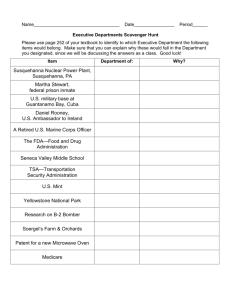

Implications of Healthcare Reform on Hospitals and Community

advertisement

Implications of Healthcare Reform on Hospitals and Community Health Centers Pennsylvania Association of Community Health Centers October 13, 2011 Susquehanna Health Road Map for Discussion • • • • • Susquehanna Health SH & Community Health Centers Past the Point of Incremental Change Major Components of Health Care Reform Achieving The New Performance Standard Susquehanna Health 2 • Our Mission: to extend God’s healing love by improving the health of those we serve • Our Vision: to provide “world-class” patientcentered care • Our Core Values: putting patients first, sharing ownership and being servant leaders Susquehanna Health 3 Susquehanna Health Williamsport Regional Medical Center Clinical Institutes & Service Centers OB/GYN/Level II Nursery Surgical Services (I/P & O/P) Heart & Vascular Center Neuroscience Center Advanced Orthopedic Care Physical Medicine & Rehabilitation Emergency Services Divine Providence Hospital Clinical Institutes & Service Centers Center for Advanced Cancer Care Surgical Services (O/P) Home Care & Hospice Sleep Disorders GI Center Behavioral Health (I/P & O/P) Breast Health Center Pain Management Wound Healing Diabetic Center MRI Center Sports Medicine Center Employee Health Occupational Health Muncy Valley Hospital Clinical Institutes & Service Centers Medical/Surgical I/P (20 beds) Long Term Care Swing Beds Surgical Services (I/P & O/P) Emergency Services Podiatric Care Center Susquehanna Eye Center Susquehanna Health 4 Susquehanna Health • • • • • • Faith-based three hospital system in Williamsport, PA Williamsport Regional Medical Center – 221 licensed beds – 50,000 ED visits – 11,000 admissions – 1,100 births – 800,000 O/P encounters – Family Medicine Residency Program Divine Providence Hospital – Cancer Center, Home Health, Hospice, Behavioral Health, O/P Surgery – 440,000 O/P encounters Muncy Valley Hospital – 20 bed CAH – 138 attached SNF – 600 admissions, 15,000 ED visits – 200,000 O/P encounters Susquehanna Health Medical Group – Multi-specialty physician group employs 150 providers (60% of medical staff) Susquehanna Health System Insurance Network – Off-shore captive for medical liability insurance Susquehanna Health 5 WRMC Achievements • • • • • • Thomson-Reuters Top 50 Cardiac Hospital Qualify for VBP as of today STEMI times 60 minutes or less 85% of time JC Certified Stroke Center BX Distinction for hips, knees, cardiac care Best Place To Work for four years Susquehanna Health 6 Regional Service Areas 7 Top Priority: High Quality, Cost Effective CARE for our Patients Building loyal customers one patient at a time. Susquehanna Health 8 History of Relationship between SH and SCH&DC • 1994 – Community Health Needs Assessment Completed (LCHIC) – Medical and Dental needs identified • 1995 – DPH opened CHC &DC in former ED space • 2006 – CHC&DC moved to strip mall located in the middle of the population served • 2011 – SH establishes independent 501(c)3; Susquehanna Community Health and Dental Clinic (SCH&DC) – – – – – Ensure sustainability of community health center Create independent entity to be eligible for FQHC status 14 member board (55% of which are CHC clients) Family practice physician with prior CHC experience is Chair Applied for FQHC status • NAP 330 (not approved, 8/13/2011) • LAL (decision by 11/1/2011) Susquehanna Health 9 SCH&DC Profile • Visits – Medical – Dental – Procedures 10,085 10,440 25,267 • Staff – full and part-time: – – – – Physicians – 5 APP – 3 Dentists – 3 Staff – 38 • Services – – – – – Infectious disease Behavioral health Social services Medical and dental Family planning Susquehanna Health 10 Why Does SH Support SCH&DC • Acts as Primary Care provider • Reduces pressure on local ED • Discharged patients have the necessary primary care follow-up • PPACA – more important going forward – Hospitals will not be paid for readmissions – Avoid serving patients in higher-cost ED – Chronic disease management Susquehanna Health11 Susquehanna Health12 Then and now… 1995 2011 $ 164 billion deficit $1.5 trillion deficit Coming off failed Clinton health care reform initiative Coming off bank/auto bailouts and great recession Followed “Contract with America” Followed emergence of tea party Broad consensus about scope of problem No broad consensus on scope of problem Republicans controlled by the House and Senate Republicans control just the House President Clinton President Obama Speaker Gingrich: grand renewal Speaker Boehner: we’re broke 13 Susquehanna Health Past the Point of Incremental Change • Facing Major Forces of Change – Baby Boomers – Information Revolution – Public Health Crisis – Health Reform Susquehanna Health 15 Meet Your Newest Medicare Beneficiaries Happy 65 th Birthday! Donald Trump Cher Sylvester Stallone Liza Minnelli Dolly Parton Pat Sajak Susquehanna Health Source: Health Care Advisory Board interviews and analysis. 