Verizon Communications, Inc. (VZ)

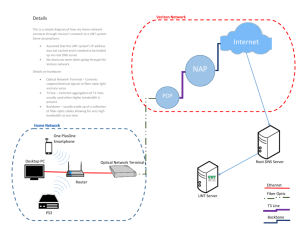

advertisement

The Henry Fund Henry B. Tippie School of Management Katie Carlson [catherine-m-carlson@uiowa.edu] November 10, 2014 Verizon Communications, Inc. (VZ) Buy Stock Rating Telecommunication Services Investment Thesis Verizon Communications is a diversified telecommunications provider that is the largest telecom provider in the U.S. We believe they are the strongest player in the US telecom market and are recommending a BUY for their stock. Drivers of Thesis • Strong Player in Telecom. Verizon Communications is well-positioned against its competitors in regards to financial metrics and customer additions. They have the lowest customer churn of all major telecommunication’s competitors and continue to report consistent earnings year over year. • Cloud Computing. Global cloud computing revenue is expected to increase another 32% into 2016 and Verizon’s Cloud platform is well positioned to capture a portion of this revenue from their enterprise customers8. Enterprise customers are increasingly needing cloud computing technologies to handle large amounts of data and become less dependent on slower, physical servers. With Verizon’s brand name and fast 4G technologies, we believe they will be able to capture a portion of this revenue. • Solar Energy Investments. Verizon has been making significant investments in solar energy and are track to generate power for internal consumption. Not only are these efforts positive for the environment, but they have the potential to reduce or maintain their operating expenses at a consistent level, potentially maximizing their net profits. Risks to Thesis • Availability of Spectrum. The availability of spectrum is crucial to telecommunication company’s survival and the spectrum capacities are being used up at a faster rate than the supply of the spectrum. Spectrum licenses are heavily regulated by the FCC and many television companies and governments have excess capacity of this spectrum that needs to be auctioned off. If this does not happen at a fast enough rate, this could pose a threat to all of the telecommunications providers, including Verizon. • High Competition & Government Regulation. The telecommunications industry has a lot of major competitors and the market for new subscribers is becoming increasingly saturated; this is turn is putting pricing pressures between many of the major providers to gain customers and minimize churn. Additionally, with the high level of government regulation, any changes in new regulations could potentially limit acquisitions and/or increase costs and reduce margins. Target Price Henry Fund DCF Henry Fund DDM Relative Multiple Price Data Current Price 52wk Range Consensus 1yr Target Key Statistics Market Cap (B) Shares Outstanding (M) Institutional Ownership Five Year Beta Dividend Yield Est. 5yr Growth Price/Earnings (TTM) Price/Earnings (FY1) Price/Sales (TTM) Price/Book (mrq) Profitability Operating Margin Profit Margin Return on Assets (TTM) Return on Equity (TTM) VZ $53-55 $54.58 $59.71 $54.73 $50.49 $45.45 – 53.66 $53.34 $208.6 4,150 64.2% 0.03 4.40% 8.0% 14.4 13.1 1.67 12.58 27.05% 13.54% 8.40% 40.69% Industry Sector 600 609.4 400 331.4 200 Earnings Estimates Year EPS growth 2011 $2.31 17.55% 2012 $2.49 7.73% 2013 $2.48 -0.45% 175.2 2014E $3.87 56.0% 2015E $3.39 -12.4% 2016E $3.80 12.0% 12 Month Performance VZ 15% 5% 0% -5% -10% D J F M A M J 40.7 28.6 14.2 P/E ROE 0 D/E Company Description S&P 500 10% N 14.4 12.7 26.1 J A S O Verizon Communications is a diversified telecommunications company founded in 1983 and located in New York, NY that provides consumers, businesses and government organizations with communication, information and entertainment products and services. They operate in two reportable segments: wireless and wireline. They currently have the largest 4G LTE network of any telecommunications provider in the United States with the biggest network coverage area serving over 97 million customers nationwide. Important disclosures appear on the last page of this report. EXECUTIVE SUMMARY Verizon Communications is a diversified telecommunications company that serves over 97 million customers globally. They operate in two reportable segments, wireless and wireline, and serve consumers, businesses, and government organizations nationwide. Their coverage area is the biggest of any of the US telecommunications companies and they have the largest market share in wireless and the second largest market share in wireline communications. We believe that they are the strongest player in the telecommunications industry as they report solid earnings year over year and pay out the biggest dividend per share of any of their competitors. Although we do not believe that the telecommunications industry is going to experience significant growth over the next decade or so, we believe that Verizon Communications is the best positioned company to capture the benefits and dividends of all of the telecommunications providers. For these reasons we are recommending a BUY for Verizon Communications stock with a target price range of $53-55. Verizon Wireless is a leader in wireless communication services in the United States. Their wireless network is available to 97% of the U.S. population with the largest fourth-generation (4G) Long-Term Evolution (LTE) technology and third-generation (3G) Evolution-Data Optimized (EV-DO) networks of any provider. Prior to 2014, Verizon Communications owned a controlling 55 percent interest in Verizon Wireless with Vodafone owning the remaining 45 percent. In February 2014, Verizon Communications completed the purchase of the 45% stake in Verizon Wireless from Vodafone for approximately $130 billion, making it the third largest corporate deal ever1. The deal was financed with cash, $6.6 billion of debt financing and issuance of 1.27 billion shares of stock to Vodafone shareholders9. COMPANY DESCRIPTION Operating Segments Source: verizonwireless.com 32.6% 67.4% Service revenues consist both pre-paid and post-paid wireless revenues and represented 85.2% of their wireless revenues in 2013. They estimated that 94% of their retail connections, totaling 102.8 million, were post-paid customers directly served by Verizon Wireless. Their prepaid customers represent the remaining 6% of connections, and include several connection plans that are tailored to the needs of their customers. Wireless Wireline Source: 2013 10-K Annual Report Wireless Verizon Communications wireless segment operates under the brand name of Verizon Wireless and represented 67.4 percent of their revenues at fiscal yearend 2013. The segment is further broken into two subsegments, service revenue and equipment and other, making up 85.2 percent and 14.8 percent of revenues, respectively. In February 2014, they introduced their More Everything plan, which replaced their Share Everything plan, which in turn provided more value to their customers through better pricing and options. These connection plans feature unlimited voice minutes, unlimited domestic and international texting plans, video and picture messaging, mobile Hotspots, cloud storage and data allowance plans which can be shared between several devices1. In 2013, the Share Everything plan represented 46% of their retail postpaid plans and by 3rd quarter 2014, the More Page 2 Everything plans represented 57% of their post-paid accounts2. Their service revenue segment also includes other wireless services such as internet access on all smartphones, notebook computers, tablets, as well as JetPacks that provide a mobile Wi-Fi connection. Additionally, their customers have access to over a million applications and services that are developed and distributed by third parties such as Google Play, Apple ITunes, Microsoft and Blackberry1. We have forecasted their service revenues to grow organically around 4-5% per year throughout our forecast period as we believe that Verizon will remain a strong player within the wireless industry. Verizon’s equipment and other segment of their wireless revenues consist of the sale of smartphones, tablets and other internet devices, and basic phones and represented 14.8% of their wireless revenues in 2013. They offer a wide variety of smartphones, tablets, and other devices purchased through a number of manufacturers that support several operating platforms such as Apple, Google, Windows and Blackberry. In 2013 they also launched the Ellipsis 7 tablet, which is exclusively available to Verizon Wireless. All of their wireless devices contain chipsets, which is the “intelligence” of the wireless device, manufactured by Qualcomm Incorporated1. We have forecasted their equipment and other revenue to continue to grow substantially around 9-10% per year through 2015 as new smartphones like the IPhone 6 and Galaxy S6 become released and more affordable. Following 2015, we forecast