartz was known for her assertive management style and her record on the organizational and

financial sides of management. She left Autodesk with significantly increased revenues, profit

margins, and income. At Yahoo, Bartz was paid $1 million annually, with further compensation

linked to the company's share price.

Within a month of her appointment, Bartz had begun a fundamental overhaul of top management at

Yahoo, cutting some positions, creating new ones and bringing in new executives. In an interview

with the Wall Street Journal Online six months after her appointment, Bartz recounted the talks that

led to it. “I couldn't figure out who was in charge of anything,” she said. “And then I thought, this is

going to be a blast, because Yahoo's such an important property and such a great name, and it

needed some structure.” In the same interview, Bartz was asked to define Yahoo. She replied: “Is

Yahoo a media or technology company? What's the big issue with that question? Because what we

are is—we use very, very fantastic technology to both create and serve up this experience for our

users. We use great technology that allows advertisers to get to those people.”

In May 2009, Bartz acknowledged that Yahoo had resumed talks with Microsoft. The following day

Microsoft introduced a revised version of its search engine, known as Bing. In July 2009 the two

companies announced they would develop a 10-year partnership under which Microsoft technology

would support the search capabilities and search advertising offered on Yahoo websites. Almost 90

percent of the revenue generated from search ads would go to Yahoo. Microsoft also agreed to pay

Yahoo $50 million a year for three years to cover transition costs. At the time of this announcement,

Google had a stable share of about two-thirds of all Web searches; Yahoo had a gradually declining

share of about 20 percent, and Microsoft, by way of the revised Bing, had an 8.5 percent share.

Web references

Yahoo annual results.

http://finance.yahoo.com/q/is?s=YHOO&annual

Yahoo stock price, historical.

http://finance.yahoo.com/echarts?s=YHOO#chart1:symbol=yhoo;range=5y;indicator=volu

me;charttype=line;crosshair=on;ohlcvalues=0;logscale=off;source=undefined

Talks with Microsoft.

http://www.forbes.com/2006/05/03/yahoo-microsoft-partnership-0503markets04.html

Yahoo Inc.

Yahoo is a provider of a wide variety of Internet-based services, the most prominent of which is its

Web portal, www.yahoo.com, and its search engine, http://search.yahoo.com. It also offers an e-mail

system, news, directories, maps, and the like. It has 11 major websites. In 2008, according to

various data services that monitor the Internet industry, the Yahoo.com domain attracted 1.56

billion visitors. In the year to December 31, 2008, the company reported revenues of $7.21 billion (a

gain of 3 percent over the previous year) and net operating income of $424.3 million (a 36-percent

decline). The company has its headquarters in Sunnyvale, California, and employed about 10,000

people in 2008.

Yahoo was started in 1994 by Jerry Yang and David Filo, who were Ph.D. candidates in electrical

engineering at Stanford University. Its original name was Jerry and David’s Guide to the World Wide

Web. A year later, having changed the website’s name to Yahoo!, Yahoo incorporated and acquired

venture capital support of $3 million. Also in 1995, Yang and Filo selected Tim Koogle as the

company’s first chief executive. The appointment was intended to bring professional management

standards to the new company; Koogle had previously participated in several Silicon Valley

startups. In 1996, an initial public offering on the NASDAQ exchange, where Yahoo is still listed,

raised almost $34 million.

Yahoo grew swiftly by many measures. In October 1996, it announced its billionth page view. At the

time, page views were at 14 million per day and were increasing at a rate of almost 20 percent per

month. Yahoo had also begun aggressively expanding its offerings by developing new products,

such as Yahoo News, by forging strategic partnerships with technology and media companies, and

by acquiring a variety of enterprises that would contribute to the diversity of the Yahoo Web portal.

Among these acquisitions were Four11 (the forerunner of Yahoo Mail), ClassicGames.com

(subsequently Yahoo Games) and GeoCities, a Web hosting provider.

Yahoo was in a strong position when the dotcom bubble collapsed in 2001. Although its stock price

fell dramatically, reaching a low of $4.06 in September 2001, the company went on to build or

enhance its capabilities in broadband services, Internet search, e-mail, blogging and networking

services, and the like.

In October 2009, the company described itself as “the world's largest global online network of

integrated services with more than 500 million users worldwide.” It said its services were available

in more than 20 markets worldwide. It had an average of 135.1 million unique visitors to its

websites per month at this time and total monthly visits of 2.52 billion. By these metrics, it ranked

second to Google by margins of 7.5 percent and 3.5 percent, respectively.

Web references

Yahoo corporate website.

http://info.yahoo.com/center/us/yahoo/

Yahoo company timeline.

http://Web.archive.org/Web/20080113062047/yhoo.client.shareholder.com/press/timeli

ne.cfm

Site visits and rankings.

http://siteanalytics.compete.com/yahoo.com/?metric=uv

http://www.alexa.com/siteinfo/yahoo.com

http://www.alexa.com/siteinfo/google.com

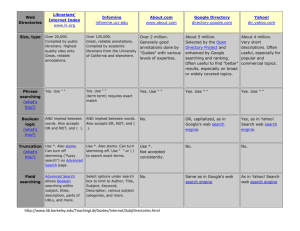

Yahoo and Its Competitors

Although Yahoo has rivaled both Microsoft and Google in various segments of its industry, it has

had relations and alliances with both companies over many years. In June 2000, Yahoo and Google

agreed that the latter would serve as Yahoo’s default search engine—an arrangement that lasted

four years. When Google initially took its stock public, Yahoo held 10 percent of it. In 2008, the two

companies agreed on an alliance allowing Yahoo to display some advertisements generated by

Google. The latter withdrew from the agreement within a few months due to antitrust concerns

raised by the U.S. Department of Justice.

