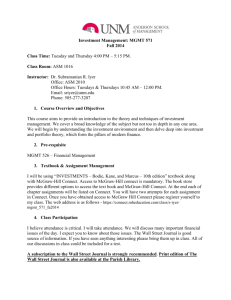

Investments FINC 431-40

advertisement

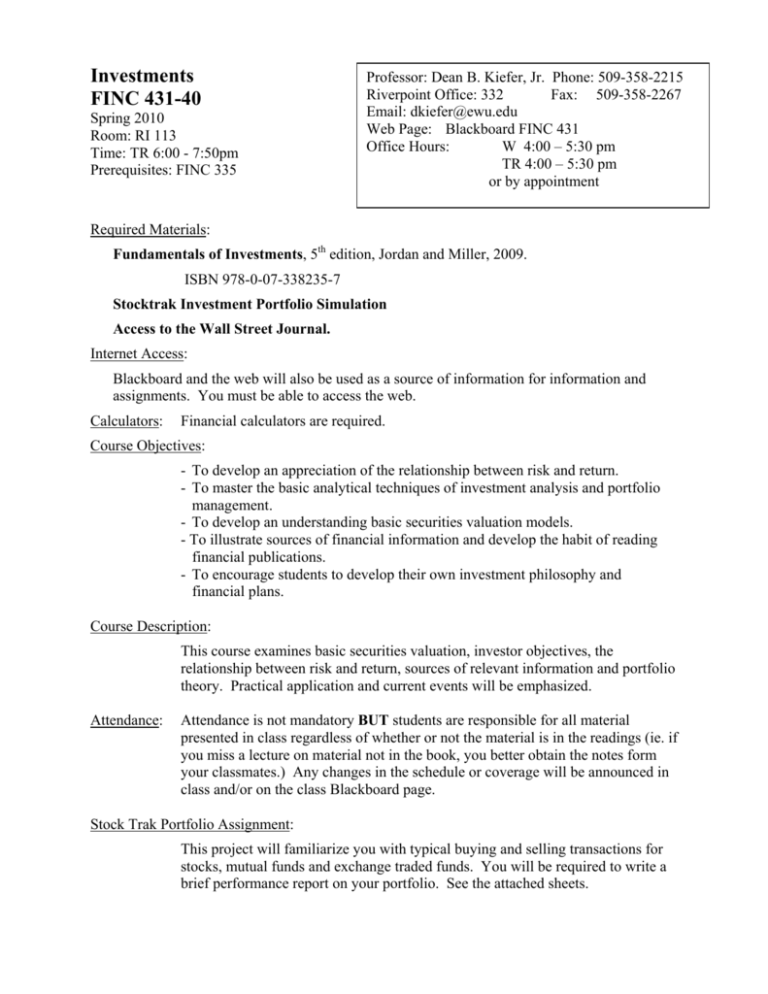

Investments FINC 431-40 Spring 2010 Room: RI 113 Time: TR 6:00 - 7:50pm Prerequisites: FINC 335 Professor: Dean B. Kiefer, Jr. Phone: 509-358-2215 Riverpoint Office: 332 Fax: 509-358-2267 Email: dkiefer@ewu.edu Web Page: Blackboard FINC 431 Office Hours: W 4:00 – 5:30 pm TR 4:00 – 5:30 pm or by appointment Required Materials: Fundamentals of Investments, 5th edition, Jordan and Miller, 2009. ISBN 978-0-07-338235-7 Stocktrak Investment Portfolio Simulation Access to the Wall Street Journal. Internet Access: Blackboard and the web will also be used as a source of information for information and assignments. You must be able to access the web. Calculators: Financial calculators are required. Course Objectives: - To develop an appreciation of the relationship between risk and return. - To master the basic analytical techniques of investment analysis and portfolio management. - To develop an understanding basic securities valuation models. - To illustrate sources of financial information and develop the habit of reading financial publications. - To encourage students to develop their own investment philosophy and financial plans. Course Description: This course examines basic securities valuation, investor objectives, the relationship between risk and return, sources of relevant information and portfolio theory. Practical application and current events will be emphasized. Attendance: Attendance is not mandatory BUT students are responsible for all material presented in class regardless of whether or not the material is in the readings (ie. if you miss a lecture on material not in the book, you better obtain the notes form your classmates.) Any changes in the schedule or coverage will be announced in class and/or on the class Blackboard page. Stock Trak Portfolio Assignment: This project will familiarize you with typical buying and selling transactions for stocks, mutual funds and exchange traded funds. You will be required to write a brief performance report on your portfolio. See the attached sheets. Stock Analysis Project This project is designed to acquaint you with stock and industry information typically available in the work environment. You are required to collect information on a selected stock and its industry and write a brief report. See the attached sheets. Academic Integrity: Students enrolled in this class are expected to adhere to the EWU Student Academic Policy as stated at the following URL: http://www.ewu.edu/x4326.xml Homework: Homework problems will be assigned for every chapter but generally will not be collected or graded. It is to your advantage to understand and complete the homework assignments since they may form the basis for quiz and exam questions. Solutions will be available on Blackboard. Exams: There will be a midterm and final exam, both of which must be taken when scheduled. If a problem arises, contact me, my voicemail, or the Management Department administrative assistant (358-2273) before the scheduled date. If you miss an exam without contacting me ahead of time, your grade will be zero. Grade Determination: The overall grade will be determined as follows. Minimum Percentage of Points Needed 95 94 93 92 91 90 89 88 87 86 85 84 83 82 81 80 79 78 Grade 4.0 3.9 3.8 3.7 3.6 3.5 3.4 3.3 3.2 3.1 3.0 2.9 2.8 2.7 2.6 2.5 2.4 2.3 Minimum Percentage of Grade Points Needed 77 2.2 76 2.1 75 2.0 74 1.9 73 1.8 72 1.7 71 1.6 70 1.5 69 1.4 68 1.3 67 1.2 66 1.1 65 1.0 64 0.9 63 0.8 62 0.7 <62 0.0 Mid-Term Exam Final Exam Stock Trak Project Stock Analysis Project Investment Policy Statement Total Points Points 100 100 100 50 25 375 Tentative Class Schedule Week of: 3/29 Chapter 1 2 Chapter Topic A Brief History of Risk and Return Buying and Selling Securities 4//5 3 4 Overview if Security Types Mutual Funds Investment Policy Statements and Investor Preferences 4/12 5 6 -- The Stock Market Common Stock Valuation Economic and Industry Analysis 4/19 7 8 Stock Price Behavior and Market Efficiency Behavioral Finance and the Psychology of Investing 4/26 Midterm Exam Tuesday April 26 Chaps. 