growth around 5-6% per year with the assumption that smartphone manufacturers will continue to come out with newer versions. Verizon Wireless’ 4G LTE and 3G EV-DO networks are the largest of any provider in the United States, covering all of the 100 most populous US metropolitan areas. In January 2014, it was estimated that their 4G LTE network was available to 305 million Americans, including rural areas served by their LTE in Rural America program. Their LTE Rural America program is a program that was developed to provide rural America with 4G LTE network access. As of 2013, they have 20 committed program participants (smaller wireless providers) that have the potential to provide coverage to over 3 million Americans. Verizon has plans to continue to expand and upgrade their network to increase capacity and identify opportunities to strategically acquire wireless operations and spectrum licenses1. We have forecasted their overall wireline revenues to grow 6.7 percent in 2014, followed by 4-5% growth in revenues throughout 2018. We believe that they will be able to continue to expand their customer base at an organic growth rate due to competitive pricing and expansion and upgrades of their networks. We also believe that they will be able to grow their equipment revenues through the continued adoption of wireless devices such as smartphones and tablets. Wireless Segments 14.8% Service Revenue Equipment & Other 85.2% Source: 2013 10-K Annual Report Wireline Verizon Communications wireline segment provides voice, data and video communications services to consumers in the United States, as well as carriers, businesses and government customers both in the United States and in over 150 countries around the world. Their products and services include broadband video and data, corporate networking solutions, data center and cloud services, security and managed network services, and local and long distance voice services. In 2013, this segment represented 32.6% of their total revenues, which are divided into subsegments such as Mass Markets, Global Enterprise, Global Wholesale, and other1. Verizon’s Mass Markets segment includes operations that provide customers with broadband services and local exchange and long distance services to residential and small business subscribers. This sub-segment represented 44.2% of wireline revenues in 2013. Their broadband services include high-speed internet, FiOS internet and FiOS Video services. Their FiOS Internet products, including FiOS Quantum, provide customers with highspeed internet and download capabilities, and it was estimated that 45% of their FiOS internet subscribers subscribed to FiOS Quantum in 2013. Their FiOS Video service is available to over 15 million homes in the United Page 3 States, and includes differentiating content features that they believe gives them an advantage to competitor’s products1. As they continue to invest in expanding their FiOS network to become available to more Americans, we believe that their FiOS products and services is one of the greatest opportunities for growth in their wireline segment. We have forecasted their Mass Markets revenue to grow around 3-4% per year throughout our forecast period. We believe that there will be adoption of their FiOS services, however, with the high amount of competition in that market we do not believe that this segment will grow no faster than 3-4% per year. Verizon’s Global Enterprise segment offers medium and large businesses networking products and solutions and advanced communications services. This segment represented 37.5% of their total wireline revenues in 2013. Their networking products and solutions provides these businesses with Private IP services that allow them to communicate over a private, secure network in more than 120 countries using Ethernet and Verizon Wireless’ 4G LTE networks. Their advanced communication services includes IP communications, infrastructure and cloud services, machine-to-machine (M2M) services and security services. Their infrastructure and cloud services include Infrastructure as a Service (IaaS) that provides customers with data center, computing, data storage, application management, and enterprise-class cloud services. It also includes their M2M technology, which is a platform that they are leveraging in several markets that permits customers to connect and monitor equipment in fields like automotive, transportation, energy, health monitoring, education and insurance industries. This technology is enabled by their 4G LTE network and they have developed several strategic partnerships with companies in these industries. We believe this is another area of growth for Verizon in their wireline segment as they continue to advance this technology and form other partnerships. Lastly, their security services provide solutions that help companies monitor and secure their networks and data1. We have forecasted their Global Enterprise revenues to decline slightly or remain fairly flat. We do not believe that Verizon has enough of a competitive advantage in this market over other software providers to gain a large portion of customers in this market. Verizon’s Global Wholesale segment provides services such as data, voice, local dial tone and broadband connectivity to other local and long distance carriers. Global Wholesale represented 17.1% of their wireline revenues in 2013 and a majority of this revenue was generated through a few large telecommunications companies, most of which are competitors to Verizon. Verizon’s other segment of their wireline consists of local exchange and long distance services that are derived from former MCI mass market customers and represent just over 1% of their total wireline revenues in 20131. We have forecasted revenues in their overall wireline segment to remain fairly flat, declining approximately 6% per year throughout 2016 and then 10% in 2017 and 18% by 2018. Although the use of wireline communications services are declining, we believe the declining revenue in wireline phone communications will be offset by slight growth in their Mass Market and Global Enterprise sub-segments, through the FiOS internet service expansion and M2M service adoption. Wireline Segments 1.2% Mass Markets 17.1% 44.2% Global Enterprise Global Wholesale 37.5% Other Source: 2013 10-K Annual Report Company Analysis As stated in the company description, Verizon’s wireless segment provides voice, data and video communications products and services. They operate in a highly competitive environment globally with many other major wireless communications providers and have developed several strategic initiatives to remain competitive. The majority of their revenue is generated by their post-paid retail customers, and they must provide them with an efficient, high-quality network in order to minimize churn of their retail subscribers. Their network technology runs on 4G LTE and 3G EV-DO platforms, and they are making significant investments to continue to upgrade their 3G networks to the higher data performance 4G network, as data usage on mobile devices continues to increase. These wireless services are operated on spectrum, which is the radio frequency that wireless signals travel over. They have several spectrum licenses on many of the bands that Page 4 cover nearly all of the population of the United States. However, these spectrum licenses are highly regulated and controlled by the Federal Communications Commission (FCC), and there are limited number of spectrum licenses and frequencies available to all of the wireless operators. In 2013, Verizon entered into several spectrum transactions with various companies, including competitors like T-Mobile, which have expanded their coverage network. However, with the increasing demand of data bandwidth through the use of mobile devices, spectrums are being used at their capacity and it will be required that Verizon continue to enter into agreements and acquire licenses to remain competitive. In midNovember 2014, the FCC is expected to conduct an auction for AWS-3 spectrum, with Verizon being one of the major bidders along with AT&T and T-Mobile1. There are several key growth areas within their wireless segment as the mobile industry expands. Mobile video content is expected to account for a majority of internet traffic by 2018, and Verizon has made investments to enhance their 4G LTE technologies to handle this growth. They have developed a LTE Multicast service, which will allow customers to access live streaming video content with essentially no buffering, regardless of the number of devices using this service. They also have tried to capitalize on the trend of using mobile devices for financial transactions, and have develop ISIS Mobile Wallet, a joint venture with AT&T and T-Mobile that enables customers to organize all of their payment cards through an application on their mobile device. Lastly, they operate