The unsolicited bid that Microsoft made for Yahoo in February 2008 was the outcome of several

years of fruitless, desultory negotiations, the focus of which was consistently Yahoo’s search

capabilities. Under the proposal struck by CEO Carol Bartz in 2009, the Yahoo website was to use

Microsoft technology and algorithmic search results. In turn, Yahoo’s advertising sales force was to

represent both companies.

Web references

Yahoo's 2008 deal with Google.

http://online.wsj.com/article/SB121329534659368693.html

Yahoo in China

On May 4, 1998, Yahoo announced the start of Yahoo! Chinese, a Chinese-language Web portal. It

was the 13th of what the company terms its world properties. In the years that followed, Yahoo’s

Web offerings in Chinese, in particular its e-mail service, enmeshed the company in four cases

concerning dissidents residing in mainland China. All four were arrested and sentenced to prison

after the Chinese authorities traced their identities through their use of Yahoo e-mail accounts.

By 2003, China’s extensive effort to monitor the Internet had been detailed in a report conducted by

the Harvard University Law School. Three years later, a report issued by Human Rights Watch and

other nongovernmental organizations implicated Yahoo among a number of Internet companies

cooperating with Chinese censorship authorities. Others named included Microsoft, Google, and

Skype. The latter three, Human Rights Watch asserted, censored searches, websites, blogs, and

spoken language. Yahoo released the IP addresses of e-mail users to Chinese officials. There was

evidence that these companies had cooperated even in instances when the mainland had not

requested them to do so.

These cases provoked considerable outrage and raised questions concerning the behavior and

responsibilities—and most fundamentally the identities—of companies combining electronic

technology and media, and providing services in such countries as China. In February 2006, Yahoo’s

attorney testified before three congressional subcommittees on one case of a jailed dissident,

claiming that the company “had no information about the nature of the investigation” at the time its

Hong Kong subsidiary gave the Chinese the dissident’s IP address. Documents made public

subsequently indicated that the Chinese warrant given to Yahoo had fully outlined the charges.

In April 2007, the wife of another jailed dissident sued Yahoo in U.S. federal court for human rights

violations under an early American law known as the Alien Tort Statute. Four months later, the

World Organization for Human Rights, an American NGO, filed a second suit against Yahoo on the

same grounds in the cases of two dissidents. Yahoo settled both cases out of court for undisclosed

sums in November 2007.

In January 2008, Jerry Yang announced the start of the Yahoo! Human Rights Fund to aid those

prosecuted in China. In 2009 Yahoo, Google, and other Internet companies mounted lobbying

efforts to oppose passage of the Global Online Freedom Act, legislation introduced in Congress to

prevent service providers from cooperating with “repressive regimes.” All four of the Yahoo e-mail

users arrested in China remained in prison.

Web references

Human Rights Watch report.

http://www.hrw.org/en/news/2006/08/08/china-Internet-companies-aid-censorship

Reporters Without Borders report.

http://www.rsf.org/spip.php?page=article&id_article=14884

The Harvard report on Chinese censorship.

http://cyber.law.harvard.edu/filtering/china/

Yahoo’s congressional testimony.

http://www.nytimes.com/packages/pdf/business/YahooStatement.pdf

Google Inc.

Google is an Internet company with headquarters in Mountain View, California. Its primary activity

is the search engine (www.google.com), which is accessed more than any competing device on the

Web. Its other offerings include G-mail, Google Maps and Google Earth, Google Product Search

(initially known as Froogle), Google Translate and Google Chrome (an open-source Web browser).

Virtually all of Google’s income derives from advertising. By way of Google AdWords, businesses bid

in open auctions to post advertising next to specified search results, so targeting their audiences.

These are known as “sponsored links.” The company distinguishes between them and the results of

a given search. Google is listed on the NASDAQ stock exchange. In 2008, it reported revenue of

$21.8 billion, a gain of 31 percent over the previous year, and operating income of $6.6 billion, a

increase of 30 percent. In September 2009 the company had 19,700 employees worldwide.

Google was founded in 1996 by Sergey Brin and Larry Page, who were (like Jerry Yang and David

Filo) Ph.D. candidates at Stanford University. Their undertaking was conceived as a student project,

and the two were, according to reports at the time, in part inspired by Yahoo’s quick success as a

search engine. The Google model differed from predecessors in that it was developed to analyze and

rank search results according to relevance, as opposed to the simpler metric of how many mentions

a search word or phrase appeared in a document yielded in a search. www.google.com was

registered as a domain in September 1997; the company was incorporated in Menlo Park,

California, one year later. At that time, Brin and Page had attracted venture capital support worth

$1.1 million.

By mid–2000, Google had overtaken Yahoo as the Web’s most popular search site. The following

year, the company began selling advertising that could be linked to search words or phrases. These

keywords were what Google put up for auction. Google AdWords, an online, self-service advertising

device, was launched at this time. The model, which was patented in 2001, proved to be a primary

source of Google’s competitive strength in coming years, including during and following the dotcom

bubble.