1-8 5/3 9 10 Interest Rates Bond Prices and Yields 5/10 11 12 Diversification and Risky Asset Allocation Risk, Return and the Security Market Line 5/17 13 18 Performance Evaluation and Risk Management Corporate Bonds 5/24 19 Government Bonds 5/31 17 Projecting Cash Flow and Earnings Course Review 6/8 Comprehensive Final Exam Tuesday June 8 from 6:00 – 8:00 pm You are responsible for reading the assigned material prior to the class in which it is discussed. Please read the assignments carefully and come to class prepared to discuss the material and apply it to solving problems. The instructor reserves the right to modify, add and delete material as well as change the sequence and timing of lectures and exams as necessary to achieve the objectives of the course. Important Dates 4/2 - Stock Trak Registration and stock selections due. (Stock Trak Part 1) 4/15 - Stock Analysis Project Part 1 4/16 - Short sale in Stock Trak portfolio. (Stock Trak Part 2) 4/20 – Investment Policy Statement due. 4/26 - Midterm Exam Chaps. 1-8. 5/6 - Stock Analysis Project Part 2 5/7 - Mutual funds and ETF purchase. (Stock Trak Part 3) 5/27 - Stock Trak Portfolio Report due. 6/8 – Final Exam Stock Track Project Finc 431 Spring 2010 Part 1 Stock Trak Registration and Initial Portfolio Purchases (20 pts.) Due: Friday April 2. I will be checking on the Stock-Trak web site to see if the assignment has been completed and that all ten stocks were purchased by 4/8/10. (Note: East Coast exchanges close at 1:00 PM Pacific Time.) 1.Register at: http://www.stocktrak.com/public/members/registrationstudents.aspx?p=EWUFinc431Sp10 If you purchased a new textbook, you will need the Certificate Number that came with the textbook. If you didn't purchase a new textbook, you will have to pay for an account on the Stock-Trak web site. Note: There may be a 24 hour delay before an account is activated. Each account has $1,000,000 in the cash account, and each account is limited to 100 trades. Additional trades can be purchased on line. A $10 commission is charged each time you trade. You may make any trades you want in addition to the required ones. The simulation ends Friday May 21. 2. Read the registration materials and trading rules for Stock-Trak at http://www.stocktrak.com/public/content/tradingrules.aspx 3. Buy 10 different common stocks. (Common stock only. No Mutual Funds, ETFs, etc... We'll get to these later.) You should be able to start trading as soon as your account is activated. Caution: Simply trading in the Stock-Trak Stocks Trading Pit does not guarantee that the securities you are purchasing are common stock. * Buy no fewer than 500 shares of each stock purchased. Do not try to spend the entire million dollars just yet. We will need some of it for later. I recommend spending about $500,000 in the initial transactions. * Buy in round lots (multiples of 100 shares) * Use only market orders for now. (If you should happen to use a limit order, it must be filled before the market's close on Friday April 9.) * You may purchase international stock if you wish. * You must keep these 10 stocks in your Stock-Trak portfolio for the entire quarter. * No futures or options may be traded. Anyone trading futures and options prior to this date will lose points. Part 2: Short Sales (20 pts.) Due: Friday April 16 Short three different stocks. Short at least 500 shares of each stock. You may cover the shorts whenever you like, but you must have your short positions established and showing in your Stock-Trak portfolio by the close of the market on Friday April 16. Part 3: Mutual Funds and ETF Purchase Due: Friday May 7 (20 pts.) Add two closed-end funds, two open-end funds, and two exchange traded funds to your StockTrak portfolio. Buy at least 1,000 shares of each of the closed-end funds and the exchange traded funds, and invest at least $50,000 in each of the open-end funds. These