innovation centers in Waltham, Massachusetts and San Francisco, CA that serve as centers that work with their strategic partners in varying industries to assist in develop and implementing products, services, applications and solutions1. Verizon’s wireline segment provides customers with broadband video and data, corporate networking solutions, data center and cloud services, security and managed network services, and local and long distance voice services. It is expected that broadband usage will continue to grow significantly over the next decade and Verizon’s FiOS network and solutions provide them with an opportunity to capitalize on this trend. They have also introduced an enterprise-grade cloud platform, Verizon Cloud Compute and Cloud Storage, which gives their customers the ability to use cloud services while maintaining control and performance. This cloud platform can also be used by M2M customers that will allow them to store, process, and analyze large amounts of data on a real-time basis1. Verizon’s marketing and distribution strategy for all of their segments are based around promoting their brand, leveraging their distribution network, and promoting their products and services to all types of customers. They market through television, print, radio, outdoor signage, internet, and point-of-sale media promotions to grow their customer base. They use both direct and indirect distribution channels to do so. Their direct channels include company operated stores and a telemarketing sales force. In November 2013, they opened their first Verizon Destination store in the Mall of America which is meant to show customers how they can become connected in all aspects of their lives. Their indirect channels include retail locations via agents, internet marketing, large-named retailers such as Best Buy, WalMart and Target, and some pre-paid only vendors such as Dollar General and various other drug store chains. They have also partnered with other service providers in which Verizon’s products and services are sold jointly within a bundled package or on a standalone basis1. RECENT DEVELOPMENTS Third-Quarter 2014 Earnings Verizon Communications reported their third-quarter earnings on October 21, 2014 and they slightly missed EPS earnings expectations by $0.01. They reported an EPS of $0.89, a 15.6% year over year increase of from Q3 2013 earnings, bringing them up to a year to date EPS of $2.65. However, they believe their year to date EPS would be $0.07 higher if the Vodafone-Verizon transaction was completed at the beginning of the fiscal year instead of in February 2014. They had strong growth in postpaid device activations, totaling 11.7 million activations, and their retail postpaid net adds totaled 1.5 million, an increase of 63.5% from 2013. Their year to date postpaid net adds total 3.5 million, which is approximately 1 million more than in 2013. They also had a strong quarter in wireline, addition 162,000 internet and 114,000 video net subscriber additions in the quarter. Overall, their growth from second quarter was up around 1 percent. They also announced a 3.8 percent increase in their dividends, bring the dividend per share payout $2.20 for 2014. They continue to increase their capex spending and they believe that total capex spending for 2014 will be around $17 billion2. We believe they will have a strong fourth quarter, Page 5 partially attributed to the holiday season spending, and project their wireless revenues to increase 2.2% and their wireline revenues to increase almost 1 percent, bringing their overall revenue growth to around 2 percent for 2014. We believe this growth will mostly be in their wireless segment, due to increased customer additions and equipment (mobile device) spending due to the holiday season. in exabytes per month Mobile Data Usage Acquisition of Verizon Wireless INDUSTRY TRENDS Mobile Broadband and Video Wireless telecommunications providers have greatly benefited in the increasing use of mobile devices over the last several years. This trend is expected to continue as more functions of daily life move towards digital uses. Overall revenue in wireless communications is expected to reach $268.5 billion by 2019, mostly driven by increased use of data on mobile devices. The perception of the need for cell phones to have internet capabilities is increasing, and these perceptions along with increasing mobile applications are expected alone to drive industry growth 2.8 percent per year, over the next 5 years. However, this growth has the potential to be stunted if the wireless spectrum licenses become less available. Per the chart below, this growth in data usage (per Exabyte per month) is expected to exponentially grow throughout 2018. 15 10 5 0 2010 2011 2012 2013 2014 2015 2016 2017 2018 Source: Statista All of the major telecommunications providers have struggled to keep up with this growing demand and been making significant investments in their network capacities to meet the growth of this demand. Major industry players, for example T-Mobile and Sprint, have attempted to merge together to grow their networks but have these mergers have been crippled by strict FCC regulations. However, the industry remains well-positioned to handle this growth by upgrading their 3G networks to faster, more reliable 4G LTE networks. The market for new subscriber additions is also beginning to become increasingly saturated and companies are facing pricing pressures and reductions in margins because of this4. We believe that Verizon will remain a main competitor in this landscape, however, they will not experience much more than organic growth rates due to this high competition, FCC regulation, and pricing pressures. Mobile Internet Connections 3000 2500 in millions In February 2014, Verizon Communications acquired Vodafone’s 45% stake in Verizon Wireless for $130 billion, giving Verizon Communications complete control over Verizon Wireless. The transaction was financed mainly through cash, $6.6 billion of debt, and issuance of over 1.2 billion shares to shareholders of Vodafone. We have incorporated this transaction into our model by decreasing shares outstanding and increasing debt. This transaction is expected to increase Verizon’s EPS by over 10 percent and provide them with other financial flexibilities and innovations they previously did not have due to Vodafone owning a large stake in the company3. We believe this acquisition has and will bring continued profits globally for Verizon Communications, as well as gaining a greater US market share as a telecommunications provider. 20 2000 1500 1000 500 0 2009 Source: Statista Page 6 2010 2011 2012 2013 2014 2015 The availability of spectrum for telecommunications companies is becoming increasingly smaller as data usage increases and takes up more spectrum capacity, and are a huge barrier to entry for the telecommunications industry. The wireless industry’s performance to handle this projected increase in data usage will largely depend on the availability of this spectrum to the major providers. Currently, spectrum is used and licensed to television, radio, telecommunications, and governments in the form of Megahertz bands. This spectrum licensing is solely controlled by the FCC and therefore they can say who gets how much. It is believed that many government agencies and television providers that are now using satellite services to provide TV have unused capacity in their spectrums, and telecommunications providers are wanting them to auction off this spectrum. This has been a large source of competition between telecom providers and will continue to be unless the spectrum starts becoming more available to them4. However, many of the large telecommunications providers have formed agreements with each other to use each other’s spectrum where there are surpluses and shortages, but these agreements also have to be approved by the FCC before they can be made. The FCC has announced an AWS-3 spectrum auction to take place in November 2014, and Congress has also adopted legislation to reallocate and auction spectrums by 20221. The main concern with these legislations and auctions will be if they will be carried out in time to meet the growing demand for data. Machine-to-Machine (M2M) Connectivity A recent report by Vodafone showed the machine-tomachine industry to grow significantly over the next several years in the Americas. They predict that the adoption within the last year has increased more than 80% globally and that more than half of companies in the Americas will adopt this technology by 2016. Many companies are finding advantages in this technology such as greater productivity and competitive advantages through connecting machines to each other through 4G technologies. Automotive, consumer electronics, healthcare, and energy and utilities are among the fastest adopters of this technology, with nearly 30% adoption rates