Retail Quarterly Market Report 109.pub

advertisement

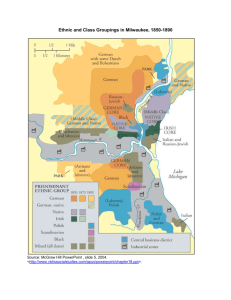

CLEVELAND RETAIL REPORT First Quarter 2009 Business Property Specialists, Inc. Broker CLEVELAND Retail Report | First Quarter 2009 TRENDS: Vacancy Rate Net Absorption Construction Asking Rents OVERVIEW: Overall Vacancy 7.1% 9.0% 8.5% 8.0% 7.5% 7.0% 6.5% 6.0% The Cleveland retail market was moderately flat during the first quarter. Vacancy was static, ending the quarter at 7.1 percent, which is almost exactly where it started the quarter. While many expected a flood of closures, few actually materialized, as evidenced by a very moderate net absorption number of (24,227) square feet. However, sublease space is significant, standing at just over 1 million square feet at the end of the first quarter. 2Q08 3Q08 4Q08 1Q09 Average Asking Rental Rate $11.14 The largest lease signings for the quarter include the Teams of Action moving into 30,500 square feet at Greenbrier Plaza and Priced Less Foods leasing 28,000 square feet at Kronheims Plaza. Primary losses for the quarter include Dollar Tree vacating 9,000 square feet at 34275 Center Ridge Road, Dollar General moving out of 8,450 square feet at Acme Plaza and Asuka Japanese Restaurant vacating 7,000 square feet at 30010 Detroit Road. $15.00 $14.00 $13.00 $12.00 $11.00 $10.00 3Q08 Despite the static nature of the overall vacancy rate, the average asking rental rates have dramatically decreased, ending the first quarter at $11.14 per square foot. This is almost 6 percent lower than the rate from a year ago. Additionally, it has become commonplace for retailers to ask landlords for rent relief, sometimes requesting a decrease of as much as 40 percent. 4Q08 1Q09 Vacancy By Available Space Type Sublet 10% New construction remains scant, with just two buildings totaling just under 25,000 square feet being delivered during the quarter. Just over 800,000 square feet of retail space is currently under construction, the largest of which is the Plaza at Southpark, which totals 312,000 square feet. Direct 90% Major Lease Transactions Tenant: Building: Size (SF): Market: Teams of Action Greenbrier Plaza 30,500 Priced Less Foods Kronheims Plaza 28,000 East Dollar General Shore Center Plaza South 11,200 Northeast N/A Merchant’s Square 8,600 Medina County Advanced Auto Parts 7474 Mentor Avenue 6,400 Northeast * All rents are per SF per YR unless otherwise noted. NAI Daus | 3401 Enterprise Pkwy., #105 | Cleveland 44122 | 216.831.3310 | www.naidaus.com CLEVELAND Retail Report | First Quarter 2009 General Retail Market Statistics Market # BLDGS. TOTAL GLA (SF) TOTAL AVAIL (SF) TOTAL VACANT AVAIL (%) YTD NET Absorption (SF) QUOTED RATES ($/SF/YR) UNDER CONSTRUCTION (SF) Downtown Cleveland 284 6,440,950 158,811 2.5% (4,855) $8.74 33,426 East 389 5,291,750 219,873 4.2% 1,492 $12.69 0 Lorain County 918 7,923,552 296,833 3.7% 51,663 $7.37 35,629 Medina County 341 3,135,559 157,789 5.0% 1,501 $13.35 0 Northeast 676 8,911,202 786,552 8.8% (13,391) $8.94 47,600 South 362 3,911,263 457,499 11.7% (2,428) $6.68 68,412 Southeast 109 1,588,536 106,432 6.7% (422) $8.70 0 Southwest 772 9,413,774 514,554 5.5% (93,399) $10.44 22,089 2,311 18,876,637 863,010 4.6% (41,871) $8.68 22,406 