transactions must take place before markets close on Friday May 7. Part 4: Performance Report (40 pts.) Due: Thursday May 27. Report on the performance of your portfolio. Include the holding period return, the standard deviation of returns (weekly basis), portfolio beta, Sharpe measure, the Treynor measure and Jensen’s alpha. Calculate the return based on the market close on Friday of each week. Compare your portfolio return and beta to the market return and portfolio for the holding period. This means that you must track the weekly return of your portfolio and the market (S&P 500) for each week of the quarter. Stock Analysis Project Finc 431 Spring 2010 Part 1 Stock Information Due: Thursday April 15 (25 pts.) Find the most recent stock, industry outlook, and Wall Street Consensus available for one of the ten stocks you originally purchased for your portfolio. Answer the following questions. 1. According to the Business Summary, in what business is the company engaged? 2. How has the P/E ratio changed over the past five years (2003 – 2008)? 3. What is 12-month target price? 4. In what sub-industry does the company operate? What is the outlook for the sub-industry? Note: Don't just write "neutral" or "positive". Include a sentence or two that explains the reasoning behind these terms. 5. Analyze the sub-industry peer group. Based on the information given would you consider your stock to be a leader in the sub-industry? Explain your answer. 6. What is the overall consensus of the analysts? Has the consensus opinion risen, fallen, or remained constant over the last year? 7. What are the consensus average earnings per share estimate for fiscal year 2010? What were the earnings per share for fiscal year 2009? Is this good news for investors? Explain. Please turn in the S&P Stock Report documents with your word processed answers (.doc file only) to the above questions. Please don't turn in the Glossary page or the Other Disclosures & Disclaimer page. Points will be deducted if you include either of them. Points will also be deducted if the papers are not in any sort of order. Part 2 Industry Information (25 pts.) Due: Thursday May 6. Select one of the stocks from your StockTrak portfolio, identify its industry classification according to the S&P Industry Survey, and read the appropriate industry report in the latest edition of the Survey. You can find the Survey at most libraries. Write a short summary of the report. DO NOT SIMPLY CUT AND PASTE. Be sure to address the following in your summary: * Identify the stock you have selected for this exercise in your summary. * Was there any information in the report that you were not aware of before reading the report? Would that information make a difference in your decision to include a stock from this industry in your portfolio? * Are there specific opportunities or threats in this industry that investors should know about? * What did you learn from the financial data at the end of the report? * After reading the report, would you invest in this industry or in the stock from your portfolio that is in this industry? Explain why or why not. Investment Policy Statement (25 pts.) Finc 431 Spring 2010 This project will develop an investment policy statement and investment objectives tailored to your individual needs and preferences. At the end of the quarter you will revisit your policy statement to determine if any changes and updates are needed. Along the way you will estimate your tolerance for risk which consists of both the ability as well as the willingness to bear risk. You will also develop your investment objectives, your return objectives and time horizon. Finally, any tax considerations, liquidity needs, legal and regulatory considerations and any unique needs and preferences you may have must be considered. Start by taking the risk tolerance quiz on pp. 59-60 in your textbook by April 5. We will use the quiz to help develop your policy statement and a preliminary portfolio. A written copy of your investment policy is due Tuesday April 20.