globally. These remote maintenance capabilities bring greater customer service, security, and productivity to these company’s products and this is mainly what is driving the adoption rates5. Verizon is starting to capitalize on these trends by offering these services within their Global Enterprise segment and we have forecasted slight growth within this segment as they attempt to become a major player in this industry. Machine-to-Machine Connectivity 250 200 in billions Spectrum Licenses 150 100 50 0 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Source: Statista MARKETS AND COMPETITION Wireless Verizon operates in an extremely competitive environment with other large telecommunications providers in the US and several providers globally. Their main competitors in the industry are AT&T, T-Mobile, and Sprint, all of which make up 93% of industry revenue and are all majority-owned US companies. Verizon Wireless has the largest share of the market at 35.9%, followed by AT&T with 30.6% of the market, Sprint with 14% of the market, and T-Mobile (a subsidiary of Deutsche Telekom AG) with 12.2% of the market. These major players compete on several factors including but not limited to network reliability, capacity, and coverage, pricing, customer service, product and service development, sales and distribution, and capital resources. Wireless Market Share 12.2% 14.0% 35.9% Verizon Wireless AT&T 30.6% Sprint T-Mobile Source: IBIS World Wireless Telecommunications Report Page 7 Verizon is one of the strongest competitors within the telecommunications industry both financially and through market share. They have acquired several small and medium sized companies over the last 5 years which has helped them to remain a strong player. However, they are becoming increasingly dependent on their wireless products and services and have begun to make investments in more of their wireline offerings such as M2M and FiOS products. They also were one of the first companies to introduce plans, such as the More Everything plan (previously Share Everything) that has provided customers with increased options including data and video, which has helped them remain competitive. Second to Verizon is AT&T, which is also a very strong player in the market. They offer very similar products and services to customers that Verizon does and they are probably Verizon’s largest competitor in the industry. network, due to these spectrum transfers, which could potentially pose a threat to their survival as a major competitor in the industry4. We believe that they also do not pose a major threat to Verizon’s revenues. They gained traction in the prepaid wireless segment by acquiring Leap Wireless International this year, which has given them the potential to gain an additional 5 million customers in an already heavily saturated market. However, in spring 2014, AT&T announced they were merging with DirecTV, a satellite TV provider, which will integrate their wireless and wireline services with DirecTV’s pay-tv business. This merger has already gained overwhelming approval from its shareholders and the Justice Department, and is awaiting final approval from the FCC. We expect this merger to close sometime in spring 2015. Sprint is the third largest competitor in the industry, however has not been a very strong player over the last several years. Softbank, a Chinese company, acquired an 80% stake in Sprint in 2013, in hopes to help them rebound from their negative financial position. They have been operating at a loss over the last five years due to high debt and large write-downs, mainly from the 2006 Sprint/Nextel merger, and large capital expenditures. They have also experienced high customer dissatisfaction with network coverage and capacity, of which they are investing heavily in their networks to alleviate these dropped calls. We do not believe that Sprint poses a major threat to Verizon’s operations. T-Mobile, a subsidiary of Deutsche Telekom AG, is the fourth largest player in the industry. T-Mobile has had historical advantages, such as being the first wireless provider of Google Android phones, a major competitor for IPhones, however they have struggled to retain subscribers through various spectrum license transfers with their major competition. They are also behind the game with upgrading their network to a 4G Wireline Market Share Wireline Verizon also operates in an extremely competitive environment for their wireline operations. Their main competitors include AT&T and CenturyLink, as well as many smaller competitors. The three biggest companies in wireline, AT&T, Verizon and CenturyLink make up 85.3% of industry revenue. AT&T has the largest market share with 47.6%, followed by Verizon with 31.9% and CenturyLink with 5.8%. These major competitors compete on several factors including customer service, network reliability, pricing, and product differentiation. AT&T 5.8% 14.7% Verizon Communications 47.6% 31.9% CenturyLink Other Source: IBIS World Wired Telecommunications Report5 Although AT&T has the majority of the market in wireline, we believe that Verizon is the stronger player within the wireline industry. Verizon has over 30 million wired landline customers, and the total segment makes up over 30% of their total revenues. They also have invested over 20 billion in their FiOS fiber optic network over the last 5 years in order to capture the increasing demand for wireline broadband connections. subscribers in millions Worldwide Broadband Connections 1000 800 600 400 200 0 2010 Source: Statista Page 8 2011 2012 2013 2014 2015 However, we still expect their overall wireline revenues to decline approximately 1% per year over the next 5 years or so, due to the decreasing use of wireline services in households. AT&T currently has 12 million retail consumer access lines, 10 million retail business access lines, and 2 million wholesale access lines, of which their wireline services makes up 46% of their total revenues. They also have made significant investments in expanding their fiber optic cable networks, however they are different from Verizon in that they extend the fiber cables to neighborhoods, but they are still using copper wiring for the “last mile” connections. This is negative for them as the copper wire connection speeds are much slower than fiber optic connection speeds and the copper eventually will have to be replaced. Additionally, Google Fiber is becoming an increasing threat to major fiber optic network providers as their network speed is up to 100 times faster than traditional broadband speeds and they plan to expand to 10 more major cities all over the US within the next several years10. The company has also experienced declines in their wireline revenues over the last 5 years, especially in 2009 due to the disconnection of many landlines, and we believe that they will continue to experience slight declines in these revenues due to the industry trend of moving away from wireline services. The third largest player in the wireline industry is CenturyLink, and their wireline access line customers are heavily concentrated in the western United States. They also have over 55 data centers throughout North America, Europe, and Asia. CenturyLink has significantly increased their size over the last several years through various acquisitions, however they are still only the third largest player in this industry. They also have strategic partnerships with both Verizon and DirecTV which allow them to offer digital television and wireless services. Their wireline revenues are expected to decline as well. Overall, we believe that Verizon is the best positioned in the wireline industry in comparison to their competitors, as they hold a large majority of the market share and seem to have the most up to date fiber optic cable layout. We do not believe that any of the other players in the industry pose a major threat to Verizon’s revenues in this segment5. Peer Comparisons Name Mkt Value (B) Price 209.4 180.4 0.02 VERIZON COMM. Inc. AT&T Inc. Sprint, Inc. T-Mobile (Deutsche Telekom AG) CenturyLink Average EPS EPS Debt/ (ttm) (FY1) P/E '13 P/E '14 Equity Profit Margin $50.45 $34.79 $ 5.18 2.84 2.50 NM 3.87 17.76x 13.04x 2.57 13.92x 13.54x -0.43 N/A -12.047 230.9 76.2 125.1 9.54% 14.17% -8.50% 0.02 $28.45 0.05 0.22 569.00x 129.32x 157.5 0.14% 0.02 $41.63 2.76 2.04 2.63 2.32 117.4 145.49 -1.32% 5.63% 15.08x 15.83x 153.94 42.93 Source: FactSet As you can see from the chart above, Verizon Communications is well-positioned against its competitors in terms of financial metrics. We have left Sprint Corporation out of the averages as they have a negative EPS for 2013 and will have an estimated negative EPS for 2014, making them an outlier. Verizon Communication is trading at an EPS that is higher than the average of some of their major competitors, including AT&T, T-Mobile, and Sprint Corp. Their P/E ratios are strong in comparison to industry