Google’s growth has come via a combination of acquisitions, in-house innovations, and

partnerships. Among the largest of its purchases have been Applied Semantics ($102 million),

Current Communications Group ($102 million), AOLB ($1 billion), and YouTube ($1.65 billion).

Partnering companies have included Sun Microsystems (an early investor in Google), Microsoft,

Nokia, and AOL. In May 2000, the company launched its first 10 foreign-language services. These

were in French, German, Italian, Swedish, Finnish, Spanish, Portuguese, Dutch, Norwegian, and

Danish. Chinese-, Japanese-, and Korean-language services appeared within several months. By

2009, Google was active in some 30 languages.

Google listed on the NASDAQ stock exchange in August 2004, a $1.67 billion initial public offering

that combined newly issued shares and those held by the shareholders prior to the IPO. The sale

gave Google a market capitalization of more than $23 billion. By 2007, Google enjoyed a 54 percent

share of the search engine market as measured by the number of visits, according to statistics

provided by industry-monitoring services. Yahoo ranked No. 2, with a 20 percent share, and

Microsoft No. 3, with 13 percent. Google’s position since then has not been challenged. In the year to

end-April 2009, Google had 5.5 billion searches, an increase of 7.8 percent over the previous year

and a 64 percent share of the market. Yahoo (No. 2) had 1.4 billion searches, a decline of 2.8 percent

and a 16.3 percent share of the total.

Like some other Silicon Valley Internet companies, Google is known for, and prides itself upon,

maintaining an informal corporate culture. Its offices in Mountain View are purposely crowded and

open-plan in layout; its corporate timeline lists the acquisition of a company dog among Google’s

early milestones. Management at Google has been stable. Page remains as president in charge of

products, his role from the first, and Brin as technology president, also his initial post. Eric Schmidt,

who was recruited to run the company in 2001, remains as chief executive and board chairman.

Following Google’s IPO, there were reports that Google had become more corporate as a

consequence of its exposure to shareholders. In 2006 the company named a "chief culture officer."

Web references

Google financial results.

http://www.google.com/finance?q=NASDAQ:GOOG&fstype=ii

Google timeline.

http://www.google.com/corporate/history.html

Google’s ranking metrics.

http://siteanalytics.compete.com/google.com/

Nielsen Net ratings.

http://enus.nielsen.com/main/news/news_releases/2009/may/Nielsen_Online_Search_Dat

a_April_2009

News report on corporate culture.

http://www.nytimes.com/2005/08/24/technology/24valley.html?_r=1

Microsoft Corp.

Microsoft is a developer, manufacturer, and marketer of software products. Chief among these

products, and the company’s most remunerative, are Microsoft Windows and Microsoft Office, both

of which take commanding positions in their markets, and a range of offerings that are ancillary to

these software systems. Among the company’s other undertakings are MSNBC, the cable television

network, and an Internet portal, www.msn.com. With headquarters in Redmond, Washington, the

company has offices in roughly 150 countries countries and employs 89,000 people worldwide. In

the year to June 30, 2009, Microsoft reported revenue of US$58.43 billion and operating income of

US$20.36 billion; both results represented declines from the previous year.

Microsoft was founded in 1975 by Bill Gates, a Harvard University dropout who had developed a

programming language called BASIC that was designed for use in a newly available microcomputer.

In 1980, the company developed a disk-operating system that led to a contract with IBM, which was

then developing its line of personal computers. The MS-DOS operating system transformed

Microsoft. In 1985, the first version of Windows was launched. A year later the company had an

initial public offering on the Nasdaq stock exchange that valued it at $520 million.

Various versions of Windows and Office were released in the years following. During this period,

Microsoft received the first of many complaints that its business practices were predatory and, in

some cases, monopolistic. By 2000, research data showed that Microsoft Office had a 96-percent

share of retail sales in its market segment. That same year, a U.S. court ruled that Microsoft had to

separate its businesses such that the company could no longer “bundle” product offerings—the

Explorer Web browser with Windows being the most prominent example. Part of this judgment

was reversed on appeal, and the matter was finally settled with the U.S. Department of Justice in

2004. That same year, Microsoft faced antitrust charges from the European Union; that case

resulted in a judgment against the company of approximately US$600 million.

By this time, Microsoft had already begun one of the most fundamental shifts in its history. Gates

first signaled this shift in 1995, when he announced internally that expansion into Web-related

products was key to the company’s future competitiveness. MSN was launched later that year, and

MSNBC, a joint venture with the broadcasting network, followed in 1996. Internet Explorer,

launched in 1995, began to dominate the Web browser segment of the industry at this time.

Between 2002 and 2005, Microsoft underwent a basic reorganization of its activities, ending with

three core units. MSN and other Web-related businesses, including MSNBC and Slate, its online

magazine, became part of the Platform Products and Services Division, the chief responsibility of

which was the Windows operating system.

In the year to the end of April 2009, MSN/Windows Live Search attracted 853,000 searches, an

increase of 7.7 percent over the previous year and a 9.9 percent share of the market. It ranked No. 3

in the search segment of the Internet industry. The focal point of Microsoft’s extensive negotiations

with Yahoo over many years had been to add search-engine capabilities to the segments of the

Internet industry where Microsoft could compete.

