2014 ANNUAL REPORT Building Lasting

advertisement

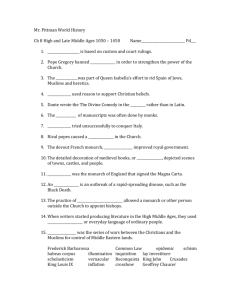

2 014 A N N UA L R E P O RT Building Lasting Relationships Through Exceptional Service 5-YEAR SNAPSHOT Diluted Earnings Per Share $1.50 $14 $1.25 $12 $1.00 $0.75 $0.50 $8 $6 $4 $0.25 $0 $11.2 $10 $1.05 (Millions) (Millions) Net Income $2 2010 2011 2012 2013 $0 2014 2010 Dividends, Per Share $10.00 $0.31 $0.25 $8.00 $0.15 $7.00 $0.10 $6.00 $0.05 2010 2011 2012 2013 $5.00 2014 2010 2011 $1,300 $125 $1,200 $100 $1,100 $1,067 $1,000 $900 2013 2014 $107 $75 $50 $25 $800 2010 2011 2012 2013 $0 2014 2010 Total Loans (HFI) 2011 2012 2013 2014 Mortgage Loans Closed $800 $3,000 $773 $2,400 (Millions) $700 (Millions) 2012 Equity Capital (Millions) (Millions) Total Assets $600 $1,800 $1,604 $1,200 $500 $600 2010 2011 2012 2013 $0 2014 2010 2011 Non-Performing Assets to Total Assets $900 0.9% $800 (Millions) $1,000 1.2% 0.6% 0.3% 0.28% 2010 2011 2012 2013 2 | Monarch Financial Holdings, Inc. 2014 2012 2013 2014 Total Deposits 1.5% 0.0% 2014 $10.10 $9.00 $0.20 $400 2013 $11.00 $0.30 $700 2012 Book Value, Per Share $0.35 $0.00 2011 $919 $700 $600 $500 2010 2011 2012 2013 2014 CONSOLIDATED FINANCIAL DATA At or for the Years Ended December 31, 2014 2013 2012 2011 2010 (Dollars in thousands, except per share data) Summary of Operations Interest income Interest expense Net interest income Provision for loan losses Net interest income after provision for loan losses Non-interest income Non-interest expense Income before income taxes Net income attributable to non controlling interests Income tax expense Net income Net income available to common stockholders $42,991 $ 3,661 39,330 0 39,330 67,079 88,480 17,929 (227) 6,490 $11,212 11,212 Per Share and Shares Outstanding Net income, basic Net income, diluted Cash Dividends per common share Book value at period end Basic weighted average shares outstanding Diluted weighted average shares outstanding $1.06 $1.05 $0.31 $10.10 10,619,443 10,658,600 Balance Sheet Total assets Total loans held for investment (HFI), net Total loans held for sale Total deposits $1,066,737 $1,016,701 $1,215,578 $908,477 $825,583 772,590 712,671 661,094 607,612 558,868 147,690 99,718 419,075 211,555 175,388 919,414 893,118 901,782 740,092 705,662 Selected Performance Ratios Return on average assets Return on average equity Net interest margin (tax adjusted) Non-interest income to operating revenue Asset Quality Ratios Non-performing assets to total assets Non-performing loans to period-end loans (HFI) Allowance for loan losses to period-end loans (HFI) Allowance for loan losses to non-performing loans Capital Equity to assets ratio Total risk-based capital ratio Stockholders’ equity 1.13% 10.95% 4.25% 63.04% 44,348 $ 4,786 39,562 0 39,562 69,882 90,911 18,533 (1,056) 6,386 $11,091 11,091 $1.09 $1.08 $0.24 $9.29 10,167,156 10,299,471 1.07% 11.97% 4.13% 63.85% 46,468 $ 5,916 40,552 4,831 35,721 89,761 104,256 21,226 (975) 7,427 $12,824 11,422 $1.54 $1.25 $0.19 $8.80 7,400,443 10,271,874 1.26% 15.84% 4.29% 68.88% 40,420 $39,273 6,797 8,798 33,623 30,475 6,320 8,639 27,303 21,836 54,746 53,400 71,044 65,480 11,005 9,756 (460) (263) 3,419 3,544 $7,126 $5,949 5,566 4,389 $0.78 $0.70 $0.16 $7.81 7,147,290 10,165,105 $0.64 $0.62 $0.14 $7.20 6,858,638 7,003,556 0.89% 9.66% 4.51% 61.95% 0.76% 8.59% 4.22% 63.71% 0.28% 0.25% 0.29% 0.84% 0.37% 0.31% 0.54% 0.71% 1.16% 1.27% 1.65% 1.63% 310.77% 409.63% 307.15% 231.36% 1.30% 1.61% 1.62% 100.19% 10.08% 13.79% $107,451 9.59% 13.91% $97,518 7.19% 12.05% $87,342 8.39% 12.42% $76,233 8.67% 12.99% $71,568 2014 Annual Report | 3 LETTER TO OUR SHAREHOLDERS The credit for our outstanding performance goes to our talented employees and directors who are committed day in and day out to building Monarch into a high-performance company. We are pleased to report another solid year of performance for your Company. In the past year you saw a year over year total shareholder return of 14%, which is stock price appreciation plus dividends. This again beat all the major stock indexes. During the year we increased the cash dividends paid on our common stock by 29%, with a direct return of capital of $3.3 million. 