averages, showing that their stock is pretty fairly valued in the market. Their profit margin is nearly 10% for 2013, and we have forecasted their profit margin to remain around 10-11% throughout our forecast period; this profit margin is lower than AT&T’s, but this is most likely due to adjustments from the February 2014 acquisition of Verizon Wireless. However, their debt to equity ratio is well above the industry average, and much higher than most of their peers, making this a risk to the investment. Overall, we believe that Verizon is the strongest player within the telecommunications industry. ECONOMIC OUTLOOK Interest Rates Interest rates are a very important economic driver for the telecommunications industry as most telecommunications providers are highly leveraged and this debt is driven by lending rates. Significant changes in lending rates will have a large impact on telecom companies as they use financing to acquire other companies and upgrade and expand their wireless networks to keep up with increasing data bandwidth demands. We believe that interest rates will remain low and stable for our 6 month forecast period, followed by rates drifting upwards and 10 year yields rising to 3.50% within the next 2 years. These increases in the yields will drive banks to raise their lending rates and therefore put increased pressure on telecommunication companies’ debt levels on their balance sheets. This could have a significant negative effect on Verizon’s balance Page 9 sheet as we have forecasted their long term debt levels to increase consistently throughout 2018 as they continue to acquire smaller telecommunications providers and finance the expansion of their network capacities and coverage areas. • Cloud computing adoption and revenue is expected to substantially increase over the next decade or so due to the demands for large data and more efficient data analytics and storage. Verizon’s Cloud platform is well-positioned to compete against many of the other large platforms in the industry and we believe they can potentially capture a portion of this revenue with their brand name, reputation, and high-speed 4G networks. • Verizon invested over $100 million in 2013 and over $40 million into solar energy to increase their solar capacity. These investments and new capacity have given Verizon the most solar-generating capacity of any US telecommunications provider. We believe this is positive for the company as not only it is environmentally friendly, it has the potential to reduce some of their operating costs. We did not forecast significant reductions in their operating costs, however we also did not forecast them to increase significantly because of these investments7. Disposable Income Higher levels of disposable income encourage customers to purchase products such as mobile devices and tablets, and therefore an increase or decrease in consumer’s disposable income could have a potential impact on profits in the industry. We have predicted that consumer confidence, which attributes to driving disposable spending, will remain positive over the next 6 months, and potentially drop to neutral over our longer-term 2 year forecast. The economy has been in a stage of recovery over the last several years and consumer confidence and spending has continued to increase. We do not believe that this will change enough to make a significant impact on Verizon’s revenues. Unemployment INVESTMENT NEGATIVES Unemployment is another key driver for this industry as it typically determines discretionary spending habits. Unemployment reach a post-recession low of 5.9% in August 2014, and we believe that unemployment will remain around 6% for both our short and longer term forecast periods. Due to this, we do not believe slight changes in unemployment will have a significant impact on Verizon’s revenues over our forecast period. • The availability of spectrum is crucial to telecommunication company’s survival and the spectrum capacities are being used up at a faster rate than the supply of the spectrum. Spectrum licenses are heavily regulated by the FCC and many television companies and governments have excess capacity of this spectrum that needs to be auctioned off. If this does not happen at a fast enough rate, this could pose a threat to all of the telecommunications providers, including Verizon. • The telecommunications industry has a lot of major competitors and the market for new subscribers is becoming increasingly saturated; this is turn is putting pricing pressures between many of the major providers to gain customers and minimize churn. Additionally, with the high level of government regulation, any changes in new regulations could potentially limit acquisitions and/or increase costs and reduce margins. INVESTMENT POSITIVES • We believe that Verizon Communications is the strongest player in the telecommunication industry. They have the lowest churn of all of the major competitors and report increase in earnings year over year. AT&T poses the biggest threat to them however we believe that AT&T is not as well positioned due to the number of fiber optic build-outs they have to complete, a lower dividend per share ($1.84 versus $2.20), and the uncertainty of the upcoming AT&T and DirecTV merger. Verizon has also been ranked by Fortune Magazine as the number 1 telecom provider and has won awards by JD Power & Association for their FiOS network. We believe that Verizon is currently the best investment for the telecommunications sector. VALUATION • Page 10 We forecasted Verizon’s wireless revenues to remain fairly organic around 4-5% throughout our forecast • • • • • period to 2018. We believe that along with the 100% ownership in Verizon Wireless, and since they are such a strong player in the wireless industry, that they will be able to sustain a moderate growth rate and increase their subscriber base enough to sustain growth. We also believe that they will remain profitable in the equipment segment of their wireless revenues, as smartphones and tablets become more affordable and newer versions continue to be released. We forecasted their wireline revenues to remain fairly flat over our forecast period into 2018. We believe the declining use of wireline services will be offset by Verizon’s FiOS expansion and Global Enterprise opportunities. We see opportunities in both of these services for Verizon, however, with the high amount of competition in the industry we do not believe Verizon will grow substantially in these industries. We have forecasted their cost of goods sold to remain at an average of 38% of revenues throughout our forecast period, leaving their profit margins fairly consistent around 10-11%. Although Verizon is making investments in areas like solar energy, which could potentially decrease costs and improve margins, we do not believe there will be significant change in their expenses through our forecast period. Verizon carries a large amount of debt on their balance sheet and we have forecasted this debt to increase around 5% per year due to potential acquisitions of smaller providers and the need for telecom companies to continuously upgrade and expand their network. We believe that Verizon will need to continue these upgrades as competitors like Google Fiber come into the market. We have forecasted their debt to equity ratio to be around 4.50 throughout 2018. Our DCF valuation model gave us a target price of $54.58. We assumed a WACC of 5.62%, using a 5 year beta of 0.8 and the Henry Fund consensus market risk premium of 4.64%. We chose to use the 5 year beta as large enterprise telecom companies tend to remain uniform over this time period. We also forecasted Verizon’s terminal growth rate to be at 2% as do not see major growth potential long-term as are already saturated in much of the US market already. Our DDM model gave us a target price of $59.71. We believe this price is higher than our DCF valuation due to their consistency in increasing their dividend yield year over year. In 2nd quarter 2014 they increased their yearly dividend to $2.20 per share, making their • yield 4.30%, which is greater than any of the other major telecommunication carriers. Our Relative P/E valuation model gave us a target price of $125.47, however, when we removed the outliers, it gave us a more reasonable price of $54.73. We used Sprint, T-Mobile, AT&T, and Century Link as our comparables, however Sprint and T-Mobile were omitted in the $54.73 valuation due to extremely low EPS figures and estimates. KEYS TO MONITOR We believe that Verizon Communications is the strongest investment in telecom industry, and would be the best addition to our telecommunications sector in the Henry Fund. They have consistent earnings growth year over year, and a high dividend payout in comparison to their competitors. Some keys to monitor would include the upcoming FCC auction of spectrum, of which many of the large telecom companies are meant to participate in, as if Verizon does not acquire a portion of this spectrum it could be detrimental to their revenues. Additionally other keys to monitor include watching any changes in FCC regulations and how these changes could potentially reduce revenues or increase profits for Verizon. Although we don’t believe there will be substantial growth within telecommunications as an industry as a whole, Verizon Communications is the best investment at the moment and we are recommending a BUY for Verizon Communications stock in the Henry Fund. Page 11 REFERENCES 1. Verizon 2013 10-K 2. Q3 2014 Earnings 3. Verizon.com, (2014). Verizon Completes Acquisition of Vodafone's 45 Percent Indirect Interest in Verizon Wireless | About Verizon. [online] Available at: http://www.verizon.com/about/news/verizoncompletes-acquisition-vodafones-45-percentindirect-interest-verizon-wireless/. 