In June 2008, several months after Microsoft made its unsolicited bid to acquire Yahoo, Gates

stepped down as chief executive; Steve Ballmer, who had joined the company in 1980, replaced him

as CEO. Gates had stepped aside as head of software design in 2006 and was replaced by Ray Ozzie,

who had joined Microsoft in 2005, when Microsoft acquired a software company Ozzie had founded

in 1997.

Web references

Microsoft annual report.

http://www.microsoft.com/msft/reports/ar09/10k_fh_fin.html

Microsoft timeline.

http://www.microsoft.com/presspass/download/newsroom/msn/MSNGlobalTimeline.doc

Report on market share.

http://www.pcworld.com/article/18462/a_peek_at_office_upgrade.html

Appendix I: Case Background

Text of interview with Carol Bartz.

It was published in The Wall Street Journal Online on June 2, 2009. The interview was

conducted, before an audience, by Kara Swisher.

MS. SWISHER: I want to ask you: What is Yahoo?

MS. BARTZ: We're the place that millions and millions of people come every day to check in with the

people and things they're interested in. Seventy-six percent of the audience in the U.S. comes to

Yahoo. Fifty percent of the worldwide audience comes to Yahoo. It's where people find relevant and

contextual information.

MS. SWISHER: About?

MS. BARTZ: About what they care about, whether it's their friends, their associates. It's news, it's

sports. We have 11 leading sites: news, sports, finance, home page, mail—twice the number of mail

accounts as the next competitor.

We have this global reach with a very local feel. When you go to India, the front page is cricket.

When you go to Taiwan, it feels like a very Asian site, but yet it's the Yahoo brand, it has a Yahoo

reach. And as time goes on, we can get more local. We should. People should see their high-school

Flip videos on Yahoo sports for the local football team. Why not? We just appeal to the broadest

number of people.

MS. SWISHER: Things have changed. There's Facebook. Now, these are starting points on the

Internet too—MySpace, Facebook. What happens in a world where people are shifting to other

starting points?

MS. BARTZ: No, it's not just starting points. In today's Internet world people go wherever they want.

They don't need to be quite as spoon fed as they were in the beginning. On the other hand, you don't

have time to wander around. They can start on a Facebook, but Facebook doesn't give them the

news. It doesn't give them what's happening with their teams. It doesn't give them their stock

quotes. It doesn't give them a lot of things.

MS. SWISHER: Does that make you a media company or a dashboard?

MS. BARTZ: [This was a question] that people wanted to know the minute I walked in the door. Is

Yahoo a media or technology company? What's the big issue with that question? Because what we

are is—we use very, very fantastic technology to both create and serve up this experience for our

users. We use great technology that allows advertisers to get to those people.

MS. SWISHER: What did you think of Yahoo before you came, and how did you get there?

MS. BARTZ: It was in November, and Jerry said, Gee, Carol, gosh, would you be interested? And I

said, Go away. No way; I'm not the right person. I'm not even remotely the right person. So thank

you very much, but no.

MS. SWISHER: You had been running a computer-aided software company for many years, [a] much

more traditional kind of—

MS. BARTZ: What does that have to do with anything? That's not the point. Are we leading up to: I'm

both too old and too stupid to know what the Internet is?

MS. SWISHER: I'm not going to say that.

MS. BARTZ: Finally, Jerry said, Will you just please come to my house and talk to me? And I said,

Jerry, OK, fine. Out of sheer respect to you I'll come and talk to you. But I'm not taking a job. So I

hope you have good wine. We get there and of course we're all very nice, and I thought, Well, I guess

I'm going to have to take control of this interview.

So I said, Well, Jerry, why don't you draw me an org chart, because I really hadn't paid any attention

to anything. He pulls a flip chart out of the closet. You all have a flip chart at home, right? He starts

drawing the org. I'm looking at this thing and I go, that's really the org?

I said, Why don't you show me who on this org would make the big decision—the big search

decision. So he started drawing arrows. And it was like a Dilbert cartoon. It was very odd. I said, you

need management here. I couldn't figure out who was in charge of anything, and he didn't explain

that part very well. So I got kind of hooked. I walked out and said, Uh, maybe I'm a little bit, 10%

interested. Then they put the full-court press on with the board, and then I thought, this is going to

be a blast, because Yahoo's such an important property and such a great name, and it needed some

structure. And I'm actually quite good at that, so there I was.

In the Way

MS. SWISHER: Which structure do you think it needs? You're talking about a management issue

versus an innovation issue, which is a separate thing.

MS. BARTZ: No, organizations can get in the way of innovation, because if people are all bound up,

and if they don't know if they get to make the decision or somebody else, and if they do, what

happens to them, and so on and so forth. There's a freeing when you organize around the idea that

you're clearly in charge and go for it. It's really a fantastic group of people, and just cleaner lines and

cleaner responsibility, and freedom to make mistakes, and have some fun. This whole business that

there's no innovation side of Yahoo is just the craziest thing I've ever heard.

MS. SWISHER: What's the problem? Are people in the way or are there staff that don't want to

change?

MS. BARTZ: All of the above. We had bigger silos inside the company than outside. The home-page

people didn't want to drive traffic to the finance page because they wanted to keep them on the

home page. It's all simple stuff. The only problem I have is I can't take nine women and make a baby

in a month. We have to kind of go through some steps here.