2014 was our second best year for net income, at $11.2 million. This was quite an accomplishment given the low interest rate environment and the highly competitive market for quality banking, mortgage and investment relationships. Our people again made the difference. Because we continued to lend to and support our clients during the financial crisis they remained loyal to Monarch – those that understand the value of a good bank, and a good banker, in both good times and bad. While we hope we never see an economic cycle like we saw recently, we do know we will stick by our clients time and time again. We grew our loan portfolio 8%, or $60 million due to our bankers, their relationships, our ability to respond quickly, and our reputation. Unlike many of our competitors we grew every one of those loan relationships with our bankers, in our markets, and did not resort to purchasing loans to drive this growth. Late in 2014 we opened a loan production office in Richmond, our first banking services office outside Hampton Roads and the Outer Banks. We also hired several talented bankers to complement our team in 2014. As we mentioned last year, the market was dominated by irrational competition defined by poor underwriting, foolish pricing, and risky structures by our competitors. As we have for over fifteen years, we continue our conservative lending style that balances credit and interest rate risk with the needs of the client. Asset quality remained strong in 2014, which was the second year in a row where we had no provision expense for bad loans. Just 0.28% of our assets were classified as non-performing at year-end, ranking us in the top quartile of our national and local peers. We also saw major reductions in our higher-risk loan categories as our client’s financial conditions improved and real estate underlying many of those loans rose in value or sold in the open market. Historically banks that achieve strong valuations (think stock price) have strong core deposit franchises. This means large numbers of clients with checking, savings and money market accounts. A core strategy since our founding, we grew our 4 | Monarch Financial Holdings, Inc. 14% T O T A L SHAREHOLDER R E T U R N 29% INCREASED C A S H DIVIDENDS 8% L O A N G R O W T H checking account balances by $40 million last year, and exceeded $300 million in checking deposits for the first time. Demand deposits, which now represent 33% of our total deposits, along with our money market deposit base will add even more long-term value to our franchise when rates eventually rise. We remain the second largest community bank in Hampton Roads based on deposits, and the fourth in market share at OBX Bank. Our mortgage team closed $1.6 billion in loans in 2014, with our biggest year ever for closing loans to purchase a home. Since we established Monarch Mortgage in 2007 our focus has been on the purchase-money mortgage market, with refinances considered a secondary business. With 80% of our closed loans dedicated to purchase mortgage loans in 2014, we were able to deliver similar revenues to 2013 with a slightly lower level of production. We applaud our mortgage leadership team led by mortgage CEO Will Morrison and President Jack Lane. We continued to adjust how we deliver our banking services in light of changing client demands. While others were building large branches