4. Wireless Telecommunication Providers – IBIS World 5. M2M Now - News and expert opinions on the M2M industry, machine to machine magazine, (2014). Vodafone report shows adoption of Machine-to-Machine (M2M) on the rise in the Americas. [online] Available at: http://www.m2mnow.biz/2014/08/18/23997vodafone-report-shows-adoption-machinemachine-m2m-rise-americas/. 6. Wireline Telecommunications Providers – IBIS World 7. Goossens, E. (2014). Verizon Triples Solar Energy With $40 Million Investment. [online] Bloomberg. Available at: http://www.bloomberg.com/news/2014-0825/verizon-triples-solar-energy-with-40-millioninvestment.html. 8. Statista.com.proxy.lib.uiowa.edu, (2014). Proxy Login - The University of Iowa Libraries. [online] Available at: http://www.statista.com.proxy.lib.uiowa.edu/sta tistics/203405/global-forecast-of-cloudcomputing-payments-revenue/. 9. Team, N. (2014). Verizon Completes Acquisition of Vodafone’s 45 Percent Indirect Interest in Verizon Wireless. [online] Verizon Wireless News Center. Available at: http://www.verizonwireless.com/news/article/20 14/02/verizon-completes-acquisition-vodafoneindirect-interest-verizon-wireless.html. 10. Fiber.google.com, (2014). Expansion Plans – Google Fiber. [online] Available at: https://fiber.google.com/newcities/. Fund may hold a financial interest in the companies mentioned in this report. IMPORTANT DISCLAIMER Henry Fund reports are created by student enrolled in the Applied Securities Management (Henry Fund) program at the University of Iowa’s Tippie School of Management. These reports are intended to provide potential employers and other interested parties an example of the analytical skills, investment knowledge, and communication abilities of Henry Fund students. Henry Fund analysts are not registered investment advisors, brokers or officially licensed financial professionals. The investment opinion contained in this report does not represent an offer or solicitation to buy or sell any of the aforementioned securities. Unless otherwise noted, facts and figures included in this report are from publicly available sources. This report is not a complete compilation of data, and its accuracy is not guaranteed. From time to time, the University of Iowa, its faculty, staff, students, or the Henry Page 12 VERIZON COMMUNICATIONS Revenue Decomposition in millions Fiscal Years Ending Dec. 31 Wireless Service Revenue YoY Growth 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 59,157 63,733 69,033 73,171 76,500 79,600 82,950 86,750 6.34% 7.74% 8.32% 5.99% 4.55% 4.05% 4.21% 4.58% Equipment and Other 10,997 12,135 11,990 13,286 Equipment Other YoY Growth 7,457 3,540 41.39% 8,023 4,112 10.35% 8,111 3,879 -1.19% 9,237 4,049 10.81% 14,600 10,475 3,925 15,560 11,760 3,800 16,190 12,590 3,600 16,500 12,910 3,600 9.89% 6.58% 4.05% 1.91% TOTAL WIRELESS 70,154 75,868 81,023 86,457 91,100 95,160 99,140 103,250 YoY Growth 10.64% 8.14% 6.79% 6.71% 5.37% 4.46% 4.18% 4.15% Wireline Mass Markets 16,337 16,702 17,328 18,046 18,750 19,460 19,905 20,510 YoY Growth Global Enterprise YoY Growth 0.50% 2.23% 3.75% 4.14% 3.90% 3.79% 2.29% 3.04% 15,622 15,299 14,703 13,969 13,875 13,785 14,050 14,160 -0.30% -2.07% -3.90% -4.99% -0.67% -0.65% 1.92% 0.78% Global Wholesale 7,973 7,240 6,714 6,263 5,875 5,550 4,990 4,070 YoY Growth -5.00% -9.19% -7.27% -6.72% -6.20% -5.53% -10.09% -18.44% 750 40,682 539 39,780 478 39,223 504 38,782 460 38,960 400 39,195 200 39,145 80 38,820 -0.83% - 142,070 2.74% Other TOTAL WIRELINE YoY Growth Corporate, eliminations (gains) and other TOTAL REVENUE YoY Growth -1.32% (39) -2.22% (198) -1.40% (304) -1.12% - 0.46% 0.60% - - -0.13% - 110,875 4.04% 115,846 4.48% 120,550 4.06% 125,239 3.89% 130,060 3.85% 134,355 3.30% 138,285 2.93% VERIZON COMMUNICATIONS Income Statement in millions Fiscal Years Ending Dec. 31 Income Statement Sales COGS excluding D&A Depreciation Amortization of Intangibles Gross Income SG&A Expense EBIT (Operating Income) Nonoperating Income - Net 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 110,875 45,875 14,991 1,505 48,504 29,670 18,834 430 115,846 46,235 14,920 1,540 53,151 32,145 21,006 408 120,550 44,887 15,019 1,587 59,057 33,599 25,458 254 68 444 -82 57 324 27 64 142 48 130,060 50,227 15,300 1,808 63,125 35,684 27,249 65 65 134,355 52,187 15,500 1,868 65,121 36,754 30,105 67 67 138,285 53,240 15,650 1,922 67,473 37,857 31,407 69 69 142,070 54,697 15,800 1,975 69,598 38,992 32,450 71 71 Interest Expense Unusual Expense - Net Pretax Income Income Taxes Minority Interest Net Income 2,827 5,954 10,483 285 7,794 2,404 2,571 8,946 9,897 -660 9,682 875 2,667 -6,232 29,277 5,730 12,050 11,497 125,979 47,980 15,187 1,578 61,234 34,644 29,090 1,210 44 1,741 -645 4,833 1,200 24,267 8,493 2,347 13,426 EPS (recurring) Total Dividend Payment 2.31 5,597 2.49 5,803 2.48 5,982 Total Shares Outstanding Dividends per Share 2,834 1.98 2,859 2.03 2,862 2.09 Nonoperating Interest Income Equity in Earnings of Affiliates Other Income (Expense) - - - - 5,281 22,033 7,712 200 14,121 5,545 24,628 8,620 200 15,808 5,822 25,654 8,979 200 16,475 6,113 26,408 9,243 200 16,965 3.87 9,070 3.39 9,531 3.80 9,704 3.95 9,711 4.07 9,843 4,159 2.18 4162 2.29 4165 2.33 4168 2.33 4171 2.36 VERIZON COMMUNICATIONS Balance Sheet in millions Fiscal Years Ending Dec. 31 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 13,362 592 3,093 470 53,528 601 6,982 650 20,429 663 36,644 676 53,887 690 73,860 704 13,954 11,776 46 940 4,223 30,939 3,563 12,576 22 1,075 3,999 21,235 54,129 12,439 0 1,020 3,406 70,994 7,632 13,505 1,159 3,779 26,075 21,092 13,942 1,197 3,902 40,133 37,320 14,403 1,276 4,031 57,030 54,576 14,824 1,341 4,149 74,891 74,563 15,230 1,406 4,262 95,462 215,626 127,192 88,434 3,448 73,250 23,357 5,878 5,155 230,461 209,575 120,933 88,642 3,401 77,744 24,139 5,933 4,128 225,222 220,865 131,909 88,956 3,432 75,747 24,634 5,800 4,535 274,098 237,865 147,096 90,769 3,450 74,990 41,878 5,887 4,409 247,458 255,865 162,396 93,469 3,500 74,240 35,000 5,975 4,552 256,869 272,865 177,896 94,969 3,500 73,497 30,000 6,065 4,702 269,763 284,865 193,546 91,319 3,588 72,762 30,000 6,156 4,840 283,555 294,865 209,346 85,519 3,620 72,035 30,000 6,248 4,972 297,856 4,849 4,194 5,940 4,857 10,921 30,761 4,369 4,740 1,494 5,006 11,347 26,956 3,933 4,954 1,539 4,790 11,834 27,050 5,588 5,165 1,385 5,291 12,371 29,801 5,868 5,332 1,247 5,463 12,772 30,681 6,161 5,509 1,122 5,643 13,194 31,628 6,469 5,670 1,010 5,808 13,580 32,536 6,792 5,825 909 5,967 13,951 33,444 Long-Term Debt Employee Benefit Obligations Deferred Tax Liabilities Other Liabilities Total Liabilities 50,303 32,957 25,060 5,472 144,553 47,618 34,346 24,677 6,092 139,689 89,658 27,682 28,639 5,653 178,682 111,763 27,405 28,639 6,047 203,655 117,351 27,131 28,639 6,243 210,045 123,219 26,860 28,639 6,449 216,795 129,380 26,591 28,639 6,638 223,784 135,849 26,325 28,639 6,819 231,077 Common Stock & Additional Paid-In Capital Retained Earnings ESOP Debt Guarantee Cumulative Translation Adjustment/Unrealized For. Exch. Gain Unrealized Gain/Loss Marketable Securities Other Appropriated Reserves Treasury Stock Total Shareholders' Equity Accumulated Minority Interest Total Equity Total Liabilities & Shareholders' Equity 38,216 1,179 308 880 72 317 (5,002) 35,970 49,938 85,908 230,461 38,287 -3,734 440 881 101 1,253 (4,071) 33,157 52,376 85,533 225,222 38,236 1,782 421 966 117 1,275 (3,961) 38,836 56,580 95,416 274,098 36,966 6,138 421 1,008 120 1,300 (3,861) 42,092 1,711 43,803 247,458 36,970 10,729 421 1,040 120 1,300 (3,856) 46,724 100 46,824 256,869 36,974 16,833 421 1,075 120 1,300 (3,854) 52,869 100 52,969 269,763 36,978 23,597 421 1,106 120 1,300 (3,851) 59,672 100 59,772 283,555 36,982 30,720 421 1,137 120 1,300 (4,000) 66,680 100 66,780 297,856 Balance Sheet Assets Cash Only Total Short Term Investments Cash & Short-Term Investments Accounts Receivables, Net Other Receivables Inventories Other Current Assets Total Current Assets Property, Plant & Equipment - Gross Accumulated Depreciation Net Property, Plant & Equipment Investments in unconsolidated businesses Wireless Licenses Net Goodwill Net Other Intangibles Other Assets Total Assets Liabilities & Shareholders' Equity ST Debt & Curr. Portion LT Debt Accounts Payable Dividends Payable Accrued Payroll Miscellaneous Current Liabilities Total Current Liabilities VERIZON COMMUNICATIONS Cash Flow Statement Fiscal Years Ending Dec. 31 2015E 2016E 2017E 2018E 13,426 15,187 1,578 14,121 15,300 1,808 15,808 15,500 1,868 16,475 15,650 1,922 16,965 15,800 1,975 (1,066) (139) (373) 211 (154) 501 537 394 (277) 29,826 (437) (38) (122) 167 (139) 171 401 196 (274) 31,155 (460) (80) (129) 176 (125) 180 422 206 (271) 33,095 (421) (65) (118) 161 (112) 165 386 189 (269) 33,963 (406) (65) (114) 155 (101) 159 372 182 (266) 34,656 Investing Activities (Increase) decrease in short-term investments Capital Expenditures Change in Intangible Assets (Increase) decrease in other businesses (Increase) decrease in wireless licenses (Increase) decrease in other assets Business Acquisitions (Change in Goodwill) Net Investing Cash Flow (49) (17,000) (1,665) (18) 757 126 (17,244) (35,093) (13) (18,000) (1,896) (50) 750 (143) 6,878 (12,474) (13) (17,000) (1,957) 742 (150) 5,000 (13,378) (14) (12,000) (2,013) (87) 735 (138) (13,517) (14) (10,000) (2,067) (33) 728 (132) (11,518) Financing Activities Proceeds from Issuance of ST Debt Proceeds from Issuance of LT Debt Payment of Dividends Proceeds from Issuance of Common Stock Repurchase of Common Stock (Treasury Stock) Change in Minority Interest Change in ESOP Debt Guarantee Change in Cumulative Translation Adjustment Change in Unrealized Gain/Loss Marketable Securities Change in Other Appropriated Reserves Net Financing Cash Flow 1,655 22,105 (9,070) (1,270) 100 (54,869) 42 3 25 (41,279) 279 5,588 (9,531) 4 5 (1,611) 33 (5,232) 293 5,868 (9,704) 4 2 34 (3,503) 308 6,161 (9,711) 4 3 31 (3,203) 323 6,469 (9,843) 4 (149) 30 (3,165) Net Change in Cash Cash, Beginning of the Period Cash, End of the Period (46,546) 53,528 6,982 13,448 6,982 20,429 16,214 20,429 36,644 17,243 36,644 53,887 19,973 53,887 73,860 Cash Flow Operating Activities Net Income Depreciation Amortization of Intangible Assets Allowance for Doubtful Accounts Changes in Working Capital: Changes in Accounts Receivable Changes in Other Receivables Changes in Inventories Changes in Other Current Assets Changes in Accounts Payable Changes in Dividends Payable Changes in Accrued Payroll Changes in Misc Current Liabilities Changes in Deferred Taxes Changes in other non-current liabilities Changes in Employee Benefit Obligations Net Operating Cash Flow 2014E VERIZON COMMUNICATIONS Common Size Income Statement Fiscal Years Ending Dec. 31 Income Statement Sales COGS excluding D&A Depreciation Amortization of Intangibles Gross Income SG&A Expense EBIT (Operating Income) Nonoperating Income - Net Nonoperating Interest Income Equity in Earnings of Affiliates Other Income (Expense) Interest Expense Unusual Expense - Net Pretax Income Income Taxes Minority Interest Net Income 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 100.00% 41.38% 13.52% 1.36% 43.75% 26.76% 16.99% 0.39% 100.00% 39.91% 12.88% 1.33% 45.88% 27.75% 18.13% 0.35% 100.00% 37.24% 12.46% 1.32% 48.99% 27.87% 21.12% 0.21% 100.00% 38.09% 12.06% 1.25% 48.61% 27.50% 23.09% 0.96% 100.00% 38.62% 11.76% 1.39% 48.54% 27.44% 20.95% 0.05% 100.00% 38.84% 11.54% 1.39% 48.47% 27.36% 22.41% 0.05% 100.00% 38.50% 11.32% 1.39% 48.79% 27.38% 22.71% 0.05% 100.00% 38.50% 11.12% 1.39% 48.99% 27.45% 22.84% 0.05% 0.06% 1.65% -0.30% 0.05% 1.20% 0.10% 0.05% 0.53% 0.18% 0.03% 6.45% -2.39% 0.05% 0.00% 0.00% 0.05% 0.00% 0.00% 0.05% 0.00% 0.00% 0.05% 0.00% 0.00% 2.55% 5.37% 9.45% 0.26% 7.03% 2.17% 2.22% 7.72% 8.54% -0.57% 8.36% 0.76% 2.21% -5.17% 24.29% 4.75% 10.00% 9.54% 3.84% 0.95% 19.26% 6.74% 1.86% 10.66% 4.06% 0.00% 16.94% 5.93% 0.15% 10.86% 4.13% 0.00% 18.33% 6.42% 0.15% 11.77% 4.21% 0.00% 18.55% 6.49% 0.14% 11.91% 4.30% 0.00% 18.59% 6.51% 0.14% 11.94% VERIZON COMMUNICATIONS Common Size Balance Sheet Fiscal Years Ending Dec. 31 Balance Sheet Assets 2011 2012 2013 2014E 2015E 2016E 2017E 2018E Cash Only Total Short Term Investments 12.05% 0.53% 12.59% 11.34% -0.72% 10.62% 0.04% 0.85% 3.81% 27.90% 58.99% 194.48% 114.72% 79.76% 3.11% 66.07% 21.07% 5.30% 20.63% 20.68% 2.67% 0.41% 3.08% 11.41% -0.55% 10.86% 0.02% 0.93% 3.45% 18.33% 57.70% 180.91% 104.39% 76.52% 2.94% 67.11% 20.84% 5.12% 3.56% 194.41% 44.40% 0.50% 44.90% 10.85% -0.54% 10.32% 0.00% 0.85% 2.83% 58.89% 59.72% 183.21% 109.42% 73.79% 2.85% 62.83% 20.43% 4.81% 3.76% 227.37% 5.54% 0.52% 6.06% 11.37% -0.65% 10.72% 0.00% 0.92% 3.00% 20.70% 15.71% 0.51% 16.22% 11.37% -0.65% 10.72% 0.00% 0.92% 3.00% 30.86% 27.27% 0.50% 27.78% 11.37% -0.65% 10.72% 0.00% 0.95% 3.00% 42.45% 38.97% 0.50% 39.47% 11.37% -0.65% 10.72% 0.00% 0.97% 3.00% 54.16% 51.99% 0.50% 52.48% 11.37% -0.65% 10.72% 0.00% 0.99% 3.00% 67.19% 188.81% 116.76% 72.05% 2.74% 59.53% 33.24% 4.67% 3.50% 196.43% 196.73% 124.86% 71.87% 2.69% 57.08% 26.91% 4.59% 3.50% 197.50% 203.09% 132.41% 70.69% 2.61% 54.70% 22.33% 4.51% 3.50% 200.78% 206.00% 139.96% 66.04% 2.59% 52.62% 21.69% 4.45% 3.50% 205.05% 207.55% 147.35% 60.19% 2.55% 50.70% 21.12% 4.40% 3.50% 209.65% 4.37% 3.78% 5.36% 4.38% 9.85% 27.74% 3.77% 4.09% 1.29% 4.32% 9.79% 23.27% 3.26% 4.11% 1.28% 3.97% 9.82% 22.44% 4.44% 4.10% 1.10% 4.20% 9.82% 23.66% 4.51% 4.10% 0.96% 4.20% 9.82% 23.59% 4.59% 4.10% 0.84% 4.20% 9.82% 23.54% 4.68% 4.10% 0.73% 4.20% 9.82% 23.53% 4.78% 4.10% 0.64% 4.20% 9.82% 23.54% Long-Term Debt Employee Benefit Obligations Deferred Tax Liabilities Other Liabilities Total Liabilities 45.37% 29.72% 22.60% 4.94% 130.37% 41.10% 29.65% 21.30% 5.26% 120.58% 74.37% 22.96% 23.76% 4.69% 148.22% 88.72% 21.75% 22.73% 4.80% 161.66% 90.23% 20.86% 22.02% 4.80% 161.50% 91.71% 19.99% 21.32% 4.80% 161.36% 93.56% 19.23% 20.71% 4.80% 161.83% 95.62% 18.53% 20.16% 4.80% 162.65% Additional Paid-In Capital/Capital Surplus Retained Earnings ESOP Debt Guarantee Cumulative Translation Adjustment/Unrealized For. Exch. Gain Unrealized Gain/Loss Marketable Securities Other Appropriated Reserves Treasury Stock Total Shareholders' Equity Accumulated Minority Interest Total Equity Total Liabilities & Shareholders' Equity 34.47% 1.06% 0.28% 0.79% 0.06% 0.29% -4.51% 32.44% 45.04% 77.48% 207.86% 33.05% -3.22% 0.38% 0.76% 0.09% 1.08% -3.51% 28.62% 45.21% 73.83% 194.41% 31.72% 1.48% 0.35% 0.80% 0.10% 1.06% -3.29% 32.22% 46.93% 79.15% 227.37% 29.34% 4.87% 0.33% 0.80% 0.10% 1.03% -3.06% 33.41% 1.36% 34.77% 196.43% 28.43% 8.25% 0.32% 0.80% 0.09% 1.00% -2.96% 35.93% 0.08% 36.00% 197.50% 27.52% 12.53% 0.31% 0.80% 0.09% 0.97% -2.87% 39.35% 0.07% 39.42% 200.78% 26.74% 17.06% 0.30% 0.80% 0.09% 0.94% -2.78% 43.15% 0.07% 43.22% 205.05% 26.03% 21.62% 0.30% 0.80% 0.08% 0.92% -2.82% 46.93% 0.07% 47.00% 209.65% Cash & Short-Term Investments Accounts Receivables, Gross Bad Debt/Doubtful Accounts Accounts Receivables, Net Other Receivables Inventories Other Current Assets Total Current Assets Property, Plant & Equipment - Gross Accumulated Depreciation Net Property, Plant & Equipment Investments in unconsolidated businesses Wireless Licenses Net Goodwill Net Other Intangibles Other Assets Total Assets Liabilities & Shareholders' Equity ST Debt & Curr. Portion LT Debt Accounts Payable Dividends Payable Accrued Payroll Miscellaneous Current Liabilities Total Current Liabilities VERIZON COMMUNICATIONS Value Driver Estimation in millions Fiscal Years Ending Dec. 31 EBITA 2011 2012 2013 2014E 2015E 2016E 2017E 2018E EBITA 110,875 45,875 14,991 1,505 29,670 31 18,865 115,846 46,235 14,920 1,540 32,145 31 21,037 120,550 44,887 15,019 1,587 33,599 25 25,483 125,979 47,980 15,187 1,578 34,644 24 26,614 130,060 50,227 15,300 1,808 35,684 24 27,066 134,355 52,187 15,500 1,868 36,754 24 28,071 138,285 53,240 15,650 1,922 37,857 24 29,641 142,070 54,697 15,800 1,975 38,992 24 30,630 Marginal Tax Rate Income Tax Provision Plus: Tax Shield on Interest Expense Less: Tax Shield on Interest Income Less: Tax Shield on Non-Operating Income Plus: Tax Shield on Non-Operating Losses Plus: Tax Shield on Op Lease Interest Total Adjusted Taxes Change in Deferred Taxes NOPLAT 34.0% 285 961 23 151 2,052 11 3,135 (40) 15,690 33.1% (660) 851 19 116 2,961 10 3,027 (420) 17,590 37.1% 5,730 989 24 2,383 9 4,322 5,836 26,997 35.0% 8,493 1,692 15 (36) 420 8 10,634 15,980 35.0% 7,712 1,848 23 8 9,545 17,520 35.0% 8,620 1,941 24 8 10,545 17,526 35.0% 8,979 2,038 24 8 11,001 18,640 35.0% 9,243 2,140 25 8 11,366 19,264 18165 ######### 267 11,776 940 4,269 17,252 62 12,576 1,075 4,021 17,734 1,071 12,439 1,020 3,406 17,936 140 13,505 1,159 3,779 18,583 409 13,942 1,197 3,902 19,449 733 14,403 1,276 4,031 20,443 1,078 14,824 1,341 4,149 21,392 1,477 15,230 1,406 4,262 22,376 Current Operating Liabilities Plus: Accounts Payable Plus: Dividends Payable Plus: Accrued Payroll Plus: Other Current Liabilities Total Operating Current Liabilities 4,194 5,940 4,857 10,921 