MS. SWISHER: What does Yahoo have to do going forward? Do you need to shed products; do you

need to become more lean?

MS. BARTZ: No, no. We have 76% reach in the U.S. We have to keep those people engaged and

happy and coming. We have to give them wow experiences. We have to give them video snacks for

their news and entertainment. We have to make our sites more personal and social. Yahoo Finance

chat room is sort of the first social site out there, right?

It really is about just driving great integrated experiences for people. What does that mean? You

look at every one of your properties and say, how can we make this better? How can we personalize

it? How can we make it more social? How can we make it more of a place to launch off? Yahoo

drives more traffic to most sites on the Internet than anyone else.

MS. SWISHER: Let's talk just about the image of Yahoo, what's happened to it. You said before you

got there you had the same idea of Yahoo, as it being broken. How do you change that perception?

MS. BARTZ: The best way to change the perception is to do a good job and then talk about it. For

instance, I know everybody out there says Yahoo has lost the youth; only old people use Yahoo. Do

you know in the 18 to 24 demographic we have 76% reach? Everybody doesn't just go to Facebook.

We just have to get our story out there; we have to continue to appeal to the people that come to us,

and frankly, at some point people get sick of having us as the underdog and say, Thank God, Yahoo's

back. And we are back. We're going to go step by step.

MS. SWISHER: Do you feel you need a strong No. 2 that's more Internet-y? You have a computerscience degree. You've been in technology forever. I'm not saying you don't know about the Internet

at all. You're clearly a charismatic leader, but do you need that Internet visionary kind of thing at

Yahoo to re-establish it or not?

MS. BARTZ: I don't need a No. 2 because I don't want to be removed from the business. That's what

happens a little bit. You get confused about who's in charge.

We have very, very smart people. And frankly—and all of you guys out there that have a little age on

you will appreciate this—all you have to do is ask questions. You just have to keep asking questions.

You ask questions and guess what, they go, Oh, I never thought of that. Because it unleashes so

much power in people by just asking. Why do I have to be the know-it-all? My God, I'm not that

smart. But I'm smart enough to just keep asking questions and say, Is that the best you can do? Does

that excite you? Will that excite the customer? Does this really have to work this way?

MS. SWISHER: How would you describe your management style?

MS. BARTZ: Fair but tough. I manage through a sense of humor. We all work hard, and work has to

be a really interesting, fun place. And that has to start at the top. You have to be willing to say, I

don't know, I made mistakes, and change. When somebody tells me they're going to do something, I

want them to do it or tell me they're not going to do it. That's fine. So, and actually I'm kind of nice.

AUDIENCE MEMBER: Can you talk a little bit about how you see Google and how you expect Yahoo

to compete or differentiate itself versus that company?

MS. BARTZ: Google is a fierce competitor. I wish I was worth a bazillion dollars; that would be really

nice. They're a fierce competitor and they're very good in search. They're very good with their

global map thing. They don't have the positioning we have. They don't have the reach we have and

the amount of information that we delight our users with. We're different companies. We are

positioned as a place where people come to be informed, not just informed through a search but

informed through great content, with great editorial and great integration. And a very local feel.

It's very interesting, when you go to Asia and you say, how do you like the Google white page. They

hate it. You guys know they love color and crowded things and cartoons. They want the feel to be,

this is my Hong Kong site. So while Google's done a good job with their platform, I think they're too

algorithm-pushed. We want to be more personal for people. We want to have that personal feeling

that you're coming to the site to be informed with what's important to you and it's there for you.

Different company than Google.

Yahoo closes Brickhouse - but what does this say about the state of

innovation?

605 words, 11 December 2008, Guardian Unlimited, GRULTD, English

Guardian Unlimited © Guardian Newspapers Limited 2008. All rights reserved

Is anybody else mourning the passing of Yahoo's Brickhouse?

By Jemima Kiss

Is anybody else mourning the passing of Yahoo's Brickhouse?

This is just one part of an increasingly brutal plan to thin the company down. 1,500 jobs are going

(that's 10% of the workforce, though Kara Swisher earlier reported that say the figure could go up

to 2,000. A Yahoo spokesman told the New York Times that there could be "additional staff

reductions next year - it depends on the decisions we make about prioritistions, and on things we

can't predict in the economy".

Offices are being closed in Dusseldorf, Hamburg, Stockholm, Amsterdam, Oslo and Copenhagen. And

the severance package for executives that was hastily rejigged in February to put off Microsoft, was

been rejigged again. All this is an effort to cut down 'company bloat' and make the company more

attractive for a buyer.

But Brickhouse? Valleywag says estate agents have "tromped through" the office in South Park, San

Francisco, suggesting an imminent sale of the Brickhouse home, and rather unfairly says "nothing

memorably has issued" from the division, which is just not true.

Former BBC developer Tom Coates has been leading the location aggregator Fire Eagle - an

extremely clever, versatile and simple product with huge potential. This is exactly the kind of

product that Yahoo's innovation wing should be producing and extremely popular with the

development community. "Although Brickhouse is gone, be reassured Fire Eagle is still here and

we'll keep working. Case in point," Coates Tweeted last night, linking to the project's Facebook app.