we were quietly reworking how we deliver banking services in person, relocating or renovating offices for higher performance, and implementing major technology initiatives. We implemented our Universal Personal Banker program in all our banking offices, with these office employees now trained to perform just about any function a client needs. This change allows us to provide our exceptional service model in a more professional and efficient manner. Late in the year we implemented a new online and mobile banking platform that ensures we have the capability to deliver leading edge banking to the fingertips of our clients. Overall we remain focused on delivering exceptional service whether in person, online, or on your tablet or smart phone. We have an app for that! The start-up of Monarch Bank Private Wealth in late 2012 continues to deliver bottom line results with $235 million in assets under management at year-end 2014. In May we opened our new Williamsburg banking and private wealth office to great success. We now have over 200 families that utilize the expertise of our licensed and experienced wealth managers and financial advisors to grow and protect their investments. With an average account size of over $1 million, and 81% of our clients utilizing our comprehensive Goal Planning and Monitoring financial planning tool, we continue to grow primarily by word of mouth. We plan to continue expanding this business and recently hired an experienced banker to lead our private banking growth in our Norfolk, Virginia Beach and Chesapeake markets. $1.6 B I L L I O N MORTGAGE L O A N S C L O S E D $235 M I L L I O N INV E ST MENT A S S E T S MONARCH B A N K P R I V A T E W E A L T H Monarch was recognized for a second year in a row as one of the “Best Places to Work in Virginia” by Virginia Business magazine. We are proud to be ranked as the 8th best large company to work for in the entire state. Our simple formula is we put our people first; they in turn take care of our clients, which allow us to support the community, which then benefits the shareholder by growing your investment. 2014 Annual Report | 5 LETTER TO OUR SHAREHOLDERS Supporting the community is one of our core values at Monarch. Monarch Children’s Charities, our very own non-profit subsidiary, raised a record $221,000 at our annual golf tournament in 2014 and has raised over $1.5 million since its formation. These funds are distributed to local children’s focused charities. With this tournament, other community sponsorships, and the time given by our staff to support local charities and churches, we continue to make a difference in all our communities. We remain strong and highly capitalized, with independent Bauer Financial giving us their top 5-Star “Exceptional” award for our financial strength. We have earned this recognition for over five years now, and plan to remain a bank of strength. We want to thank our Boards of Directors comprising our Corporate Board; our City Boards in Chesapeake, Virginia Beach, Norfolk, and Williamsburg; our OBX Bank Board; and our Hampton Roads Leadership Board for their unwavering support. Our newest board, the Monarch Peninsula Board led by Peninsula Market President William “Bill” Carr, was organized late in the year and has already made a significant impact to our results. We want to thank you for entrusting us as stewards of your investment. All of us in the Monarch family are grateful for your support and will continue to prove ourselves worthy of your trust and confidence. Brad E. Schwartz E. Neal Crawford, Jr. Chief Executive Officer President 6 | Monarch Financial Holdings, Inc. SM AR T GR OW While keeping true to our culture and conservative nature, we do see that size, or “scale,” can benefit all our stakeholders. With