25,912 4,740 1,494 5,006 11,347 22,587 4,954 1,539 4,790 11,834 23,117 5,165 1,385 5,291 12,371 24,212 5,332 1,247 5,463 12,772 24,813 5,509 1,122 5,643 13,194 25,467 5,670 1,010 5,808 13,580 26,067 5,825 909 5,967 13,951 26,652 Net Operating Working Capital (8,660) (4,853) (5,181) (5,630) (5,364) (5,024) (4,675) (4,276) 88,434 640 64,764 5,878 38,429 121,287 88,642 640 67,595 5,933 40,438 122,372 88,956 517 71,149 5,800 33,335 133,087 90,769 500 82,849 5,887 33,452 146,553 93,469 500 82,292 5,975 33,374 148,862 94,969 500 81,700 6,065 33,309 149,925 91,319 500 81,190 6,156 33,229 145,936 85,519 500 80,627 6,248 33,145 139,750 Value Drivers NOPLAT Beginning Invested Capital Return on Invested Capital 15,690 40,670 38.58% 17,590 121,287 14.50% 26,997 122,372 22.06% 15,980 133,087 12.01% 17,520 146,553 11.95% 17,526 148,862 11.77% 18,640 149,925 12.43% 19,264 145,936 13.20% Beginning Invested Capital ROIC-WACC Economic Profit 40,670 32.95% 13,403 121,287 8.88% 10,768 122,372 16.44% 20,114 133,087 6.38% 8,495 146,553 6.33% 9,278 148,862 6.15% 9,154 149,925 6.81% 10,208 145,936 7.58% 11,057 NOPLAT Change in Invested Capital Free Cash Flow 15,690 80,617 (64,927) 17,590 1,085 16,505 26,997 10,715 16,281 15,980 13,465 2,515 17,520 2,309 15,211 17,526 1,063 16,463 18,640 (3,989) 22,629 19,264 (6,186) 25,450 Revenue Cost of Goods Sold Depreciation Amortization of intangibles S,G,&A Plus: Operating Lease Interest Invested Capital Current Operating Assets Normal Cash Plus: Accounts Receivable Plus: Inventory Plus: Prepaid Expenses & Other Assets Total Operating Current Assets Plus: Net PPE Plus: PV of Operating Leases Plus: Other LT Assets Plus: Non-goodwill intangibles Less: Other LT Liabilities Invested Capital VERIZON COMMUNICATIONS Weighted Average Cost of Capital (WACC) Estimation WACC = Re(E/V) + Rd(1-t)(D/V) + Rpfd(PFD/V) Cost of Equity (Re) Risk-free rate Market Risk Premium Equity Beta of Firm Cost of Equity (Re) 3.07% 4.64% 0.80 6.78% Cost of Debt (Rd) Cost of Debt (Rd) 4.84% Weight of Equity (E) MV of Common Stock Shares Outstanding (in millions) Weight of Equity 50.49 4,150 209,534 Weight of Debt (D) PV of Operating Leases Current Portion of LT Debt Market Value of LT Debt Weight of Debt (D) 517 3,933 89,658 94,108 0 0 WACC Calculation Re Rd E D V (1-t) Wd We WACC = Re(E/V) + Rd(1-t)(D/V) + Rpfd(PFD/V) 6.78% 4.84% 209,534 94,108 303,642 62.90% 30.99% 69.01% WACC = 5.62% VERIZON COMMUNICATIONS Discounted Cash Flow (DCF) and Economic Profit (EP) Valuation Models Key Inputs: CV Growth CV ROIC WACC Cost of Equity 2.00% 13.20% 5.62% 6.78% Fiscal Years Ending Dec. 31 DCF Model Free Cash Flow Periods to Discount Discounted FCF Sum of DCF's Plus: Excess Cash Plus: Short term investments Plus: Long term investments Less: Total Debt (including PV OL) Less: Minority Interest Liabilities Less: Employee Benefit Obligations Less: ESOP Value of Equity Shares Outstanding Share Price Price Today EP Model Invested Capital EP Periods to Discount Discounted EP 2014E 2015E 2016E 2017E 2018E 2,515 1 2,381 15,211 2 13,635 16,463 3 13,972 22,629 4 18,183 451,528 4 362,827 8,495 1 8,043 9,278 2 8,317 9,154 3 7,769 10,208 4 8,203 305,489 4 245,477 410,999 6,842 601 3,432 94,108 56,580 27,682 16,489 227,015 $ $ 4,159 54.58 50.49 133,087 Sum of EP Beginning Invested Capital Plus: Excess Cash Plus: Short term investments Plus: Long term investments Less: Total Debt (including PV OL) Less: Minority Interest Liabilities Less: Employee Benefit Obligations Less: ESOP Value of Equity Shares Outstanding Share Price Price Today 277,809 133,087 6,842 601 3,432 94,108 56,580 27,682 16,489 226,912 4,159 $ 54.56 $ 50.49 Today Next FYE Last FYE Days in FY Days to FYE Elapsed Fraction 11/20/2014 $ 12/31/2014 $ 12/31/2013 365 324 0.888 54.56 55.53 VERIZON COMMUNICATIONS Dividend Discount Model (DDM) or Fundamental P/E Valuation Model Fiscal Years Ending Dec. 31 EPS 2014E $ Key Assumptions CV growth CV ROE Cost of Equity 3.87 $ 2015E 3.39 $ 2016E 3.80 $ 2017E 2018E 3.95 $ 4.07 2.74% 12.00% 6.78% Future Cash Flows P/E Multiple (CV Year) EPS (CV Year) Future Stock Price Dividends Per Share Future Cash Flows $ 2.18 $ 2.04 1 2.29 $ 2.01 2 Discounted Cash Flows Intrinsic Value $ 59.71 Today Next FYE Last FYE Days in FY Days to FYE Elapsed Fraction 11/20/2014 $ 59.71 12/31/2014 $ 63.29 12/31/2013 365 324 0.888 2.33 $ 1.91 3 2.33 1.79 4 19.08 4.07 77.63 4 59.71 VERIZON COMMUNICATIONS Relative Valuation Models Ticker T S TMUS CTL Company AT&T SPRINT T-MOBILE CENTURY LINK $ $ $ $ VZ VERIZON COMMUNICATIONS $ 50.49 Implied Value: Relative P/E (EPS14) Relative P/E (EPS15) Price 33.66 6.09 29.36 39.94 EPS 2014E $2.57 ($0.19) $0.22 $2.63 EPS 2015E $2.62 ($0.15) $0.81 $2.60 Average $3.87 $3.39 $ 125.47 $ 20.24 Average (omitting Sprint and T-Mobile as outliers) P/E 14 P/E 15 14.1 14.1 Relative P/E (EPS14) $ 54.73 Relative P/E (EPS15) $ 47.86 P/E 14 13.1 (32.1) 133.5 15.2 32.4 P/E 15 12.8 (40.6) 36.2 15.4 6.0 13.0 14.9 VERIZON COMMUNICATIONS Key Management Ratios Fiscal Years Ending Dec. 31 2011 2012 2013 2014E 2015E 2016E 2017E 2018E 100.58% 78.78% 262.45% 87.50% 130.81% 180.31% 230.18% 285.44% 30939 30761 21235 26956 70994 27050 26075 29801 40133 30681 57030 31628 74891 32536 95462 33444 97.52% 74.79% 258.68% 83.61% 126.91% 176.28% 226.06% 281.23% 29999 30761 20160 26956 69974 27050 24916 29801 38937 30681 55753 31628 73549 32536 94055 33444 Activity or Asset-Management Ratios Inventory Turnover 48.80 Liquidity Ratios Current Ratio =Current Assets/ Current Liabilities Quick Ratio =(Current Assets - Inventory)/ Current Liabilities 43.01 44.01 41.40 41.98 40.89 39.69 38.89 45875 46235 44887 47980 50227 52187 53240 54697 940 1075 1020 1159 1197 1276 1341 1406 9.42 9.21 9.69 8.80 8.80 8.80 8.80 8.80 110875 115846 120550 125979 130060 134355 138285 142070 11776 12576 12439 14324 14788 15276 15723 16153 0.48 0.51 0.44 0.51 0.51 0.50 0.49 0.48 =Sales/ 110875 115846 120550 125979 130060 134355 138285 142070 Total Assets 230461 225222 274098 247458 256869 269763 283555 297856 =Cost of Goods Sold/ Inventory Receivables Turnover =Sales/ Accounts Receivable Total Assets Turnover Financial Leverage Ratios Debt/Equity =Total Liabilities/ Total Equity 1.68 1.63 1.87 4.84 4.50 4.10 3.75 3.47 144553 139689 178682 203655 210045 216795 223784 231077 85908 85533 95416 42092 46724 52869 59672 66680 62.72% 62.02% 65.19% 82.30% 81.77% 80.36% 78.92% 77.58% =Total Liabilities/ 144553 139689 178682 203655 210045 216795 223784 231077 Total Assets 230461 225222 274098 247458 256869 269763 283555 297856 2.17% 0.76% 9.54% 10.66% 10.86% 11.77% 11.91% 11.94% 2404 875 11497 13426 14121 15808 16475 16965 110875 115846 120550 125979 130060 134355 138285 142070 1.04% 0.39% 4.19% 5.43% 5.50% 5.86% 5.81% 5.70% 2404 875 11497 13426 14121 15808 16475 16965 Total Assets 230461 225222 274098 247458 256869 269763 283555 297856 Return on Equity 2.80% 1.02% 12.05% 30.65% 30.16% 29.84% 27.56% 25.40% 2404 875 11497 13426 14121 15808 16475 16965 85908 85533 95416 43803 46824 52969 59772 66780 58.02% Debt Ratio Profitability Ratios Net Profit Margin =Net Income/ Net Sales Return on Assets =Net Income/ =Net Income/ Total Equity Payout Policy Ratios Dividend Payout Ratio 117.52% 323.27% 24.62% 67.56% 67.49% 61.39% 58.94% =Dividends/ 2825 2829 2830 9070 9531 9704 9711 9843 Net Income 2404 875 11497 13426 14121 15808 16475 16965 CV Growth CV Growth WACC WACC $ 54.58 1.40% 1.60% 1.80% 2.00% 2.20% 2.40% 2.60% 5.00% 62.18 66.04 70.40 75.33 80.96 87.47 95.06 5.20% 56.45 59.80 63.55 67.76 72.53 77.99 84.29 $ 54.58 1.40% 1.60% 1.80% 2.00% 2.20% 2.40% 2.60% 37.00% 46.50 49.02 51.81 54.90 58.35 62.23 66.63 37.50% 46.41 48.93 51.72 54.81 58.26 62.14 66.54 $ 54.58 5.00% 5.20% 5.40% 5.62% 5.80% 6.00% 6.20% 4.00% 75.31 67.74 61.06 54.57 49.81 45.03 40.70 $ 54.58 5.00% 5.20% 5.40% 5.62% 5.80% 6.00% 6.20% 0.50 75.33 67.76 61.08 54.58 49.83 45.05 40.72 5.40% 51.29 54.21 57.46 61.08 65.16 69.78 75.06 WACC 5.62% 46.19 48.71 51.49 54.58 58.04 61.92 66.31 5.80% 42.39 44.63 47.10 49.83 52.86 56.24 60.05 6.00% 38.52 40.50 42.66 45.05 47.68 50.61 53.88 6.20% 34.97 36.72 38.63 40.72 43.02 45.56 48.38 Cost of Sales 38.00% 38.30% 46.32 46.27 48.84 48.79 51.63 51.57 54.72 54.66 58.17 58.12 62.05 62.00 66.45 66.39 38.50% 46.23 48.75 51.54 54.63 58.08 61.96 66.36 39.00% 46.14 48.66 51.45 54.54 57.99 61.87 66.27 39.50% 46.06 48.58 51.36 54.45 57.90 61.78 66.18 4.25% 75.31 67.75 61.07 54.57 49.82 45.04 40.71 Cost of Debt 4.50% 4.84% 75.32 75.33 67.75 67.76 61.07 61.08 54.58 54.58 49.82 49.83 45.04 45.05 40.71 40.72 5.00% 75.33 67.76 61.08 54.59 49.83 45.05 40.72 5.25% 75.34 67.77 61.09 54.59 49.84 45.05 40.73 5.50% 75.34 67.77 61.09 54.60 49.84 45.06 40.73 0.60 75.33 67.76 61.08 54.58 49.83 45.05 40.72 0.70 75.33 67.76 61.08 54.58 49.83 45.05 40.72 0.90 75.33 67.76 61.08 54.58 49.83 45.05 40.72 1.00 75.33 67.76 61.08 54.58 49.83 45.05 40.72 1.10 75.33 67.76 61.08 54.58 49.83 45.05 40.72 Beta 0.80 75.33 67.76 61.08 54.58 49.83 45.05 40.72