Another extremely popular project was Yahoo Pipes, which provides a range of tools for mashing

together content feeds. ReadWriteWeb called it "one of the coolest ways to mashup the RSS feeds of

sites to get the data you want". Pipes has powered a filtered Digg feed, aggregated search results, a

FriendFeed stream without Twitter and plenty of mainstream media services too - including the

New York Times' Flickr mashup. The real advantage is that you don't need to be technical, so it's a

brilliant way to experiment with mixing together different media and different formats.

Brickhouse has suffered with the departure of a series of executives Flickr co-founder Caterina Fake

headed the division first with Salim Ismail, then Chad Dickerson - all of whom have now left. Born in

March 2007, it was supposed to be a way of allowing that weekend-long hack day spirit to live on

and become part of the working process.

It's a given that firms have to clamp down on costs. But innovation? That's the future. Brickhouse

was supposed to be Yahoo's answer to the nimble and creative startup community, putting small,

talented teams of developers away from the corporate HQ to invent new, exciting services. Given

the intensity of competition they face, and the fact the market is about to demand that companies

prove their strength and uniqueness, you'd have thought that remained a priority. After all, two of

Yahoo's most popular services were both startups it bought in: Flickr and Delicious.

If some of Brickhouse's projects failed, that should be accepted as part of the process of developing

experimental projects - without testing and failing you can't learn what really works. It's a terrible

shame that there's no space for a service like this in Yahoo's cold new world.

Google, Yahoo Target Internet 'Freedom' Bill

By John Letzing , 915 words, 21 November 2009, 01:29, Dow Jones News Service

(c) 2009 Dow Jones & Company, Inc.

Google Inc. (GOOG) and other Internet companies have zeroed in on a resilient effort by a

Republican lawmaker to pass legislation that could restrict their ability to take a nuanced approach

to operating in "repressive" foreign countries, according to third-quarter lobbying reports.

Google, Yahoo Inc. (YHOO) and a trade group that also includes Microsoft Corp. (MSFT) have

focused lobbying efforts on the bill, dubbed the "Global Online Freedom Act of 2009."

Introduced by Rep. Chris Smith (R., N.J.), the legislation could upset the delicate balancing act

required of companies trying to do business in countries such as China - where surging economies

and expanding Internet access may be paired with censorship and political repression.

Google has struggled to compete in China, where it lags behind local firm Baidu Inc. (BIDU) in terms

of Internet search market share.

The legislation proposes an "Office of Global Internet Freedom," which would monitor any moves

by U.S. companies to filter or limit their Internet search results in foreign countries.

In addition, if a company receives a user-information request from a foreign government for "other

than legitimate law enforcement purposes," such as tracking down dissidents, the U.S. Attorney

General could order the company not to comply - potentially setting it up for an impasse with local

authorities.

Google has modified its search service for Chinese users at the government's request before. In

2006, for example, it began limiting search results there for those exploring topics such as the prodemocracy, Tiananmen Square demonstrations in 1989.

In addition, the company has been targeted by other foreign governments unhappy with the

content it makes available online. Google has argued that it's better to provide censored Internet

search results in foreign markets, than no results at all.

A previous effort by Smith to pass similar legislation in 2006 met with resistance, and he

subsequently penned a column in the National Review blaming Google's efforts in tandem with a

firm run by powerful Washington, D.C.-based lobbyist Anthony Podesta.

According to public records, in the third quarter of this year Google employed Podesta's firm,

Podesta Group Inc., to lobby House and Senate members on the legislation, which was reintroduced in May.

Podesta is widely recognized as a top D.C. powerbroker. His brother, John, was a chief of staff to

President Bill Clinton. Podesta did not respond to a request for comment.

In addition, Google directly lobbied Congress, the Office of the U.S. Trade Representative, the

Commerce Department and the White House on the bill - often referred to as "GOFA" - according to

third-quarter reports.

Noble Goals, Big concerns

Google director of corporate and policy communications Bob Boorstin said in a statement that the

GOFA legislation could be "improved to avoid impeding the spread of technologies around the

world that promote free expression."

Boorstin added that the issues of censorship and free expression might best be addressed as part of

"international human rights accords and trade mechanisms."

Yahoo became ensnared in a human rights debacle after it was sued in 2007 for handing personal

information about pro-democracy users in China to local authorities, which helped lead to their

imprisonment and torture.

Yahoo directly lobbied the State Department and Congress about the GOFA legislation in the third

quarter, while also hiring Mehlman Vogel Castagnetti Inc. to take up the issue, records show.

Yahoo has pulled out of direct competition in China, though it retains an ownership stake in

Hangzhou-based Alibaba Group (1688.HK). However, the GOFA legislation could apply to other

countries where Yahoo does business.

A Yahoo spokeswoman said in a statement that, "While the goals set forth by the sponsors of GOFA

are noble, the bill's scope could ultimately mean that companies will have to cease providing

information services in a number of countries."

"Yahoo will continue working with Congress as it addresses this legislation," the statement read.

In the wake of intense scrutiny in the media and on Capitol Hill of their operations in markets such

as China, Yahoo, Google, Microsoft and other companies formed the Global Network Initiative last

year. The group is dedicated to protecting "freedom of expression" in information technology,

according to its Web site.