493 6,259,742 198,917 3.2% (8,762) $14.87 0 # CTRS. TOTAL GLA (SF) TOTAL AVAIL (SF) TOTAL VACANT AVAIL (%) YTD NET Absorption (SF) QUOTED RATES ($/SF/YR) UNDER CONSTRUCTION (SF) Summit County West Mall Market Statistics Market Downtown Cleveland 2 384,294 50,000 13.0% 0 $15.00 146,170 East 4 3,228,378 398,317 12.3% (800) $0.00 0 Lorain County 1 940,174 52,101 5.5% 0 $0.00 0 Medina County 0 0 0 0.0% 0 $0.00 0 Northeast 4 3,436,671 373,031 10.9% 0 $10.11 0 South 2 2,532,340 67,923 2.7% 0 $24.00 0 Southeast 0 0 0 0.0% 0 $0.00 0 Southwest 2 2,617,761 39,121 1.5% 0 $14.59 0 Summit County 4 2,817,922 157,990 5.6% (2,059) $3.19 0 West 3 1,826,414 49,975 2.7% 0 $30.00 0 Power Center Market Statistics Market # CTRS. TOTAL RBA (SF) TOTAL AVAIL (SF) TOTAL VACANT AVAIL (%) YTD NET Absorption (SF) QUOTED RATES ($/SF/YR) UNDER CONSTRUCTION (SF) Downtown Cleveland 0 0 0 0.0% 0 $0.00 0 East 1 638,416 18,786 2.9% (4,278) $0.00 0 Lorain County 2 1,292,428 73,658 5.7% 0 $13.00 0 Medina County 3 1,068,769 40,415 3.8% (1,280) $11.32 0 Northeast 5 1,249,442 31,760 2.5% (2,731) $19.95 0 South 1 886,596 18,956 2.1% 0 $0.00 56,097 Southeast 1 317,380 25,045 7.9% 0 $0.00 0 Southwest 3 1,151,265 154,391 13.4% 1,580 $0.00 312,000 Summit County 9 3,885,543 146,415 3.8% 17,617 $14.46 0 West 2 878,293 119,558 832 $0.00 13.6% 0 NAI Daus | 3401 Enterprise Pkwy., #105 | Cleveland 44122 | 216.831.3310 | www.naidaus.com CLEVELAND Retail Report | First Quarter 2009 Shopping Center Market Statistics Market # CTRS. TOTAL GLA (SF) TOTAL AVAIL (SF) TOTAL VACANT AVAIL (%) YTD NET Absorption (SF) QUOTED RATES ($/SF/YR) UNDER CONSTRUCTION (SF) Downtown Cleveland 1 66,973 0 0.0% 0 $0.00 0 East 54 3,052,647 268,132 8.8% 0 $15.63 0 Lorain County 62 5,055,147 694,977 13.7% 69,828 $11.63 70,000 Medina County 47 2,804,484 328,638 11.7% 4,100 $11.45 0 Northeast 163 8,433,886 1,000,313 11.9% 20,627 $12.82 0 South 51 2,776,425 216,971 7.8% (18,814) $10.61 0 Southeast 30 2,176,535 477,006 21.9% 400 $14.50 0 Southwest 137 7,807,383 683,789 8.8% 40,660 $14.07 0 Summit County 270 11,230,256 949,785 8.5% (29,051) $10.77 0 West 79 4,019,152 388,929 9.7% 18,114 $12.95 0 TOTAL AVAIL (SF) TOTAL VACANT AVAIL (%) YTD NET Absorption (SF) QUOTED RATES ($/SF/YR) UNDER CONSTRUCTION (SF) Specialty Center Market Statistics Market # CTRS TOTAL GLA (SF) Downtown Cleveland 0 0 0 0.0% 0 $0.00 0 East 0 0 0 0% 0 $0.00 0 Lorain County 1 187,483 11,400 6.1% 0 $10.00 0 Medina County 2 395,938 19,529 4.9% (4,500) $6.00 0 Northeast 0 0 0 0.0% 0 $0.00 0 South 0 0 0 0.0% 0 $0.00 0 Southeast 0 0 0 0.0% 0 $0.00 0 Southwest 1 525,555 0 0.0% 0 $0.00 0 Summit County 2 161,083 495 0.0% 0 $0.00 0 West 1 575,861 50,000 0 $0.00 8.7% 0 Total Retail Market Statistics Market # CTRS. TOTAL GLA (SF) TOTAL AVAIL (SF) TOTAL VACANT AVAIL (%) YTD NET Absorption (SF) QUOTED RATES ($/SF/YR) UNDER CONSTRUCTION (SF) Downtown Cleveland 288 6,892,217 208,811 3.0% (4,855) $12.26 179,596 East 470 12,211,191 905,108 7.4% (3,586) $14.06 0 Lorain County 1,038 15,398,784 1,128,969 7.3% 121,491 $10.10 105,629 Medina County 423 7,404,750 546,371 7.4% (179) $11.79 0 Northeast 920 22,031,201 2,191,626 9.9% 4,505 $10.74 47,600 South 464 10,106,624 761,349 7.5% (45,242) $8.66 124,509 Southeast 155 