increasing regulatory, compliance, technology, and overhead costs the community bank that survives and thrives must grow. Strategically we are focused on the organic growth of our bank, intelligent banking acquisitions if they can be found, the growth of Monarch Bank Private Wealth, as well as the potential to add other complementary lines of business to the mix. You have our word we will not complete a transaction or growth strategy that is not good for the long-term value of our shareholders. Growth is not only good, it has become necessary in our industry. TH What we have built in the past fifteen years is the foundation of a great company. Those that know us know we keep our egos in check, and that this comment merely means we have the structure and capacity to grow beyond our current size. As we look to 2015 in the short-term and to the year 2020 in a longer time frame we visualize a larger and stronger financial services company that we know you would be proud to own. LEADERSHIP Corporate Board of Directors Jeffrey F. Benson, Chairman Overton Enterprises, Inc. Virginia (Ginny) Sancilio Cross Ashdon Builders Elizabeth T. Patterson Waypoint Advisors, L.L.C. Lawton H. Baker, Vice Chairman Baker & McNiff CPAs Taylor B. Grissom Davenport Land Management / Blue Water Pools Dwight C. Schaubach Schaubach Companies Joe P. Covington, Jr. Covington Contracting, Inc. William T. Morrison Monarch Mortgage CEO Brad E. Schwartz Chief Executive Officer E. Neal Crawford, Jr. President Robert (Bobby) M. Oman Oman Funeral Homes, Inc. Executive Management Brad E. Schwartz Chief Executive Officer E. Neal Crawford, Jr. President William T. Morrison Monarch Mortgage CEO Denys Diaz Executive Vice President Chief Information Officer Lynette P. Harris Executive Vice President Chief Financial Officer Andrew N. Lock Executive Vice President Chief Risk Officer Senior Management Mary J. Anderson Senior Vice President Human Resources William H. Carr Peninsula President Patrick A. Faulkner Executive Vice President Managing Director, Investments James R. Ferber Real Estate Group President Adam J. Goldblatt Suffolk President Barbara L. Guthrie Executive Vice President Property Management Jack H. Lane Monarch Mortgage President W. Craig Reilly Norfolk President Steven C. Layden Business Banking President David K. Ropp Chesapeake President Barry A. Mathias Executive Vice President Chief Credit Officer Terri A. Ruby Senior Vice President Cash Management Director David W. McGlaughon OBX Bank President Jeremy R. Starkey Commercial Real Estate Finance President Karyn M. Mercier Senior Vice President Retail Banking Chas M. Wright Virginia Beach President Bernard H. Ngo Williamsburg President 2014 Annual Report | 7 LEADERSHIP Monarch Bank & OBX Bank Executive Vice President N. Joseph Dreps, Jr. Real Estate Loan Officer Senior Vice President Debbie Morgan Retail Loan Support Manager Dennis Napier Real Estate Banker Joanie Needham Business Banker Kathy Nowell Senior Credit Analyst Andrew Proctor Commercial Real Estate Finance Lacey (Ed) Putney Jr. Commercial Real Estate Banker Robert White Real Estate Banker First Vice President Michele Gladu Loan Administration Manager Juliet Jaljulio Compliance Officer Michael Jones Internal Audit Manager Cathy Lockwood Real Estate Banker Becky Lovelace Cash Management Officer Chris Lyle Real Estate Banker Debbie Millard Private Banker Michelle Nealey Controller Terri Trotman Deposit Operations Manager Vice President Debbie Cagle Private Banker James (Rox) Corbin Business Banker Lynn Crump Private Banker Wanda Garrett Private Banker Michael Glover Business Banker Vita Harper Private Banker Nancy Hines Training Director Dee McManus Cash Management Officer Ben Miles Private Banker Graham Miller Performance Management Phyllis