16 Baby Boomers • Number of People 20-64 for Every Person >65 – – – – 1950 1980 2011 2050 7.2 5.1 4.1 2.1 • Life Expectancy – 1940 – 77 – 2007 – 83 • New Medicare beneficiaries: – 1995-2010 (each year) 623K – 2010-2030 (each year) 1.6M – In 2030, Medicare will have twice as many beneficiaries as 2010 Susquehanna Health 17 Information Revolution • Increasing availability of information – Universal service for computing - creates easy access to computers, online resources – Emergence of the “virtual” – sets baseline for increasing shift to online information sharing, purchasing – The Portable Internet – integrates into real-world decision making; increases demand for rapid information; makes information ubiquitous, 24/7 – Shift to the Cloud – enhances immediacy of data access; creates virtually limitless space for data storage; promotes universal sharing of data among individuals, across systems Susquehanna Health 18 Susquehanna Health 19 Public Health Crisis-The New Global Epidemic • Modern lifestyles taking a serious toll with chronic disease the top public health concern – 63% of deaths worldwide due to non-communicable diseases – 7 0f 10 deaths in the U.S. attributed to chronic conditions – 122M adults in U.S. with at least one chronic condition; almost 1 of every 2 U.S. adults – World Health Organization Identifies Key Risk Factors • Lifestyle Factors – Tobacco use – Physical inactivity – Unhealthy diet • Limited Health Care Access – No preventative care – Cost-effective interventions inaccessible 20 Health Reform Changes the Rules of the Game-Bringing an End to Volume-Based Payment • “Our proposal would change incentives so that providers will give patients the best carenot just the most expensive care-which will mean big savings over time.” President Barack Obama Susquehanna Health 21 Susquehanna Health 22 Susquehanna Health 23 Patient Protection & Affordable Care Act (PPACA) • Major Components of PPACA – Meaningful Use Requirements – Value-Based Purchasing – Accountable Care Organizations (ACO’s) Susquehanna Health 24 Meaningful Use Requirements • Definition: Incentives and penalties that encourage “meaningful use” of EHR technology; providers must adopt certified EHR, meet performance thresholds for defined objectives, report on clinical quality measures • Purpose: Promote adoption and utilization of EHR in support of CMS’s health outcomes and policy priorities • Assessment: Overtime, all hospitals and doctors will implement, given downside penalties; partially-funded mandate • Role of CMMI: Investing in care design projects that support seamless and coordinated care delivery Susquehanna Health 25 Value-Based Purchasing • Definition: pay-for-performance program differentially rewards or punishes hospitals based on performance against predefined process and outcomes performance measures • Purpose: create material link between hospital payments and clinical quality, patient satisfaction scores • Assessment: withhold-earnback model will put significant dollars at risk for all providers, force immediate focus on quality and experience metrics • Role of CMMI: dedicating $500M to Partnership for Patients, targeting hospital-acquired infections, readmissions Susquehanna Health 26 Picking Winners, Losers Based on Performance • Measure Performance – CMS evaluates hospitals based on achievement and improvement on selected clinical care and patient experience measures – Based on weighted average of achievement and improvement scores, CMS calculates Total Performance Scores (TPS) for each hospital (clinical measures 70%-patient experience 30%) • Compare Hospitals – Medicare ranks all hospitals based on TPS – For achievement score, hospitals ranked below the 50th percentile do not receive points towards TPS – For improvement score, hospitals whose performance has not improved relative to a baseline score do not receive points towards TPS • Adjust Payments – Medicare converts TPS into incentive payments – Calculation will use linear exchange function – Hospitals that receive higher TPS will receive higher incentive payments than those that receive lower TPS – CMS will notify hospitals of incentive payment for FY 2013 on November 1, 2012 Susquehanna Health 27 Accountable Care Organizations (ACO’s) • Definition: Network of providers collectively accountable for the total cost and quality of care for a population of patients; ACOs are reimbursed through total cost payment structures, such as the shared savings model or capitation • Purpose: reward providers for reducing total cost of care for patients through prevention, disease management, coordination • Assessment: long-range goal of CMS to migrate to risk contracting; will spark industry-wide investment in primary care infrastructure to gatekeep • Role of CMMI: accepting providers’ proposals to test various payment systems, including both shared savings and partial capitation Susquehanna Health 28 Biggest News of the Year? • Program in Brief: Medicare Shared Savings Program: – Program begins January 1, 2012; contracts to last minimum of three years – Physician groups and hospitals eligible to participate, but primary care physicians must be included in any ACO group – Participating ACOs must serve at least 5,000 Medicare beneficiaries – Bonus potential to depend on Medicare cost savings, quality metrics – Two options available: one with no downside risk until year three, the second with downside risk in all three years – Proposed rule available for comment until end of May; final rule due later this year Susquehanna Health 29 Proposed Rules for Medicare Shared Savings • Participants – Minimum population size: 5,000 beneficiaries – ACO Founders: PCPs, PCP IPAs, employed groups – ACO Participants: Hospitals, specialists, PCPs with <5,000 patients, Critical Access Hospitals, other suppliers and providers – ACO must be a legal entity with own tax identification number, governance, management Susquehanna Health 30 Proposed Rules for Medicare Shared Savings • Patient Attribution – Retrospective based on plurality of primary care E&M billings by ACO provider – Patients may not opt out of being counted against ACO performance measure – Patients retain unrestricted choice of providers • Quality and Reporting – 65 quality measures (care coordination, patient safety, preventive health, and metrics of quality of care for frail, elderly, and at-risk populations) – Bonus payout to ACO is adjusted based on quality performance – Significant transparency requirements around ACO operations and financing • Antitrust – New safety zone created for ACOs below 30% market share – Modified Clinical Integration review for those Medicare ACO’s above 30% market share Susquehanna Health 31 ACO Participation Not a Practice Field (Key Operational Risks for ACOs) • Manage Utilization Risk – Drive care to ambulatory medical network – Reduce preventable acute care episodes • Deliver Exceptional Quality – Meet high standards for care quality across multiple dimensions – Demonstrate care coordination across sites of care over time • Operate Under Intense Transparency – Provide all necessary documentation, data to CMS – Manage communication to key stakeholders Susquehanna Health32 NO MORE CUTS TO HOSPITAL CARE Susquehanna Health33 Susquehanna Health34 Making Delivery System Reform a Success Three Keys to Delivery System Reform Quality Health IT Clinical Integration Susquehanna Health35 Reform Implications for Hospital Leaders 1. Integrate the hospital and physician business and culture. 2. Become proficient at high-quality, costefficient care that is safe and reliable. 3. Transparency. 4. Accelerate implementation and use of HIT; real-time capture of outcome and cost data that lead to improvement. 5. Make tough decisions regarding efficient use of capital, reduction of fixed costs, and services provided. 6. Focus on elimination of waste. Susquehanna Health 36 Improving Quality of Care: A Few Incentives and Many Penalties Value-Based Purchasing (VBP), 2013: Incentives for moving from paying purely for volume, regardless of outcomes. Penalties: For Reductions In Payments For Hospital-Acquired Infections, 2015 For High Readmissions, October 1, 2012. Medicaid Global Payment Demonstration Project, 2010: Allow 5 states to adjust FFS payment model for safety-net hospitals to a global capitated payment structure. Medicaid Bundled Payment Demonstration Project, 2012: For 5 years in 8 states chosen by HHS. Bundled Payments National Pilot, 2013: Fixed bundled payment for an episode of care beginning three days before hospitalization and ending 30 days after discharge. Susquehanna Health37 Source: Standard & Poor’s, May 13, 2010 Implementation Concerns How much of a concern are the following implementation issues? 88% 79% 75% 68% 61% 61% 54% 42% 35% 34% Source: Commonwealth Fund/Modern Healthcare “Health Care Opinion Leaders Survey,” April 2010 Susquehanna Health 38 Susquehanna Health 39 Provider Success Factors Scale, size, and market essentiality. A strong position in the geographies served. Multiple operations in a connected geography. Brand identification and an effective service distribution strategy that offers patient ease of access to a comprehensive “system of care.” Integrated arrangements with physicians that promote care quality and value. Source: Kauffman Hall Susquehanna Health Provider Success Factors Sophisticated information technology (IT) and electronic health record capabilities. Managed care contracting expertise. A care, cost, and quality management culture. Acute attention to operations and business portfolio management. Readiness and ability to measure and manage clinical and financial performance in exquisite detail. Source: Kauffman Hall Susquehanna Health Achieving the New Performance Standard • • • • • • Maximize Revenue Capture Excel Under Performance Risk Bend Labor Cost Curves Standardize Clinical Care Pathways Redesign Inpatient Care Models Build Effective Capacity (physician providers, APP) • Deflect Demand of Less Profitable Services • Leadership • Scope and Size of Organization Susquehanna Health 42 Maximize Revenue Capture (Letting Nothing Slip Through the Cracks) • Clinical documentation • Invest in adequate staffing • Hold staff accountable for productivity and accuracy • Leverage