Still, Rep. Smith is pressing ahead. His bill has been referred to two House committees, and is being

co-sponsored by Democrats Brad Sherman (D., Calif.) and David Wu (D., Ore.), as well as two other

Republicans.

Smith said in a statement that GOFA "is aimed at ending the collaboration between U.S. companies

and brutally repressive regimes when there is concern that U.S. products will be used to put

innocent, pro-democracy advocates in jail."

During his recent visit to China, President Barack Obama voiced support for open access to

information, but stopped short of criticizing Beijing for censoring the Internet.

Microsoft, like Google, competes directly in the Chinese Internet market. The company began

making its revamped search engine, Bing, available there last summer.

In 2006, Microsoft was criticized for deleting a politically sensitive blog written by a China-based

journalist. A Microsoft spokesman deferred comment to the trade association TechAmerica - which

also includes Google, and has lobbied on the GOFA legislation.

"We're opposed to the bill, but not its underlying principles," said Josh Lamel, TechAmerica's senior

vice president, commercial policy and government affairs.

Yahoo! Hopes Hollywood Vet Can Steer It In Hard Times

By Ross Snel, Of DOW JONES NEWSWIRES, 948 words, 18 April 2001, 00:11, Dow Jones News

Service

English

(c) 2001 Dow Jones & Company, Inc.

NEW YORK -(Dow Jones)- Yahoo! Inc. (YHOO), one of the quirky, irreverent pioneers of the Internet

economy, is getting a seasoned Hollywood veteran to lead it through challenging times.

The appointment of former Warner Bros. co-chief executive Terry Semel to the top posts at Yahoo!

also marks a continuation of the Internet portal's recent efforts to bring fresh blood into a

management that has been criticized as being too insular.

Yahoo!, of Santa Clara, Calif., announced Tuesday that Semel would take over as its new chairman

and chief executive at the beginning of next month. His hiring ends a closely watched executive

search that lasted more than a month. Semel, 57, will replace Tim Koogle, who is expected to serve

as transitional vice chairman until August. After that, Koogle will remain a director.

Semel definitely has his work cut out for him, as Yahoo! has been reeling in recent months from the

sharp downturn in online advertising spending - a byproduct of the slowing economy and the

implosion of the dot-com bubble.

The company's stock, which hit a 52-week high of $150 last June, now trades around $17. Most

recently, the stock has come under pressure after Yahoo! lowered estimates for first-quarter

results, which it then met, then slashed 2001 financial estimates and announced its first widespread

job cuts.

Yahoo! watchers note that Semel has an impressive resume. The executive, who left Warner Bros. in

1999 after a 24-year stint with the movie and music unit of what is now AOL Time Warner Inc.

(AOL), has been credited with diversifying and growing his alma mater's revenue streams.

Under the leadership of Semel and partner Robert Daly, Warner Bros. achieved 18 consecutive

years of record profit and revenue, Yahoo said in a news release Tuesday.

Nevertheless, analysts who follow Yahoo! are still taking a wait-and-see approach.

"I think there's little doubt that he's a talented guy," said Arthur Newman, an analyst at ABN Amro.

"It's just going to take some time to figure out whether he's the right match for Yahoo. The movie

industry is not the same as advertising-driven media. They're sisters, but they're very different

sisters."

Yahoo! said Semel, its new chairman and chief executive, was unavailable for an interview in time

for this story.

But analysts and reporters are just getting a chance to hear what plans Semel has for the Internet

company as he prepares to take over the reins as chairman and chief executive. The executive is

participating in a 1 p.m. EDT conference call.

A graduate of Long Island University with a BS in accounting and finance, Semel joined Warner

Bros. in 1964 as a sales trainee selling movies to theaters, according to the Yahoo! news release.

Between 1965 and 1972, Semel held executive positions at CBS and Walt Disney, then returned to

Warner Bros. in 1973.

Along with partner Robert Daly, Semel tried to expand Warner Bros. revenue streams and increase

its international presence. Semel was a key proponent of building Warner Bros.' consumer products

business, creating licensed merchandise based on Warner Bros. productions, notably cartoons like

Bugs Bunny.

Semel was also instrumental in creating Warner Bros.' home video business and its WB television

network, known for such teen hits as Dawson's Creek.

Yahoo said Semel grew Warner Bros. from $750 million in revenue in 1980 to $11 billion in revenue

in 1999, when he left the company.

Semel currently holds board positions with Polo Ralph Lauren Corp. (RL), Revlon Inc. (REV) and the

Guggenheim museum of New York City.

Besides Semel, Yahoo! has made other recent attempts to diversify its management team. Last

month it named Gregory Coleman, a publishing industry veteran with experience at stalwart

companies such as Reader's Digest Association Inc., as executive vice president of its North

American operations.

Yahoo! has been known for some time for having an insular management team and company

culture, but some observers may have forgotten that Koogle, known for a non-confrontational style,

was himself brought in to provide some experienced supervision in the company's early days.

The company's founders Jerry Yang and David Filo were twenty-something Stanford graduate

students and realized that they needed more seasoned manager. In the fall of 1995, they and their

venture-capital backers brought in Koogle, who had helped start several technology companies.

Then in his early forties, Koogle had also spent time working for Motorola Inc.'s (MOT) in-house

venture-capital outfit ABN Amro's Newman wonders whether Semel will simply try to bolster

Yahoo!'s online advertising revenue and lead it through tough cost-cutting measures or try to turn it

into more of an entertainment company as broadband Internet access becomes more widely

available.