Neal Private Banker Sherrie Newsome Private Banker Kasey Schmidt Business Banker Susan West Private Banker Sabrena Williams Information Security Analyst Jamie Young Private Banker Assistant Vice President Derrell Combs IT Business Analyst Nicole Crandall Real Estate Portfolio Manager Casey Cudney Private Banker Karen Gawne Personal Banker Ryan King Business Banker Jo Ann Lambert Security Officer Meagan Parker Business Banker Jesus Ramirez IT Infrastructure Manager Bank Officer David Adams Credit Analyst Lori Brodie Personal Banker Monica Diette Cash Management Officer Melissa Fletcher Commercial Account Manager Ryan Helvig Business Banker Debra Mueller Assistant Operations Manager Laura Pearce BSA/AML Analyst Christinne Pearson Cash Management Coordinator Casey Rawles Personal Banker Lee Van De Water Portfolio Manager Nelson Wroten III IT Infrastructure Engineer 8 | Monarch Financial Holdings, Inc. Monarch Bank Private Wealth Executive Vice President Ben Vanderberry Private Wealth Advisor Senior Vice President Michele Orabona Private Wealth Advisor Caroline Sorokos Private Wealth Advisor First Vice President Timothy Kraus Financial Advisor Barbara Spady Investment Associate Vice President Daniel Carlile Investment Executive Bank Officer Vickie Garner Investment Associate Peggy Pitts Personal Banker Monarch Mortgage Executive Vice President Matthew Bensen Regional Manager Daniel FitzGerald Regional Manager Raymond Gunter Regional Manager Clayton Hicks Regional Manager Timothy Miller Secondary Marketing Manager Stephen Sager Regional Manager Senior Vice President George (Trey) Cooper Regional Manager David Hinds Area Manager Amber Kilian Operations Manager Deborah Laursen Accounting Manager Samuel Meekins Area Manager Oliver Midgett Regional Sales Manager Connie West Construction Perm Manager First Vice President Alisa Gerald Compliance Officer Wendy Lewis Marketing Director Norma Selby Training Director Vice President Deborah Coleman HMDA Manager John Frankos Branch Manager Timothy Good Branch Manager Pamela Jones Area Manager Joan Kozlowski Regional Operations Manager Ellen Lenihan Loan Fulfillment John (Ritchie) Love Regional Manager John McAleese Regional Manager Michael Miller Branch Manager Robert O’Bday, Jr. Regional Manager Michelle Westervelt Risk Officer Lee Woods, Jr. Compliance Officer Assistant Vice President Pamela Housand Loan Closing Manager Julia Killinger Assistant Accounting Manager Tricia Permito Secondary Marketing Supervisor Matthew Windsor IT Business Analyst Manager Bank Officer Adria Daniels Loan Shipping Manager Elizabeth Haid Suspense Manager Rebecca Mahaffey MERS Administrator CITY BOARDS OF DIRECTORS Chesapeake / Suffolk W. Michael Bryant OBBCO Safety & Supply, Inc. Mark R. Christian Esprit Décor Brian M. Clements The Title Quest Companies Floyd M. Cross, Jr. Standard Calibrations, Inc. Stacy Cummings Priority Automotive Jorge A. Dabul McPhillips, Roberts & Deans, PLC Douglas W. Davis Davis Law Group, P.C. Vernon (Richard) R. Divers, Jr. Savage & McPherson Insurance Agency E. Grier Ferguson Ferguson Rawls & Raines PC James A. Gudac Titan Contractors, Inc. James (Les) L. Hall Allfirst LLC Glenn B. Heard Heard Concrete Construction Corporation Kevin L. Hubbard Hubbard Law Group Daniel J. Hugeback Diamond Glazing, Inc. Michael D. Luter Arrowhead Environmental Services, Inc Charles B. Pond, III Nansemond Cold Storage Company, Inc Christopher W. Prince Keller Williams Realty Barbara L. Smith Cherry, Bekaert & Holland, LLP Melissa L. Venable Land Planning Solutions Thomas T. Winborne Clark Nexsen, Architecture & Engineering Norfolk Jon M. Ahern Sykes, Bourdon, Ahern & Levy, P.C. Edward J. Amorosso McPhillips, Roberts & Deans, PLC David J. Benjack Chesapeake Drywall & Acoustics, Inc. Michael Burnette