4,082,451 608,483 14.9% (22) $13.32 0 Southwest 991 21,515,738 1,391,855 6.5% (51,159) $13.02 334,089 2,779 36,971,441 2,117,200 5.7% (55,364) $9.40 22,406 631 13,559,462 807,379 10,184 $13.86 Summit County West 6.0% 0 NAI Daus | 3401 Enterprise Pkwy., #105 | Cleveland 44122 | 216.831.3310 | www.naidaus.com CLEVELAND Methodology | Definitions | Sub Market Map Absorption (Net) The change in occupied space in a given time period. Available Square Footage Net rentable area considered available for lease; excludes sublease space. 4 Average Asking Rental Rate Rental rate as quoted from each building’s owner/management company. For office space, a full service rate was requested; for retail, a triple net rate requested; for industrial, a NN basis. 3 8 Building Class Class A product is office space of steel and concrete construction, built after 1980, quality tenants, excellent amenities & premium rates. Class B product is office space built after 1980, fair to good finishes & wide range of tenants. 6 7 1 9 Direct Vacancy Space currently available for lease directly with the landlord or building owner. Market Size Includes all existing and under construction office buildings (office, office condo, office loft, office medical, all classes and all sizes, both multi-tenant and single-tenant, including owner-occupied buildings) within each market. 5 2 10 Cleveland Submarkets 1. Lorain County Overall Vacancy All unoccupied lease space, either direct or sublease. Vacancy: 7.3% YTD Abs: 121K SF Avg. Rents: $10.10 PSF SF/PSF Square foot/per square foot, used as a unit of measurement 3. Sublease Arrangement in which a tenant leases rental property to another, and the tenant becomes the landlord to the subtenant. 4. Sublease Space Total square footage being marketed for lease by the tenant. Sublease space is not considered in the overall occupancy or absorption numbers—only direct leases are included. Sublease Vacancy Space currently available in the market for sublease with an existing tenant within a building acting as the landlord. 2. West Vacancy: 6.0% YTD Abs: 10K SF Avg Rent: $13.86 PSF Downtown Cleveland Vacancy: 3.0% YTD Abs: (5)K SF Avg. Rent: $12.26 PSF Northeast Vacancy: 9.9% YTD Abs: 5K SF Avg. Rent: $10.74 PSF 5. East Vacancy: 7.4% YTD Abs: (4)K SF Avg. Rent: $14.06 PSF 6. South Vacancy: 7.5% YTD Abs: (45)K SF Avg. Rent: $8.66 PSF 7. Southeast Vacancy: 14.9% YTD Abs: (22)K SF Avg. Rent $13.32 PSF 8. Southwest Vacancy: 6.5% YTD Abs: (51)K SF Avg. Rent: $13.02 PSF 9. Medina County Vacancy: 7.4% YTD Abs: (179)K SF Avg. Rents: $11.79 PSF 10. Summit County Vacancy: 5.7% YTD Abs: (55)K SF Avg. Rent: $9.40 PSF This report is a research document of NAI Daus in Cleveland, Ohio. Questions related to information herein should be directed to the Marketing Department at 216-831-3310 x200. Information contained herein has been obtained from sources deemed reliable and no representation is made as to the accuracy thereof. NAI Daus is an independently owned and operated business and a member firm of NAI Global, an affiliation of independent companies with over 325 offices and in 55 countries worldwide. Source-Costar.com NAI Daus | 3401 Enterprise Pkwy., #105 | Cleveland 44122 | 216.831.3310 | www.naidaus.com