Electronic Medical Records Susquehanna Health 43 Excel Under Performance Risk (Quality Pays) • Best-performing hospitals will benefit from VBP • Cut cost growth, not just costs – Curb labor cost growth • Employee health • Principled hiring • Flexible staffing – Standardize clinical care pathways • Physician alignment • Protocol design • Decision support – Redesign Care Models • Team-based care • Skill mix management Susquehanna Health 44 Bend Labor Cost Curves • Wages and salaries – Flexible staffing reduces need for OT, agency – Skill mix management better aligns labor expenses to clinical needs • Staffing levels – Principled hiring counters FTE creep – Unnecessary positions eliminated through attrition Susquehanna Health 45 Standardize Clinical Care Pathways (Physician engagement, leadership must be major foci) • Building a platform for alignment – Identify physicians with shared strategic vision – Formalize shared control in governance, management – Include performance-based incentives in compensation models • Standardizing Protocols around best practice – Establish consensus on best clinical practices – Ensure continuous feedback – Proactively mitigate physician, staff resistance • Support Principled Decision-Making – Escalate incentives from rewards to mandates Susquehanna Health 46 Redesign Care Model • Migrating toward top-of-license care – Physicians – RN’s – Nurse Practitioners – Physician Assistants – LPN’s – Medical Assistants – Non-clinical staff Susquehanna Health 47 Build Effective Capacity (Making Room for Growth) • Expediting patient throughput – Creates more capacity – Requires investment in better care pathways • Ability to meet increased volumes from babyboomer generation Susquehanna Health 48 How SH Can Be Successful… 1. Readiness Assessment (scale of 1 to 10) •Physician Integration 5 •Quality Care Protocols & Coordination 7 •Information System Sophistication 5 •Balanced Service Distribution System 5 •Managing to “value” 8 •Capital Capacity 2 •Cost Management 5 •Scale 3 Composite Position 5 Susquehanna Health 49 How SH Can Be Successful… 2. 3. 4. 5. Gain a robust understanding of how the transformation will affect our hospitals, our physicians and our business partners, Establish a keen appreciation of our own competencies and assets, then leverage these to take advantage of emerging opportunities, Develop a committed and aligned physician and hospital leadership with a clear strategy for creating sustained competitive advantage and the ability to respond rapidly when circumstances dictate Develop physicians , trustees, business leaders and employee service partners who are master change agents Susquehanna Health 50 How SH Can Be Successful… 6. 7. 8. 9. Reorganize our service distribution system to increase access, improve care coordination, improve quality, increase patient satisfaction and be effective competitors Create more scale with vertical as well as horizontal consolidation Assure the availability of an IT platform that supports clinical decision making, information management and access by physicians, administrators and patients to assure proper care management and decision making. Use peer group benchmarks to assure the organizations staffing, capital spend, supply chain cost structure can breakeven on Medicare. Susquehanna Health 51 Attributes of the New Breed Health System • Redefining the Footprint – Gains operational efficiencies, market share through partnership – Achieves clinical advantage through affiliation – Maps service footprint to population need • Leveraging the Information Asset – – – – Operates within an integrated enterprise data network Positions leader to merge data analytics with clinical care Builds competitive advantage from full data transparency Leverages robust patient data set to support proactive, comprehensive care Susquehanna Health52 Attributes of the New Breed Health System • Transforming the Clinical Workforce – – – – Advances clinical care with next-generation technology Merges local and virtual specialty talent to offer best-in-class care Elevates PCP to “CEO” of care team Leverages high-tech and high-touch approach to meet individual and community needs – Mobilizes community workforce to extend care team reach • Realizing Our New Reach – – – – Overcomes non-clinical barriers to maximize health outcomes Integrates patient’s values into care plan Designs communication strategy to bridge health literacy gaps Activates community stakeholders to connect patients with high-value resources – Expands reach beyond care continuum to anchor community health Susquehanna Health53 Achieving The New Performance Standards Community Health Centers • Key in on community relationships • Value to your local health care environment (follow-up care, reduce readmissions, disease management) • Meet higher quality standards at lower cost • Patient access to avoid ED’s and inpatient admissions • Understanding the critical role you play and what it takes to make your organization successful in HC reform Susquehanna Health 54 Susquehanna Health55 Questions? Susquehanna Health 56