Burnette Development Adam Casagrande Williams Mullen Webster M. Chandler, III Nancy Chandler Associates, Inc. Charles T. Church Getem Services Erik S. Cooper Cooper Realty, Inc. R. Gatewood Dashiell R.G. Electric Co., Inc. John W. Domanski Accurate Marine Environmental, Inc. Timothy A. Faulkner The Breeden Company Robert S. Friedman Harbor Group Marc H. Glickman M.D., Vascular & Transplant Specialists David F. Host T. Parker Host, Inc. Richard H. Jackson, Jr. Jackson Property Company John (Jack) T. Kavanaugh Retired Admiral/US Navy Michael W. McCabe Harvey Lindsay Commercial Real Estate William (Shep) S. Miller, III Kitco Fiber Optics D. Scott Pritchett Snow Jr. & King, Inc. Michael L. Sterling Vandeventer Black, LLP John (Randy) R. Stokes Stokes Law Group, PLC Edward D. Whitmore Norfolk Tug Co. F. Blair Wimbush Norfolk Southern Corporation Lauren V. Wolcott Lauren V. Wolcott, CPA, P.C. Peninsula Donald Allen E.T. Lawson & Son, Inc. Bob Burch Century 21 Nachman Realty Dawn F. Griggs Thalhimer Donald Moore Craft Bearing Company, Inc. Jeffrey D. Morrison T.P.M.G., P.C. Megan Perry Sentara Healthcare Joyce Schaffer Malvin, Riggins and Company, P.C. Mark A. Short Kaufman & Canoles Cowles (Buddy) Spencer Mid Atlantic Residential Lee Scott Trainum International Communications Group, Inc. Williamsburg Ronald J. Boyd Stantec Gregory R. Davis Kaufman & Canoles P. C. John W. Gerdelman River2 Paul (Steve) S. Hunter Philip Morris USA (Retired) James E. Lesnick Riverside Health System Sylvia C. Payne Prudential Realty Millard (Sandy) P. Robinson Arcadis U S., Inc. Brett K. Smith Cleckley & Smith, Inc. Virginia Beach Thomas H. Atherton, III Atherton Real Estate Development, Inc. Randal K. Bregman 4 Ever Summer Charters Eric N. Bucklew Divaris Real Estate Inc. Ann K. Crenshaw Kaufman & Canoles, P.C. Dennis R. Deans McPhillips, Roberts & Deans, P.C. William R. DeSteph DeSteph Enterprises James E. Dowd Jordan Young Institute Dennis M. Ellmer Priority Automotive Christopher J. Ettel VB Homes Robert J. Eveleigh Marine Oil Service Inc. Michael A. Inman Inman & Strickler, PPLC James P. Karides Karides Group Andrew C. Kline Payday Payroll, Inc. Donald E. Lee, Jr. Donald E. Lee, Jr. & Associates, P.C. Michael H. Levinson Attorney at Law Victor D. Lewis, III MD, Chesapeake General Hospital Aubrey (Gene) E. Loving, Jr. Max Media William (Joe) H. McCutcheon Jr. McQ Builders LLC Alfred B. Midgett The Noblemen Gordon E. Parker, Jr. Heritage Business Strategies, LLC Adam W. Ritt Hoy Construction, Inc. Virginia B. Rountree William F. Rountree Fund Marc A. Sauter Zoës Restaurant Wayne C. Sawyer Victory Lap, L.L.C. Terri S. Stickle Rose and Womble Realty Bruce B. Smith Bruce Smith Enterprises Ramsay S. Smith Pembroke Enterprises, Inc. William H. Williard Nationwide Katherine C. Willis Palladium Partners, LLC OBX Bank Tim A. Beacham Earth Resources, Inc. Timothy M. Cafferty Outer Banks Blue Charles E Hardy Hardy Moving & Storage Robert F. Harrell Harrell & Associates Myra Ladd-Bone Atlantic Realty of the Outer Banks Robert L. Outten Dare County Government James F. Perry Jim Perry & Company James (Jimbo) C. Ward Beach Realty & Construction W. Ray White OBX Bank 2014 Annual Report | 9 HAMPTON ROADS LEADERSHIP BOARD Ephriam Adler Harbor Group Aaron Ambrose Kaufman & Canoles P. C. Lyle Beckner London & Norfolk, LTD Zachary Brandau Rutherfoord, A Marsh & McLennan Agency LLC Robert Brown R.G. Electric Company, Inc. Todd Budlong Budlong Enterprises, Inc. Bill Burnette Burnette Capital Chamie Burroughs CB Richard Ellis Adam Casagrande Williams Mullen Jared Chalk Norfolk Economic Development Authority Hugh Cohen Cohen Investment Group Richard Counselman S.L. Nusbaum Realty Co. Graham Covington Covington Contracting, Inc. Donnie Cross Ashdon Builders Richard