The analyst cautions that the landscape is already littered with failed attempts at providing

entertainment offerings online, including those of the huge Walt Disney Co. (DIS).

But Fred Moran, an analyst at Jefferies & Co., said opportunities lie in broadband.

"Clearly, the future for Yahoo! is the broadband opportunity, which will require an understanding of

the content that consumers demand, ease of access to that content and creative ways to make

revenue from that content," Moran said.

Semel's "experience overseeing the development and monetizing of content assets may prove very

successful for Yahoo! But how and when that's going to have an impact on their bottom line remains

an open question," Moran said.

-By Ross Snel, Dow Jones Newswires; 201-938-5285; ross.snel@dowjones.com

The following is a chronology of the events leading to the agreement between Microsoft and Yahoo,

as detailed in the study. The chronology was published by Reuters on July 30, 2009, when the

agreement was announced.

Early 2006 - Yahoo begins to report a string of weak quarterly results, reflecting competitive

missteps by the company, market share gains by rival Google Inc , changes in the online advertising

landscape and weakening spending in some ad segments.

Late 2006/early 2007 - Microsoft and Yahoo begin preliminary talks on various partnerships,

including a merger.

2007

February - Yahoo, under the leadership of CEO Terry Semel, tells Microsoft it is not the right time to

discuss a takeover, as the Yahoo board sees great potential in its new advertising technology and by

making internal organizational changes.

June 12 - A strong minority of Yahoo shareholders challenges the company's direction, as Semel

comes under fire. Nearly a third of votes cast at the company's annual shareholders' meeting

oppose some of Yahoo's directors.

June 18 – Yahoo co-founder Jerry Yang takes over as chief executive as Semel steps aside. Semel

remains Yahoo chairman.

2008

Jan. 31 - Microsoft CEO Steve Ballmer makes a $44.6 billion, $31-per-share, cash-and-stock takeover

offer to Yahoo's board. Semel resigns as chairman and is replaced by Roy Bostock.

Feb. 1 - Microsoft makes the offer public. Its shares fall 6.6 percent to $30.45; Yahoo shares rise 48

percent to $28.38.

Feb. 11 - Yahoo rejects the Microsoft offer as too low.

May 3 - After several earlier meetings, Yang meets Ballmer in Seattle. Microsoft verbally raises its

offer to $33 a share, or $47.5 billion. Yahoo wants $37 per share, or about $5 billion more. Late in

the day, Ballmer calls off the talks.

May 15 - Carl Icahn proposes a full dissident board slate for election at Yahoo's annual shareholder

meeting in July. Icahn says he now holds a 4.3 percent stake in Yahoo, including 9.9 million shares

and 49 million call options. Bostock replies to Icahn that "none of the alternatives we are

considering would preclude us from entering into a transaction with Microsoft or any other party."

June 12 - Yahoo announces search advertising deal with Google for up to 10 years, and says talks

with Microsoft have ended. Yahoo forecast an $800 million annual revenue opportunity from the

Google deal, and a $250 million to $450 million boost to cash flow in the first 12 months. U.S.

lawmakers are expected to scrutinize the deal on antitrust concerns.

July 14 - Yahoo rejects a "search only" deal jointly proposed by Microsoft and Icahn that would have

entailed $1 billion in upfront fees for Microsoft to take over Yahoo's search assets, as well as $2.3

billion a year in guaranteed revenue for five years. Among other reasons for rejecting the deal,

Yahoo disputes the $1.1 billion to $1.6 billion in annual cost savings projected for Yahoo in the

proposal.

July 21 - Yahoo settles proxy contest with Icahn ahead of annual shareholder meeting. Icahn and

two nominees from his alternative slate of director nominees will get seats on an expanded Yahoo

board of directors.

Nov. 5 - Google pulls out of search deal with Yahoo, citing regulatory objections.

Nov. 17 - Yahoo says Yang will step down as CEO and return to Chief Yahoo role once the search for

a new chief executive is completed.

2009

Jan. 13 - Yahoo announces that Carol Bartz, the former CEO of Autodesk Inc <ADSK.O , is the new

CEO. In her first earnings conference call with investors two weeks later, Bartz says she did not join

Yahoo to sell the company, but also says "everything is on the table."

Feb. 25 - Ballmer tell an analysts' meeting that he hopes to discuss a possible search partnership

with Bartz, comments he will repeatedly make over the next few months.

May 27 - Bartz acknowledges that Yahoo has had discussions with Microsoft about a search

partnership, but she says any deal will require a partner with "boatloads of money."

May 28 - Microsoft introduces Bing, a revamped version of its search engine backed by a massive

marketing campaign. In the first month, Microsoft's U.S. search share increases to 8.4 percent from

8 percent, while Yahoo's share falls to 19.6 percent from 20.1 percent. Google's share stays at 65

percent.

July 29 - Microsoft and Yahoo announce a 10-year search partnership. Microsoft technology will

power search on Yahoo sites, as well as the paid search ads that appear alongside search results.

Microsoft will pay Yahoo 88 percent of the revenue generated by search ads on Yahoo sites for the

first five years. Yahoo's sales force to sell premium search ads for both companies, but Yahoo and

Microsoft will keep their own sales teams for online display ads.