Crouch Vandeventer Black, LLP Jason Deans McPhillips, Roberts & Deans, PLC John Domanski, Jr. Accurate Marine Environmental, Inc. Matt Ellmer Priority Automotive Billy Ennis Virginia Gentlemen Foundation Ted Enright S.L. Nusbaum Insurance Agency George Fox Wheeler Interests Ryan Gore Mulkey & Company, P.C. C. Wiley Grandy, VI Crenshaw, Ware & Martin, P.L.C. Rob Green Caliper Inc. Ross Greene Pender & Coward, P.C. Christopher J. Hamilton Hamilton Realty Porter Hardy, IV Smartmouth Brewing, LLC Byron Harrell Davenport & Co Albert Hartley Hartley Law Group Jason Head Jason Head, PLC Edward Hewitt Viridian Homes, LLC Kathryn Hoover Nancy Chandler Associates, Inc. Randolph Hoover Va Turf Management Daniel Howell Troutman Sanders LLP Michael Hull Mosquito Joe Christopher John Byrd & Baldwin Bros. Steakhouse Jaime Keogh Jaime E. Keogh, CPA, CFE Danny Kline Payday Payroll Services Kevin Knaack Standard Calibrations, Inc. Russell Lyons Coastal Hospitality Associates, LLC Jason Magruder Morgan Marrow Company John Mason Robinson Development Inc. Jeremy McLendon Continental Realty Services Brian Mello Drucker and Faulk J.D. Miles, IV J.D. Miles Roofing Willis Miller CMA - CGM Thomas Minton Minton Interests Jason Murphy Norfolk Marine Co. Nick Nestor Oceanside Structures, Inc. L. Christopher Noland Signature Kristen O’Connor Troutman Sanders LLP Ellen Sanders-Pelstring The Bow Group 10 | Monarch Financial Holdings, Inc. Jennifer Pfitzner Saunders, Matthews & Pfitzner, PLLC Billy Poynter Kaleo Legal Jonathan Reed Kaufman & Canoles P.C. Cart Reilly Wolcott Rivers Gates Laura Rixey Kaufman & Canoles Jim Savin Dollar Tree Andrew Schaubach Schaubach Companies Damian Seitz Clark Nexsen, Architecture & Engineering Clark Simpson Worldwide Express Katherine Simpson Virginia Beach School System John (Cappy) Sinclair, DDS Coastal Cosmetic Dentistry Brooks Sinnen Sinnen Green & Associates Jeff Snader Charles W. Snader, P.C. Christopher E. Todd Colliers International Jane Tower Waypoint Advisors Joe Verser Heath, Overbey & Verser, PLC Jason Vita Portfolio Recovery Associates Brian Ward Professional Printing Center Brian Whitehurst Southeastern Mechanical Inc. T. Wayne Williams Williams DeLoatche, P.C. Clay Winn Winn Nursery of Virginia Wendall Winn Winn Nursery of Virginia Russell Young Va Port Authority Hal Yuill First Potomac Management, LLC LOCATIONS Monarch Bank Chesapeake • Newport News • Norfolk Richmond • • Virginia Beach • Williamsburg OBX Bank Kitty Hawk • Nags Head Monarch Bank Private Wealth Williamsburg • Norfolk Monarch Mortgage Virginia Alexandria • Chesapeake • Fairfax • Fredericksburg • Manassas Newport News • Norfolk • Oakton • Richmond • Virginia Beach • Woodbridge Monarch Mortgage Maryland Annapolis • Greenbelt • Crofton Frederick • • Rockville • Towson • Waldorf Monarch Mortgage North Carolina Charlotte • Elizabeth City • Kitty Hawk • Wilmington Monarch Mortgage South Carolina Greenwood Advance Financial Group Chesapeake • Newport News • Norfolk • Suffolk • Virginia Beach Coastal Home Mortgage Virginia Beach Real Estate Security Agency Chesapeake • Virginia Beach SHAREHOLDER INFORMATION Investor Relations & Financial Statements: Monarch Financial Holdings, Inc. files an annual report on Form 10-K and quarterly reports on Form 10-Q with the Securities and Exchange Commission. A copy of the reports may be obtained on our Web site at www.monarchbank.com. Transfer Agent & Shareholder Questions Our stock transfer agent is Computershare P.O. Box 30170, College Station, Texas 77842 (800) 368-5948 Stock Listing Current market quotations for the common stock of Monarch Financial Holdings, Inc. are available on the NASDAQ Capital Market under the symbol MNRK. Member FDIC 2014 Annual Report | 11 OUR FAMILY OF COMPANIES www.monarchbank.com